Biodegradable Packaging Market Share, Size, Trends, Industry Analysis Report: By Material, Packaging Format, End Use (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Homecare, and Other Consumer Goods), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 110

- Format: PDF

- Report ID: PM1497

- Base Year: 2023

- Historical Data: 2019-2022

Biodegradable Packaging Market Overview

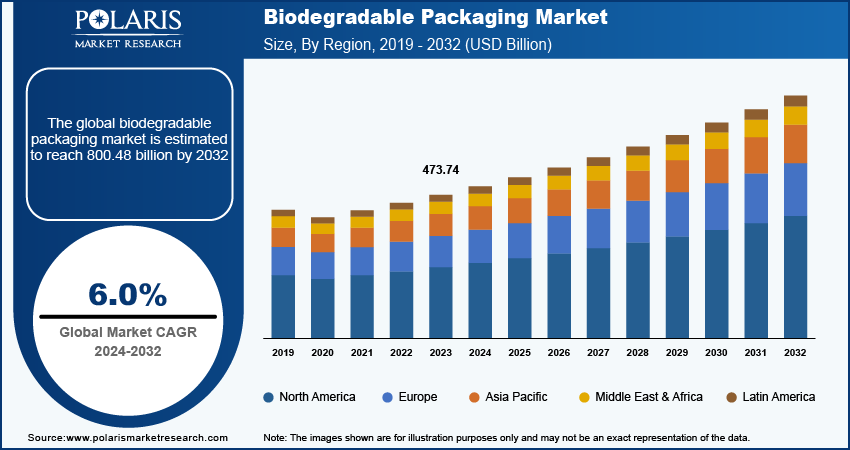

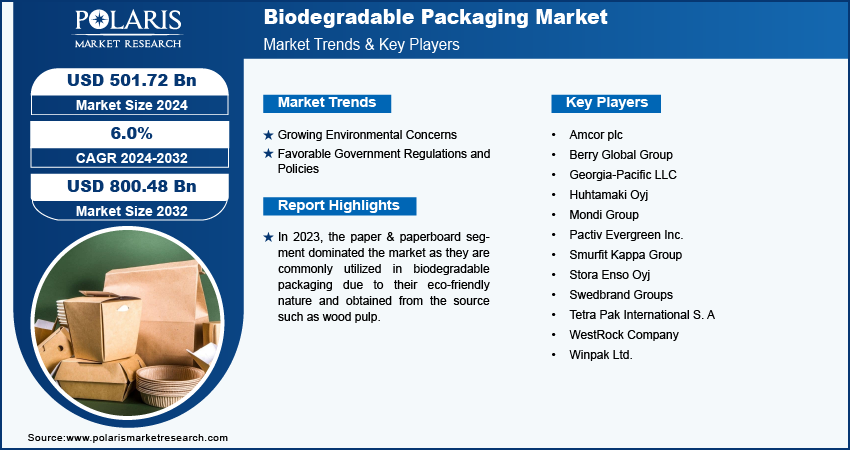

The biodegradable packaging market size was valued at USD 473.74 billion in 2023. The market is projected to grow from USD 501.72 billion in 2024 to USD 800.48 billion by 2032, exhibiting a CAGR of 6.0% during 2024–2032.

Biodegradable packaging refers to packaging that can be decomposed by microorganisms such as bacteria, fungi, and algae, transforming into natural elements within a year or less. The rising demand for biodegradable packaging is fueled by growing awareness of the environmental impact of plastic waste and its effects. Consumers are seeking eco-friendly alternatives such as biodegradable packaging that reduce greenhouse gas (GHG) emissions.

Additionally, Biodegradable type of packaging offers several benefits, including lower production costs, recyclability, nontoxic and allergen-free properties, and a reduced carbon footprint. As the global population expands and waste generation increases, the need for sustainable waste management solutions rises, further driving the demand for biodegradable packaging and allied activities. In 2019, plastics were responsible for 3.4% to 5.3% of global greenhouse gas emissions. This proportion is projected to rise to 17% to 22% by 2050. In contrast to traditional packaging materials such as plastic, which can take centuries to decompose, biodegradable packaging offers an eco-friendly solution.

To Understand More About this Research: Request a Free Sample Report

Biodegradable Packaging Market Trends

Growing Environmental Concerns

Environmental concerns such as pollution and global warming influence people to abandon nonbiodegradable and single-use packaging. According to the data published by the UN Environment Programme in 2023, 19–23 million tons of plastic waste enter into the aquatic ecosystems, contaminating lakes, rivers, and oceans each year. Plastic waste and other toxic packaging materials damage marine ecosystems, leading to the death of aquatic species through ingestion or entanglement. Additionally, many packaging materials contain harmful substances such as BPA and benzene, which pose risks to human health, potentially causing cancer, blood pressure issues, and respiratory problems. Thus, the growing concerns regarding environmental pollution are expected to fuel the growth of the biodegradable packaging market during the forecast period.

Favorable Government Regulations and Policies

Governments are placing greater emphasis on environmentally sustainable practices, leading to the establishment of various regulations and policies that encourage the use of compostable packaging materials. These efforts are designed to mitigate the environmental impact of conventional packaging and tackle the challenges posed by plastic waste. As per a report from UK Parliament, the UK's plastic packaging tax incentivizes companies to use packaging that contains at least 30% recycled plastic. Companies that exceed this 30% threshold for recycled content in their plastic packaging may receive incentives, aiming to encourage the use of more sustainable materials and reduce the environmental impact of difficult-to-recycle plastics.

Biodegradable Packaging Market Segment Insights

Biodegradable Packaging Market Breakdown – Material Insights

The global biodegradable packaging market, based on material, is segmented into paper & paperboard, bio-plastic, and bagasse.

In 2023, the paper & paperboard segment dominated the market as they are commonly utilized in biodegradable packaging due to their eco-friendly nature and obtained from the source such as wood pulp. These materials are easily recyclable, compostable, and biodegradable. They offer excellent strength and durability, making them suitable for several applications. Additionally, paper and paperboard packaging provides superb printability and branding opportunities.

Notpla, a London-based startup, has developed seaweed-based coatings for paper and board packaging. This coating is grease-proof and water-resistant, making it an ideal alternative to traditional food packaging. Notpla's seaweed-lined boxes are utilized by various Just Eat restaurant partners and are now adopted across eight European markets.

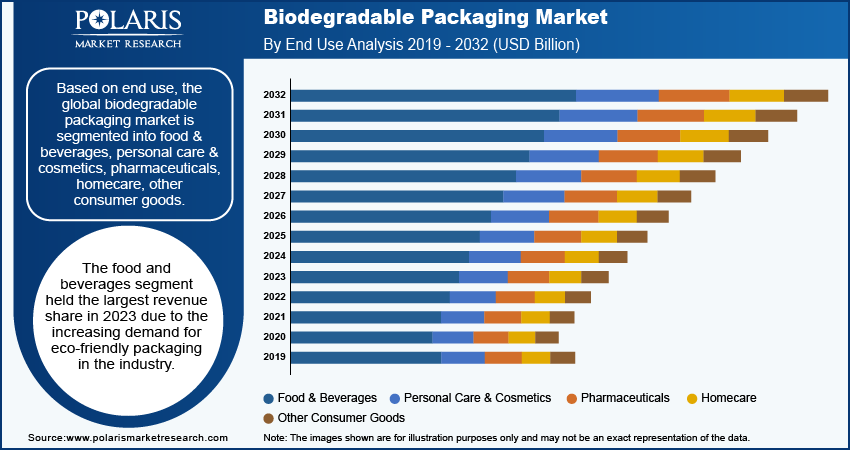

Biodegradable Packaging Market Breakdown – End Use Insights

Based on end use, the global biodegradable packaging market is segmented into food & beverages, personal care & cosmetics, pharmaceuticals, homecare, other consumer goods. The food and beverages segment held the largest revenue share in the year 2023 due to the increasing demand for eco-friendly packaging in the industry. The shift towards biodegradable packaging is driven by government regulations in many regions that restrict the use of plastics and oxo-degradable plastics, prompting companies to adopt more sustainable packaging alternatives. According to a report from European Commission, The European Union (EU) banned polystyrene plastic containers for food and beverages from July 2021 as more than 80% of marine litter is plastic. Plastic pollution affects marine life and enters the human food chain, causing environmental harm and economic losses in tourism, fisheries, and shipping, underscoring the need for better plastic use, reuse, and recycling.

Biodegradable Packaging Market Breakdown Regional Insights

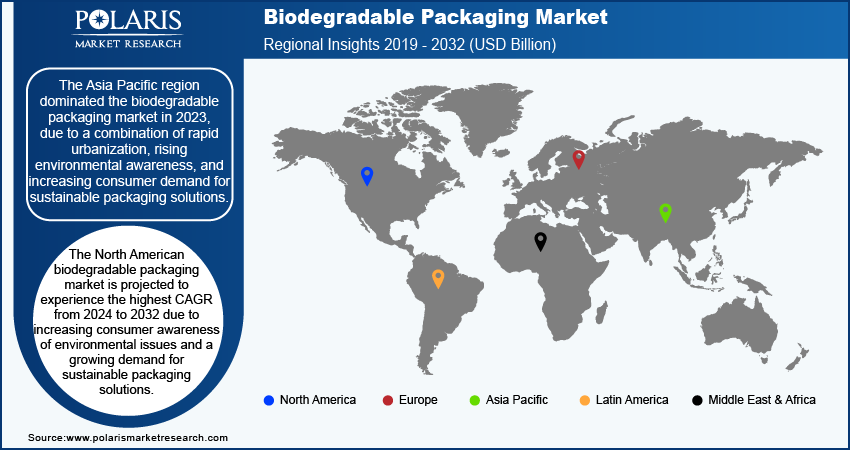

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The Asia Pacific region dominated the biodegradable packaging market in 2023, due to a combination of factors such as rapid urbanization, rising environmental awareness, and increasing consumer demand for sustainable packaging solutions. As populations grow and disposable incomes rise, consumers are becoming more conscious of the environmental impact of plastic waste, driving the shift towards biodegradable options. Additionally, supportive government policies and regulations promoting eco-friendly packaging practices further drives the market growth in this region. The presence of key manufacturing hubs and innovations in biodegradable materials also contribute to the region's leadership in this market, making it a vital player in the global shift towards sustainability. According to a report from Ministry of Environment, Forest and Climate Change, in 2020, the Indian government announced plans to phase out single-use plastics by 2022 as part of its commitment to combat plastic pollution. This initiative aimed to promote the adoption of biodegradable alternatives, encouraging businesses and consumers to embrace sustainable practices. To facilitate this transition, the government raised awareness about the environmental impacts of plastic waste and incentivized the development of eco-friendly packaging solutions. By enforcing the ban on single-use plastics, local governments sought to drive innovation in the packaging industry, ultimately driving a shift towards more sustainable consumption patterns across the country.

The North American biodegradable packaging market is projected to experience the highest CAGR from 2024 to 2032 due to increasing consumer awareness of environmental issues and a growing demand for sustainable packaging solutions. Government regulations promoting eco-friendly practices such as the US 2030 Food Loss and Waste Reduction Goal and the rising adoption of biodegradable materials across various industries such as food and beverages, pharmaceutical, among others further drive this growth. Additionally, investments in innovative packaging technologies are expected to improve market expansion during this period.

Biodegradable Packaging Market – Key Players and Competitive Insights

The biodegradable packaging market is characterized by a high level of fragmentation, with major players including Amcor Limited; Sealed Air Corp.; Mondi Group; and Tetra Pak. In addition to these key players, numerous regional companies in developing countries such as India are actively working to gain market share. The low barriers to entry have resulted in a surge of smaller competitors, increasing the intensity of rivalry within the industry. Other notable companies in the biodegradable packaging market include Stora Enso Oyj; Smurfit Kappa; Georgia-Pacific; Pactiv Evergreen; Berry Global; Huhtamaki; WestRock Company; Swedbrand Group; Winpak Ltd.; and Kruger Inc.

