Biological Safety Cabinet Market Size, Share, Trends, Industry Analysis Report: By Product (Class I, Class II, and Class III), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 116

- Format: PDF

- Report ID: PM3209

- Base Year: 2024

- Historical Data: 2020-2023

Biological Safety Cabinet Market Overview

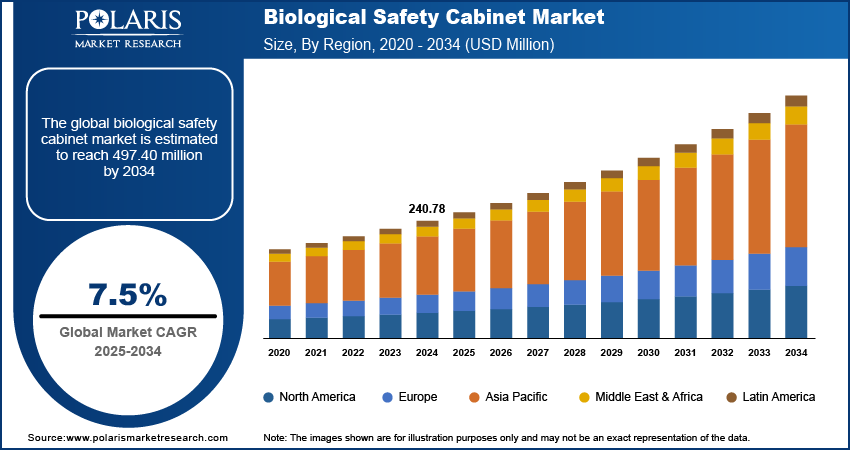

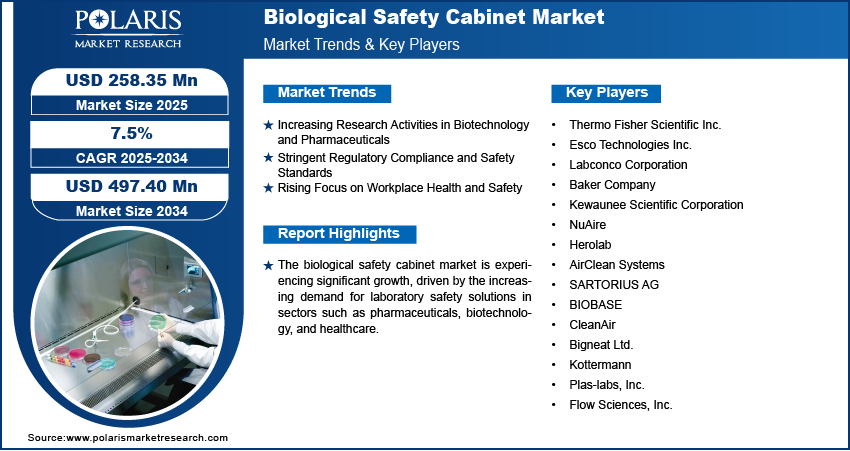

The biological safety cabinet market size was valued at USD 240.78 million in 2024. The market is projected to grow from USD 258.35 million in 2025 to USD 497.40 million by 2034, exhibiting a CAGR of 7.5% during 2025–2034.

The biological safety cabinet (BSC) market refers to the production and distribution of enclosed workspaces designed to provide a sterile environment for laboratory procedures, protecting workers, research samples, and the external environment from biohazardous materials. The market is primarily driven by the increasing demand for safe and compliant laboratory environments in sectors such as pharmaceuticals, biotechnology, and healthcare. Other drives influencing the biological safety cabinet market include growing research activities, stringent regulatory requirements for biosafety standards, and advancements in filtration technologies. Additionally, the rising adoption of BSCs in research institutions and healthcare facilities due to heightened awareness of workplace safety and infection control is contributing to market growth.

To Understand More About this Research: Request a Free Sample Report

Biological Safety Cabinet (BSC) Market Dynamics

Increasing Research Activities in Biotechnology and Pharmaceuticals

The growing demand for biological safety cabinets (BSCs) is largely driven by the expansion of research activities in biotechnology, pharmaceuticals, and life sciences. These sectors are heavily dependent on BSCs to ensure safety during the handling of hazardous biological materials, such as pathogens or genetically modified organisms. The increased focus on drug development, particularly in the fields of cancer, immunotherapy, and personalized medicine, requires advanced laboratory environments equipped with BSCs to meet safety protocols. According to a report by the National Institutes of Health (NIH), global spending on biomedical research has surpassed USD 200 million annually, fueling the need for safe working conditions in laboratories. As research progresses, the demand for high-quality BSCs continues to rise.

Stringent Regulatory Compliance and Safety Standards

Regulatory bodies such as the Occupational Safety and Health Administration (OSHA), the Centers for Disease Control and Prevention (CDC), and the World Health Organization (WHO) have set comprehensive guidelines on laboratory safety, especially in environments handling potentially harmful biological agents. Compliance with these regulations is mandatory, and laboratories are required to use certified BSCs to ensure both worker safety and environmental protection. The regulatory environment surrounding biosafety has become more stringent with the global expansion of infectious diseases, pushing laboratories to adopt advanced BSCs. For example, OSHA's standards for laboratory safety have led to increased investments in BSCs to ensure compliance with ventilation, air filtration, and containment standards. The stringent regulatory landscape surrounding laboratory safety and biosafety standards is one of the key BSC market growth drivers.

Rising Focus on Workplace Health and Safety

The heightened awareness around workplace health and safety has significantly contributed to the BSC market expansion. Laboratories are increasingly adopting BSCs as a critical component of their safety protocols to protect personnel from airborne contaminants and accidental exposure to hazardous materials. The COVID-19 pandemic further emphasized the importance of maintaining sterile and controlled environments, which has led to a surge in demand for safety equipment, including BSCs, in healthcare and research settings. In the US, the Centers for Disease Control and Prevention (CDC) and the National Institute for Occupational Safety and Health (NIOSH) have emphasized the importance of proper containment measures, thereby driving the adoption of BSCs across laboratories and healthcare facilities. This trend is supported by growing investments in laboratory safety infrastructure by both public and private sectors.

Biological Safety Cabinet Market Segment Insights

Biological Safety Cabinet Market Assessment by Product

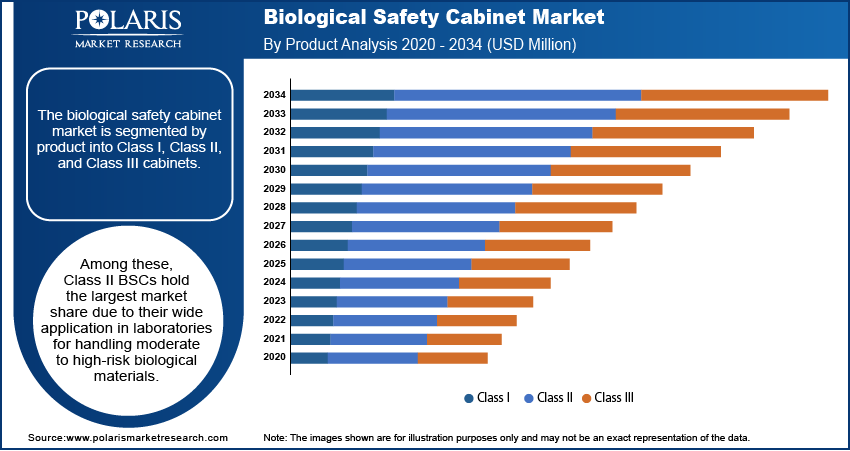

The biological safety cabinet market is segmented by product into Class I, Class II, and Class III cabinets. Class II hold the largest market share due to their wide application in laboratories for handling moderate to high-risk biological materials. It is also the fastest growth segment. These cabinets are equipped with both inflow and exhaust air systems, ensuring operator safety and environmental protection. Class II cabinets are further divided into types, with Type A2 and Type B2 being the most commonly used, especially in the biotechnology and pharmaceutical industries. The growing demand for Class II is primarily driven by the increasing need for compliance with regulatory standards in research and clinical environments. These cabinets are considered essential for laboratories dealing with pharmaceuticals, healthcare, and microbiological research, which require reliable containment systems.

Meanwhile, Class I and Class III cabinets continue to play critical roles in highly specialized environments, such as handling high-risk pathogens or in industries requiring containment for extreme hazards. However, their growth is comparatively slower than Class II cabinets, as these segments cater to more specific applications. Overall, the dominance and rapid growth of Class II are expected to persist, driven by increased investments in laboratory safety and the ongoing expansion of research activities.

Biological Safety Cabinet Market Evaluation by End Use

The biological safety cabinet market segmentation, based on end use, includes pharmaceutical & biopharmaceutical companies, diagnostics & testing laboratories, and academic & research organizations. The pharmaceutical & biopharmaceutical companies holds the largest biological safety cabinet market share, driven by the growing need for BSCs in the manufacturing and testing of vaccines, biologics, and pharmaceuticals. These companies require robust containment systems to ensure the safety of workers and the integrity of products, particularly when dealing with hazardous biological substances or pathogens during the drug development and production processes. The demand for BSCs in this sector is closely linked to the expanding pipeline of biologic drugs and vaccines, as well as stringent regulations governing manufacturing environments.

The diagnostics & testing laboratories segment is registering the fastest growth due to the increasing number of diagnostic tests and the rising demand for safe testing environments, particularly in clinical settings. With the growing prevalence of infectious diseases, including viruses and bacteria, these laboratories require reliable containment solutions for handling potentially infectious materials. Additionally, the expansion of laboratory testing services, fueled by advancements in personalized medicine and diagnostics, is contributing to the rapid growth of BSC adoption in this segment. Academic and research organizations also remain a significant contributor to the market, as the need for safe research environments continues to increase, although at a relatively slower pace compared to diagnostics and testing laboratories.

BSC Market Regional Insights

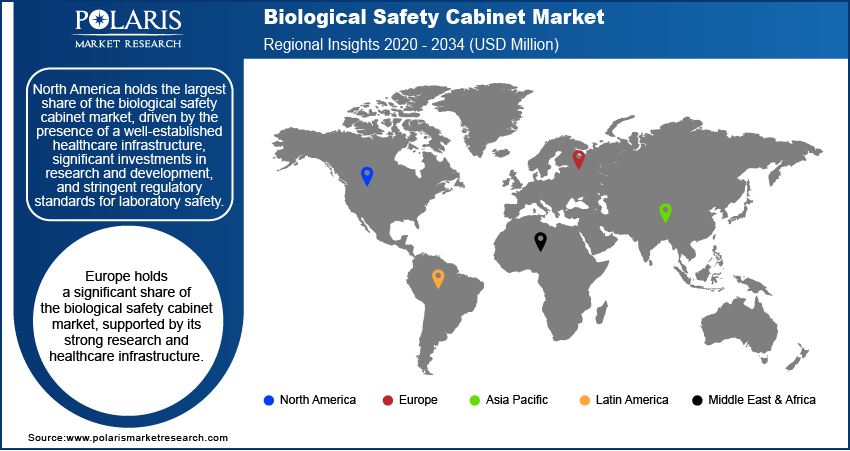

By region, the study provides biological safety cabinet market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by the presence of a well-established healthcare infrastructure, significant investments in research and development, and stringent regulatory standards for laboratory safety. The US, in particular, is a key contributor, with its pharmaceutical, biotechnology, and healthcare industries requiring high-quality BSCs for drug development, testing, and research. Additionally, the increasing emphasis on laboratory safety and biosafety regulations by organizations such as OSHA and CDC further support the demand for BSCs in the region. Europe follows closely, with a strong focus on research and biotechnology, while Asia Pacific is experiencing rapid growth due to expanding healthcare and research sectors in countries such as China and India. Latin America and the Middle East & Africa are smaller markets, but they are witnessing gradual growth as laboratory safety standards evolve.

