Biochar Market Share, Size, Trends, Industry Analysis Report: By Type (Wood Biochar, Bamboo Biochar, Manure Biochar, and Additional Feedstocks), Application, Production Technique, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM1590

- Base Year: 2023

- Historical Data: 2019-2022

Biochar Market Overview

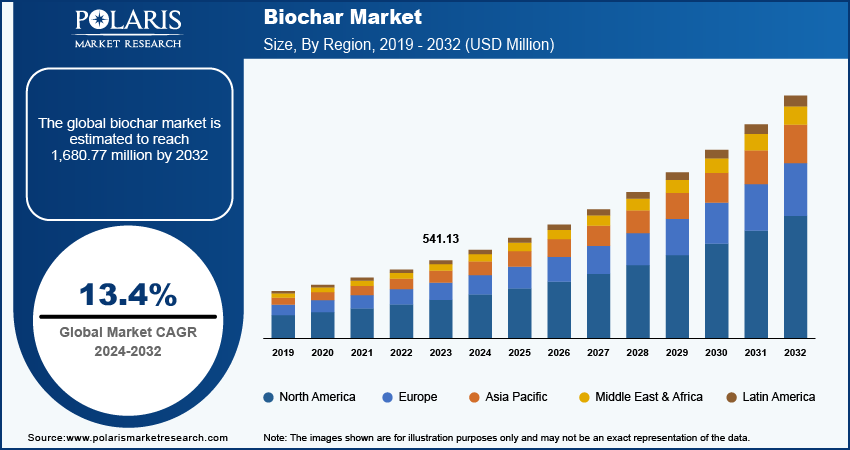

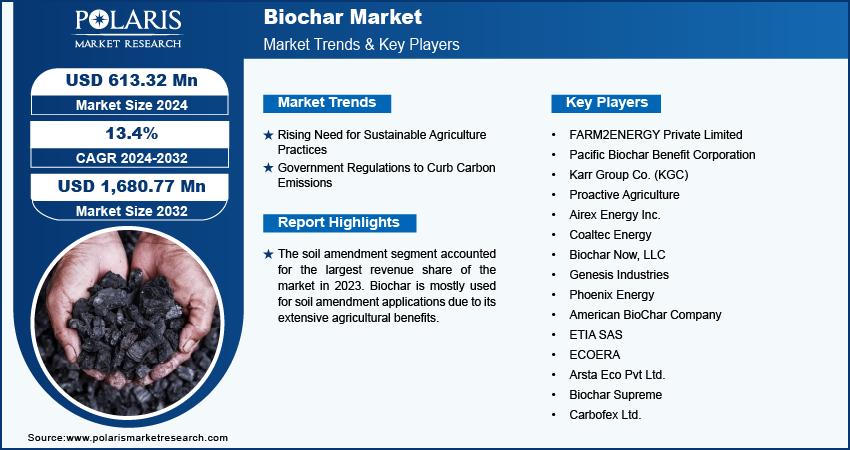

The biochar market size was valued at USD 541.13 million in 2023. The market is projected to grow from USD 613.32 million in 2024 to USD 1,680.77 million by 2032, exhibiting a CAGR of 13.4% during 2024–2032.

Biochar is a carbon-rich substance created by heating organic materials such as agricultural waste or wood in a low-oxygen environment (pyrolysis). Pyrolysis method transforms carbon into a stable form, reducing greenhouse gas emissions (GHGs) and improving soil health. Biochar offers a range of benefits across agriculture, environmental clean-up, and energy production. In agriculture, it enhances soil fertility by boosting water retention, nutrient availability, and microbial activity, leading to improved crop yields and greater resilience. Biochar also plays a crucial role in carbon sequestration, which helps mitigate climate change. For environmental clean-up, it adsorbs heavy metals, pesticides, and other pollutants, safeguarding water ecosystems. Furthermore, biochar production utilizes organic waste such as agricultural residues, forest waste, and livestock manure, aligning with the circular economy and waste reduction goals. For instance, according to the United Nations Environment Programme (UNEP) estimates, in 2023, annually, the global accumulation of agricultural waste was ∼2 billion tons, while forest waste accounted for 200 million tons, municipal waste totaled around 1.7 billion tons, and industrial waste accounted for 9.1 billion tons. Thus, the increasing focus on waste reduction by managing produced wastes from sources such as forests and municipal is driving the demand for biochar, which is further contributing to the market growth.

