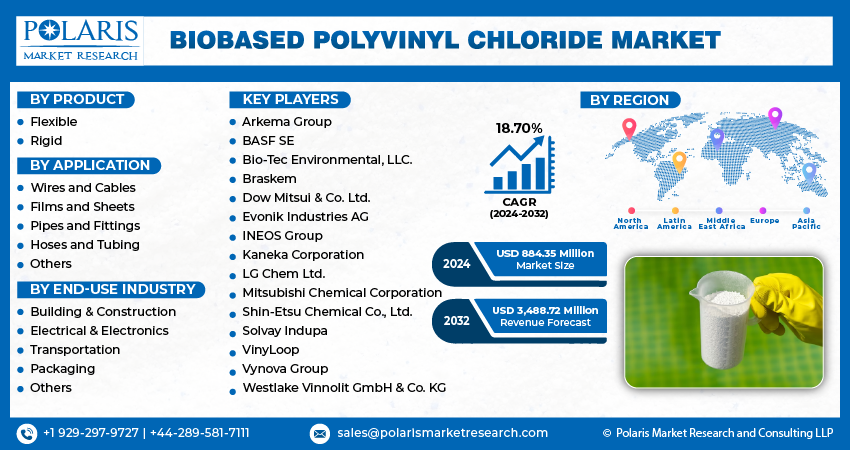

Biobased Polyvinyl Chloride Market Share, Size, Trends, Industry Analysis Report, By Product (Flexible, Rigid); By Application; By End-Use Industry; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4002

