Bio-Based Polypropylene in Medical Devices Market Size, Share, Trends, Industry Analysis Report: By Application, End User, Material Type, Production Method, Modification (Grafting, Blending, and Crosslinking), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 128

- Format: PDF

- Report ID: PM5356

- Base Year: 2024

- Historical Data: 2020-2023

Bio-Based Polypropylene in Medical Devices Market Overview

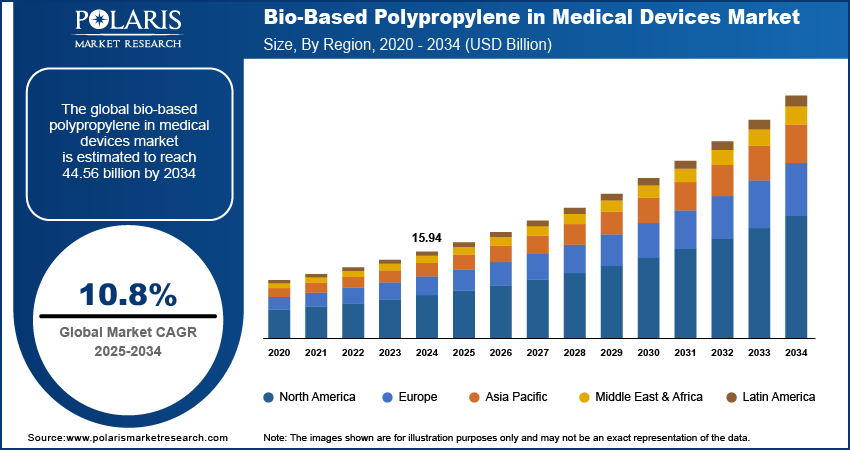

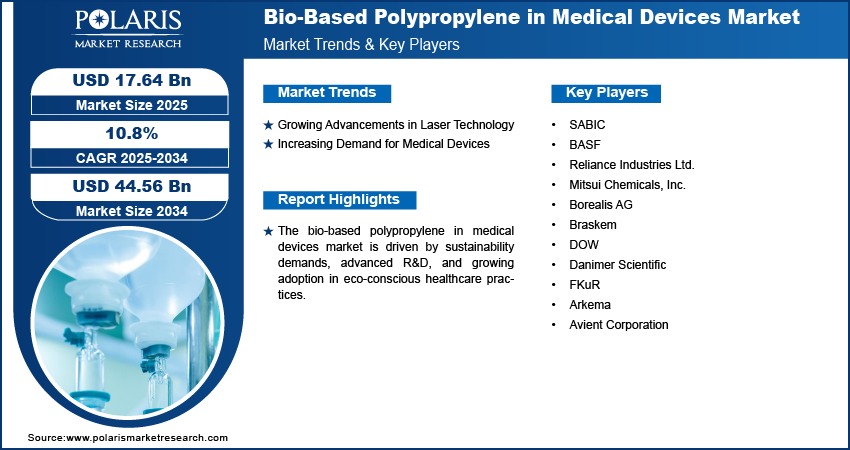

The bio-based polypropylene in medical devices market size was valued at USD 15.94 billion in 2024. The market is projected to grow from USD 17.64 billion in 2025 to USD 44.56 billion by 2034, exhibiting a CAGR of 10.8% during 2025–2034.

Bio-based polypropylene in medical devices refers to a sustainable polymer derived from renewable feedstocks, such as biomass, designed for use in medical applications such as packaging, drug delivery systems, and surgical tools. It offers a reduced carbon footprint while ensuring compliance with severe medical safety and performance standards.

The bio-based polypropylene in the medical devices market growth is driven by the increasing demand for sustainable and eco-friendly materials. Derived from renewable resources such as biomass, bio-based polypropylene offers a reduced carbon footprint while maintaining the high-performance requirements essential for medical applications. Its use spans a wide range of products, including drug delivery systems, medical packaging, and surgical tools, meeting stringent regulatory standards. The market demand is further driven by advancements in manufacturing technologies and a growing emphasis on reducing dependency on fossil fuels in the healthcare sector. In December 2023, LyondellBasell and Pigeon Singapore partnered to enhance the sustainability of baby nursing bottles. The new bottles will feature LyondellBasell's bio-based CirculenRenew polypropylene polymers, moving away from 100% virgin polypropylene resins. Additionally, major players are investing in R&D to enhance product properties and align with sustainability goals, addressing the rising awareness of environmental impacts in medical device production. This market represents a convergence of innovation, sustainability, and regulatory compliance, contributing to the broader transition toward green healthcare solutions.

