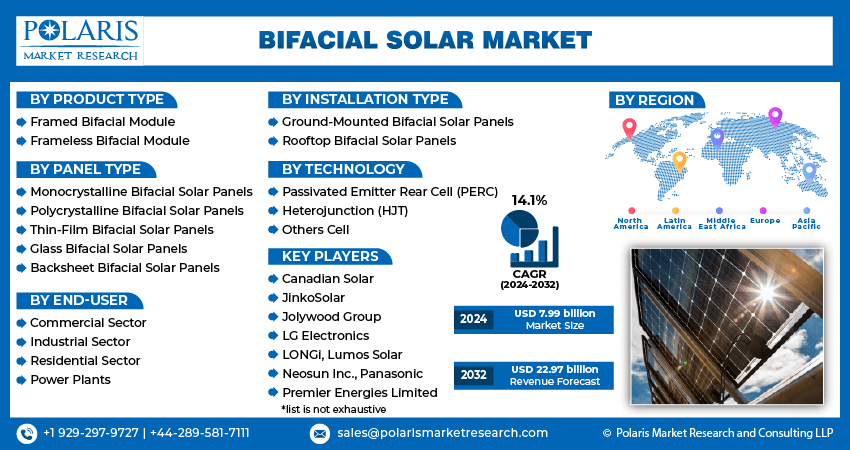

Bifacial Solar Market Size, Share, Trends, Industry Analysis Report: By Product Type (Framed Bifacial Module, Frameless Bifacial Module), By Panels Type, By Installation Type, By Technology, By End-User, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032.

- Published Date:Aug-2024

- Pages: 117

- Format: PDF

- Report ID: PM5019

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

Global bifacial solar market size was valued at USD 7.01 billion in 2023. The industry is projected to grow from USD 7.99 billion in 2024 to USD 22.97 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 14.1% during the forecast period (2024 - 2032).

Bifacial solar panels are the creative advancement in photovoltaic technology that allows solar cells to capture sunlight from both sides of the panel. Traditional solar panels are monoracial, absorbing light only from the front side. In contrast, bifacial panels are designed to let light pass through the transparent back sheet, enabling the rear side to capture reflected and diffused sunlight from surfaces like the ground, water, or nearby structures. This dual-sided light capture increases the overall energy yield, making bifacial panels more efficient and potentially more cost-effective over time.

The demand for bifacial solar panels is on the rise, fueled by the increasing need for efficient and sustainable energy solutions. Furthermore, the rapid urbanization and industrialization in emerging markets are playing a significant role in driving the adoption of bifacial solar technology, shaping the future of the bifacial solar market and the global energy landscape.

To Understand More About this Research:Request a Free Sample Report

One of the significant advantages of bifocal solar panels is the potential for higher energy output per unit area, which is crucial for maximizing the use of limited space in urban and industrial settings. Various key players in the bifacial solar market have significantly marked their footprint through the development of new technologies and the expansion of their production capacities.

For instance, In February 2019, LONGi announced the construction of the "bifacial+tracker" power generation project in Mitchell County, Georgia, with a capacity of 224 MW, to supply bifacial PERC modules. This project supports the widespread adoption of bifacial solar technology and contributes to driving growth in the bifacial solar market.

Bifacial Solar Market Trends:

Rising Technological Advancements is Driving the Market Growth

The rising technological advancements in panels are driving market CAGR for bifacial solar. These advancements continually enhance the efficiency, performance, and application versatility of bifacial solar technology. Ongoing research and development efforts lead to the development of more efficient bifacial solar cells and modules. Improvements in materials, manufacturing processes, and cell designs maximize energy capture from both the front and rear sides of panels.

Innovations such as PERC (Passivated Emitter Rear Cell) and N-type bifacial cells improve cell efficiency and durability. These advancements enable bifacial panels to generate more electricity from sunlight reflected off surfaces like snow, water, or surrounding buildings.

Companies investing in research and development to advance bifacial technology gain a competitive edge. They offer higher efficiency panels at competitive prices, attracting more customers and driving market growth.

For instance, in 2020, Jolywood Group introduced N-type bifacial all-black solar panels aimed at the high-end market. These panels feature the massively produced N-type TOPCon 2.0 product, boasting an efficiency exceeding 24%. Besides, they incorporate advanced organic and inorganic nano-hybrid alloy technology in the transparent backsheet. These advancements not only propel the expansion of the bifacial solar market but also foster wider adoption of renewable energy solutions worldwide.