- Base Year: 2023

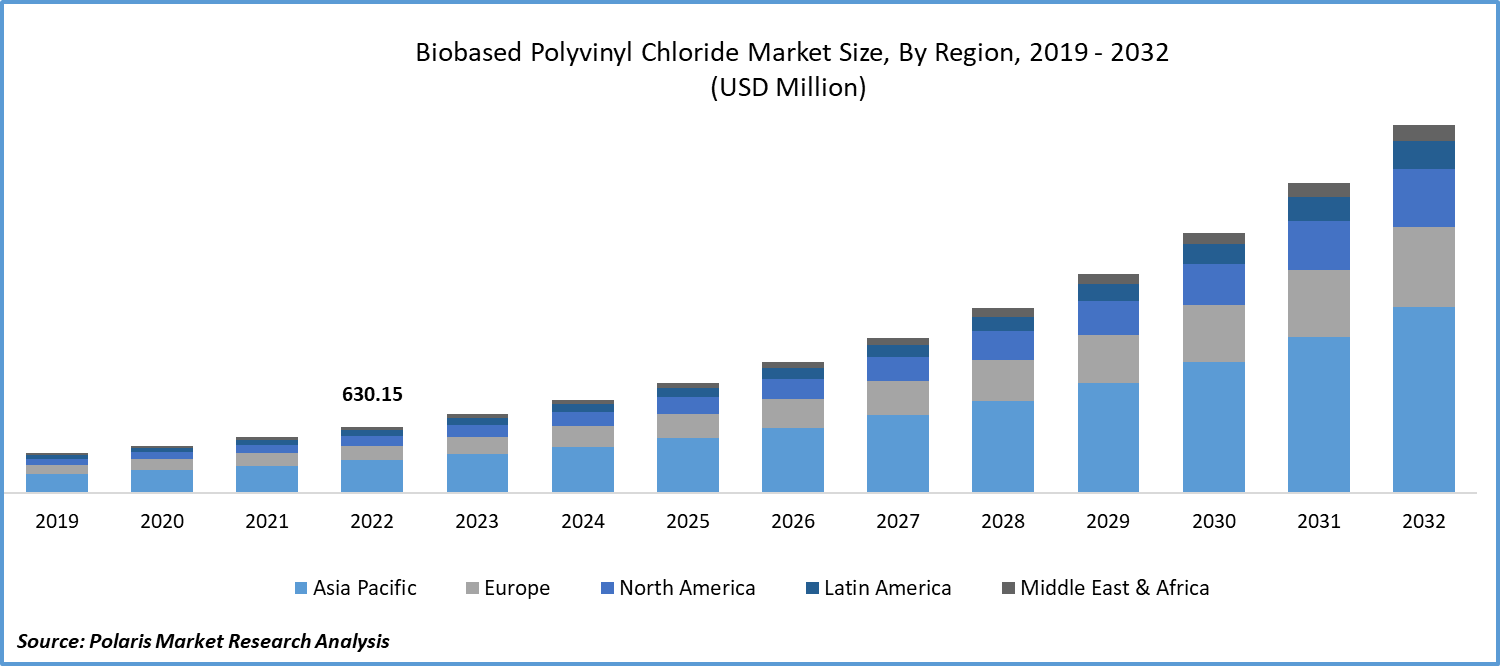

- Historical Data: 2019-2022

Report Outlook

The global biobased polyvinyl chloride market was valued at USD 746.35 million in 2023 and is expected to grow at a CAGR of 18.70% during the forecast period.

Biobased PVC reduces reliance on finite fossil fuels. The ability to utilize renewable feedstocks, such as plant-based sources, makes it an attractive choice for industries looking to diversify their raw material sources. Numerous industries and companies have incorporated sustainability goals into their operations. These goals often include incorporating biobased materials like PVC into their products to reduce their carbon footprint.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the market are collaborating with other players to expand their regional presence and strengthen their market presence.

In August 2023, Braskem collaborated with SCG Chemicals to create Braskem Siam Company Limited. This would enable the company to expand its offerings and strengthen its market presence.

Biobased PVC offers performance attributes similar to traditional PVC. It can be durable and resistant to various environmental factors, making it suitable for a wide range of applications across industries. Biobased PVC materials are often recyclable, making them in line with circular economy principles. This recyclability reduces waste and supports sustainable practices, thereby contributing to market growth. With increasing production volumes and advancements in production technology, the cost of biobased PVC is becoming more competitive compared to traditional petroleum-based PVC. This cost-effectiveness enhances its appeal for various applications.

Despite the growing interest in biobased PVC, it faces several challenges. These encompass aspects like ensuring the availability of cost-competitive feedstocks, addressing the complexities of scaling up production, and ensuring compatibility with the current PVC processing equipment.

Growth Drivers

Increasing Environmental Awareness, Supportive Regulations, and Changing Consumer Preference Across the World

The growing concern over plastic pollution and the need for eco-friendliness has led to a significant shift towards sustainable materials. Biobased PVC is one such material that is derived from renewable feedstocks and is considered to be a responsible choice to reduce the environmental impact of PVC production.

Governments and regulatory bodies worldwide are now introducing policies and regulations that encourage the use of biobased materials. This, in turn, is promoting the adoption of biobased PVC as a sustainable alternative, which is driving market growth.

Today's consumers are becoming more environmentally conscious and are looking for eco-friendly products. The rising demand for such products, including those made with biobased PVC, is influencing purchasing decisions.

Report Segmentation

The market is primarily segmented based on product, application, end use industry, and region.

|

By Product |

By Application |

By End-Use Industry |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Flexible Type Emerged as the Largest Segment in 2022

The flexible segment held the largest market share in 2022 and is expected to maintain its position throughout the forecast period. It is produced using renewable feedstocks like plant-based resources, which helps to reduce the need for fossil fuels and lower carbon emissions. As more consumers are becoming eco-conscious, there is a growing demand for environmentally friendly products. Flexible biobased PVC meets this demand by enabling businesses to promote their products as sustainable, which attracts consumers who value eco-friendliness. Flexible biobased PVC is suitable for use in various industries due to its pliability, durability, and resistance to corrosion and UV radiation.