Amcor Plc (Amcor), a packaging solutions provider based, in England, UK, offers a range of products such as plastic, fiber, metal, and glass packaging. Amcor’s products are used across various industries, including beverages, food, pharmaceuticals, medical devices, home care, pet care, and specialty cartons. the company operates in Europe, Asia Pacific, North America, and Oceania. In July 2024, Amcor collaborated with Lorenz Snacks to introduce a new, recyclable package for its Lentil Coated Peanuts product.

Tetra Pak International SA (Tetra Pak), an entity of Tetra Laval International, offers solutions for food processing and packaging. The company develops and markets distribution equipment, including film wrappers, cardboard packers, and conveyors. It delivers complete machine lines, encompassing equipment, engineering, installation, design, project management, and services. The company operates through a network of partner subsidiaries, marketing offices, and sales offices across the Americas, Europe, the Middle East, Africa, and Asia Pacific. Tetra Pak is headquartered in Lausanne, Switzerland. In September 2024, Tetra Pak announced a partnership with a prominent European juice brand to introduce the Tetra Prisma Aseptic 300 Edge beverage carton. This innovative carton maximizes the use of renewable materials, incorporating paperboard and plant-based polymers sourced responsibly from sugarcane. By adoption of this carton, the company aims to minimize its carbon footprint significantly.

Key Companies in Biodegradable Packaging Market

- Amcor plc

- Berry Global Group

- Georgia-Pacific LLC

- Huhtamaki Oyj

- Mondi Group

- Pactiv Evergreen Inc.

- Smurfit Kappa Group

- Stora Enso Oyj

- Swedbrand Groups

- Tetra Pak International S. A

- WestRock Company

- Winpak Ltd.

Biodegradable Packaging

January 2024: Print & Pack introduced sustainable packaging solutions to small businesses and eco-friendly brands across North America. It includes advanced technologies such as BDP for biodegradable packaging and GREENGUARD Gold Certified inks. Notably, their offerings include INVISIBLEBAG, a compostable and water-soluble packaging solution.

February 2024: TIPA introduced compostable packaging as an alternative to plastic. Certified to biodegrade in domestic and industrial compost bins, these packages leave no environmental footprint and offer maximum convenience for their consumers.

September 2023: Mondi, in partnership with the rice supplier Veetee, introduced new recyclable paper-based packaging for dry rice. This packaging provides moisture protection and is designed to maintain stability on store shelves.

Biodegradable Packaging Market Segmentation

By Material Outlook (Revenue, USD Billion, 2019–2032)

- Paper & Paperboard

- Bio-plastic

- Polylactic Acid (PLA)

- Cellulose-based

- Starch-based

- Polybutylene succinate

- Others

- Bagasse

By Packaging Format Outlook (Revenue, USD Billion, 2019–2032)

- Bottles & Jars

- Boxes & Cartons

- Cans

- Trays & Clamshells

- Cups & Bowls

- Pouches & Bags

- Films & Wraps

- Labels & Tapes

- Others

By End Use Outlook (Revenue, USD Billion, 2019–2032)

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Homecare

- Other Consumer Goods

By Regional Outlook (Revenue, USD Billion, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biodegradable Packaging Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 473.74 Billion |

|

Market Size Value in 2024 |

USD 501.72 Billion |

|

Revenue Forecast By 2032 |

USD 800.48 Billion |

|

CAGR |

6.0% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global biodegradable packaging market size was valued at USD 473.74 billion in 2023 and is projected to grow to USD 800.48 billion by 2032.

The global market is projected to register a CAGR of 6.0% during 2024–2032.

Asia Pacific accounted for the largest share of the global market.

Stora Enso Oyj; Smurfit Kappa; Georgia-Pacific; Amcor; Pactiv Evergreen; Berry Global; Huhtamaki; WestRock Company; Mondi Group; Tetra Pak International; Swedbrand Groups; Winpak Ltd.; and Kruger Inc. are among the key players in the market.

The paper & paperboard segment dominated the market in 2023.

In 2023, the food & beverages segment held the largest market share