Bio-Derived Nanotube Manufacturing Market Size, Share, Trends, Industry Analysis Report: By Type (Protein-Based Nanotubes, Lipid-Based Nanotubes, Carbohydrate-Based Nanotubes, DNA-Based Nanotubes, and Others), Application, Industry Vertical, Manufacturing Process, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5518

- Base Year: 2024

- Historical Data: 2020-2023

Bio-Derived Nanotube Manufacturing Market Overview

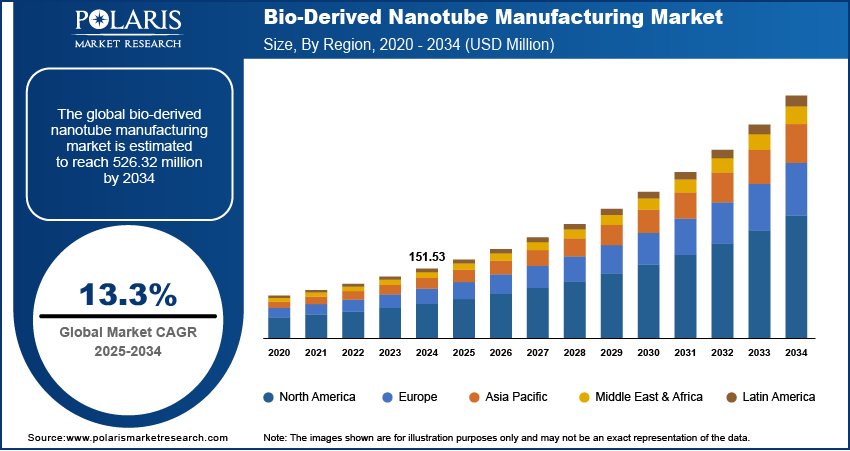

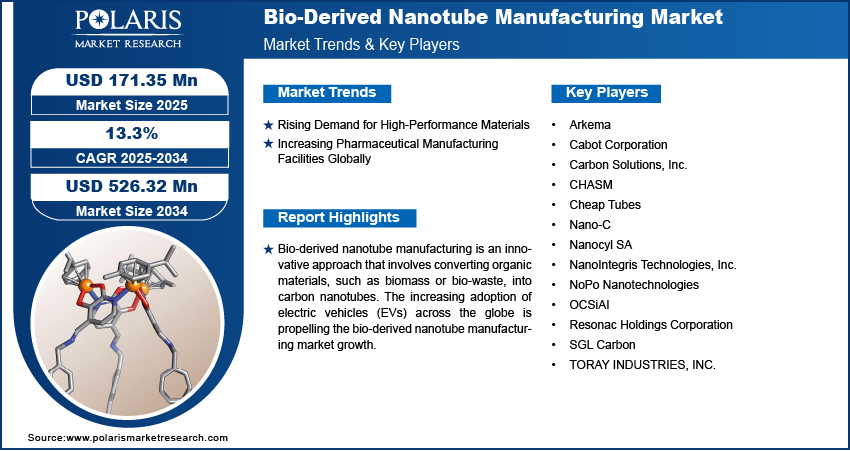

Bio-derived nanotube manufacturing market size was valued at USD 151.53 million in 2024. The market is projected to grow from USD 171.35 million in 2025 to USD 526.32 million by 2034, exhibiting a CAGR of 13.3 % during 2025-2034.

Bio-derived nanotube manufacturing is an innovative approach that involves converting organic materials, such as biomass or bio-waste, into carbon nanotubes. This method offers several advantages over traditional production processes, including reduced reliance on fossil fuels and lower carbon footprints. The process of bio-derived nanotube manufacturing typically involves thermal or catalytic cracking of biomass-derived volatiles. The efficiency of this process depends significantly on temperature and pressure conditions. Bio-derived nanotube manufacturing supports a circular economy by converting waste materials into valuable products, thereby reducing waste disposal challenges.

The increasing adoption of electric vehicles (EVs) across the globe is propelling the bio-derived nanotube manufacturing market growth. EVs rely heavily on advanced battery technology to achieve optimal performance and range. Nanotechnology, particularly the use of nanotubes, plays a crucial role in enhancing battery efficiency and durability. Bio-derived nanotubes offer a sustainable and eco-friendly alternative to traditional nanotubes, aligning with the environmental goals of EV adoption. Bio-derived nanotubes enhance the strength-to-weight ratio of EV components, resulting in improved energy efficiency and extended vehicle range. This makes them a highly attractive option for manufacturers striving to create more efficient and sustainable electric vehicles. As the global adoption of EVs continues to rise, the demand for bio-derived nanotube manufacturing is also gaining momentum. According to the International Energy Agency, nearly 14 million new electric cars were registered worldwide in 2023, bringing the total number on the roads to 40 million. Bio-derived nanotubes are poised to play a crucial role in shaping the future of EV innovation with the push for greener transportation solutions.

To Understand More About this Research: Request a Free Sample Report

The bio-derived nanotube manufacturing market demand is driven by the growing drug development activities. The expansion of drug development activities directly increases the demand for bio-derived nanotube manufacturing by driving the need for advanced drug delivery systems, bio-compatible materials, and nanocarriers. Pharmaceutical companies are continually seeking innovative ways to enhance drug efficacy, minimize side effects, and improve targeted delivery. Bio-derived nanotubes, synthesized from renewable sources such as cellulose or chitosan, offer excellent biocompatibility, making them ideal for pharmaceutical companies seeking ways to enhance drug efficacy. Moreover, the increasing focus on green and sustainable practices in the pharmaceutical industry fuels the market expansion.

Bio-Derived Nanotube Manufacturing Market Dynamics

Rising Demand for High-Performance Materials

Industries such as aerospace, automotive, and construction are increasingly seeking lightweight and high-strength materials to enhance performance and efficiency. Bio-derived nanotubes, particularly carbon nanotubes (CNTs), offer exceptional mechanical strength, electrical conductivity, and thermal stability, making them ideal for aerospace, automotive, and construction. Furthermore, the increasing demand for high-performance materials in electronics and semiconductors drives the adoption of bio-derived nanotubes due to their excellent electrical properties and ability to form highly conductive networks. Hence, as the electronic, construction, automotive, and other industries continue to grow, the demand for bio-derived nanotubes in manufacturing these high-performance materials also increases.

Increasing Pharmaceutical Manufacturing Facilities Globally

The expansion of pharmaceutical manufacturing facilities leads to higher production capacity, prompting companies to explore more efficient and targeted drug delivery methods. Bio-derived nanotubes emerge as a promising solution due to their biocompatibility and precise ability to encapsulate and transport therapeutic agents. As the number of pharmaceutical facilities grows, so does the research, development, and commercialization of bio-derived nanotube-based drug delivery systems, further driving demand for their production. According to the India Brand Equity Foundation, India leads globally with the highest number of pharmaceutical manufacturing facilities, including 500 Active Pharmaceutical Ingredient (API) producers, contributing to approximately 8% of global API production. Bio-derived nanotubes are set to revolutionize modern pharmaceuticals with the continuous evolution of drug delivery technologies.

Companies investing in new pharmaceutical manufacturing facilities often prioritize innovative technologies to stay competitive, and bio-derived nanotubes provide an advanced option for improving drug efficacy and reducing side effects, which encourages their adoption in pharmaceutical manufacturing, thereby propelling bio-derived nanotube manufacturing market expansion.

