Bearings Market Size, Share, Trends, Industry Analysis Report

By Product Type (Ball Bearings, Roller Bearings, Plain Bearings), By Application, By Design, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 129

- Format: PDF

- Report ID: PM1408

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

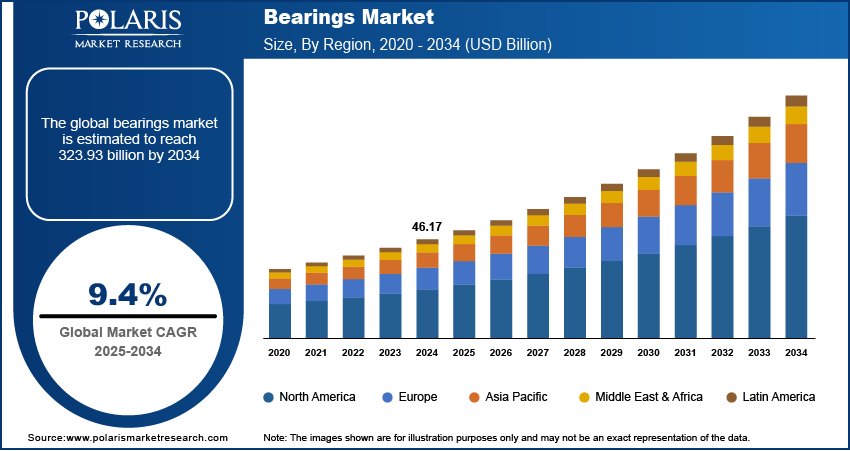

The global bearings market size was valued at USD 132.15 billion in 2024 and is expected to register a CAGR of 9.4% from 2025 to 2034. The rise of industrial automation drives the industry growth. The deployment of automated machinery in bearing manufacturing and logistics applications for precise, high-performance components is rapidly expanding.

Key Insights

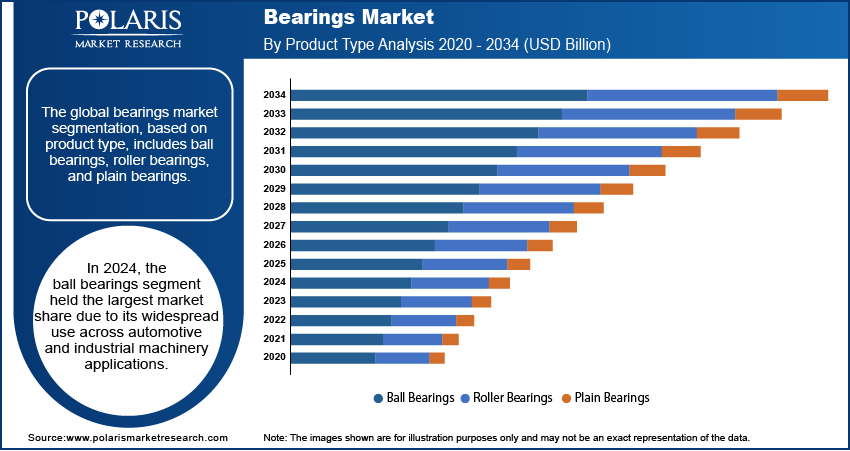

- In 2024, the ball bearings segment held the largest share. It is due to its widespread use across automotive and industrial machinery applications.

- The automotive segment accounted for the market share in 2024. The dominance is attributed to its widespread use across automotive and industrial machinery applications.

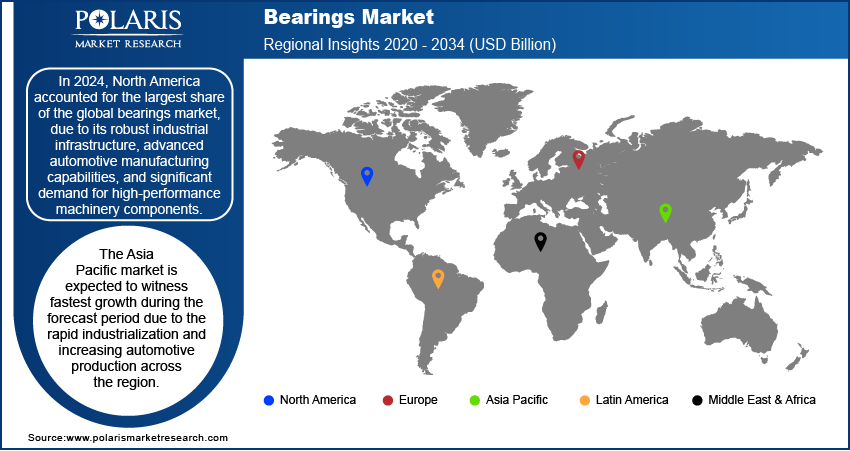

- In 2024, North America accounted for the largest share. The leading position is driven by its robust industrial infrastructure, advanced automotive manufacturing capabilities, and significant demand for high-performance machinery components.

- The Asia Pacific bearings industry is expected to witness the fastest growth during the forecast period. The growth is fueled by rapid industrialization and increasing automotive production across the region.

Industry Dynamics

- Rising advancements in electric vehicle (EV) motors and drivetrain systems necessitate precision-engineered bearings. Thus, increasing adoption of EVs is boosting the demand for bearings.

- The growing preference for innovative bearings, which offer real-time performance monitoring and predictive maintenance capabilities, drives the industry growth

- Technological advancements, such as robotics and IoT technology, are expected to create new bearings market opportunities during the forecast period.

- Fluctuating raw material prices hinder the market expansion.

Market Statistics

2024 Market Size: USD 132.15 billion

2034 Projected Market Size: USD 323.93 billion

CAGR (2025–2034): 9.4%

North America: Largest market in 2024

AI Impact on Bearings Market

- The integration of AI and sensors into bearings monitor vibration, temperature, and load in real time. It offers predictive maintenance, extending equipment life and minimizing unplanned downtime.

- AI-based automation enhances defect detection and precision in the production of bearings. Machine learning (ML) models reduce material waste and optimize machining parameters.

- The technology enhances demand forecasting, inventory management, and procurement strategies. It reduces excess stock in global distribution networks and improves lead times.

To Understand More About this Research: Request a Free Sample Report

Bearings are a critical component in the manufacturing, automotive, and industrial sectors, facilitating the efficient operation of operation machinery by reducing friction and enhancing rotational or linear motion. Bearings are extensively used in applications such as automotive systems, aerospace equipment, industrial machinery, and power generation, making them indispensable to global infrastructure and technological advancement.

The increasing adoption of electric vehicles (EVs), which require specialized bearings for high speed and energy-efficient, is fueling the bearings market demand. Bearings market statistics reflect growing demand from sectors investing in accuracy engineering and durable components to enhance operational efficiency. Additionally, the increasing automotive sector, rapid industrialization, and automation in manufacturing processes fuel the market expansion. The development of advanced materials, including hybrid and ceramic bearings, is further driving innovation in the bearings industry, aligning with sustainability goals and enhancing product lifecycle.

Market Dynamics

Increasing Adoption of Electric Vehicles

The adoption of electric vehicles (EVs) is a critical driver for the bearings market development. In 2023, electric vehicle (EV) sales surged to 14 million units, as reported by the International Energy Agency. The combined markets of China, the US, and Europe dominated this growth, collectively representing 95% of total sales volume. Bearings market research indicates a surge in the demand for high-speed, low-friction bearings tailored to EV requirements, such as compact designs and energy efficiency. EV adoption is accelerating due to stringent emission norms and consumer preference for greener mobility; manufacturers are focusing on developing specialized solutions to meet bearings demand in this segment. Additionally, advancements in EV motors and drivetrain systems necessitate precision-engineered bearings, further boosting bearings market growth.

Smart Bearings Technology

A major bearings market trend is the integration of IoT-enabled smart bearings. The market analysis reveals a growing preference for these innovative solutions, which offer real-time performance monitoring and predictive maintenance capabilities. Smart bearings reduce operational downtime and maintenance costs by providing insights into wear and tear, aligning with bearings industry efforts to enhance efficiency. These advancements, coupled with the introduction of data-driven bearings, position smart bearings as a transformative development for high-performance applications across sectors such as aerospace and industrial automation.

Segment Insights

Market Assessment by Product Type Outlook

The global bearings market segmentation, based on product type, includes ball bearings, roller bearings, and plain bearings. In 2024, the ball bearings segment held the largest market share due to its widespread use across automotive and industrial machinery applications. Furthermore, the essential role of these bearings in enhancing efficiency and reducing friction in mechanical systems is driving the segment growth. The automotive sector, which extensively utilizes ball bearings in components such as engines and transmissions, significantly contributed to this growth. Technological advancements and rising production rates of vehicles boosted the bearings market expansion, positioning ball bearings as a crucial component in modern manufacturing and machinery applications.

Market Evaluation by Application Outlook

The global bearings market segmentation, based on application, includes automotive, industrial machinery, and aerospace. In 2024, the automotive segment accounted for the largest bearings market share due to its widespread use across automotive and industrial machinery applications. Bearings market evaluation highlights their versatility, compact design, and ability to handle both radial and axial loads, making them essential for diverse applications. Additionally, the increasing production rates of vehicles and the growing trend toward automation in manufacturing processes fueled demand for automotive bearings.

Market Share Regional Analysis

By region, the study provides bearings market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share due to its robust industrial infrastructure, advanced automotive manufacturing capabilities, and significant demand for high-performance machinery components. The region's strong emphasis on technological innovation has boosted the development of advanced bearings for various applications, contributing to bearings market expansion. Additionally, the widespread adoption of electric vehicles (EVs) and renewable energy projects in North America has driven the demand for specialized bearings, such as lightweight, energy-efficient, and high-durability variants. For instance, according to the US Department of the Interior, the department has exceeded its 25-gigawatt renewable energy permitting target, now reaching nearly 29 gigawatts, which is enough to power over 12 million homes. This includes more than double the project approvals compared to the previous Administration. Additionally, eight new areas in Solar Energy Zones have been designated, capable of generating around 2.5 gigawatts of extra clean energy. Investments in research and development (R&D) by leading manufacturers, coupled with a well-established supply chain network, have further supported bearings market growth in the region.

