Biocomposites Market Share, Size, Trends, Industry Analysis Report

By Fiber Type; By Polymer Type (Synthetic, Natural); By Product (Hybrid, Green); By End-use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 119

- Format: PDF

- Report ID: PM2412

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

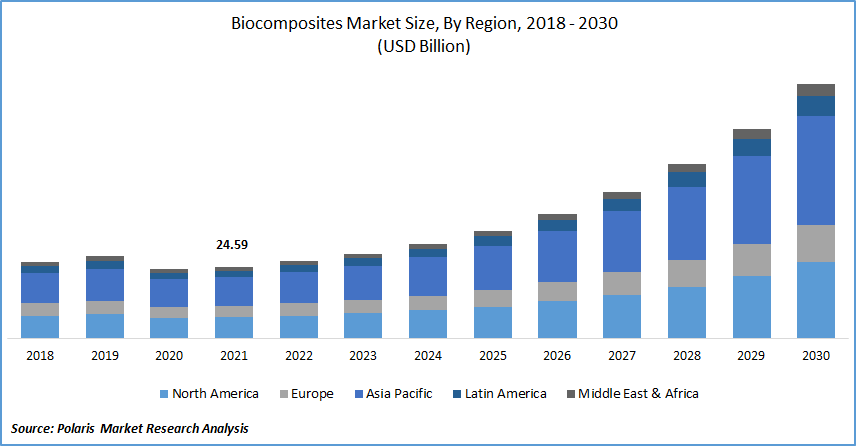

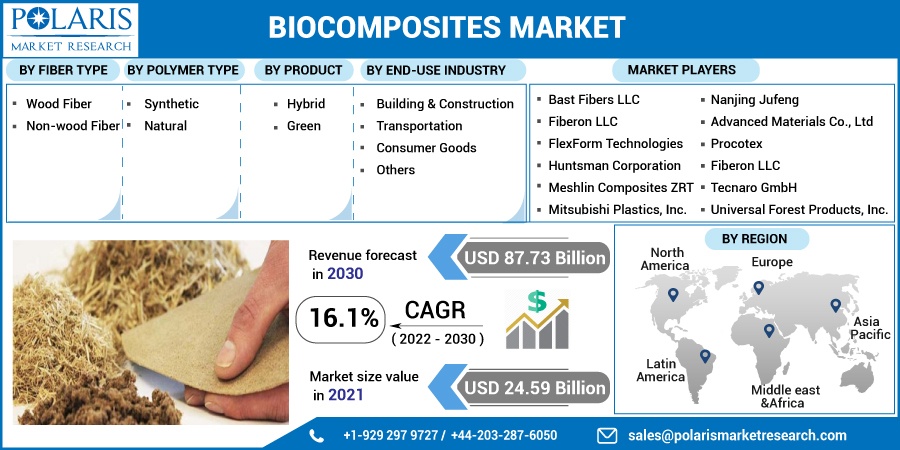

The global biocomposites market was valued at USD 24.59 billion in 2021 and is expected to grow at a CAGR of 16.1% during the forecast period. Factors such as key players' adoption of various strategies to raise their strong presence in the biocomposites industry are significant factors driving the market growth during the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The businesses emphasize teamwork, acquisitions, and the introduction of new products. As an illustration, Biocomposites said in July 2021 that its STIMULAN products had been given further Canadian permission for mixing with antibiotics such vancomycin, gentamicin, and tobramycin to treat bacterial infections in soft tissue that surrounds bone. In addition, Fiberon debuted Wildwood composite cladding in March 2021. This cladding blends wood's unmatched comfort and beauty with the durability of high-performance, low-maintenance components. For further design versatility, Wildwood fiberglass cladding is offered in various board lengths and widths and has an open-joint description.

In order to meet customer demands for recyclable options and carbon dioxide reductions while also maintaining product consistency, reliability, and performance, Celanese Corporation announced a joint venture in November 2021. The venture aims to grow recycling and recovery solutions for both post-industrial and post-consumer source materials of polyoxymethylene (POM), also known as acetal copolymer.

As a result, this endeavor is fueling the growth of the biocomposites market during the projected period and expanding the potential applications for biocomposites as the businesses concentrate on the initiatives. But some of the drawbacks that prevent biocomposites from being widely used are their comparatively low strength compared to glass fibers and poor fiber separation and dispersion.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Essential factors such as rising consumer awareness of eco-friendly products and government policies to replace plastics with biodegradable friendly alternatives drive the growth of biocomposites. Developed countries like Germany, the U.S., and Japan emphasize environmentally friendly products. E.U. favored such product lines over the U.S. and Japan.

However, the necessities for automotive manufacturers in North America are not as strict as they come from different markets worldwide. In January 2022, the U.S. Department of Energy (DOE) announced that it would invest USD 13.4 Mn in next-generation plastic materials technologies to decrease single-use plastics' energy use and carbon emission levels.

Furthermore, the Japanese government has set a target of substituting renewable resources for 25% of plastic use by 2030. According to the E.U. Commission, the European car sector employs 80,000 tonnes of fibers annually to strengthen composite goods rather than alternative synthetic fibers. The E.U has also emphasized using recyclable and biodegradable materials for interior car components. The demand for bio-polymers and other end-use manufacturers is anticipated to increase due to these laws.

Report Segmentation

The market is primarily segmented based on fiber type, polymer type, product, end-use industry, and region.

|

By Fiber Type |

By Polymer Type |

By Product |

By End-Use Industry |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Polymer Type

The natural polymer sector is anticipated to provide the most revenue to the global biocomposites market based on the polymer type segment. Natural polymers are being employed more often because customer demand for biodegradable goods is growing across various end-use sectors.

Numerous automotive and consumer product applications utilize bioplastics such as wool, silk, rubber, cellulose, and peptides. In addition, based on the product, green bio-composites have the largest market because of their advantages, such as being completely biodegradable and having no negative environmental consequences. These variants are typically in high demand among consumers because of their high tensile strength.

Geographic Overview

In terms of geography, Asia Pacific had the largest share. Due to the rapid growth of the automobile industry in the area and the growing demand for lightweight automobile parts that can reduce pollutant emissions and are fuel-efficient, this region is anticipated to grow significantly during the forecast period.

Automobile manufacturing capacity is continually rising in countries such as China and India, fueling the market demand for biocomposites. India is currently the fifth largest producer of light and commercial vehicles and the second biggest manufacturer of two-wheelers. This will drive the market's growth in this region to a great extent.

Further, due to COVID-19, composite materials producers and numerous companies have stopped production in various countries, resulting in lower demand for biocomposites in Asia Pacific countries. During the projected period, biocomposites requirements would be driven by the recovery of end-use industries and the reconstruction of the supply chain.

Additionally, a high CAGR is anticipated in the worldwide market for North America. The region's market for biocomposites is being driven by stringent government regulations on the usage of plastic. North America is anticipated to maintain its position as the largest market due to the original region's developing aircraft sector and more effective use of lightweight materials. Additionally, as it helps safeguard the environment, the growing popularity of electric cars drives up demand for biocomposites.

Competitive Insight

Some of the major players operating in the global industry include Bast Fibers LLC, Fiberon LLC, FlexForm Technologies, Huntsman Corporation, Meshlin Composites ZRT, Mitsubishi Plastics, Inc., Nanjing Jufeng Advanced Materials Co., Ltd, Procotex, Fiberon LLC, Tecnaro GmbH, Universal Forest Products, Inc.

Biocomposites Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 24.59 Billion |

|

Revenue forecast in 2030 |

USD 87.73 Billion |

|

CAGR |

16.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Fiber Type, By Polymer Type, By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Bast Fibers LLC, Fiberon LLC, FlexForm Technologies, Huntsman Corporation, Meshlin Composites ZRT, Mitsubishi Plastics, Inc., Nanjing Jufeng Advanced Materials Co., Ltd, Procotex, Fiberon LLC, Tecnaro GmbH, Universal Forest Products, Inc. |