By Application Analysis

Pipes and Fittings Segment Held Significant Market Revenue Share in 2022

The Pipes and fittings segment held a significant market share in revenue share in 2022. Biobased PVC pipes and fittings exhibit the same level of robustness and endurance as their traditional PVC counterparts. They stand up to the challenges of transporting water, be it for sewage, drainage, or potable water supply. These materials come inherently equipped with resistance to corrosion, assuring prolonged service life with minimal maintenance. This property is especially valuable in scenarios where pipes encounter a variety of chemicals or moisture. Biobased PVC materials typically adhere to the established industry standards and regulations for pipes and fittings. This compliance guarantees that they meet essential safety and performance benchmarks.

By End-Use Industry Analysis

The Demand for Biobased Polyvinyl Chloride is Expected to Increase from the Building and Construction Segment During the Forecast Period

The demand for biobased polyvinyl chloride is set to increase in the building and construction segment during the forecast period. Biobased PVC is in line with sustainable construction practices and green building certifications such as LEED. Its usage helps in reducing the overall environmental impact of construction materials, promoting eco-friendly building initiatives.

Biobased PVC profiles and moldings can be utilized for interior design and decorative purposes, such as baseboards, chair rails, and crown moldings. Biobased PVC panels and sidings are effective wall cladding materials, suitable for both residential and commercial construction. They are known for their durability and minimal maintenance requirements. Sustainable biobased PVC can be used in a variety of flooring types, including vinyl tiles and luxury vinyl planks. It is recognized for its longevity and ease of maintenance.

Regional Insights

Asia-Pacific Region Dominated the Global Market in 2022

The Asia-Pacific region holds a prominent position within the global biobased polyvinyl chloride market. The increasing emphasis on ecological sustainability chiefly drives the expansion of this industry, the enforcement of environmental standards, and consumer inclinations for products that have a lower environmental footprint. Within this region, both corporations and government entities are exploring strategies to diminish their reliance on fossil fuels during plastic production. Notably, countries in the Asia-Pacific region, such as China and India, boasting robust agricultural sectors, play a pivotal role as major contributors to the feedstock supply. Additionally, the industry experiences significant growth as it garners backing from regulatory frameworks and attains official certifications for biobased materials. Government incentives and industry-endorsed certifications for biobased products serve as incentives for the adoption of biobased PVC.

The North America region is anticipated to experience considerable growth during the projected period. The biobased PVC industry has been steadily advancing in the region, driven by a heightened awareness of environmental concerns and a growing acceptance of sustainable and green plastic materials. Businesses and consumers alike are increasingly seeking alternatives to conventional petroleum-based PVC. Biobased PVC finds application across a wide spectrum, encompassing packaging, construction materials, automotive components, and consumer goods. The embrace of biobased PVC in these applications is shaped by multiple factors such as cost-competitiveness, performance attributes, and market demand. Numerous entities in the United States are actively engaged in the research, development, and production of biobased PVC. This encompasses long-established chemical companies, startups specializing in sustainable materials, and collaborative efforts with research institutions aimed at pioneering innovative solutions.

Key Market Players & Competitive Insights

The biobased polyvinyl chloride market demonstrates a fragmented nature with multitude of players involved. Leading participants in this market consistently unveil innovative products as part of their strategy to strengthen their market position. These industry leaders prioritize the establishment of partnerships, improvement of product portfolios, and the cultivation of collaborations to attain a competitive edge over their peers and establish a significant presence within the market.

Some of the major players operating in the global market include:

- Arkema Group

- BASF SE

- Bio-Tec Environmental, LLC.

- Braskem

- Dow Mitsui & Co. Ltd.

- Evonik Industries AG

- INEOS Group

- Kaneka Corporation

- LG Chem Ltd.

- Mitsubishi Chemical Corporation

- Shin-Etsu Chemical Co., Ltd.

- Solvay Indupa

- VinyLoop

- Vynova Group

- Westlake Vinnolit GmbH & Co. KG

Recent Developments

- In October 2022, LG Chem supplied bio-balanced polyvinyl chloride to Nox for the production of luxury vinyl tiles for high-performance commercial and residential flooring.

Biobased Polyvinyl Chloride Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 884.35 million |

|

Revenue forecast in 2032 |

USD 3,488.72 million |

|

CAGR |

18.70% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By End Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |