Behavior Analytics Market Size, Share, Trends, Industry Analysis Report: By Component (Solution and Services), Deployment, Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 125

- Format: PDF

- Report ID: PM5360

- Base Year: 2024

- Historical Data: 2020-2023

Behavior Analytics Market Overview

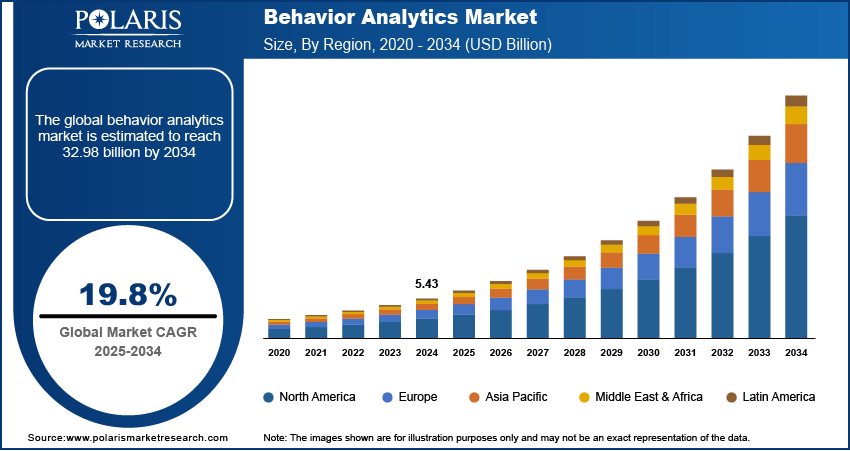

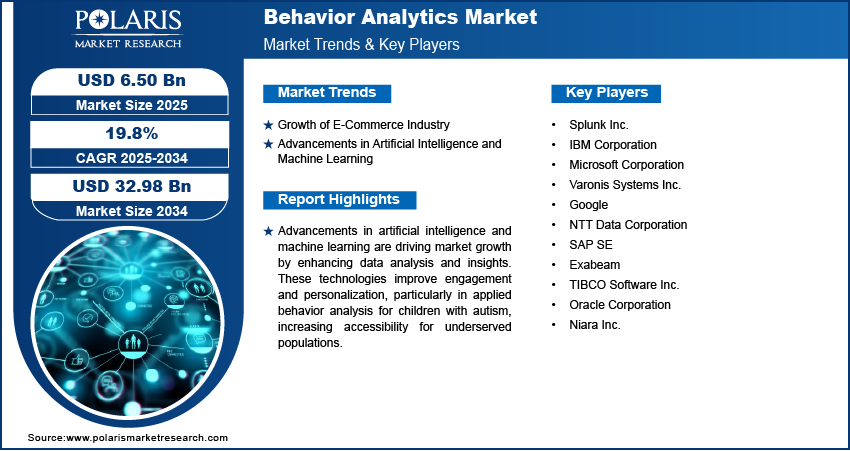

The global behavior analytics market size was valued at USD 5.43 billion in 2024. The market is projected to grow from USD 6.50 billion in 2025 to USD 32.98 billion by 2034, exhibiting a CAGR of 19.8% from 2025 to 2034.

Behavior analytics is the process of collecting and analyzing data on individuals' actions, often in digital environments, to understand patterns and reasons. It involves studying how users interact with products, services, or websites to gain insights that inform decision-making, improve user experience, and drive business strategies.

The rising focus on data-driven decision-making is fueling the behavior analytics market expansion. Organizations across various sectors are realizing the importance of using data to shape their strategies, streamline operations, and enhance customer experiences. By gaining valuable insights into user interactions, preferences, and trends, businesses can make well-informed decisions that drive growth. The data-driven approach also allows companies to pinpoint what resonates with their audiences, customize their marketing strategies, and enhance product offerings based on real-time data. The demand for behavior analytics solutions is also increasing as more organizations prioritize data literacy and invest in advanced analytics tools.

To Understand More About this Research: Request a Free Sample Report

The growing focus on regulatory compliance and risk management is driving the behavior analytics market development. As industries face stricter regulations regarding data privacy and security, organizations are increasingly turning to behavior analytics to monitor user activities and ensure compliance. For instance, according to the Department of Science, Innovation and Technology UK, three-quarters of businesses (75%) and more than six in ten charities (63%) report that cybersecurity is a high priority for their senior management, with even higher proportions among larger businesses (93% of medium and 98% of large businesses) and high-income charities (93% of those with income of USD 650,000 or more). By analyzing behavioral patterns, businesses can detect anomalies, prevent fraud, and identify potential compliance breaches before they escalate. This proactive approach not only mitigates risks but also builds trust with customers and stakeholders.

Behavior Analytics Market Drivers

Growth of E-Commerce Industry

As e-commerce platforms expand, they are increasingly relying on behavior analytics to analyze customer interactions and preferences. This data-driven approach enables businesses to refine their marketing strategies and effectively promote relevant products to their target audiences. For instance, according to the India Brand Equity Foundation, India's e-commerce sector achieved a significant milestone, reaching a gross merchandise value (GMV) of approximately USD 60 billion in the fiscal year 2023. This represents a substantial 22% increase from the previous year, highlighting the rapid expansion of online shopping in the region. As e-commerce continues to grow, the demand for advanced behavior analytics tools will rise, helping companies improve customer experiences, enhance retention rates, and drive sales through more personalized offerings. Thus, the growth of the e-commerce industry is expected to boost the behavior analytics market revenue.

Advancements in Artificial Intelligence and Machine Learning

With artificial intelligence (AI) and machine learning (ML) technologies, organizations are able to analyze large amounts of behavioral data more efficiently and accurately, leading to enhanced insights. For instance, according to the Applied Behavior Analysis Organization, AI identifies patterns in user behavior that human analysts may overlook. In applied behavior analysis (ABA), AI and ML are revolutionizing therapeutic practices, helping professionals engage children with autism using robots to stimulate interaction. A study by the University of Southern California demonstrated that these technologies effectively re-engaged children when their attention waned, showcasing their potential to enhance social skills. As AI and ML continue to evolve, their integration into behavior analytics will improve personalization, efficiency, and accessibility, particularly for underserved populations, driving the behavior analytics market demand in the coming years.

Behavior Analytics Market Segment Insights

Behavior Analytics Market Assessment Based on Component

The behavior analytics market, based on component, is segmented into solution and services. The services segment is expected to experience significant growth with a higher CAGR from 2025 to 2034. This growth is driven by the increasing demand for consulting, implementation, and ongoing support services that help organizations effectively leverage behavior analytics tools. As businesses seek to optimize user engagement and enhance customer experiences, the need for expert guidance in data analysis, strategy development, and technology integration becomes critical. Additionally, training and maintenance services are essential for maximizing the value of behavior analytics solutions, boosting the growth of the services segment in the global market.

Behavior Analytics Market Evaluation Based on Deployment

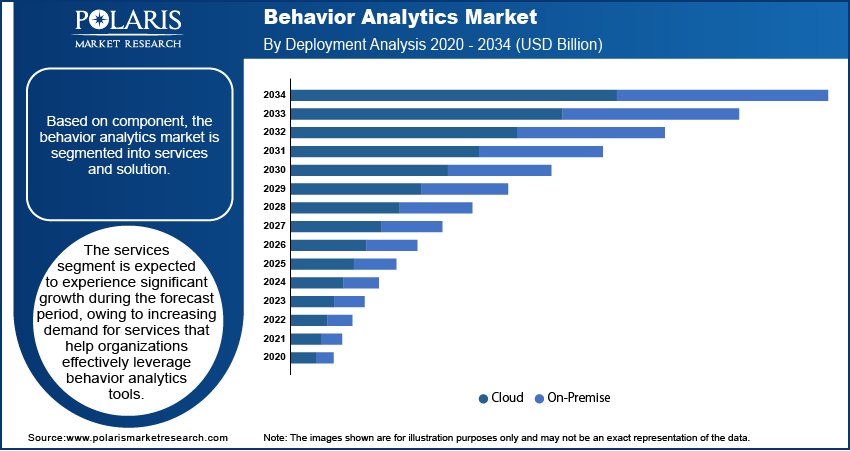

The behavior analytics market, based on deployment, is segmented into cloud and on-premise. The cloud segment is expected to dominate the behavior analytics market in the forecast years due to the advantages of scalability, cost-effectiveness, and easy accessibility offered by cloud-based solutions. Organizations increasingly prefer cloud deployments for their ability to handle large volumes of data, facilitate real-time analytics, and support collaboration across teams. Additionally, cloud solutions enhance data security and compliance, resulting in increased demand for cloud services.

Behavior Analytics Market Regional Analysis

By region, the study provides behavior analytics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest revenue share of the global market in 2024, driven by the presence of major players in the region. The leading companies leverage advanced technologies and extensive research and development capabilities to drive innovation in behavior analytics solutions. This competitive landscape fosters advancements, enabling businesses to take advantage of data-driven insights for improved customer engagement. Additionally, the region benefits from a strong focus on digital transformation across various industries, speeding up the adoption of behavior analytics tools.

The Asia Pacific behavior analytics market is projected to register a substantial CAGR during the forecast period due to increasing investments in cybersecurity. As businesses across various sectors prioritize data protection and compliance, the demand for advanced analytics solutions that monitor user behavior and detect anomalies is growing. Governments and organizations are recognizing the critical need to safeguard sensitive information, leading to heightened spending on cybersecurity initiatives. This focus not only enhances security measures but also fosters a greater understanding of user interactions, enabling companies to tailor their offerings effectively.

India is experiencing significant growth in the behavior analytics market, driven by the rapid expansion of its e-commerce industry. With the increasing popularity of online shopping, businesses are using behavior analytics to understand customer preferences, enhance user experience, and boost sales. The rise in internet penetration and smartphone usage has further accelerated this trend, allowing companies to gather and analyze large amounts of data. Recently, In December 2023, the homegrown e-commerce giant Flipkart is set to raise USD 1 billion in a new funding round, with its parent company, Walmart, expected to contribute USD 600 million. This investment underscores the growth of the e-commerce industry and, in turn, the behavior analytics market in the country.

Behavior Analytics Market – Key Market Players and Competitive Insights

The behavior analytics market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, advanced software technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the market by introducing advanced solutions and catering to the specific needs of users. This competitive environment is amplified by continuous progress in product offerings, greater emphasis on sustainability, and the rising requirement for tailor-made products in diverse industries. A few of the key players in the behavior analytics market include Splunk Inc., IBM Corporation, Microsoft Corporation, Varonis Systems Inc., Google, NTT Data Corporation, SAP SE, Exabeam, TIBCO Software Inc., Oracle Corporation, and Niara Inc.

IBM (International Business Machines Corporation) is an American multinational technology company that operates in over 75 countries. IBM has a vast network of 80,000 business associates who assist in serving 5,200 clients, including 95% of the Fortune 500. Despite being a B2B (business-to-business) firm, IBM has significant external influence. For example, it is responsible for 50% of all wireless and 90% of all credit card transactions. In May 2024, IBM announced the release of the latest QRadar User Behavior Analytics (UBA) app updates, featuring enhancements such as new user roles, upgraded Java, and fixed security vulnerabilities. Notably, the updates brought improvements in machine learning functionality and better integration with QRadar, enhancing the overall user experience.

Google LLC, a subsidiary of Alphabet Inc., provides search and advertising services on the Internet. The company, Google LLC, operates in two major reportable segments – Google Services and Google Cloud.

The "Google Services" segment comprises a wide range of core products and platforms, including Android, Ads, Hardware, Chrome, Google Drive, Gmail, Google photos, Google Maps, Google Play, YouTube, and Search. The segment's hardware products also characterized by various products such as Pixel 5a 5G, Pixel 6 phones, Chromecast with Google TV, the Fitbit Charge 5, Google Nest Cams, and Nest Doorbells.

The company's cloud segment is further categorized into two Google Cloud Platforms and Google Workspace. The Google Cloud platform aids developers in building, testing, and deploying applications on its scalable and reliable infrastructure. The Google collaboration tools include applications such as Gmail, Calendar, Docs, Drive, Meet, and more. Also, it provides OCR on Google Cloud Platform, including image uploading, text extraction, translation, and Cloud Pub/Sub integration.

Besides Google, the company has also been operating to solve various problems across industries through its technological solutions under "Other Bets." The segment is an independent company with boards with independent members and outside investors.

List of Key Companies in Behavior Analytics Market

- Splunk Inc.

- IBM Corporation

- Microsoft Corporation

- Varonis Systems Inc.

- NTT Data Corporation

- SAP SE

- Exabeam

- TIBCO Software Inc.

- Oracle Corporation

- Niara Inc.

Behavior Analytics Industry Developments

August 2024: Hewlett Packard Enterprise announced the launch of AI-powered network detection and response (NDR) capabilities and a campus-based Zero Trust Network Access (ZTNA) solution. These innovations aimed to enhance cybersecurity by leveraging behavioral analytics to detect and respond to threats more effectively.

April 2023: UserTesting announced the launch of new behavioral analytics capabilities, which include friction detection powered by machine learning and integration with Microsoft Teams. These updates aim to enhance user insights and streamline the sharing of feedback across organizations for better decision-making.

Behavior Analytics Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Solution

- Services

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- Cloud

- On-Premise

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Customer Engagement

- Brand Promotion

- Workforce Optimization

- Threat Detection and Prevention

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Retail and E-commerce

- BFSI

- Healthcare

- IT and Telecom

- Energy and Utilities

- Government and Defense

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Behavior Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.43 billion |

|

Market Size Value in 2025 |

USD 6.50 billion |

|

Revenue Forecast by 2034 |

USD 32.98 billion |

|

CAGR |

19.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End-User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 5.43 billion in 2024 and is projected to grow to USD 32.98 billion by 2034.

The global market is projected to register a CAGR of 19.8% from 2025 to 2034.

North America had the largest share of the global market in 2024.

A few of the key players in the market are Splunk Inc., IBM Corporation, Microsoft Corporation, Varonis Systems Inc., Google, NTT Data Corporation, SAP SE, Exabeam, TIBCO Software Inc., Oracle Corporation, and Niara Inc.

The services segment is anticipated to experience substantial growth during the forecast period, driven by the increasing demand for consulting, implementation, and ongoing support services that help organizations effectively leverage behavior analytics tools.

The cloud segment accounted for the largest revenue share of the market in 2024 due to advantages of scalability, cost-effectiveness, and easy accessibility offered by cloud-based solutions.