To Understand More About this Research: Request a Free Sample Report

Bio-Based Polypropylene in Medical Devices Market Drivers Analysis

Rising Demand for Sustainable and Bio-Based Materials in Medical Devices

Manufacturers are adopting bio-based alternatives such as bio-based polypropylene to reduce environmental impact as the healthcare industry increasingly prioritizes eco-friendly practices. These materials meet sustainability goals and maintain the necessary quality and safety standards for medical applications. The shift toward renewable resources aligns with stricter regulatory requirements and growing consumer preferences for green products. Additionally, advancements in bio-based polypropylene production technologies are making these materials more cost-effective and accessible. In October 2024, PVCMed Partner TekniPlex Healthcare launched medical-grade bio-based PVC compounds to match the performance and chemical properties of traditional medical-grade PVC, while offering a more environmentally friendly alternative, further accelerating adoption across the medical device sector. Therefore, the increasing demand for sustainable and bio-based materials in medical devices boosts the bio-based polypropylene in medical devices market development.

Advancement in Bio-Based Polypropylene Technology

Innovations such as improved catalytic processes and enhanced bio-feedstock formulations have made the production of bio-based polypropylene more efficient and cost-effective. The advancements ensure the material meets strict medical standards for safety and performance, broadening its applications in medical packaging, surgical tools, and diagnostic devices. In November 2021, Arkema introduced a high-rigidity bio-circular polyamide 11 polymers designed to replace metals and traditional polymers in advanced medical applications. This innovative material aims to address the demands for enhanced performance and sustainability in the healthcare sector. Additionally, such developments help reduce reliance on fossil fuels, aligning with sustainability goals and regulatory mandates for environmentally friendly materials in healthcare. Therefore, advancements in bio-based polypropylene technology propel the bio-based polypropylene in medical devices market growth.

Bio-Based Polypropylene in Medical Devices Market Segment Analysis

Bio-Based Polypropylene in Medical Devices Market Assessment by Production Method Outlook

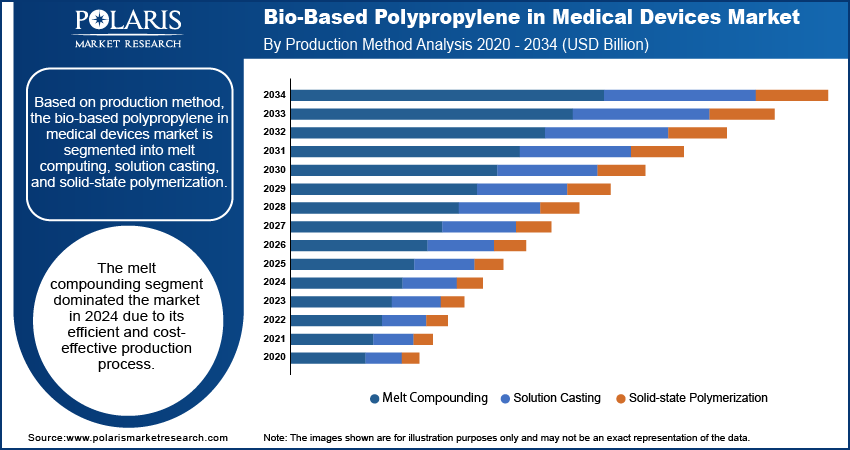

The global bio-based polypropylene in medical devices market segmentation, based on production methods, includes melt computing, solution casting, and solid-state polymerization. In 2024, the melt compounding method led the market due to its efficient and cost-effective production process. This technique involves mixing bio-based polypropylene with other materials at high temperatures to ensure uniform consistency and high quality, which is essential for medical applications. Melt compounding has several advantages, including high production speeds, scalability, and flexibility in creating complex medical device components. It also allows for the use of sustainable materials without compromising performance. The growing demand for cost-effective and eco-friendly solutions in healthcare, along with advances in processing technologies, has made melt compounding a preferred choice over other methods like solution casting and solid-state polymerization.