Bio-Derived Nanotube Manufacturing Market Segment Analysis

Bio-Derived Nanotube Manufacturing Market Evaluation by Type

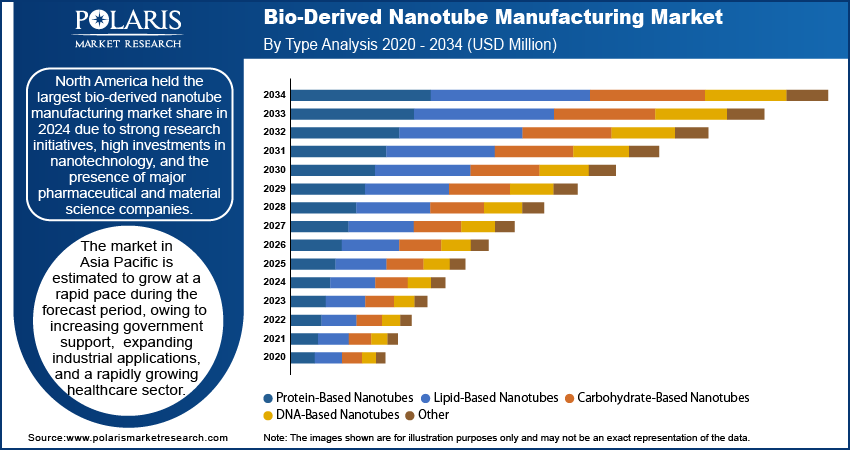

Based on type, the bio-derived nanotube manufacturing market is divided into protein-based nanotubes, lipid-based nanotubes, carbohydrate-based nanotubes, DNA-based nanotubes, and others. The protein-based nanotubes held the largest bio-derived nanotube manufacturing market share in 2024 due to their extensive applications in drug delivery, biosensing, and tissue engineering. Researchers and pharmaceutical companies widely adopted these nanotubes owing to their superior biocompatibility, self-assembling properties, and ability to interact with biological systems at the molecular level. Protein-based nanotubes demonstrated significant potential in targeted drug delivery, enabling precise transport of therapeutic agents while minimizing side effects. Additionally, advancements in biotechnology and nanomedicine fueled their integration into biosensors, which played a crucial role in disease detection and diagnostics. The growing emphasis on personalized medicine further strengthened protein-based nanotubes demand, as these nanotubes provided a platform for developing customized treatment solutions. The increasing focus on sustainable and biodegradable nanomaterials also contributed to their market dominance, making them a preferred choice for researchers and industries seeking eco-friendly alternatives.

Bio-Derived Nanotube Manufacturing Market Assessment by Application

The bio-derived nanotube manufacturing market segmentation, based on application, includes drug delivery systems, tissue engineering, biosensors, environmental remediation, energy storage, and others. The biosensors segment is expected to grow in the coming years owing to the growing usage in disease detection, environmental monitoring, and biomedical diagnostics. The increasing need for highly sensitive and rapid diagnostic tools has accelerated the integration of nanotube-based biosensors in medical and industrial settings. These biosensors offer exceptional sensitivity, selectivity, and real-time detection capabilities, making them crucial for early disease diagnosis and continuous health monitoring. The expansion of wearable health technologies and point-of-care testing devices has further expanded their demand. Additionally, researchers are developing nanotube-based biosensors for detecting environmental contaminants, supporting global efforts to monitor air and water quality.

Bio-Derived Nanotube Manufacturing Market Regional Analysis

By region, the study provides the bio-derived nanotube manufacturing market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest bio-derived nanotube manufacturing market share in 2024 due to strong research initiatives, high investments in nanotechnology, and the presence of major pharmaceutical and material science companies. The region further benefited from well-established biotechnology and healthcare industries that actively integrated bio-derived nanotubes into drug delivery systems, biosensors, and tissue engineering applications. Government agencies, including the National Science Foundation (NSF) and the National Institutes of Health (NIH), provided substantial funding for nanotechnology research, accelerating innovation and commercialization in the region. The growing focus on sustainable and high-performance materials in industries such as electronics, automotive, and aerospace further boosted demand for bio-derived nanotube manufacturing in North America. The US, within North America, dominated the market, driven by a high number of research institutions, advanced manufacturing capabilities, and strong collaborations between academia and industry. The rapid expansion of personalized medicine and regenerative therapies also contributed to the region’s dominance.

The bio-derived nanotube manufacturing market in Asia Pacific is estimated to grow at a rapid pace during the forecast period, owing to increasing government support, expanding industrial applications, and a rapidly growing healthcare sector. Countries in the region have significantly increased investments in nanotechnology research and development, recognizing its potential in biotechnology, electronics, and environmental sustainability. China is estimated to hold a major market share within the region due to its strong manufacturing base, extensive research programs, and rising demand for advanced materials in multiple industries. The country has actively promoted nanotechnology through national initiatives and funding programs, positioning itself as a global hub in nanomaterials production and application. The rising need for high-performance and eco-friendly materials, combined with the region’s expanding pharmaceutical and electronics markets, ensures that Asia Pacific will experience substantial market growth in the coming years.