Europe holds a significant biological safety cabinet market share, supported by its strong research and healthcare infrastructure. The region’s stringent regulations regarding laboratory safety, particularly within the pharmaceutical and biotechnology sectors, are key drivers of demand. The European Medicines Agency (EMA) and various national agencies enforce high standards for laboratory containment, promoting the adoption of BSCs. Additionally, Europe’s growing focus on personalized medicine and research into infectious diseases continues to drive market growth. Countries such as Germany, France, and the UK are notable contributors, with increased funding for scientific research and advancements in biotechnology further propelling the demand for BSCs.

Asia Pacific is experiencing rapid BSC market growth, driven by the expansion of healthcare and research activities, particularly in China, India, and Japan. As these countries invest in advanced research infrastructure and pharmaceutical production capabilities, the need for high-quality BSCs has surged. China’s pharmaceutical industry, for instance, is one of the largest in the world, and the increasing focus on biosafety in research laboratories is fueling market demand. Additionally, the region’s growing population and rising healthcare needs are contributing to a higher demand for diagnostic and testing laboratories, further boosting the adoption of BSCs. The Asia Pacific market is expected to continue expanding as regulatory standards improve and the region becomes a hub for research and drug development.

Biological Safety Cabinet Market Key Players and Competitive Insights

The biological safety cabinet market features a wide range of active players, including Thermo Fisher Scientific Inc., Esco Technologies Inc., Labconco Corporation, and Baker Company. These companies manufacture and supply various models of biological safety cabinets, serving different industries such as healthcare, research, and pharmaceuticals. Other notable players include Kewaunee Scientific Corporation, NuAire, and Herolab, each offering a diverse array of laboratory safety equipment. Additionally, brands including AirClean Systems, SARTORIUS AG, and BIOBASE are recognized for their BSC solutions, as are CleanAir, Bigneat Ltd., and Kottermann. These companies focus on product innovation, meeting regulatory standards, and addressing specific laboratory requirements to maintain their competitive positions.

In terms of competitive analysis, the biological safety cabinet industry remains highly competitive, with companies focusing on enhancing product features, such as improved filtration systems, energy efficiency, and user-friendly designs. Companies such as Thermo Fisher Scientific Inc. and Esco Technologies are known for their global presence, extensive product portfolios, and strong research capabilities. The market also sees considerable regional competition, with local players in Asia Pacific, such as BIOBASE and Bigneat, focusing on cost-effective solutions to cater to the growing demand in the region. While established companies typically maintain an edge due to their large-scale operations and resources, smaller and regional companies continue to thrive by offering specialized products or localized services tailored to specific industry needs.

As the demand for laboratory safety equipment rises, particularly in research, pharmaceuticals, and diagnostics, companies are increasingly investing in research and development to improve the efficiency and safety features of their BSCs. This includes innovations in air filtration systems, as well as integration of smart technologies for better monitoring and control. Furthermore, partnerships with pharmaceutical and biotechnology companies for laboratory infrastructure projects provide an additional growth avenue. Companies also face competition from price-sensitive markets in developing regions, prompting the need for cost-effective solutions while still adhering to international safety standards.

Thermo Fisher Scientific Inc. is a prominent biological safety cabinet market player. It is known for its broad range of laboratory products, including BSCs. The company focuses on providing solutions for research, healthcare, and laboratory safety. With a strong presence globally, Thermo Fisher Scientific continually invests in technology to enhance product functionality and regulatory compliance.

Esco Technologies Inc. also plays a significant role in the market, offering a variety of BSCs for applications in research and healthcare. Esco is recognized for its commitment to delivering solutions that meet the safety standards required by various industries.

List of Key Companies in Biological Safety Cabinet Market

- Thermo Fisher Scientific Inc.

- Esco Technologies Inc.

- Labconco Corporation

- Baker Company

- Kewaunee Scientific Corporation

- NuAire

- Herolab

- AirClean Systems

- SARTORIUS AG

- BIOBASE

- CleanAir

- Bigneat Ltd.

- Kottermann

- Plas-labs, Inc.

- Flow Sciences, Inc.

Biological Safety Cabinet Market Developments

- December 2024: Esco announced a new strategic partnership with a major pharmaceutical company to develop customized laboratory safety solutions. These solutions aim to improve work efficiency and maintain high safety protocols in laboratory environments.

- November 2024: The company expanded its laboratory equipment offerings by introducing a new line of BSCs designed for research institutions working with higher containment levels.

Biological Safety Cabinet Market Segmentation

By Product Outlook (Revenue-USD Million, 2020–2034)

- Class I

- Class II

- Class III

By End Use Outlook (Revenue-USD Million, 2020–2034)

- Pharmaceutical & Biopharmaceutical Companies

- Diagnostics & Testing Laboratories

- Academic & Research Organizations

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biological Safety Cabinet Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 240.78 million |

|

Market Size Value in 2025 |

USD 258.35 million |

|

Revenue Forecast by 2034 |

USD 497.40 million |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The biological safety cabinet market has been segmented into detailed segments of product and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth strategy in the biological safety cabinet market is focused on product innovation, expanding regional reach, and enhancing customer relationships. Companies are investing in research and development to improve BSC performance, including better filtration systems, energy efficiency, and user-friendly features. Marketing strategies are increasingly centered on targeting emerging markets, particularly in Asia Pacific, where demand is rising due to the expansion of healthcare and research sectors. Additionally, partnerships with pharmaceutical and biotechnology companies are a key approach to secure long-term contracts and customized solutions. Companies are also focusing on educating customers about regulatory requirements, positioning themselves as trusted partners in maintaining laboratory safety standards.

FAQ's

The biological safety cabinet market size was valued at USD 240.78 million in 2024 and is projected to grow to USD 497.40 million by 2034.

The market is projected to register a CAGR of 7.5% during the forecast period, 2025-2034.

North America had the largest share of the market.

The biological safety cabinet market features a wide range of active players, including Thermo Fisher Scientific Inc.; Esco Technologies Inc.; Labconco Corporation, Baker Company, Kewaunee Scientific Corporation, NuAire, Herolab, AirClean Systems, and SARTORIUS AG.

The Class II segment accounted for the larger share of the market in 2024.

The pharmaceutical & biopharmaceutical companies segment accounted for the larger share of the market in 2024.

A biological safety cabinet (BSC) is an enclosed workspace used in laboratories to provide a controlled environment for handling biological materials that may pose a risk to researchers, the environment, or public health. BSCs protect users from exposure to harmful microorganisms, chemicals, or aerosols by utilizing a combination of airflow systems and filtration mechanisms, such as HEPA filters, to contain contaminants. They are commonly used in settings like pharmaceutical, biotechnology, and healthcare labs, where they are essential for conducting experiments involving infectious agents or hazardous biological substances. The cabinets come in different classes (I, II, III) based on the level of containment and specific applications.

A few key trends in the market are described below: Advancements in Filtration Technologies: Increased focus on improving HEPA and ULPA filtration systems to enhance containment and air quality within BSCs. Energy Efficiency: Growing demand for energy-efficient BSCs to reduce operational costs and meet sustainability goals. Smart BSCs: Integration of digital monitoring and control systems to improve performance, safety, and ease of use. Customization: Increased emphasis on offering customized BSC solutions tailored to specific industry needs, such as higher containment levels for pharmaceutical and biopharmaceutical companies

A new company entering the biological safety cabinet market could focus on innovation and differentiation by developing energy-efficient and technologically advanced BSCs. Emphasizing smart features like digital monitoring systems, remote diagnostics, and real-time performance tracking could offer a competitive edge. Additionally, offering customizable solutions tailored to specific industries, such as pharmaceuticals or biopharmaceuticals, could attract niche customers. Focusing on cost-effective yet high-quality products for emerging markets, especially in Asia-Pacific, where demand is growing, could also provide a strategic advantage. Finally, strong partnerships with research institutions and regulatory bodies to ensure compliance and safety standards would help establish credibility and market trust

Companies manufacturing, distributing, or purchasing biological safety cabinet and related products, and other consulting firms must buy the report.