Bio-based Polypropylene Market Share, Size, Trends, Industry Analysis Report, By Source (Sugars, Starch, Lignocellulosic Biomass); By Application; By End-user; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 118

- Format: PDF

- Report ID: PM4973

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

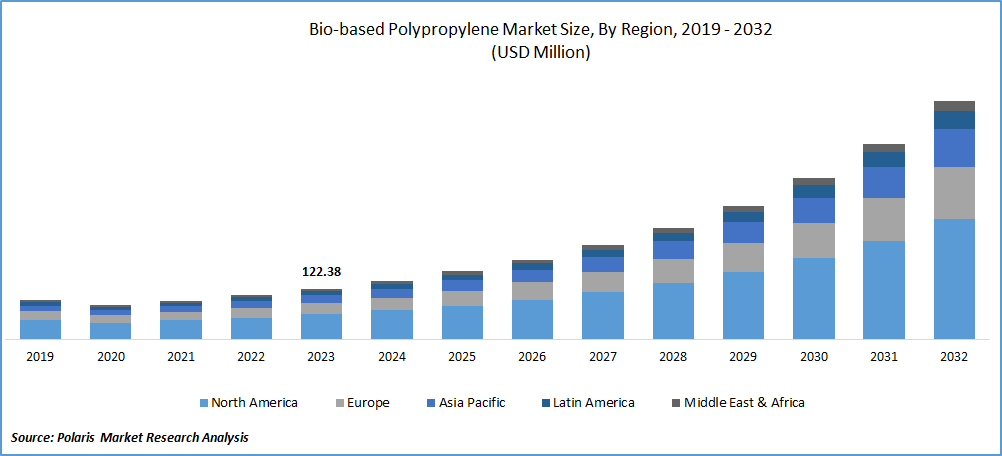

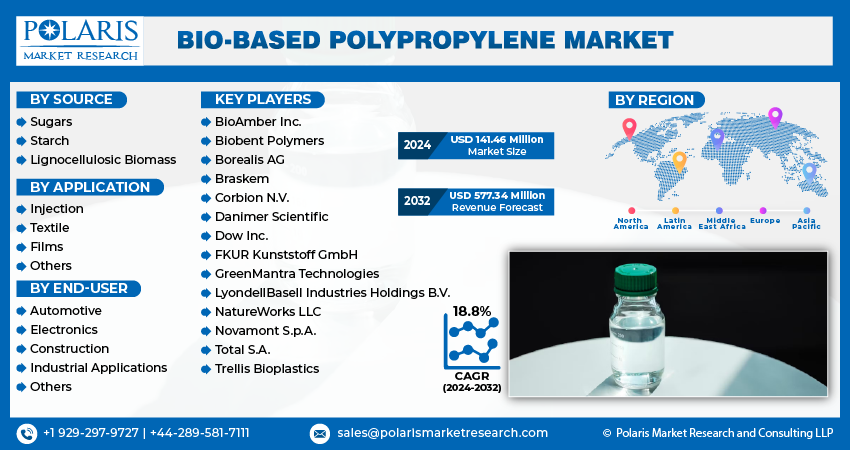

Bio-based Polypropylene Market size was valued at USD 122.38 million in 2023. The market is anticipated to grow from USD 141.46 million in 2024 to USD 577.34 million by 2032, exhibiting the CAGR of 18.8% during the forecast period.

Market Overview

Bio-based polypropylene is witnessing significant adoption in the global market, with the increasing importance of recyclable and sustainable products. The increasing prevalence of extreme weather conditions and increasing greenhouse gas emissions are emphasizing the necessity of adopting effective alternatives to plastic. Furthermore, the rising expansion activities of the companies to enhance their market position and promote production capacity are positively influencing the global bio-based polypropylene market.

To Understand More About this Research:Request a Free Sample Report

- For instance, in December 2023, Pigeon Singapore and LyondellBasell entered a collaboration to promote research and developments in producing sustainable baby nursing bottles. The new pigeon nursing bottles are expected to utilize CirculenRenew polypropylene, aiming to offer 100% pure polypropylene resins.

Moreover, the growing innovations exploring the multiple uses of green polypropylene in various disciplines are introducing new growth opportunities for global bio-based polypropylene. For instance, in January 2024, Srimax announced the launch of bio-based polypropylene for automotive interiors.

However, increasing feedstock scarcity is the major factor causing the biggest problem in producing bio-based polypropylene worldwide. The need for superior infrastructure and technologies to develop these compounds is likely to limit the emergence of new market players in the sector.

Growth Drivers

A Growing Number of Companies are Opting for Sustainable Packaging

The changing global population preferences, rising demand for sustainable packaging solutions, and increasing environmental consciousness are encouraging companies to choose environmentally friendly packaging. This is where bio-based polypropylene is gaining attention. For instance, in October 2023, Lactalis Nestlé introduced a new 30% bio-propylene-based coffee cup. These types of initiatives are expected to boost the demand for bio-based polypropylene in the next few years.