To Understand More About this Research: Request a Free Sample Report

The biochar market is expected to grow significantly due to its potential in climate change mitigation, sustainable agriculture, and the circular economy. As a carbon-negative technology, biochar contributes to achieving carbon neutrality by offsetting the emissions. Growing interest in organic agriculture is boosting the use of biochar to enhance soil health and crop yield. Additionally, biochar's versatility in the energy and materials industries opens new avenues for innovation and sustainable development.

The biochar market faces challenges related to production costs, including expenses for biomass acquisition, processing, and infrastructure. Its economic viability is influenced by transportation costs, market demand, and competition with less expensive alternatives. High initial investments are required for biochar production facilities, which can restrict scalability and make it less competitive. Therefore, the restraints mentioned above hinder the biochar market growth.

Biochar Market Trends

Rising Need for Sustainable Agriculture Practices

There is a rising awareness among farmers regarding the benefits of biochar in agriculture practices. The rising demand for sustainable agricultural practices propels the requirement for biochar. Biochar’s ability to enhance soil fertility and improve water retention aligns with the increasing preference for organic and eco-friendly farming methods. As food security and environmental sustainability become important to consumers and policymakers, the adoption of biochar in agriculture is expected to grow in the coming years.

The growing collaboration between governments, NGOs, and local councils to advance carbon sequestration efforts and promote sustainable food production is significantly driving the biochar market. These partnerships focus on improving soil fertility, enhancing water retention, and reducing greenhouse gas emissions through biochar application. For instance, in August 2024, the US Composting Council (USCC) & the US Biochar Initiative (USBI) signed a memorandum of agreement (MoA) for partnership to improve composting. This collaboration aims to improve soil health and water quality by promoting the use of compost and biochar, which is significantly driving the market growth.

Government Regulations to Curb Carbon Emissions

Stringent environmental regulations are designed to reduce carbon emissions and pollution. According to Nature Communications, the broad adoption of zero-emission technologies (NETs) is crucial for achieving CO2 reduction and renewable energy targets necessary to meet the Paris Agreement's goals of limiting global temperature rise to 2°C, or ideally, 1.5°C, in a cost-effective manner. Biochar is increasingly used for effective carbon sequestration and pollution remediation. Its adsorption captures pollutants from air and water, offering solutions for waste management and water purification. Therefore, efforts by governments and businesses to lower emissions and enhance air and water quality would contribute to the growth of the biochar market during the forecast period.

Biochar Market Segment Insights

Biochar Market Breakdown – Type Insights

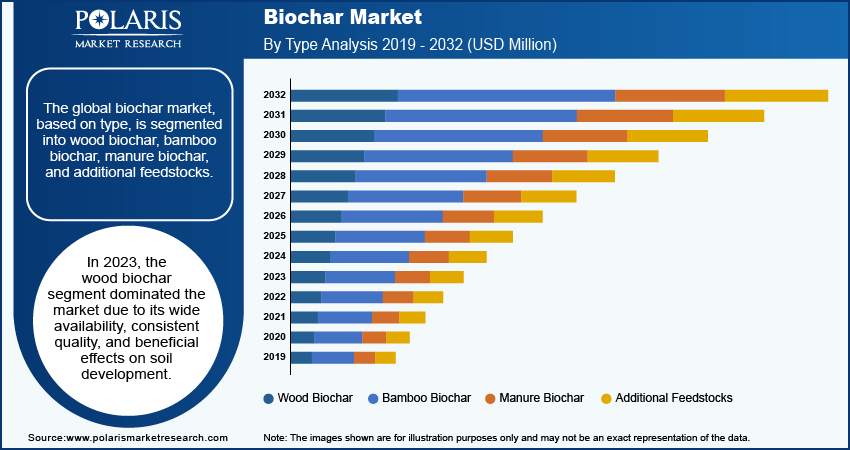

The global biochar market, based on type, is segmented into wood biochar, bamboo biochar, manure biochar, and additional feedstocks. In 2023, the wood biochar segment dominated the market due to its wide availability, consistent quality, and beneficial effects on soil development. The abundance of wood biomass in the nature makes it an ideal feedstock for biochar production. Additionally, it has excellent porosity, stability, and nutrient retention properties to enhance soil fertility and agricultural productivity.

Biochar Market Breakdown – Application Insights

In terms of application, the global biochar market is segmented into soil amendment, water filtration, waste management and landfill diversion, enhancement of compost, bioenergy production, and livestock management.

The soil amendment segment accounted for the largest revenue share of the market in 2023. Biochar is mostly used for soil amendment applications due to its extensive agricultural benefits. Biochar improves soil fertility, boosts water retention, and enhances nutrient availability, leading to higher crop yields. Its capacity to sequester carbon and improve soil health makes it an asset for agriculture and environmental conservation. Furthermore, the rising demand for organic food, growing health consciousness among consumers, and higher consumer spending are accelerating the adoption of biochar, particularly as it aligns with sustainable agricultural practices. However, conventional farming methods continue to dominate in many rural areas due to their higher yields, posing a challenge to the widespread adoption of biochar.

Biochar Market – Regional Insights

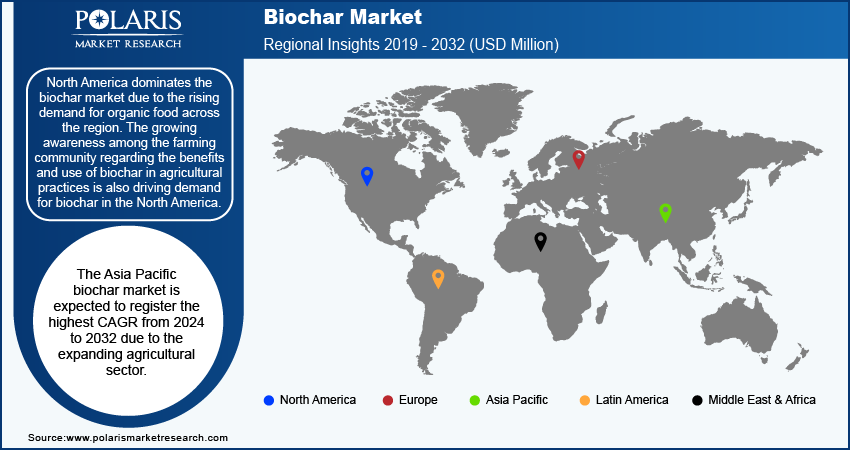

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America dominates the biochar market due to the rising demand for organic food across the region. The growing awareness among the farming community regarding the benefits and use of biochar in agricultural practices is also driving demand for biochar in the North America. Furthermore, the lower feed costs for livestock are also increasing the biochar consumption. For instance, in July 2023, Canada collaborated with Airex Energy, Groupe Remabec, and SUEZ to establish CARBONITY, the country’s first industrial biochar production facility in Quebec. This partnership between SUEZ and Airex Energy aims to produce 350,000 tonnes of biochar by 2035.

In August 2024, the Missouri Organic Association (MOA) started an initiative to promote biochar, a carbon-rich soil amendment, on farms across Missouri. Currently, it is tested on four farms, and is expected to expand to 76 additional farms. Funded by the U.S. Department of Agriculture partnerships for climate-smart commodities, this project aims to evaluate biochar’s effectiveness on a larger scale.

The

Biochar Market – Key Players and Competitive Insights

The biochar market is still in its early stages and remains fragmented, with only a few producers operating with varied production capacities. As an emerging market, it holds significant growth potential. Companies are focusing on backward integration to produce their raw materials to cut costs. Market players compete primarily on product quality and price, striving to offer competitive pricing globally.