Rising Government Supportive Policies and Incentives

The bifacial solar market is experiencing significant growth, driven by rising government-supportive policies and incentives. Many governments have committed to reducing greenhouse gas emissions and increasing renewable energy adoption to meet international climate agreements. Supportive policies for bifacial solar help governments achieve these ambitious targets. Thus, governments offer a range of financial incentives such as subsidies, grants, tax credits, and rebates to reduce the initial capital costs associated with installing bifacial solar panels. These incentives make renewable energy investments more financially attractive for consumers and businesses alike, which creates a favorable environment for customers' investment and drives growth in the bifacial solar market.

For instance, in August 2022, the Ministry of New and Renewable Energy (MNRE) declared a scheme aimed at achieving 100% solarization of Modhera in Gujarat. Under this initiative, all domestic and agricultural electricity needs of households in Modhera will be met through solar energy. This pilot project serves as a demonstration for transitioning a village or town entirely to solar power. Such supportive government schemes underscore the increasing demand for solar panels and contribute to the growth of the bifacial solar market revenue.

Bifacial Solar Segment Insights:

Bifacial Solar Panels Type Insights:

The global bifacial solar market segmentation, based on panel type, includes monocrystalline bifacial solar panels, polycrystalline bifacial solar panels, thin-film bifacial solar panels, glass bifacial solar panels, and back sheet bifacial solar panels. In 2023, the monocrystalline bifacial solar panels segment dominated the market due to higher efficiency compared to polycrystalline. Monocrystalline silicon is known for its robustness and longevity, with lower degradation rates over time compared to other materials. The use of monocrystalline silicon in bifacial panels translates to overall higher energy yields per panel area. Also, it ensures a longer operational lifespan and reliable performance of bifacial panels.

Continuous advancements of key players in monocrystalline silicon technology, such as PERC (Passivated Emitter Rear Cell) and N-type cells, have further boosted efficiency and performance. These advancements have made monocrystalline bifacial panels increasingly attractive for large-scale solar installations.

For instance, in October 2022, Premier Energies developed India’s first bifacial monocrystalline silicon PERC solar cell based on the 182 mm structure, which has an efficiency rating of up to 23.2%. Such innovations create a market opportunity among the key players and drives the bifacial solar market share.

Bifacial Solar End-User Insights:

The global bifacial solar market segmentation, based on end-users, includes commercial sectors, industrial sectors, residential sectors, and power plants. The residential category is expected to witness significant growth during the forecast period due to rising energy costs, increasing government incentives for renewable energy adoption, and growing environmental awareness among homeowners. Bifacial panels can be integrated more seamlessly into residential rooftops due to their sleek design and often all-black appearance, which appeals to homeowners concerned with aesthetic impact.

Governments worldwide provide various schemes that encourage residential solar installations. These incentives are designed to lower the upfront costs associated with purchasing and installing solar PV systems, thereby accelerating adoption among homeowners. By reducing the initial investment burden, these financial incentives make renewable energy technologies like bifacial solar panels more accessible and appealing to residential consumers.

For instance, in September 2022, the Indian government's Ministry of New & Renewable Energy, through its Grid Solar Power Division, assigned a total capacity of 39,600 MW of household Solar PV module manufacturing to 11 companies. This allocation, part of the Production Linked Incentive Scheme for High-Efficiency Solar PV Modules, involves a total investment of Rs. 14,007 crores. A manufacturing capacity of 7,400 MW is expected to be operational by October 2024, 16,800 MW by April 2025, and the remaining 15,400 MW by April 2026. These stimulate economic growth in the solar sector by creating demand for the bifacial solar market.

Global Bifacial Solar Industry, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

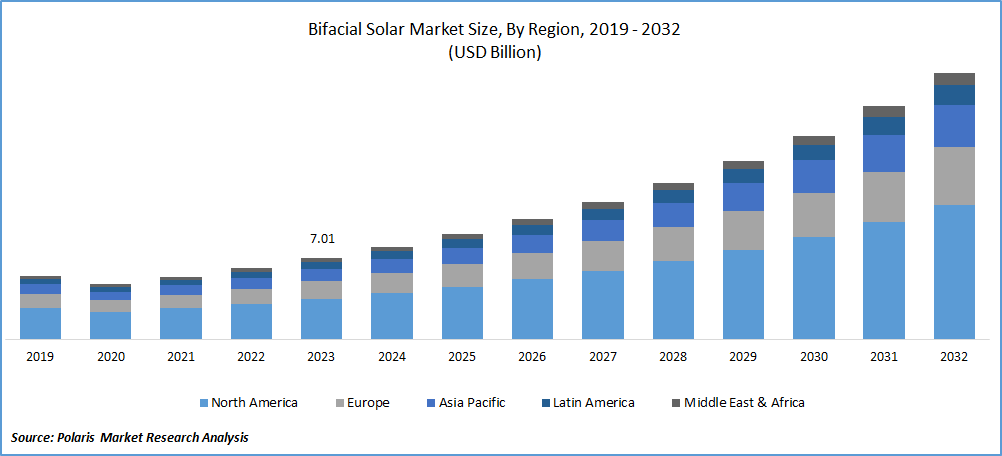

Bifacial Solar Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific and Latin America, and Middle East & Africa. North America accounted for the largest share of the bifacial solar market, as the region is at the forefront of technological innovation in solar energy.