Bio-Derived Nanotube Manufacturing Key Market Players & Competitive Analysis Report

The bio-derived nanotube manufacturing market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. According to the bio-derived nanotube manufacturing market statistics, this competitive trend is amplified by continuous progress in product offerings. Major players in the market include Nano-C; NoPo Nanotechnologies; Nanocyl SA; OCSiAI; Cheap Tubes; TORAY INDUSTRIES, INC.; Carbon Solutions, Inc.; NanoIntegris Technologies, Inc.; Cabot Corporation; SGL Carbon; Arkema; Resonac Holdings Corporation; and CHASM.

Nano-C, founded in 2001 and headquartered in Westwood, Massachusetts, is a pioneering company in the field of nanostructured carbon materials. It specializes in the development and manufacturing of fullerenes, single-walled carbon nanotubes (SWCNT), and their chemical derivatives. These materials are renowned for their strength, environmental safety, and abundance, making them ideal for a wide range of applications, from electronics and energy to sustainable solutions. Nano-C's technology is based on an exclusive license from MIT, allowing them to deliver significant improvements in the performance and efficiency of their materials. Bio-derived nanotube manufacturing by the Nano-C offers several advantages. It reduces reliance on fossil fuels and decreases the carbon footprint associated with traditional nanotube production.

Nanocyl SA, founded in 2002 and based in Sambreville, Belgium, is a major company in the production and commercialization of industrial multi-walled carbon nanotubes (MWCNTs). Nanocyl specializes in developing and manufacturing high-quality MWCNTs, which are used across various industries, including electronics, transportation, energy storage, and industrial applications. The company's flagship product, NC7000, is a multi-walled carbon nanotube powder renowned for its excellent electrical conductivity and dissipative properties, making it ideal for enhancing the performance of materials in diverse sectors. Nanocyl's product portfolio includes a range of formulated products, such as PLASTICYL, EPOCYL, and AQUACYL, designed to meet specific industrial needs.

Key Companies in Bio-Derived Nanotube Manufacturing Market

- Arkema

- Cabot Corporation

- Carbon Solutions, Inc.

- CHASM

- Cheap Tubes

- Nano-C

- Nanocyl SA

- NanoIntegris Technologies, Inc.

- NoPo Nanotechnologies

- OCSiAI

- Resonac Holdings Corporation

- SGL Carbon

- TORAY INDUSTRIES, INC.

Bio-Derived Nanotube Manufacturing Market Development

March 2025: A nanotech breakthrough was made by a collaborative research team from Jagiellonian University and UK universities, revealing dynamic pentamer-based protein nanotubes that responded to stimuli, revolutionizing nanomaterials.

Bio-Derived Nanotube Manufacturing Market Segmentation

By Type Outlook (Revenue, USD Million, 2020-2034)

- Protein-Based Nanotubes

- Lipid-Based Nanotubes

- Carbohydrate-Based Nanotubes

- DNA-Based Nanotubes

- Others

By Application Outlook (Revenue, USD Million, 2020-2034)

- Drug Delivery Systems

- Tissue Engineering

- Biosensors

- Environmental Remediation

- Energy Storage

- Others

By Industry Vertical Outlook (Revenue, USD Million, 2020-2034)

- Pharmaceuticals & Biotechnology

- Healthcare

- Environmental Science

- Energy & Power

- Others

By Manufacturing Process Outlook (Revenue, USD Million, 2020-2034)

- Self-Assembly

- Template-Based Synthesis

- Electrospinning

- Chemical Vapor Deposition (CVD)

- Others

By Regional Outlook (Revenue, USD Million, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bio-Derived Nanotube Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 151.53 Million |

|

Market Size Value in 2025 |

USD 171.35 Million |

|

Revenue Forecast by 2034 |

USD 526.32 Million |

|

CAGR |

13.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global bio-derived nanotube manufacturing market size was valued at USD 151.53 million in 2024 and is projected to grow to USD 526.32 million by 2034

The global market is projected to register a CAGR of 13.3% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Nano-C; NoPo Nanotechnologies; Nanocyl SA; OCSiAI; Cheap Tubes; TORAY INDUSTRIES, INC.; Carbon Solutions, Inc.; NanoIntegris Technologies, Inc.; Cabot Corporation; SGL Carbon; Arkema; Resonac Holdings Corporation; and CHASM

The protein-based nanotubes segment dominated the bio-derived nanotube manufacturing market revenue share in 2024.

The biosensors segment is expected to grow at the fastest pace in the coming years.