Bioinformatics Services Market Size, Share, Trends, Industry Analysis Report: By Type, Application (Genomics, Chemo Informatics & Drug Design, Proteomics, Transcriptomic, Metabolomics, and Other Applications), Specialty, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5487

- Base Year: 2024

- Historical Data: 2020-2023

Bioinformatics Services Market Overview

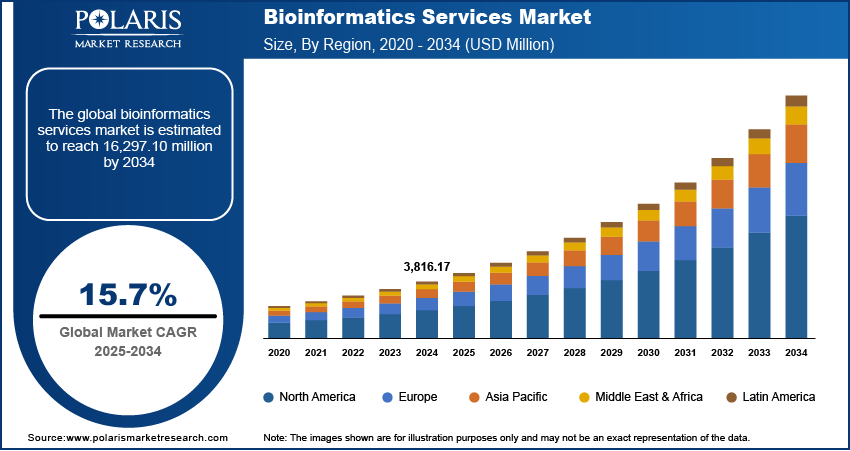

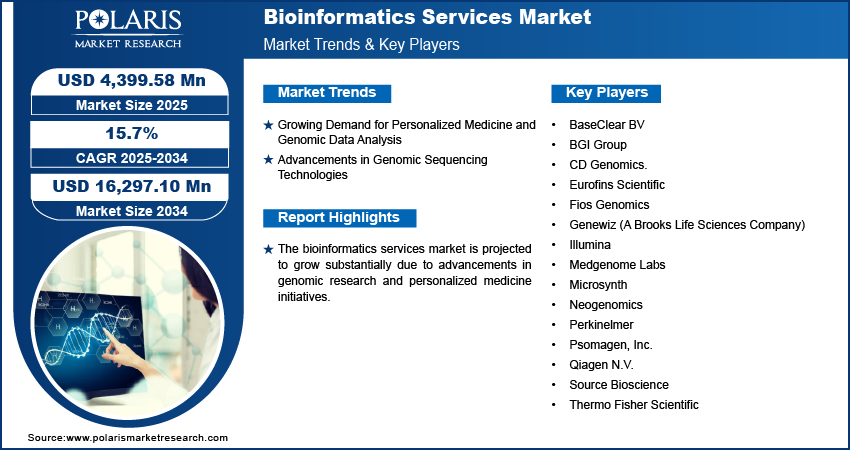

The global bioinformatics services market size was valued at USD 3,816.17 million in 2024. The market is expected to grow from USD 4,399.58 million in 2025 to USD 16,297.10 million by 2034, at a CAGR of 15.7% from 2025 to 2034.

Bioinformatics services encompass computational and analytical solutions that facilitate the interpretation of biological data, driving advancements in research, drug discovery services, and personalized medicine.

The expanding applications of bioinformatics services across various industries, such as pharmaceuticals, agriculture, and environmental science, are driving the bioinformatics services market growth. The integration of bioinformatics in drug discovery accelerates target identification and validation, optimizing research efficiency. In agriculture, bioinformatics improves crop breeding through genomic analysis, improving yield and disease resistance. For instance, in October 2024, Benson Hill Biosystems utilized bioinformatics and AI to improve crop breeding, focusing on drought tolerance and nutrient efficiency. Their CropOS platform, analyzing over 470 billion data points, achieved 85% accuracy in soybean breeding predictions, optimizing seed development for specific agricultural challenges. Additionally, bioinformatics plays a key role in environmental science, aiding in biodiversity conservation and microbial research, further broadening its scope. The demand for bioinformatics services continues to grow as industries increasingly rely on data-driven insights.

To Understand More About this Research: Request a Free Sample Report

Another key factor fueling the bioinformatics services market expansion is the increasing public and private sector investment in bioinformatics services, supporting innovation and infrastructure development. Governments and research institutions are allocating substantial funding to improve bioinformatics capabilities, boosting advancements in genomics, proteomics, and personalized medicine. For instance, in November 2023, UKRI invested over USD 100 million in the European Bioinformatics Institute (EMBL-EBI), part of the European Molecular Biology Laboratory (EMBL), to support advancements in bioinformatics and molecular biology research. Simultaneously, private-sector investments are fostering collaborations between bioinformatics service providers and biotechnology firms, accelerating research outcomes. For instance, in November 2022, Arima Genomics partnered with Basepair to improve 3D genomic data analysis. The collaboration focuses on providing a user-friendly interface, faster processing, better data management, and simplified reporting to make advanced bioinformatics tools more accessible to researchers. It supports the development of high-throughput computing, artificial intelligence-based analytics, and cloud-based bioinformatics solutions, enhancing accessibility and efficiency. As financial support continues to expand, the bioinformatics services market is poised for sustained growth, reinforcing its critical role in advancing life sciences research and innovation.

Bioinformatics Services Market Dynamics

Growing Demand for Personalized Medicine and Genomic Data Analysis

Personalized medicine relies on genomic sequencing and bioinformatics tools to analyze genetic variations, enabling targeted therapies and precision treatments. Bioinformatics services facilitate large-scale genomic data processing, supporting biomarker discovery, pharmacogenomics, and disease risk assessment as advancements in genomics continue to transform healthcare and disease management. Governments worldwide are recognizing the critical role of genomic research and investing significantly in bioinformatics infrastructure. For instance, in December 2022, the UK government allocated USD 231.4 million in funding for genomic research initiatives. This investment supports research programs focused on newborn disease diagnosis, health equity in genomic medicine, cancer diagnostics, and functional genomics studies in collaboration with the NHS Genomic Medicine Service and Genomics England. Additionally, the increasing adoption of next-generation sequencing (NGS) technologies is boosting the need for refined bioinformatics solutions, ensuring efficient data interpretation. Thus, as healthcare shifts toward individualized treatment strategies, the bioinformatics services market demand is expected to rise.

Advancements in Genomic Sequencing Technologies

Next-generation sequencing (NGS) and third-generation sequencing methods generate vast amounts of complex biological data, necessitating advanced bioinformatics tools for efficient data processing and interpretation. These technologies allow comprehensive genomic studies, facilitating breakthroughs in personalized medicine, disease diagnostics, and evolutionary biology. For instance, in May 2024, QIAGEN launched QCI Secondary Analysis, a cloud-based SaaS solution for high-throughput secondary analysis of clinical NGS data. Integrated with QCI Interpret, it streamlines bioinformatics workflows for oncology and inherited diseases, allowing smaller labs to adopt NGS testing efficiently and securely while ensuring compliance with data protection standards. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) in genomic sequencing has enhanced data analysis capabilities. For instance, in June 2023, Illumina Inc. developed PrimateAI-3D, an AI algorithm for predicting disease-causing genetic mutations. The research included algorithm training details and its application to UK Biobank genome data, alongside primate evolution studies. Therefore, as sequencing technologies continue to evolve, the need for refined bioinformatics solutions to manage, analyze, and derive meaningful insights from genomic data is expected to grow, reinforcing their essential role in life sciences research and healthcare.

Bioinformatics Services Market Segment Insights

Bioinformatics Services Market Assessment by Specialty Outlook

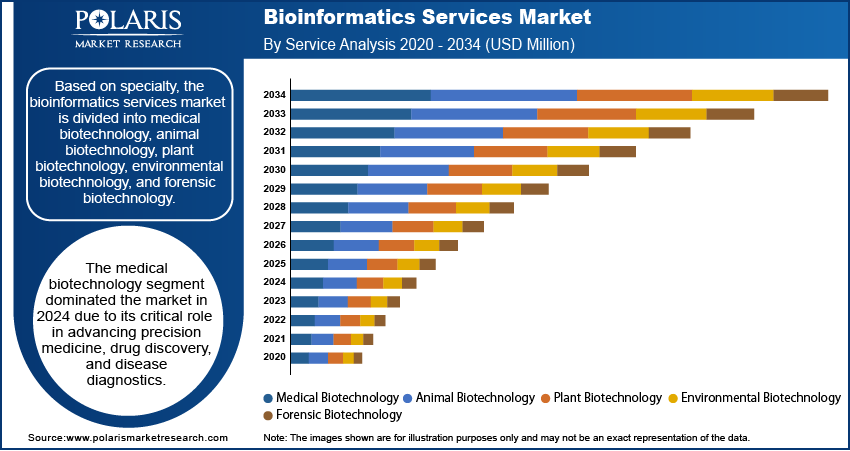

The global bioinformatics services market assessment, based on specialty, includes medical biotechnology, animal biotechnology, plant biotechnology, environmental biotechnology, and forensic biotechnology. The medical biotechnology segment dominated the market in 2024 due to its critical role in advancing precision medicine, drug discovery, and disease diagnostics. The increasing adoption of bioinformatics in genomics, proteomics, and transcriptomics has greatly improved biomarker identification, allowing targeted therapies for complex diseases such as cancer and genetic disorders. Additionally, the rising integration of AI and ML in bioinformatics has improved data analysis efficiency, accelerating drug development timelines. As healthcare systems continue to prioritize personalized treatment strategies, the demand for bioinformatics services in medical biotechnology remains strong, driving market growth.

Bioinformatics Services Market Evaluation by End User Outlook

The global bioinformatics services market evaluation, based on end user, includes academic institutes & research centers, hospitals & clinics, pharmaceutical & biotechnology companies, CROs, and other end users. The academic institutes & research centers segment is expected to witness the fastest growth from 2025 to 2034, driven by the increasing focus on genomics research, molecular biology studies, and computational biology advancements. These institutions serve as hubs for innovation, leveraging bioinformatics services to analyze vast biological datasets and develop novel therapeutic solutions. Government and private sector funding for research initiatives further supports the adoption of bioinformatics tools, boosting advancements in precision medicine and agricultural biotechnology. As research institutions continue to expand their collaborations with biotechnology firms and pharmaceutical companies, the demand for bioinformatics services is projected to accelerate, reinforcing their critical role in scientific discovery.

Bioinformatics Services Market Regional Analysis

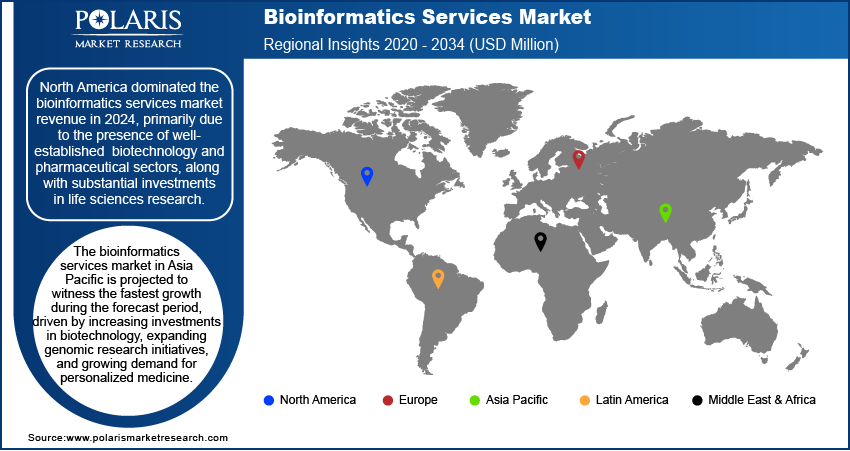

By region, the report provides the bioinformatics services market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global market in 2024, primarily due to its well-established biotechnology and pharmaceutical industries, along with substantial investments in life sciences research. The region benefits from a strong infrastructure for genomics, bioinformatics, and clinical research, which facilitates the rapid adoption of advanced computational tools. Additionally, the widespread implementation of NGS technologies and AI in healthcare has driven the need for robust bioinformatics services. Supportive regulatory frameworks and government funding initiatives further strengthen North America's leadership in the bioinformatics sector, ensuring continued market expansion. For instance, in September 2022, the National Institutes of Health (NIH) launched the Bridge2AI program, with a funding allocation of USD 130 million over four years to improve the use of AI in biomedical and behavioral research. The initiative aims to generate ethically sourced data sets and best practices, addressing challenges in data diversity and quality while boosting collaboration to improve health outcomes.

The Asia Pacific bioinformatics services market is projected to witness the fastest growth during the forecast period, driven by increasing investments in biotechnology, expanding genomic research initiatives, and a growing demand for personalized medicine. The region’s rapidly developing healthcare and life sciences sectors, particularly in countries such as China, India, and Japan, are fueling the adoption of bioinformatics solutions. Government-backed genomic projects, coupled with a rising number of research collaborations, are further accelerating market growth. Additionally, advancements in bioinformatics infrastructure and the increasing availability of skilled professionals are improving the region’s ability to support large-scale biological data analysis, positioning Asia Pacific as a major growth hub for the bioinformatics services market.

List of Key Companies in Bioinformatics Services Market

- BaseClear BV

- BGI Group

- CD Genomics.

- Eurofins Scientific

- Fios Genomics

- Genewiz

- Illumina

- Medgenome Labs

- Microsynth

- Neogenomics

- Perkinelmer

- Psomagen, Inc.

- Qiagen N.V.

- Source Bioscience

- Thermo Fisher Scientific

Bioinformatics Services Market – Key Players and Competitive Insights

The competitive landscape features a mix of global leaders and regional players competing for bioinformatics services market share through innovation, strategic collaborations, and geographic expansion. Global players such as Illumina, Inc.; Thermo Fisher Scientific; QIAGEN; and PerkinElmer leverage strong R&D capabilities and expansive distribution networks to deliver advanced bioinformatics solutions, such as genomic data analysis, proteomics, and drug discovery platforms. Bioinformatics services market trends highlight increasing demand for cloud-based bioinformatics tools, AI-driven data analytics, and personalized medicine solutions, reflecting advancements in computational biology and biotechnology. According to bioinformatics services market analysis, the market is projected to experience substantial growth, driven by the rising volume of biological data, increasing adoption of precision medicine, and growing applications in genomics and clinical research.

Regional companies are focusing on addressing localized needs by offering cost-effective and customized bioinformatics services, particularly in emerging markets. Market competitive strategies, including mergers and acquisitions, partnerships with academic and research institutions, and the development of innovative bioinformatics platforms, cater to the growing demand for data-driven insights in healthcare and life sciences. The importance of technological innovation, bioinformatics services market adaptability, and investments in driving the expansion of the bioinformatics services industry. A few key major players are BaseClear BV; BGI Group; CD Genomics; Eurofins Scientific; Fios Genomics; Genewiz; Illumina; Medgenome Labs; Microsynth; Neogenomics; Perkinelmer; Psomagen, Inc.; Qiagen N.V.; Source Bioscience; and Thermo Fisher Scientific.

Illumina, Inc., founded in 1998 and headquartered in San Diego, California, is a biotechnology company specializing in genomic sequencing and array-based technologies. The company develops integrated systems that facilitate the analysis of genetic variation and biological function, serving a diverse clientele, such as academic institutions, pharmaceutical companies, and genomic research centers across over 160 countries. Illumina's product portfolio encompasses a wide range of solutions, such as sequencing kits, reagents, and microarray services, which are pivotal in molecular diagnostics, translational genomics, and cancer research. Illumina is recognized for its innovative technologies that have advanced personalized medicine by allowing researchers to conduct large-scale genomic analyses. The company's sequencing platforms, such as the NovaSeq series, are capable of generating vast amounts of data efficiently, thereby supporting various applications from whole-genome sequencing to gene expression analysis. Additionally, Illumina offers bioinformatics services that help interpret complex genomic data, making it easier for researchers and clinicians to derive actionable insights for disease detection and treatment. Illumina continues to drive advancements that enhance the understanding of genetics and improve healthcare outcomes globally.

QIAGEN N.V., founded in 1996 and headquartered in Venlo, Netherlands, is a global provider of "Sample to Insight" solutions that facilitate the extraction and analysis of biological materials. The company specializes in technologies that isolate DNA, RNA, and proteins from various samples, such as blood and tissue. Its innovative assay technologies improve the visibility of these biomolecules for further analysis, while its bioinformatics services play a crucial role in interpreting complex data to deliver actionable insights. QIAGEN's bioinformatics software and knowledge bases support a diverse clientele across multiple sectors, such as molecular diagnostics, applied testing (forensics), pharmaceuticals, and academic research. The company is committed to advancing science and improving healthcare outcomes through its comprehensive range of products and services. QIAGEN has also expanded its capabilities through strategic acquisitions, improving its offerings in molecular diagnostics and bioinformatics solutions.

Bioinformatics Services Industry Developments

January 2025: Illumina partnered with NVIDIA to integrate AI and multiomic data, enhancing genomic analysis, drug discovery, and clinical research through advanced tools like NVIDIA BioNeMo and Illumina Connected Analytics.

January 2025: Almaden Genomics launched g.nome 2.0, improving its bioinformatics platform with g.nome analytics and a user-friendly interface. These upgrades facilitate deeper data exploration and streamlined workflows for researchers, boosting efficiency in the life sciences industry.

Bioinformatics Services Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Sequencing Services

- Data Analysis

- Drug Discovery Services

- Differential Gene Expression Analysis

- Database and Management Services

- Other Bioinformatics Services

By Application Outlook (Revenue, USD Million, 2020–2034)

- Genomics

- Chemo Informatics & Drug Design

- Proteomics

- Transcriptomic

- Metabolomics

- Other Applications

By Specialty Outlook (Revenue, USD Million, 2020–2034)

- Medical Biotechnology

- Animal Biotechnology

- Plant Biotechnology

- Environmental Biotechnology

- Forensic Biotechnology

By End User Outlook (Revenue, USD Million, 2020–2034)

- Academic Institutes & Research Centers

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- CROs

- Other End Users

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bioinformatics Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3,816.17 million |

|

Market Size Value in 2025 |

USD 4,399.58 million |

|

Revenue Forecast by 2034 |

USD 16,297.10 million |

|

CAGR |

15.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global bioinformatics services market size was valued at USD 3,816.17 million in 2024 and is projected to grow to USD 16,297.10 million by 2034.

The global market is projected to register a CAGR of 15.7% during the forecast period.

North America dominated the global market in 2024.

Some of the key players in the market are BaseClear BV; BGI Group; CD Genomics; Eurofins Scientific; Fios Genomics; Genewiz; Illumina; Medgenome Labs; Microsynth; Neogenomics; Perkinelmer; Psomagen, Inc.; Qiagen N.V.; Source Bioscience; and Thermo Fisher Scientific.

The medical biotechnology segment dominated the market in 2024.