FARM2ENERGY Private Limited; Pacific Biochar Benefit Corporation; Karr Group Co. (KGC); Proactive Agriculture; Airex Energy Inc.; Coaltec Energy; Biochar Now, LLC; Genesis Industries; Phoenix Energy; American BioChar Company; ETIA SAS; ECOERA; Arsta Eco Pvt. Ltd.; Biochar Supreme; Carbofex Ltd. are among the major players in the biochar market.

Pacific Biochar Benefit Corporation, a manufacturer of biochar products, specializes in agriculture and ecosystem management. The company offer a range of raw and processed products, including Blacklite Pure, Blacklite Compost, and Fish Char, allowing customers to utilize biochar as soil amendments. The company was founded in April 2024 and is headquartered in the US.

Biochar Supreme (BS) specializes in manufacturing and engineering biochar products for environmental remediation and agriculture. The company claims that it produces biochar using high-quality feedstock and clean, green energy, ensuring it is free from dioxins, PAHs, and PCBs. Rich in organic carbon, BS products offer unique benefits to soil and water that distinguish them from compost and other amendments. Additionally, their biochar is OMRI-listed for organic use. The company is located in the Pacific Northwest, with facilities along the West Coast, enabling them to distribute their products across most of the US and Canada.

Key Companies in Biochar Market

- FARM2ENERGY Private Limited

- Pacific Biochar Benefit Corporation

- Karr Group Co. (KGC)

- Proactive Agriculture

- Airex Energy Inc.

- Coaltec Energy

- Biochar Now, LLC

- Genesis Industries

- Phoenix Energy

- American BioChar Company

- ETIA SAS

- ECOERA

- Arsta Eco Pvt Ltd.

- Biochar Supreme

- Carbofex Ltd.

Biochar

November 2023: BIOSORRA launched a biochar production plant in Thika, Kiambu County, Kenya. The biochar produced at this facility will be supplied to Kenya Nut Company, a multinational agribusiness engaged in cultivating a diverse range of products.

November 2023: Pyreg GmbH introduced Biochar Carbon Removal (BCR) via its carbonization systems. The company’s Climate Finance Solutions (PCFS) aims to accelerate the adoption of such technology in the agriculture sector.

June 2022: Airex Energy partnered with the BDO Zone Strategic Alliance as a group member. This alliance includes leading companies in the bioenergy sector that work together to mitigate risks in biobased project development within BDO Zones.

Biochar Market Segmentation

By Type Outlook

- Wood Biochar

- Bamboo Biochar

- Manure Biochar

- Additional Feedstocks

By Application Outlook

- Soil Amendment

- Water Filtration

- Waste Management and Landfill Diversion

- Enhancement of Compost

- Bioenergy Production

- Livestock Management

By Production Technique Outlook

- Pyrolysis

- Hydrothermal Carbonization (HTC)

- Gasification

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Biochar

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 541.13 Million |

|

Market Size Value in 2024 |

USD 613.32 Million |

|

Revenue Forecast by 2032 |

USD 1,680.77 Million |

|

CAGR |

13.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global biochar market size was valued at USD 541.13 million in 2023 and is projected to grow to USD 1,680.77 million by 2032

The global market is projected to register a CAGR of 13.4% during 2023–2032.

North America accounted for the largest share of the global market in 2023 due to the growing awareness among the farming community regarding the benefits and use of biochar in agricultural practices.

FARM2ENERGY Private Limited; Pacific Biochar Benefit Corporation; Karr Group Co. (KGC); Proactive Agriculture; Airex Energy Inc.; Coaltec Energy; Biochar Now, LLC; Genesis Industries; Phoenix Energy; American BioChar Company; ETIA SAS; ECOERA; Arsta Eco Pvt Ltd.; Biochar Supreme; Carbofex Ltd. are among the key players in the market.

The wood biochar segment dominated the market in 2023 due to its wide availability, consistent quality, and beneficial effects on soil development.

The soil amendment segment accounted for the largest share of the global market in 2023 due to its extensive agricultural benefits.