In addition, the presence of major solar technology companies and manufacturers in North America fosters competition and promotes innovation in bifacial solar panel designs and applications. Such a competitive environment drives improvements in product performance and cost-effectiveness. Some of the key players, such as Trinasolar, JinkoSolar, VIKRAM SOLAR LTD., and LG Electronics, offer their services to further strengthen the bifacial solar market landscape in North America.

These key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, which is further driving the market.

Global Bifacial Solar Industry, Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

The U.S. bifacial solar market is expected to witness significant CAGR growth during the forecast period. This is due to a significant push towards utility-scale solar projects, driven by the need to diversify energy sources, reduce carbon emissions, and enhance energy security. Bifacial solar panels, with their higher efficiency and energy yield, are well-suited for large-scale installation, contributing to their demand. Businesses and industries in the U.S. are increasingly investing in solar energy to reduce operational costs, demonstrate corporate social responsibility, and meet sustainability goals.

For instance, in September 2019, Vikram Solar played a significant role in enhancing competition among players in the U.S. by introducing three new product lines for pre-order. These products include half-cell modules with a power output of up to 425 watts and a 27-year linear power warranty, as well as the company’s first bifacial module available in both Glass-Glass and glass with transparent backsheet architecture. Additionally, Vikram Solar introduced Frameless Bifacial Modules SOMERA P-Duplex and Framed Bifacial Half-Cell Modules SOMERA P-Duplex, which come with a 30-year linear power warranty. These shipments to the U.S. began in January 2020, driving demand in the bifacial solar market.

The Canadian bifacial solar market held a significant market share in 2023 due to technological improvements in bifacial solar panel efficiency and performance, making them an increasingly viable option for Canadian solar projects. There is a growing number of utility-scale solar power plants in Canada where bifacial solar panels are being deployed to maximize energy yield and efficiency. Companies are incorporating cutting-edge technologies into bifacial panels to make them more reliable and efficient, further boosting their appeal for power plant projects.

For instance, in October 2020, Canadian Solar Inc. introduced its bifacial BiHiKu7 and monofacial HiKu7 high-power, high-efficiency modules, boasting power output of up to 665 W. These next-generation modules are designed to deliver one of the industry's most competitive levelized costs of electricity (LCOE) by further reducing balance of system (BOS) and other associated costs for solar power plants. The monofacial HiKu7 and bifacial BiHiKu7 modules are optimized with advanced tracker and inverter designs, ensuring seamless installation for solar plants.

The Asia-Pacific bifacial solar market is anticipated to witness the highest CAGR during the forecast period due to the region's rapidly growing population and industrialization. Countries in the Asia-Pacific are turning to renewable energy sources like bifacial solar panels to meet this rising demand sustainably. Continuous advancements in solar technology, including improvements in bifacial solar panel efficiency and performance, are making these panels more attractive for various applications. Moreover, India's bifacial solar market held the largest market share in 2023, driven by market player’s new innovative launches. For instance, in May 2024, Noida-based Bluebird Solar introduced its N-Type TOPCon PV Modules at RenewX. The company’s 600W N-TOPCon dual glass Bi-Facial PV Module, which was the highlight of the launch, features a light transformation efficiency of 23.25% and a bifaciality factor of 70 +/- 5%. This advanced product is set to influence the bifacial solar market in India significantly. On the other hand, China's bifacial solar market is expected to witness the highest growth during the forecast period.

Bifacial Solar Key Market Players & Competitive Insights

Leading market players are not just investing heavily in research and development but also forging strategic partnerships that set industry standards and drive market trends through continuous innovation. This emphasis on collaboration is a key factor in the industry's evolution. Manufacturing costs, economies of scale, and supply chain efficiencies play a crucial role in determining market developments. Companies that produce high-efficiency bifacial panels at lower costs can capture larger market shares. One of the key strategies employed by manufacturers in the global bifacial solar industry to benefit customers and drive market growth is the reduction of operational expenses. Recent years have seen significant technological advancements in the bifacial solar sector, enhancing efficiency and performance.

Major players in the bifacial solar market include LONGi, Jolywood Group, Trina Solar, JinkoSolar, Risen Energy Co., Ltd. LG Electronics, SunPower Corporation, Soleos, Premier Energies Limited, Canadian Solar, Sharp Electronics, Tigo Energy, Inc., Panasonic, Prism Solar Technologies, Neosun Inc, and Lumos Solar.

Trina Solar, a global manufacturer of solar photovoltaic products, delivers smart industry solutions to meet diverse energy needs. The company is involved in the research and development, sales, and production of PV modules, PV systems, and smart energy solutions. Trina Solar's PV systems include power stations and various system products. Since its inception, Trina Solar has built a strong global presence. In February 2022, Trina Solar achieved notable success in India with its ultra-high power Vertex modules, including the 670W Vertex modules. These modules, like others in the Vertex range, are available in both mono-facial and bifacial options.

Jinko Solar Co., Ltd. is a major innovative solar technology company globally. Its business encompasses the core elements of the photovoltaic industry chain, with a strong focus on the research and development of integrated photovoltaic products and comprehensive clean energy solutions. Over 3,000 customers currently utilize Jinko Solar's products in more than 160 countries and regions worldwide. The company offers bifacial modules with transparent backsheet technology, providing up to 20% power gain relying on PV system design. In July 2024, Jinko Solar announced its success in securing a 150MW PV module supply agreement for Algeria's solar project initiative. Such achievement marks a significant milestone in Jinko Solar's international expansion.

Key companies in the bifacial solar market include:

- Canadian Solar

- JinkoSolar

- Jolywood Group

- LG Electronics

- LONGi

- Lumos Solar

- Neosun Inc

- Panasonic

- Premier Energies Limited

- Prism Solar Technologies

- Risen Energy Co., Ltd.

- Sharp Electronics

- Soleos

- SunPower Corporation

- Tigo Energy, Inc.

- Trinasolar

Bifacial Solar Industry Developments

- In March 2024, LONGi launched its Hi-MO X6 Bifacial Dual-Glass solar modules, which include the Hi-MO X6 Guardian and Hi-MO X6 Explorer. The launch of the new modules marks a significant advancement in the photovoltaic (PV) industry.

- In March 2023, Soleos unveiled its new generation ANTARES BI 144 Solar Panel featuring dual glass technology and a bifacial factor of 70%. It aims to increase output by 10-15% compared to capacities ranging from 400 watts to 700 watts.

- In July 2020, Canadian Solar Inc. celebrated Canada Day by launching its super-high power PV modules Series 5 and 6. These new modules are part of the BiHiKu, HiKu, and HiDM portfolios, which expand the range of high-efficiency monofacial and bifacial solar modules.

Bifacial Solar Market Segmentation:

Bifacial Solar Product Type Outlook

- Framed Bifacial Module

- Frameless Bifacial Module

Bifacial Solar Panel Type Outlook

- Monocrystalline Bifacial Solar Panels

- Polycrystalline Bifacial Solar Panels

- Thin-Film Bifacial Solar Panels

- Glass Bifacial Solar Panels

- Backsheet Bifacial Solar Panels

Bifacial Solar Installation Type Outlook

- Ground-Mounted Bifacial Solar Panels

- Rooftop Bifacial Solar Panels

Bifacial Solar Technology Outlook

- Passivated Emitter Rear Cell (PERC)

- Heterojunction (HJT)

- Others Cell

Bifacial Solar End-User Outlook

- Commercial Sector

- Industrial Sector

- Residential Sector

- Power Plants

Bifacial Solar Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bifacial Solar Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 7.01 billion |

|

Market Size Value in 2024 |

USD 7.99 billion |

|

Revenue Forecast in 2032 |

USD 22.97 billion |

|

CAGR |

14.1% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global bifacial solar market size was valued at USD 7.01 billion in 2023 and is expected to grow to 22.97 billion in 2032

The global market is projected to grow at a CAGR of 14.1% during the forecast period, 2023-2032

North America held the largest share in the global market.

The key players in the market are LONGi, Jolywood Group, Trinasolar, JinkoSolar, Risen Energy Co., Ltd. LG Electronics, SunPower Corporation, Soleos, Premier Energies Limited, Canadian Solar, Sharp Electronics, Tigo Energy, Inc., Panasonic, Prism Solar Technologies, Neosun Inc, and Lumos Solar

In 2023, the monocrystalline bifacial solar panels segment dominated the market

The residential category is expected to witness significant growth during the forecast period