Battery Metals Market Share, Size, Trends, Industry Analysis Report, By Product (Lithium, Nickel, Cobalt), By Application (EVs, Electronic Devices, Stationary Battery Energy Storage, SLI), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3909

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

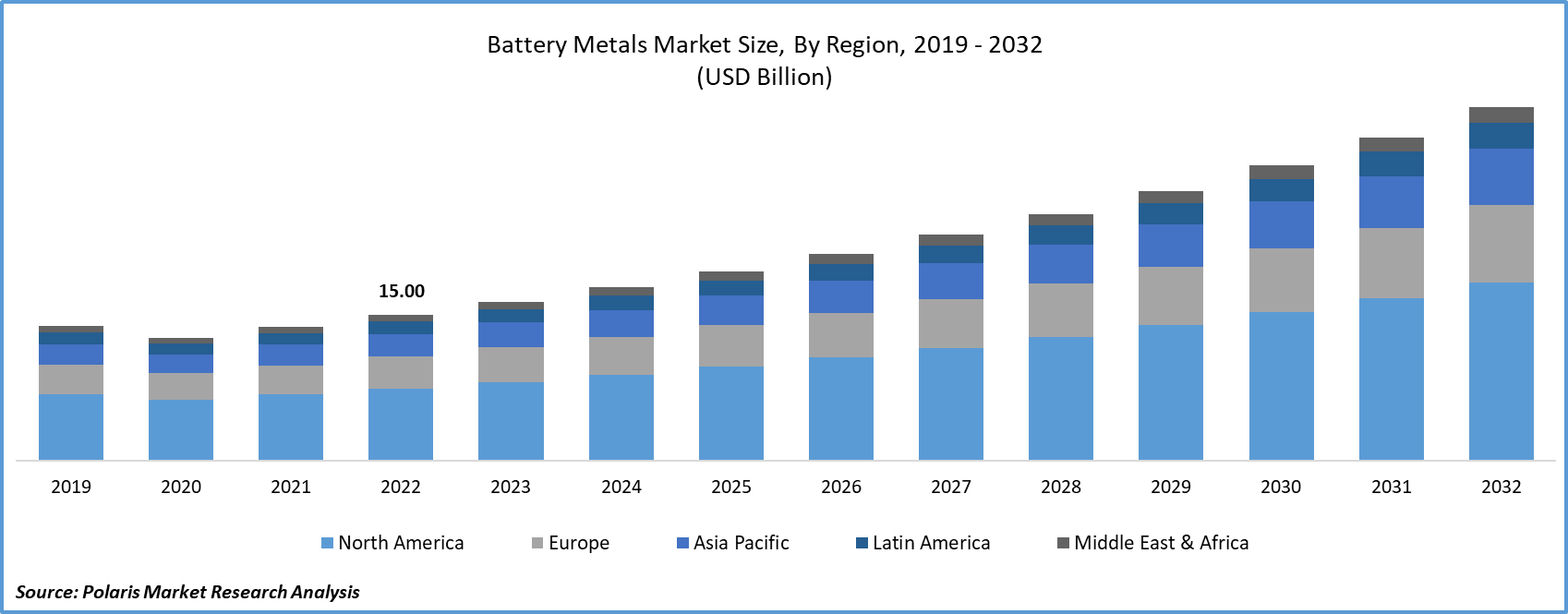

The global battery metals market size and share was valued at USD 16.35 billion in 2023 and is expected to grow at a CAGR of 9.30% during the forecast period.

One of the pivotal forces behind this growth trajectory is the rapid expansion of the global electric vehicles (EVs) industry. This trend is not only noticeable in a particular region but is a phenomenon that has gained momentum across the globe. As the EV market continues to grow at an accelerating pace, the demand for battery metals has similarly risen, creating a symbiotic relationship between the two industries. Batteries are not merely an ancillary element within EVs; they have become the beating heart that powers these vehicles, making them efficient, environmentally friendly, and economically viable alternatives to traditional internal combustion engine vehicles.