Bio-Based Polypropylene in Medical Devices Market Evaluation by End User Outlook

The global bio-based polypropylene in medical devices market segmentation, based on end user, includes hospitals, ambulatory surgery centers, clinics, and patients. The ambulatory surgery centers (ASCs) segment is expected to experience substantial growth in the bio-based polypropylene in medical devices market during the forecast period due to their cost-effective nature and ability to provide high-quality care while reducing operational costs. ASCs are increasingly favored for outpatient and minimally invasive procedures devices, which often require advanced, sustainable materials such as bio-based polypropylene. Additionally, ASCs are adopting more environmentally friendly practices in response to growing consumer demand for eco-conscious solutions. ASCs are well-positioned to benefit from these trends as sustainability becomes a priority in the healthcare sector, further driving demand for bio-based polypropylene in medical devices.

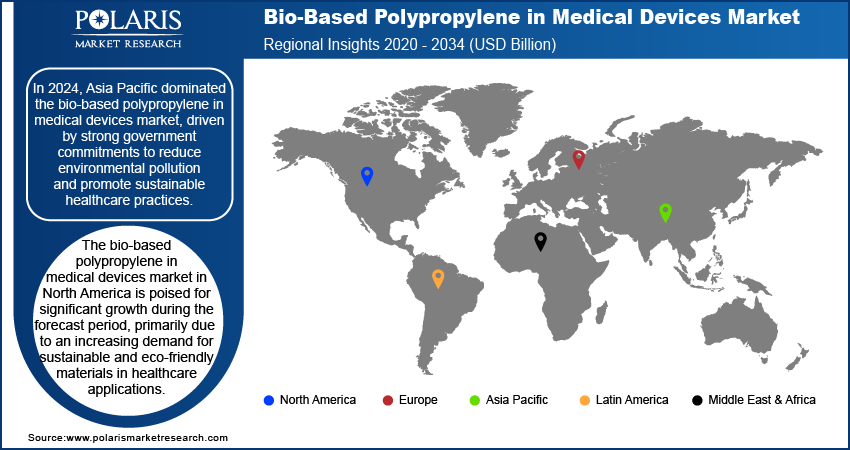

Bio-Based Polypropylene in Medical Devices Market Regional Analysis

By region, the study provides bio-based polypropylene in medical devices market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific dominated the market, driven by strong government commitments to reducing environmental pollution and promoting sustainable healthcare practices. Countries in the region, such as China, Japan, and India, have implemented stricter environmental regulations and increased funding for eco-friendly initiatives. For instance, in April 2023, the Ministry of Chemicals and Fertilizers reported the Union Cabinet's approval of the National Medical Devices Policy in India, targeting sector growth from USD 11 billion to USD 50 billion by 2030. The policy focuses on regulatory ease, infrastructure, R&D, investments, workforce development, and brand positioning, supporting 'Atmanirbhar Bharat' and 'Make in India' to establish India as a global MedTech leader. These efforts are aligning with the growing demand for sustainable solutions in medical device manufacturing, including the adoption of bio-based polypropylene. The region's large healthcare sector, expanding infrastructure, and rising awareness of the benefits of sustainable materials further contribute to this growth. Additionally, as the market for medical devices continues to expand in Asia Pacific, the demand for green alternatives such as bio-based polypropylene is expected to increase, fueled by both regulatory and consumer pressure for environmentally responsible solutions.

The bio-based polypropylene in medical devices market in North America is poised for significant growth during the forecast period, primarily due to an increasing demand for sustainable and eco-friendly materials in healthcare applications. The region benefits from a robust healthcare infrastructure and substantial investments in research and development, which facilitate the integration of innovative biomaterials. Furthermore, supportive government policies that prioritize environmental sustainability, along with the presence of leading market players, are key drivers of this growth trajectory. Increasing awareness around carbon footprint reduction, combined with a strong emphasis on the production of high-quality medical devices, further drives bio-based polypropylene in medical devices market growth.

Bio-Based Polypropylene in Medical Devices Market – Key Players and Competitive Analysis Report

The competitive landscape of the bio-based polypropylene in medical devices market features a mix of global leaders and regional players focusing on innovation, strategic collaborations, and market expansion. Major companies such as SABIC, BASF, and Avient Corporation leverage strong R&D capabilities and advanced production techniques to offer sustainable, high-performance polypropylene solutions tailored for medical applications. Emerging trends in the market highlight the adoption of bio-based polymers for their reduced carbon footprint and compliance with stringent medical regulations, reflecting a shift toward eco-friendly materials in the healthcare sector. Bio-based polypropylene in medical devices market growth is driven by increasing demand for sustainable and biocompatible materials in critical applications such as medical packaging, drug delivery systems, and surgical instruments. Regional players address specific market needs through localized production and cost-effective solutions, particularly in rapidly growing regions such as Asia Pacific. Competitive strategies include the development of innovative bio-based products, certifications such as ISO 13485 to ensure quality and safety, and partnerships to expand market presence. These dynamics underscore the significance of sustainability, technological advancements, and regulatory compliance in shaping the bio-based polypropylene market for medical devices. A few key major players are SABIC; BASF; Reliance Industries Ltd.; Mitsui Chemicals, Inc.; Borealis AG; Braskem; DOW; Danimer Scientific; FKuR; Arkema; and Avient Corporation.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, surface technologies provide chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The nutrition and care segment provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the agricultural solutions segment offers seeds and crop protection products such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products.

Dow is a chemical manufacturing conglomerate with a wide range of products. Dow Inc. offers consumer care, construction, and industrial materials science solutions across the US, Canada, Latin America, Europe, Africa, India, the Middle East, and Asia Pacific. Dow maintains 113 production facilities in 31 countries. Coatings, durable goods, home and personal care, adhesives and sealants, and food and specialized packaging are among the applications served by the company. Dow's portfolio includes six global business divisions, structured into three functioning segments, including industrial intermediates & infrastructure, packaging & specialty plastics, and performance material & coatings. The industrial intermediates & infrastructure segment offers propylene oxide, ethylene oxides, aromatic isocyanates & polyurethane systems, propylene glycol, polyether polyols, coatings, sealants, adhesives, composites, elastomers caustic soda, vinyl chloride monomers, ethylene dichloride, cellulose ethers, silicones, acrylic emulsions, and redispersible latex powders. The packaging & specialty plastics segment offers ethylene, polyolefin elastomers, propylene and aromatics products, ethylene propylene diene monomer rubbers, polyethylene, and ethylene-vinyl acetate. The performance materials and coatings segment offers industrial coatings and architectural paints that are used in maintenance and protective industries, thermal paper, metal packaging, wood, traffic markings, leather, standalone silicones, performance monomers and silicones, and home and personal care solutions.

Key Companies in Bio-Based Polypropylene in Medical Devices Market

- SABIC

- BASF

- Reliance Industries Ltd.

- Mitsui Chemicals, Inc.

- Borealis AG

- Braskem

- DOW

- Danimer Scientific

- FKuR

- Arkema

- Avient Corporation

Bio-Based Polypropylene in Medical Devices Market Development

In January 2024, Avient Corporation showcased its bio-based polymer solutions at Pharmapack 2024, a leading European trade show for pharma packaging and drug delivery devices. These solutions included bio-based polymer colorants, additives, and bio-derived thermoplastic elastomers with reduced carbon footprints verified through TÜV Rheinland-certified ISO 14067 compliance.

In September 2023, Ducor Petrochemicals launched the DuCare product range, an ISO 13485-certified polypropylene developed for medical and life science uses. This product line aligns with sustainability efforts through the use of bio-based and circular feedstocks under ISCC PLUS certification. DuCare is designed for applications such as PCR pipette tips and medical packaging, emphasizing quality, consistency, and compliance with regulatory standards.

Bio-Based Polypropylene in Medical Devices Market Segmentation

By Application Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Implantable Device

- Medical Tubing

- Medical Packaging

- Sutures and Meshes

By End User Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgery Centers

- Clinics

- Patients

By Material Type Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Homopolymers

- Copolymers

- Terpolymers

By Production Method Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Melt Compounding

- Solution Casting

- Solid-State Polymerization

By Modification Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Grafting

- Blending

- Crosslinking

By Regional Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bio-Based Polypropylene in Medical Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 15.94 billion |

|

Market Size Value in 2025 |

USD 17.64 billion |

|

Revenue Forecast by 2034 |

USD 44.56 billion |

|

CAGR |

10.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Tons; Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 15.94 billion in 2024 and is projected to grow to USD 44.56 billion by 2034.

The global market is projected to register a CAGR of 10.8% during the forecast period.

In 2024, Asia Pacific dominated the bio-based polypropylene in medical devices market revenue share, driven by strong government commitments to reduce environmental pollution and promote sustainable healthcare practices.

A few key players in the market are SABIC; BASF; Reliance Industries Ltd.; Mitsui Chemicals, Inc.; Borealis AG; Braskem; DOW; Danimer Scientific; FKuR; Arkema; and Avient Corporation.

The melt compounding segment dominated the market in 2024.

The ambulatory surgery centers (ASCs) segment is expected to experience substantial growth in the bio-based polypropylene in medical devices market during the forecast period