Bauxite Market Share, Size, Trends, Industry Analysis Report, By Product (Metallurgical-grade, Refractory-grade, Other Products); By Application; By End-user; By Sales Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 117

- Format: PDF

- Report ID: PM4936

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

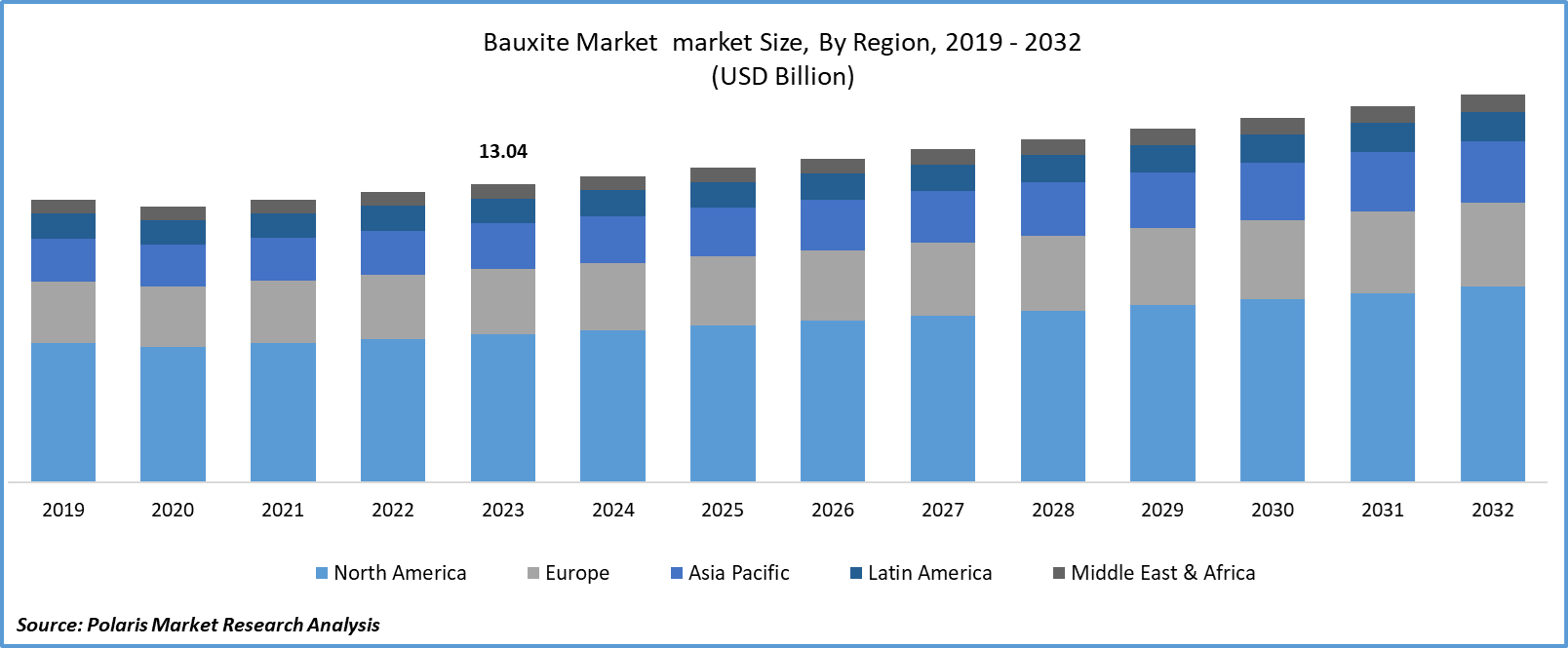

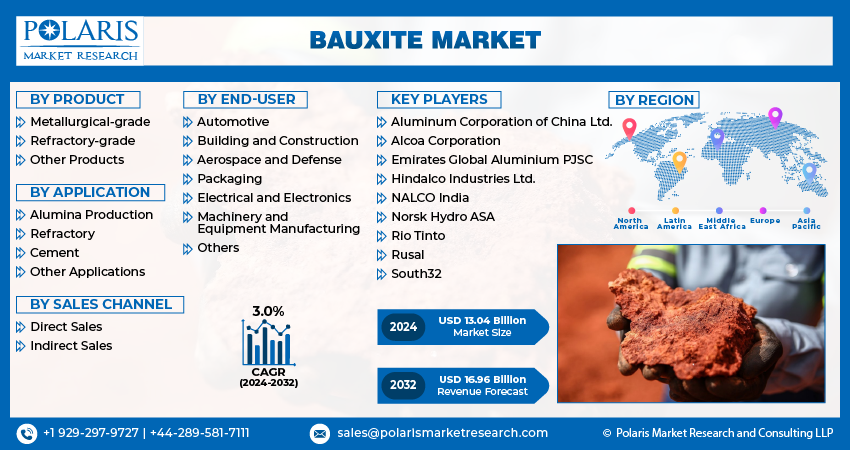

Bauxite Market size was valued at USD 13.04 billion in 2023. The market is anticipated to grow from USD 13.40 billion in 2024 to USD 16.96 billion by 2032, exhibiting the CAGR of 3.0% during the forecast period.

Market Overview

The bauxite market is registering significant demand driven by aluminum's unique properties, such as rigidity, longevity, corrosion-freeness, and conductivity. These properties propel aluminum's use in food packaging, construction, and transportation. Aluminum's lightweight characteristic is gaining utility in food wrapping and packaging applications, stimulating the demand for bauxite ore extraction in the market.

Furthermore, collaboration between manufacturers and the cement industry for repurposing bauxite residues may involve compliance with regulatory requirements and standards governing waste management, environmental protection, and product quality. Ensuring regulatory compliance is essential to safeguarding public health, environmental sustainability, and the integrity of cement-based products.

To Understand More About this Research:Request a Free Sample Report

- For instance, in February 2022 when Vedanta Aluminium in India joined forces with the cement sector to repurpose their bauxite residue for cement production.

Moreover, the increasing expansion activities are widening the market. The growing automotive industry is expected to create significant demand for bauxite in the coming years, encouraging companies to improve their supply potential. Emerging economies, with growing industrialization and urbanization, are significant contributors to this demand.

Infrastructure projects, such as roads, bridges, railways, and buildings, require significant amounts of aluminum for construction materials. Bauxite is essential for the production of aluminum, which is widely used in these infrastructure projects. Countries investing in infrastructure development, including emerging markets and those undergoing urbanization, provide a substantial market for bauxite.

Furthermore, ongoing technological advancements in mining, processing, and refining techniques improve the efficiency and cost-effectiveness of bauxite extraction and processing. These advancements can unlock previously inaccessible bauxite reserves, expanding the resource base and creating new opportunities for market growth.

Growth Drivers

Increasing government initiatives to boost manufacturing sector

The rising efforts taken by governments to promote the aerospace, defense, and automotive sectors in the world are optimally influencing the global bauxite market, driven by its major use in vehicle and defense equipment manufacturing. For instance, in January 2024, the Ghana Integrated Aluminum Development Corporation (GIADEC), a state-owned firm, announced that it had chosen Mytilineos S.A. as a partner for its 3A-bauxite mine and alumina refinery development project in Ghana.

Growing demand for electric vehicles (EVs)

Electric vehicles rely heavily on aluminum for their construction due to its lightweight, durability, and ability to improve vehicle efficiency. Aluminum is used in EV components such as frames, body panels, battery housings, and heat exchangers. As the production of EVs escalates to meet the rising demand for sustainable transportation solutions, there is a corresponding increase in the consumption of aluminum, a key product derived from bauxite ore.

The surge in demand for aluminum to meet the needs of the electric vehicle industry translates to increased demand for bauxite as a raw material. This creates opportunities for bauxite mining companies to expand production to meet the growing requirements of the aluminum sector. The burgeoning demand for electric vehicles has prompted investments in bauxite mining and processing facilities to ensure an adequate supply of alumina and aluminum. Mining companies may explore new bauxite reserves, invest in infrastructure, and adopt advanced technologies to enhance production efficiency and meet the quality specifications required for aluminum production.

Restraining Factors

Huge cost of extraction and refinery procedures

Bauxite extraction and alumina processing are energy-intensive, which is restraining producers from entering the global market for bauxite production due to higher costs. The unstable market prices for aluminum are likely to limit their use, and fuel their substitute adoption, including steel and plastic in the world. Additionally, the biodegradability of aluminum foil is estimated to restrict its use in the food sector, as aluminum foil can take 400 years to degrade in the soil.

Report Segmentation

The market is primarily segmented based on product, application, end-user, sales channel, and region.

|

By Product |

By Application |

By End-user |

By Sales Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Metallurgical-grade segment is expected to witness the highest growth during the forecast period

The metallurgical-grade segment is projected to grow at a CAGR during the projected period. This is mainly attributable to its prominent application in construction, transportation, electronics, and vehicle manufacturing. Furthermore, the rising use of aluminum in the chemical industry, particularly for water treatment, is likely to showcase new growth opportunities in the coming years.

By End-user Analysis

Automotive segment held the largest revenue share in 2023

The automotive segment held the largest revenue share, due to the continuous rise in demand for vehicles and the rising disposable income among the population. The government incentives to boost the use of electric vehicles are likely to facilitate the need for aluminum and, therefore, bauxite in the long run.

According to the International Aluminium Institute (IAI), by 2023, the demand for aluminum is expected to grow by 40%. This is mainly driven by the growing ongoing industrial transformation and increasing population. 75% of the aluminum is utilized in construction, packaging, and transportation. This trend is likely to foster bauxite demand and growth in the study period.

Regional Insights

North America region registered the largest revenue share of the global market in 2023

In 2023, the North America held the largest revenue share. The presence of major electric vehicle manufacturers, rising demand for food, and growing housing demand are optimally bolstering region’s growth. North America is a major hub for aluminum production, with several smelters and refineries located across the region. Bauxite is the primary source of aluminum, and while some bauxite is mined domestically, North American aluminum producers also import bauxite from other regions to meet their production needs.

The demand for aluminum in North America is driven by various industries, including automotive, aerospace, construction, packaging, and consumer electronics. The growing trend towards lightweighting in automotive manufacturing, in particular, has increased the demand for aluminum, thus impacting the bauxite market. Companies operating in the region are subject to strict environmental standards regarding mining, processing, and waste management. This can affect the feasibility and cost of bauxite extraction and processing activities.

APAC anticipated to grow at the rapid pace, owing to the growing innovations in aluminum to cater to diverse consumer needs. The growing investments by the companies in research activities to minimize costs and maximize resource output are further expanding the global bauxite market. For instance, in November 2023, Vedanta Aluminium announced the new technology in the bauxite refinery procedures in co-operation with the IIT Kharagpur. This development is expected to promote resource efficiency & will reduce bauxite residue, nearly by 30%.

Key Market Players & Competitive Insights

The bauxite market is consolidated. The increasing use of bauxite in several industries is fueling the demand for extraction in the marketplace.

Some of the major players operating in the global market include:

- Aluminum Corporation of China Limited

- Alcoa Corporation

- Emirates Global Aluminium PJSC

- Hindalco Industries Ltd.

- NALCO India

- Norsk Hydro ASA

- Rio Tinto

- Rusal

- South32

Recent Developments in the Industry

- In May 2022, South32 Limited (South32) was delighted to declare the finalization of our acquisition of an extra 18.2 percent stake in the MRN (Mineração Rio do Norte) bauxite mine situated in northern Brazil from Alcoa Corporation (Alcoa).

Report Coverage

The bauxite market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, end-user, sales channel, and their futuristic growth opportunities.

Bauxite Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13.04 billion |

|

Revenue forecast in 2032 |

USD 16.96 billion |

|

CAGR |

3.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Bauxite Market are Aluminum Corporation of China Limited

Bauxite Market exhibiting the CAGR of 3.0% during the forecast period.

Ammunition Market report covering key segments are product, application, end-user, sales channel, and region

The key driving factors in Bauxite Market are Increasing government initiatives to boost manufacturing sector

Bauxite Market Size Worth $ 16.96 Billion By 2032.