Additionally, in May 2023, Lumene introduced a new bio-based packaging solution for its cosmetic containers, converting polypropylene to recyclable jars. It aims to reduce emissions by 1.5 million jars per year and added labels to lower 60 tons of fossil-based plastics annually.

Increasing Development of Polypropylene Production Facilities

The growing demand for bio-based polypropylene is forcing major market players to expand their production capacity. This trend is likely to increase the supply of polypropylene, which is crucial given its rising use in multiple applications. For instance, in December 2023, Citroniq and Lummus announced their plans to construct four green polypropylene manufacturing centers in the United States.

Restraining Factors

Growing Development of Effective Alternatives to Polypropylene

The increasing research activities in the market are driving the development of effective chemicals that are proficient in replacing bio-based polypropylene functions. For instance, in October 2023, a study published in Eurekalert developed bio-based re-usable polyesters that have superior tensile strength over polypropylene and polyethylene. Additionally, in November 2023, the VTT Technical Research Centre (Finland) announced the development of cellulose-based food trays, a sustainable alternative to polypropylene.

Report Segmentation

The market is primarily segmented based on source, application, end-user, and region.

|

By Source |

By Application |

By End-user |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Source Analysis

The Lignocellulosic Biomass Segment is Expected to Witness the Highest Growth During the Forecast Period

The lignocellulosic biomass segment will grow rapidly, mainly driven by its abundance. The higher availability of lignocellulosic biomass compared to fossils has increased its use in bio-based polypropylene production. It is cost-effective, driving its incorporation into the bio-based polypropylene market. Furthermore, rising research studies reviewing the pretreatment procedures for bio-based polypropylene are expected to drive polypropylene production in the coming years.

By Application Analysis

The Injection Segment Accounted for the Largest Bio-Based Polypropylene Market Share in 2023

The injection segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. This is mainly attributable to the increasing use of injection-molded green polypropylene in automotive interiors and rising company initiatives to develop injection-molded polypropylene. For instance, in September 2023, Sabic, in collaboration with Taghleef Industries, Karydakis IML, & Kotronis Packaging, announced the innovation of mono-polypropylene containers with thin walls by utilizing injection molding procedures for food packaging.

By End-user Analysis

The Automotive Segment Held a Significant Bio-Based Polypropylene Market Revenue Share In 2023

The automotive segment held a significant revenue share in 2023 due to the continuous rise in the innovation of new-model automobiles, necessitating the demand for lightweight parts. The ongoing transition towards green mobility is expected to boost its adoption rate. In addition, the increasing integration of sustainable chemical compounds into manufacturing activities will create demand for green polypropylene in the future.

Regional Insights

North America Region Registered the Largest share of the Global Market in 2023

The North American region held the dominant share in 2023. The growing demand for eco-friendly vehicles and packaging equipment highly influences this. The presence of nations that are promoting sustainable product manufacturing, such as the United States and Canada, is further bolstering the use of bio-based polypropylene in the region. The increasing knowledge about sustainable packaging of food products, textiles, and automotive products among consumers is projected to bolster the use of bio-based polypropylene in the global marketplace.

The Asia-Pacific region is expected to be the fastest-growing region with a healthy CAGR during the projected period, owing to the growing consumption of automobiles and increasing public incentives to boost e-mobility adoption. By 2030, the Indian government is expecting to transform transportation by 30%. These initiatives are creating a huge demand for electric- vehicle production in the region, and thereby, the demand for raw materials is likely to grow in the coming years.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The bio-based polypropylene market is partly consolidated. The major companies in the market are showing interest in expanding their presence and brand outreach through collaborations, partnerships, and acquisitions. For instance, in January 2024, Kafrit completed the acquisition of ABSA Resin Technologies to expand its thermoplastic product line and regional landscape.

Some of the major players operating in the global market include:

- BioAmber Inc.

- Biobent Polymers

- Borealis AG

- Braskem

- Corbion N.V.

- Danimer Scientific

- Dow Inc.

- FKUR Kunststoff GmbH

- GreenMantra Technologies

- LyondellBasell Industries Holdings B.V.

- NatureWorks LLC

- Novamont S.p.A.

- Total S.A.

- Trellis Bioplastics

Recent Developments in the Industry

- In May 2023, Kingfa announced its strategy to enhance its capacity to recycle one million tonnes of plastic compounds by 2025 in China. Additionally, it is planning to build polymerization and polypropylene plants with the potential to produce 3000 tonnes annually.

Report Coverage

The bio-based polypropylene market report emphasizes key regions across the globe to provide users with a better understanding of the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, source, application, end-user, and their futuristic growth opportunities.

Bio-based Polypropylene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 141.46 million |

|

Revenue Forecast in 2032 |

USD 577.34 million |

|

CAGR |

18.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million, Volume in Kilotons, and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

Bio-based Polypropylene Market report covering key segments are source, application, end-user, and region

Bio-based Polypropylene Market Size Worth $ 577.34 Million By 2032

Bio-based Polypropylene Market exhibiting the CAGR of 18.8% during the forecast period

North America is leading the global market

The key driving factors in Bio-based Polypropylene Market are Growing Development of Effective Alternatives to Polypropylene