The Asia Pacific bearings market is expected to witness the fastest growth during the forecast period due to rapid industrialization and increasing automotive production across the region. Countries such as China, India, and Japan are experiencing significant market growth driven by rising investments in manufacturing infrastructure and government initiatives to promote industrial development. The rising electric vehicle (EV) sector in the region is creating substantial demand for advanced bearings tailored for high-speed, energy-efficient operations. Additionally, the expansion of wind and solar energy projects has accelerated the need for large-diameter bearings designed for turbines and other renewable energyv equipment. For instance, in 2023, solar and wind capacity in the ASEAN increased by 20%, surpassing 28 gigawatts (GW) from last year. The availability of low-cost raw materials, skilled labor, and a robust supply chain further supports bearings market expansion in the region.

Key Players & Competitive Analysis Report

The competitive landscape of the bearings market is characterized by the presence of established global players and a growing number of regional manufacturers, all striving to gain bearings market share through innovation, product differentiation, and strategic expansions. Leading companies such as SKF, Schaeffler AG, NTN Corporation, and Timken Company dominate the market, leveraging advanced technologies, extensive R&D investments, and robust global distribution networks to maintain their competitive edge. These key players are focused on bearings market development by introducing high-performance and energy-efficient products, particularly for emerging applications such as electric vehicles, renewable energy, and industrial automation. The adoption of IoT-enabled smart bearings and predictive maintenance solutions has become a critical area of competition, with companies competing to offer advanced products that enhance operational efficiency. Additionally, mergers and acquisitions, and collaborations are key strategies employed to expand bearings market reach and strengthen portfolios. Regional manufacturers are also gaining traction by catering to cost-sensitive markets with competitively priced products.

SKF is engaged in the bearings market, leveraging its advanced technologies and global presence to maintain a significant bearings market share. The company focuses on sustainability, offering energy-efficient solutions that align with evolving market demands. SKF Hybrid ceramic bearings feature steel rings paired with silicon nitride ceramic rolling elements. This design offers excellent electrical insulation and exceptional durability, making them suitable for demanding operating conditions.

Schaeffler AG is contributing to bearings market growth through high-performance solutions. The company’s latest offerings include smart bearings with integrated sensors for predictive maintenance. It focus on digitalization and R&D positions it as a key player in driving bearings market trends.

List of Key Companies

- AB SKF

- C&U Group

- Continental AG

- JTEKT Corporation

- Luoyang Bearing Research Institute Co., Ltd.

- MinebeaMitsumi Inc.

- Nippon Seiko Co. Ltd.

- NSK Ltd.

- NTN Corporation

- RBC Bearings Incorporated

- Rexnord Corporation

- Schaeffler AG

- SKF

- THK Co., Ltd.

- Timken Company

Bearings Industry Developments

In September 2024, NSK launched an advanced low-friction hub unit bearing with a newly engineered seal that provides superior muddy water resistance, leveraging expertise in tribology. This innovation offers a 40% reduction in friction over conventional models, enhancing vehicle efficiency and extending driving range.

In April 2024, NSK launched specialized bearings for gas turbine generators in eVTOL aircraft and larger UAVs. These bearings are designed to handle high-speed, high-temperature conditions, ensuring optimal performance and reliability. NSK aims to reduce friction and enhance durability to support the advancement of urban air mobility and drone technologies.

In March 2024, DuPont partnered with Menatek Defense Technologies to advance the global bearing market with NAZ Bearings, an innovative, self-lubricating, and maintenance-free technology that enhances efficiency and minimizes maintenance costs.

Bearings Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Ball Bearings

- Roller Bearings

- Plain Bearings

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Industrial Machinery

- Aerospace

By Design Outlook (Revenue, USD Billion, 2020–2034)

- Single-Row Bearings

- Double-Row Bearings

- Angular Contact Bearings)

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bearings Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 132.15 billion |

|

Market Size Value in 2025 |

USD 144.43 billion |

|

Revenue Forecast by 2034 |

USD 323.93 billion |

|

CAGR |

9.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global bearings market size was valued at USD 132.15 billion in 2024 and is projected to grow to USD 323.93 billion by 2034.

The global market is projected to register a CAGR of 9.4% during the forecast period.

In 2024, North America accounted for the largest market share, due to its robust industrial infrastructure, advanced automotive manufacturing capabilities, and significant demand for high-performance machinery components.

A few of the key players in the market are AB SKF; C&U Group; Continental AG; JTEKT Corporation; Luoyang Bearing Research Institute Co., Ltd.; MinebeaMitsumi Inc.; Nippon Seiko Co. Ltd.; NSK Ltd.; NTN Corporation; RBC Bearings Incorporated; Rexnord Corporation; Schaeffler AG; SKF; THK Co., Ltd.; and Timken Company.

In 2024, the ball bearings segment held the largest market share due to its widespread use across automotive and industrial machinery applications.

In 2024, the automotive segment accounted for the largest market share in the bearing industry due to its widespread use across automotive and industrial machinery applications.