Bean Flour Market Share, Size, Trends, Industry Analysis Report, By Product (Black Bean Flour, White Bean Flour, Red Bean Flour); By Nature; By Application; By Distribution Channel; By Region; Segment Forecast, 2023 - 2032

- Published Date:Oct-2023

- Pages: 118

- Format: PDF

- Report ID: PM3864

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

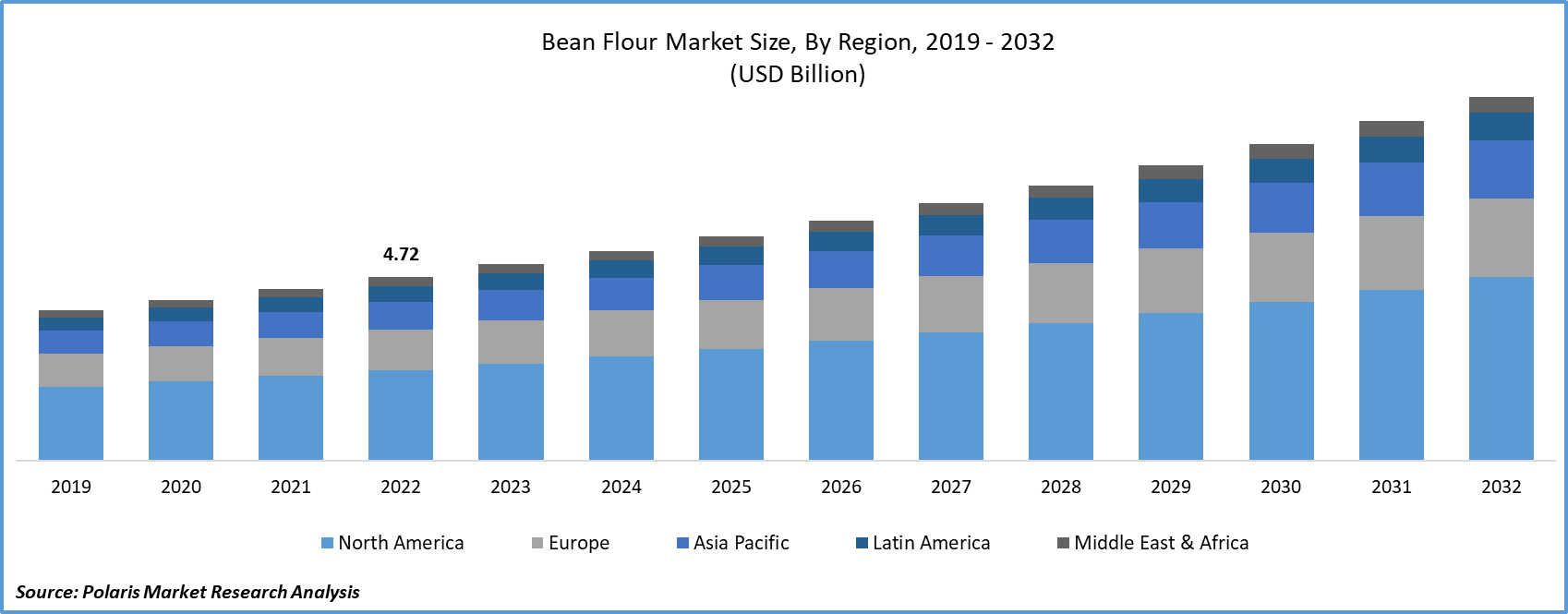

The global bean flour market was valued at USD 4.72 billion in 2022 and is expected to grow at a CAGR of 7.1% during the forecast period.

Bean flour is made up of dried beans, specifically legumes such as chickpeas, lentils, and black beans. Grinding beans gives a highly rich source of protein, which is bean flour. It is used in various applications like making chips, protein bars, bakery products, and bread. Bean flour is a good source of plant-based protein. When it is added to bread formulations, it enriches the protein content of the bread. Protein plays a vital role in breadmaking, as it contributes to gluten formation. The presence of bean flour's protein enhances the bread's protein content, potentially making it more nutritious and appealing to consumers who seek higher protein content in their diet.

To Understand More About this Research: Request a Free Sample Report

- For instance, according to the study published in MDPI in 2023, the usage of bean flour in bread making improved its qualities, such as increased water absorption, protein content, and good fermentation capacity.

The prevalence of health-conscious consumers is on the rise, accompanied by an increasing incidence of health-related issues. This trend is driving the growth of the market due to its digestive benefits, such as reducing cholesterol and sodium levels.

Furthermore, it contributes to cancer risk reduction. The market is witnessing a surge in demand for delectable products for various occasions, and organic soybean flour is emerging as a key ingredient in crafting these delightful offerings. The younger generation, inclined toward healthier beverage choices and protein shakes, is propelling the demand for bean flour.

The appetite for processed foods, particularly those like black bean flour that offer diverse health advantages to consumers, is steadily growing. This surge can be attributed to the expanding population of health-conscious individuals and the increasing incidence of health-related problems arising from shifts in lifestyle.

Black soybean flour boasts a range of health benefits, including cardiovascular disease prevention, cancer risk mitigation, diabetes management, and relief from constipation. These factors are fueling the expansion of the bean flour market.

For Specific Research Requirements: Request for Customized Report

By adding 10% bean flour to the fermentation, there is an increase in the fermentation capacity of the dough. It is making manufacturers adopt bean flour in bread making, fueling the demand for bean flour in the coming years. Furthermore, rising consumer consciousness about healthy food is encouraging manufacturers to innovate new products with higher nutritional content. It is driving the demand and creating new growth opportunities for bean flour in the study period.