Batteries, which are electrochemical devices that can be charged with an electric current, have become an integral component of the modern world. They serve as a power source for various carry-around portable devices, such as laptops, watches, power tools, and GPS systems. Also, they store energy from renewables and are used to start vehicles such as buses, trucks, and motorcycles. Furthermore, batteries ensure backup power in case of power outages in critical areas like hospitals and telecom installations.

Battery metals are a group of metals that are crucial for the manufacturing of batteries. The most commonly used battery metals include cobalt, lithium, manganese, graphite, nickel, and vanadium. As the lightest metal and solid element, lithium is the most well-known of battery metals. Cobalt is a hard, silver-gray metal that’s usually mined as a by-product of nickel and copper mining. Being a good conductor of electricity, graphite accounts for the biggest portion by weight in lithium-ion batteries. With technological advances and increasing applications, the demand for battery metals is projected to rise, impacting the battery metals market growth favorably.

To Understand More About this Research: Request a Free Sample Report

A noteworthy trend worth highlighting is the projected trajectory of battery costs within the context of automotive manufacturing. As the EV industry gains further ground and attracts significant investments, it is anticipated that batteries will account for a significant portion of the total manufacturing cost of electric vehicles. In fact, experts predict that batteries could soon encompass up to 40.0% of the total cost of producing electric vehicles. This shift in cost distribution is indicative of the pivotal role that batteries occupy not only in the functionality of EVs but also in their overall economic viability.

The practice of reusing batteries in less critical roles showcases another influential aspect driving the battery metals market growth. The adoption of these batteries in stationary storage devices represents a substantial force propelling the growth of battery metals industries. This dynamic illustrates the multifaceted impact of battery recycling, repurposing, and diversified usage, collectively shaping the market's development and sustainability.

The battery metals market report is a comprehensive assessment of all the opportunities and challenges in the industry. It covers all the recent innovations and major events in the industry while shedding light on the key market features such as CAGR, supply/demand, cost, production rate, and consumption. Along with that, the study offers a thorough analysis of the key market dynamics and latest trends to help businesses develop strategies that will drive battery metals industry growth.

The proper disposal of batteries represents a notable challenge and drawback within the market, primarily due to the adverse impacts their waste can have on the environment. The rapid growth in battery production that accompanies the rise of EV adoption adds to this concern, creating a potential strain on waste management and environmental sustainability.

Industry Dynamics

Industry Growth Drivers

- Technological Advancement

Battery production on a global scale exhibits a notable concentration within a select few countries, and among these nations, the U.S. holds a significant position. The momentum behind this phenomenon is fueled by a combination of technological advancements and the formidable presence of key industry players, including but not limited to Tesla, EnerSys, & Panasonic. These influential entities collectively contribute to driving the expansion of the battery metals market within the country.

Lithium-ion batteries are engineered with a lifespan that extends over a decade. However, their performance often experiences degradation within the initial five years due to factors like extreme operational temperatures, fluctuating discharge rates, and the occurrence of numerous partial charge and discharge cycles annually. Despite this initial decline, these batteries possess the potential for continued utility through recycling or repurposing rather than being discarded.

Report Segmentation

The market is primarily segmented based on application, product, and region.

|

By Application |

By Product |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

- SLI segment accounted for the largest market share in 2022

The SLI segment accounted for the largest market share. The significance of SLI batteries is underscored by their ability to deliver power in a concentrated manner, addressing the intense energy requirements associated with starting vehicle engines. This demand necessitates the provision of large currents, often reaching around 300 amperes for brief durations of a few seconds. The reliability and efficiency of SLI batteries in meeting this power surge requirement have solidified their indispensability in conventional vehicle systems.

The stationary battery segment will grow at a steady pace. Stationary battery energy storage plays a pivotal role in mitigating this fluctuation by accumulating surplus electricity generated from renewable sources during peak production periods. This stored energy is subsequently tapped into during times when renewable sources are less active, ensuring a consistent and reliable power supply.

The burgeoning significance of stationary battery energy storage is intrinsically linked to the expansion of renewable energy capacities. As the world continues to invest in and harness renewable energy sources like solar and wind, the need for efficient energy storage solutions becomes more pronounced. This, in turn, fuels the demand for stationary battery energy storage systems that facilitate the optimal utilization of green energy without the reliance on conventional fossil fuel-based power plants.

By Product Analysis

- Lithium segment held the largest share in 2022

The lithium segment held the majority market share. The surge in demand for lithium-ion batteries, primarily driven by the electric vehicle (EV) sector and the consumer electronics industry, is poised to exert a significant influence on the need for battery metals throughout the envisaged forecast period. This escalating demand for lithium-ion cells has catalyzed manufacturers to enhance their production capacities to meet the mounting requirements strategically.

The nickel segment will grow at a rapid pace. The segment's growth is due to a concurrent surge in EV sales and the swift embrace of nickel cathode chemistries such as NCM 622, 523, and 811. A primary catalyst propelling nickel's indispensability within batteries is its remarkable capacity to deliver heightened energy density and enhanced storage capabilities at a relatively low cost. This unique attribute positions nickel as a sought-after component, facilitating the production of batteries that offer greater efficiency and extended operating durations.

Cobalt's significance resides in its application within the cathodes of lithium-ion batteries, driven by its exceptional conductivity and steadfast structural integrity across successive charge cycles. This projection stems from cobalt's inherent high cost, a factor that has prompted manufacturers to explore and embrace alternative options. While cobalt's attributes make it a favored choice for certain applications, its financial considerations are steering the industry toward seeking more cost-effective substitutes.

Regional Insights

- APAC region dominated the global market in 2022

APAC held the largest share. China's unrivaled manufacturing prowess in the battery domain underscores its formidable influence over the entire supply chain. Its unparalleled manufacturing capacity is a result of its strategic control over crucial aspects of the battery industry. China plays a pivotal role by contributing over 20.0% to the global supply of battery metals, solidifying its status as a vital player on the world stage. Moreover, China boasts the largest production capacity for battery-grade raw materials, accounting for a staggering 80.0% of the global output. This dominance, deeply entrenched in China's strategic advantage, is poised to reverberate across the global automotive industry, particularly in the aftermath of the COVID-19 pandemic.

North America will grow at a steady pace. This substantial share can be attributed to the pivotal role played by the United States as a major battery producer within the region, consequently positioning it as the primary consumer of battery metals in the region. The surge in demand emanating from the electric vehicle (EV) sector stands as a catalyst propelling the augmentation of production capacity within the United States. This dynamic underscores the nation's strategic position in fostering growth, as the increasing appetite for EVs ignites a parallel demand for the essential components powering these vehicles.

Key Market Players & Competitive Insights

The landscape of the market is characterized by its inherent competitiveness, primarily driven by the notable presence of major manufacturers within the industry. In their pursuit to augment their respective market shares, these manufacturers are strategically embracing a range of tactics. These approaches encompass endeavors such as enlarging their production capacities and engaging in mergers and acquisitions.

Some of the major players operating in the global market include:

- Albemarle

- China Molybdenum Co., Ltd.

- Ganfeng Lithium Co. Ltd.

- Glencore

- Sumitomo Metal Mining

- Umicore

- Vale

Recent Developments

- In March 2023, Albemarle completed the acquisition of Liontown, a move aimed at establishing a dependable and top-tier source of battery-grade materials. This strategic step is positioned to provide essential support for the ongoing transition towards clean energy solutions.

Battery Metals Industry Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 17.83 billion |

|

Revenue Forecast in 2032 |

USD 36.31 billion |

|

CAGR |

9.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Uncover the dynamics of the battery metals sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.