Biofabrication Market Size, Share, Trends, Industry Analysis Report: By Technology (3D-Bioprinting and Tissue Engineering), Material Type, Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM5334

- Base Year: 2024

- Historical Data: 2020-2023

Biofabrication Market Overview

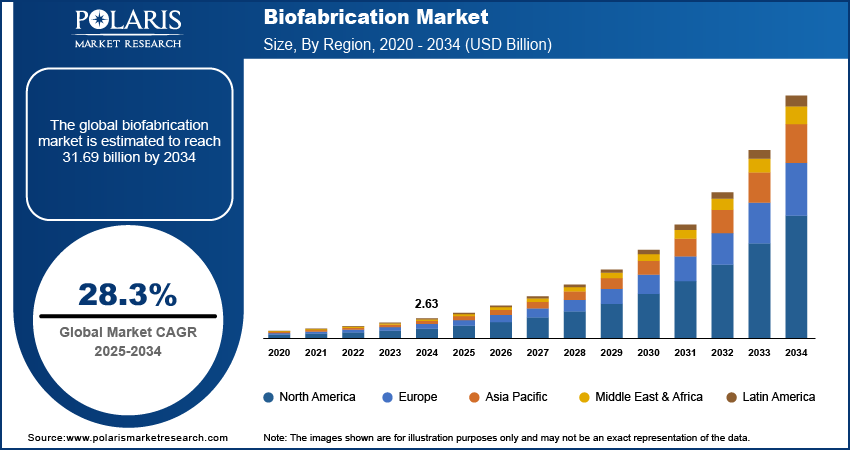

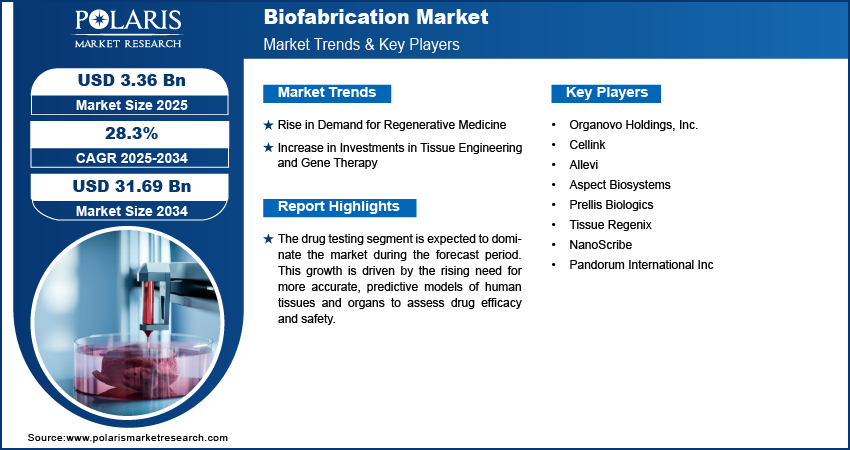

The biofabrication market size was valued at USD 2.63 billion in 2024. The market is projected to grow from USD 3.36 billion in 2025 to USD 31.69 billion by 2034, exhibiting a CAGR of 28.3% during 2025–2034.

Biofabrication is the process of using biological materials and technologies to create functional tissue structures, organs, and other products for medical, research, and industrial applications. The biofabrication market is significantly driven by the rising incidence of traumatic injuries worldwide. According to the World Health Organization (WHO), traumatic injuries account for 3 out of 5 deaths annually among individuals aged 5 to 29. Road accidents alone are responsible for ∼4.4 million deaths each year. This high mortality rate has increased awareness among the general population and intensified the demand for effective solutions to address severe injuries. As a result, there is a growing need for advanced biofabrication techniques capable of regenerating damaged tissues and organs. This market trend reflects an urgent call for innovations in tissue engineering and regenerative medicine to improve patient outcomes and enhance recovery processes. The increasing prevalence of traumatic injuries emphasizes the critical need for advancements in biofabrication to provide viable solutions and support the development of effective therapies and interventions.

To Understand More About this Research: Request a Free Sample Report

The biofabrication market is significantly driven by increased investments in research and development due to recent funding initiatives that enhance technological capabilities in the field. For instance, Pennsylvania State University’s Bio-Soft Materials Laboratory (B-SMaL) received a substantial boost through a USD 293,016 NIH diversity grant, complementing an existing USD 3 million NIH grant. This funding is dedicated to advancing research in bioprinting blood vessel networks, which is crucial for understanding and treating vascular diseases. Such support underscores the growing commitment to innovation in biofabrication technologies. Similarly, the Royal College of Surgeons in Ireland (RCSI) was awarded USD 3.1 million for the POLINA project by the European Innovation Council. Led by Professor Andreas Heise, this project focuses on developing new materials and technologies to improve the precision of 3D biostructures and devices. These investments highlight the increasing emphasis on refining biofabrication methods and enhancing their applications in medicine. Collectively, these funding efforts advance the scientific understanding of biofabrication and drive the development of sophisticated and effective solutions, propelling the market forward and expanding its potential across various medical and research domains.

Biofabrication Market Drivers

Rise in Demand for Regenerative Medicine

Increased demand for regenerative medicines globally for the treatment of damaged organs due to chronic diseases or traumatic injuries fuels the biofabrication market growth. As a result, new players are entering the sector with capital funding or due to the government’s support. According to Alliance for Regenerative Medicine, North America has 1,243 developers working on different fields of regenerative medicine, whereas Asia Pacific recorded 1,000 developers and Europe has 579 as of August 2024. Among 2,822 developers, 30 developers work in the field of tissue engineering. Meanwhile, 1,153 developers work in the field of gene therapy, 1,184 work in cell therapy, and others work in the field of GMCT & CBIO. 60% of developers belong to or own private firms focused on regenerative medicine development. Due to an increase in demand and funding, a greater number of players enter the sector every year, which drives the biofabrication market.

Increase in Investments in Tissue Engineering and Gene Therapy

A rise in capital investments and government funding in the sector increases the number of players in the market and propels the demand for fabrication techniques. For instance, according to Alliance of Regenerative Medicine, the investments in the tissue engineering field increased to USD 22.7 billion in 2021 from USD 13.3 billion in 2018. In August 2024, USD 4 billion was raised by capital investing in the field, and USD 0.2 billion was raised by strategic alliances globally. Out of USD 4 billion, Europe recorded USD 0.2 billion by capital investing and USD 0.1 billion by strategic alliances. Also, USD 0.1 billion was raised by strategic alliances by licensing agreements across the world. This increase in investments boosts research and development activities in gene therapy, tissue engineering, and cell therapy and simultaneously leads to an increase in demand for biofabrication techniques. Thus, an increase in Investments in various applications of biofabrication fuels the biofabrication market expansion.

Biofabrication Market Segment Insights

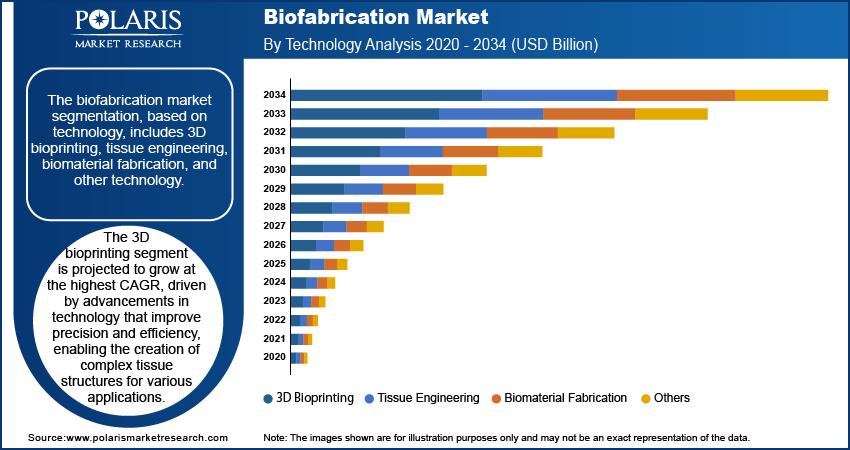

Biofabrication Market Breakdown – Technology Insights

The biofabrication market segmentation, based on technology, includes 3D bioprinting, tissue engineering, biomaterial fabrication, and other technology. The 3D bioprinting segment is expected to record the highest CAGR in the global market during the forecast period. This growth is attributed to the rising technological advancements that have enhanced the precision and efficiency of bioprinting, facilitating the creation of complex tissue structures for medical, pharmaceutical, and cosmetic applications. Increased applications in regenerative medicine, personalized drug testing, and organ transplantation drive the market growth for the segment as researchers and companies seek innovative solutions to improve patient outcomes. Moreover, advancements in biomaterials and printing techniques continue to expand the possibilities of bioprinting.

Biofabrication Market Breakdown – Application Insights

The biofabrication market segmentation, based on application, includes regenerative medicine, drug testing, and cosmetic treatment. The drug testing segment is expected to dominate the market during the forecast period. This growth is driven by the rising need for more accurate, predictive models of human tissues and organs to assess drug efficacy and safety. 3D bioprinting enables the creation of complex, tissue-specific constructs that better mimic in vivo conditions compared to traditional cell cultures, allowing for more reliable drug testing outcomes. This advancement accelerates the drug development process and reduces reliance on animal testing, aligning with ethical and regulatory shifts in the pharmaceutical industry.

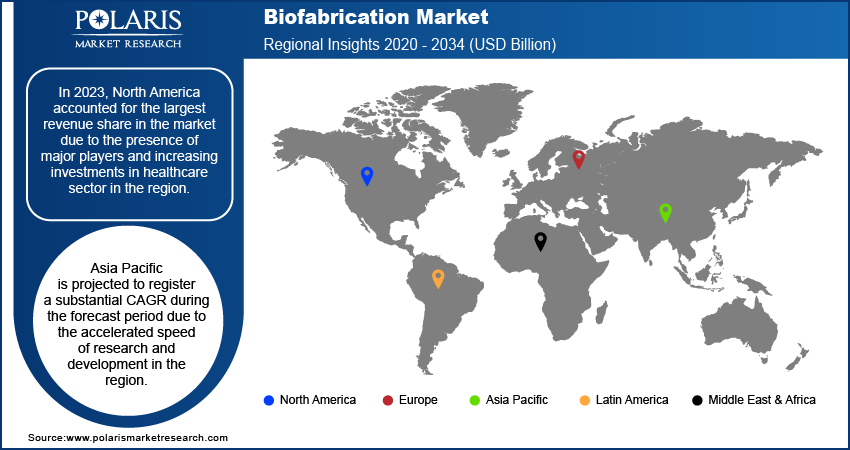

Biofabrication Market Regional Insights

By region, the study provides the biofabrication market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest revenue share in the market due to the presence of major players and increasing investments in healthcare sector in the region. For instance, in regenerative medicine North America reported a capital raising of USD 3.7 billion in the second quarter of 2024. In this capital, USD 766 million were raised by venture financing, USD 676 million by equity offering, and USD 2,262 million by FPO (follow-on Public Offering). Additionally, USD 50 million were raised by the strategic alliance. These increased investments and capital raising in the biofabrication and tissue engineering sectors boost research and developments, sales network in the unmet population of the region, and simultaneously result in the biofabrication market growth in North America.

Asia Pacific is projected to register a substantial CAGR during the forecast period due to the accelerated speed of research and development in the region. According to the World Economic Forum, South Asia is the fifth rapidly developing region and on the verge of being fourth. The accelerated pace of research and development in the region is attributed to an increase in the number of academics and research institutes and research and development activities by pharmaceutical and biotechnology companies. Pharmaceutical and biotechnology companies are intensifying their R&D activities, investing heavily in innovative fabrication solutions. Countries such as China, Japan, and South Korea are at the forefront, leveraging their robust research infrastructure and strong government support to drive advancements. This collaborative environment between academic institutes and industry is expected to drive the biofabrication market in Asia Pacific in the coming years.

The biofabrication market in India is poised for significant growth due to an increase in the number of pipeline drugs for testing. The biofabrication process, which includes 3D bioprinting, has major significance in drug testing and trials. Due to the expansion of pharmaceutical and biotechnology companies, the number of new drugs in the pipeline is increasing. For instance, according to the Clinical Trial Registry of India, a total of 54,547 new drugs were registered in India, and is expected to grow in number in the coming years. This surge in drug development activities is fueling demand for advanced 3D bioprinting technologies to create more accurate tissue models for preclinical testing. As pharmaceutical companies intensify their R&D efforts, biofabrication offers enhanced capabilities for drug screening and efficacy evaluation. This growing need for innovative testing solutions is fueling the biofabrication market in India.

Biofabrication Market – Key Players and Competitive Insights

The biofabrication market is constantly changing as many businesses compete to be most effective at what they do. The market is dominated by major international companies that stay ahead of the competition by investing heavily in R&D, advanced manufacturing techniques, and substantial capital. These businesses adopt strategic initiatives, including partnerships, mergers, acquisitions, and collaborations, to improve their product offerings and enter new markets.

New companies are impacting the industry by introducing innovative medical devices and meeting the needs of specific market sectors. This competitive environment is amplified by continuous progress in product offerings and new material types, greater emphasis on sustainability, and the rising requirement for tailor-made single-use products in diverse industries. Major players in the biofabrication market are Organovo Holdings, Inc.; Cellink; Allevi; Aspect Biosystems; Prellis Biologics; Tissue Regenix; NanoScribe; Pandorum International Inc.; and others.

Organovo Holdings, Inc., established in 2007, is a biotechnology company operating under the parent organization, Organovo Holdings, Inc. The company specializes in the development of three-dimensional (3D) bioprinting technology aimed at creating functional human tissues for medical research and therapeutic applications. Organovo operates primarily within the biotechnology and medical research sectors, focusing on advancing tissue engineering and regenerative medicine. The company’s technological innovations are designed to address complex medical challenges by enabling more accurate and efficient testing of pharmaceuticals and the creation of transplantable tissues. Headquartered in San Diego, California, Organovo's activities extend across various regions, including North America and Europe. The company’s research and development efforts are central to its operations, aiming to transform the landscape of tissue engineering and drug discovery. In May 2024, company has priced a public offering of 6,562,500 shares of common stock and accompanying common warrants at $0.80 per share. The common warrants are exercisable immediately with a five-year term. The offering, expected to raise $5.25 million before expenses, is set to close around May 13, 2024, pending customary conditions. JonesTrading Institutional Services LLC is the exclusive placement agent.

Cellink, founded in 2016, is an innovative biotechnology company specializing in 3D bioprinting technology. As a standalone entity without a parent company, Cellink focuses on developing advanced bioprinting solutions that enable the creation of complex biological tissues and structures for research, pharmaceutical, and medical applications. The company operates primarily in the biotechnology and regenerative medicine sectors and has a global presence spanning North America, Europe, and Asia. Cellink's product portfolio includes 3D bioprinters, bioinks, and supporting technologies designed to facilitate tissue engineering and personalized medicine. In December 2022, the company and the Indian Institute of Science (IISc) launched the first 3D bioprinting Center of Excellence at IISc’s Bengaluru campus, India. The center is expected to provide researchers with access to advanced 3D bioprinting systems, including the BIO X, BIO X6, and BIONOVA X. This facility aims to accelerate research and improve health outcomes across critical applications in the region.

Key Companies in Biofabrication Market

- Organovo Holdings, Inc.

- Cellink

- Allevi

- Aspect Biosystems

- Prellis Biologics

- Tissue Regenix

- NanoScribe

- Pandorum International Inc.

Biofabrication Industry Developments

June 2024: Tethon 3D, a Nebraska-based ceramic 3D printing specialist, launched its Bison Bio DLP 3D printer, marking its entry into the bioprinting market. Developed with Carima, the desktop-sized Bison Bio is designed for medical R&D and is compatible with Tethin 3D’s photoinitiator and GelMA hydrogel bioink in partnership with Cell Bark Innovation. Tethon 3D’s new venture into bioprinting, supported by bioprinting advisor Dr. Hojae Bae, aims to advance healthcare and biomedical research.

November 2022: Avay Biosciences, a Chennai-based deep tech startup, unveiled its advanced bio 3D printer, ‘Mito Plus,’ at the Bengaluru Tech Summit held from November 16 to 18, 2022. The printer, designed for printing human tissues, represents a significant advancement from the prototype installed at IISc, Bangalore, with contributions from Dr. Bikramjit Basu's research lab. Avay Biosciences offers a fully indigenous solution for bio 3D printing, encompassing software and hardware development.

April 2020: Techshot Inc. bioprinted a human meniscus aboard the ISS National Lab using its BioFabrication Facility (BFF), which launched on SpaceX’s CRS missions. Since its first prints in December 2019, the BFF has expanded its capabilities, utilizing a direct dispensing method to create tissues in microgravity. This milestone positions the BFF as the first American bioprinter in space and opens it for use by life science researchers. The BFF's advancements could significantly impact organ manufacturing and address the organ shortage crisis.

Biofabrication Market Segmentation

By Technology Outlook

- 3D Bioprinting

- Tissue Engineering

- Biomaterial Fabrication

- Other

By Material Type Outlook

- Bioinks

- Biological Cells

- Biomaterials

- Others

By Application Outlook

- Regenerative Medicine

- Durg Testing

- Cosmetic Treatment

By End User Outlook

- Academic and Research Institutes

- Biotechnology and Pharmaceutical Companies

- Hospitals and Specialty Clinics

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biofabrication Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.63 billion |

|

Market Size Value in 2025 |

USD 3.36 billion |

|

Revenue Forecast by 2034 |

USD 31.69 billion |

|

CAGR |

28.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Application |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The biofabrication market size was valued at USD 2.63 billion in 2024 and is projected to grow to USD 31.69 billion by 2034.

The global market is projected to record a CAGR of 28.3% during the forecast period.

North America accounted for the largest share of the global market.

A few key players in the market are Organovo Holdings, Inc.; Cellink; Allevi; Aspect Biosystems; Prellis Biologics; Tissue Regenix; NanoScribe; and Pandorum International Inc.

The Bioinks segment is anticipated to experience substantial growth at a significant CAGR in the global market. This growth is attributed to an increase in demand for the 3D-bioprinters

The 3D Bioprinting segment accounted for the largest revenue share of the market in 2024 due to the rising technological advancements that have enhanced the precision and efficiency of bioprinting.