Industry Dynamics

Growth Drivers

Increasing Prevalence of Healthy Food Ingredients

Access to information is prompting consumers to know more about healthy food. Manufacturers are showing interest in upgrading and expanding their product offerings by adding healthy ingredients. Beneo widened its product portfolio with faba bean-derived ingredients for aquaculture and livestock feed in 2023. It demonstrates the commitment of manufacturers to understanding the nutrition levels of natural legumes and introducing them into their new products. It works as a signal to other companies to use bean flour in their offerings, driving demand for the global market.

Additionally, research activities are going on to find insights into replacing traditional flour with bean flour. According to a study conducted by a University of Reading Professor, replacing wheat flour with fava flour increased nutrition content by 25%, with a higher protein, iron, zinc, and fiber than white bread. Pulses are equipped with nutrients and low-fat content, but direct intake could be better for consumers, as there is a preference for pasta, chips, and more. Flour with beans enables its usage in a wide range of products. Bean flour makes foods with higher nutritional value, driving its demand by households and manufacturers.

Report Segmentation

The market is primarily segmented based on product, nature, application, distribution channel and region.

|

By Product |

By Nature |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Nature Analysis

Organic segment held the fastest market share in 2022

In 2022, the organic segment held the fastest market share. It refers to the production of bean flour with organic farming. In farming, farmers do not use synthetic herbicides, pesticides, or chemical fertilizers. A growing number of people showing interest in organic farming is creating demand for organic bean flour. According to the report published by the International Federation of Organic Agriculture Movement (IFOAM) in Germany and FeBL Switzerland in 2022, the global organic market witnessed an 8.7% CAGR from 2015 to 2020. It signifies a shift in consumer behavior towards organic production in the global market.

The environmental impact of conventional production is enormous, as it leads to soil pollution, air pollution, and chemical food. Rising concerns about healthy food are driving the demand for organic production. Farmers are stepping forward with organic products like bean flour to meet consumer preferences. This rapid change is driving the demand for organic bean flour in the coming years.

By Application Analysis

Protein Bars segment accounted for the largest market share during the forecast period.

Protein Bars segment accounted for the largest market share during the forecast period. These bars are affordable and convenient snacks with sufficient protein for the human body. Bean Flour is used in manufacturing as it is rich in proteins along with fiber, vitamins, and minerals. It enables customers to gain protein with on-the-go snacks. It is one of the best options for fitness enthusiasts, sports personnel, and children to intake protein more easily.

It consists of a significant number of proteins, which are essential for muscle growth and the functioning of the body. Busy professionals consume these as it makes them consume proteins needed for the body with on-the-go consumption. These provide adequate protein for post-workout recovery. Manufacturers use bean flour as it works as a gluten-free alternative to traditional wheat-based flour, providing access to customers with gluten-free preferences. It is driving manufacturers to adopt bean flour for protein bars.

Regional Insights

North America accounted for the largest revenue share during the forecast period.

North America accounted for the largest revenue share during the forecast period. Growth in the demand for plant-based products in the region is creating new growth potential for the bean flour market. Based on the report released by the Plant-Based Food Association, The Good Food Institute, and SPINS, plant-based sales in the U.S. increased by 6.3% in 2021. The rise in domestic plant-based value to an all-time high of USD 7.4 Billion. It implies a rising trend towards plant-based products in the region due to the rise in the vegan population in the region. Bean Flour is a rich source of protein obtained from legumes such as chickpeas, lentils, and black beans. It offers alternatives to non-vegetarian products, which are essential for the vegan population. This shift towards plant-based products is driving demand for bean flour in this region.

APAC witnessed the fastest growth rate in the study period. This region is witnessing higher demand for noodles, driving the demand for bean flour, which plays a crucial role in the manufacturing of noodles. According to the Economic Times Report, South Korean ramen imports increased to 30.63 crore in 2021 from 10.44 crore in 2020. Based on the Big Basket report, Korean noodles witnessed growth of 140% in 2021, contributing 90% of the overall category. As there is a growing trend towards noodles, manufacturers are exploring various ways to improve nutrients, tastes, and texture. Bean flour is known for its higher nutritional content with proteins, which is encouraging consumers to incorporate it in noodle manufacturing. It will fuel the growth and demand for bean flour in this region.

Key Market Players & Competitive Insights

Key players highlight the strategies and factors driving competition in this dynamic industry. Market players focus on product diversification, quality assurance, sustainability, and distribution networks to maintain their competitive edge and meet the changing preferences of health-conscious consumers.

Some of the major players operating in the global market include:

- Anthony's Goods

- Blue Mountain Organics

- Bob's Red Mill

- Green Image Organic Sdn. Bhd.

- King Arthur Baking Company

- Nikken Foods

- NutriCargo LLC.

- PureLiving Organic

- Xi'an Sost Biotech Co., Ltd

- Z Natural Foods

Recent Developments

- In June 2023, Arva Flour unveiled Full of Beans gluten-free products under Arva flour mills at their retail store, which was acquired in January.

- In March 2023, Portland Pet Food Company expanded its Grain & Gluten-Free dog biscuit product line with an additional flavor, Apple & Mint dog biscuits. This new flavor contains garbanzo bean flour, organic mint, and more.

Bean Flour Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 5.04 billion |

|

Revenue forecast in 2032 |

USD 9.34 billion |

|

CAGR |

7.1% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Nature, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |