Battery Energy Storage System Market Share, Size, Trends, Industry Analysis Report, By Battery Type; By Connection Type (On-grid, Off-grid); By Energy Capacity; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM2439

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

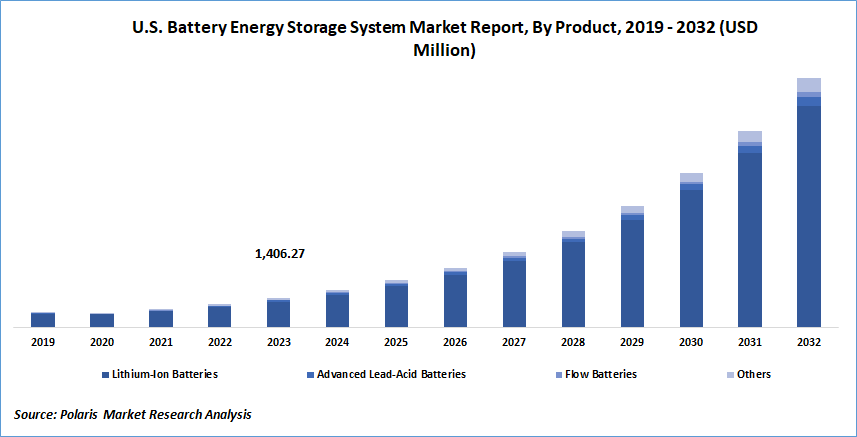

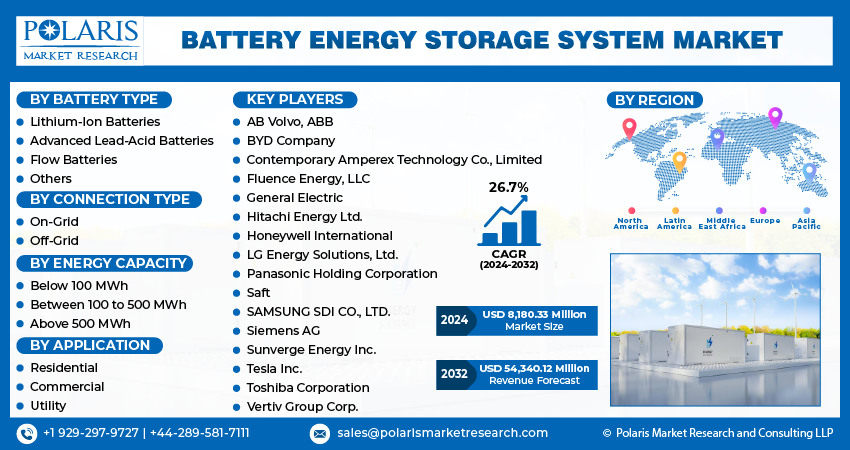

Battery Energy Storage System Market size was valued at USD 6,463.09 million in 2023. The market is anticipated to grow from USD 8,180.33 million in 2024 to USD 54,340.12 million by 2032, exhibiting a CAGR of 26.7% during the forecast period

Industry Trends

The surge in demand for battery energy storage systems is a result of ongoing initiatives aimed at modernizing grids, the widespread adoption of lithium-ion batteries, and the global shift toward low-carbon and less fossil fuel-dependent economies. Furthermore, the ongoing revolution in renewable energy significantly contributes to the growth of the battery energy storage system industry. Anticipated growth in residential electricity consumption is driven by increasing disposable incomes and the prevalent trend of remote work worldwide.

Energy storage systems play a crucial role in providing continuous power during peak hours and outages. They are supported by government incentive programs such as California's Self-Generation Incentive Program (SGIP), which is specifically designed to boost the residential storage sector. The residential energy storage market is expected to flourish due to advancing energy storage technologies, leading to declining battery costs and the widespread adoption of renewable power sources. Solar energy, in particular, is a major contributor to this demand, creating a need for residential battery energy storage systems.

To Understand More About this Research:Request a Free Sample Report

Large-scale BESS projects allow for economies of scale in manufacturing and deployment. The sheer volume of batteries and components needed for major projects enables cost reductions through bulk purchasing and streamlined manufacturing processes, which in turn contributes to overall demand in the global BESS market.

- For instance, In November 2022, Harmony Energy Income Trust plc, a UK-based investment company, successfully commissioned the Bumpers Battery Energy Storage System (BESS) project in Buckinghamshire, boasting a capacity of 99 MW / 198 MWh. This achievement positions it as the joint largest BESS in Europe.

The project's double-energization represents a significant advancement in the transition to clean energy technologies, contributing to Harmony Energy Income Trust's total operational capacity of 277.5 MW / 555 MWh across five projects. Recognized as one of Europe's major BESS projects, it can power approximately 300,000 UK homes for two hours. The Bumpers BESS will play a crucial role in providing balancing services to the UK electricity grid network, utilizing a Tesla two-hour Megapack. Harmony Energy spearheaded the project's development, with Tesla overseeing the construction, and the project will be managed by Autobidder, Tesla's algorithmic trading platform.

- For instance, In May 2022, NHOA, previously known as Engie EPS, a prominent global energy storage entity, secured a contract to develop a 30MWh Battery Energy Storage System (BESS) in Peru. This BESS project is slated for installation at the Chilca thermal power plant, boasting an 800MW capacity, in Peru. The system's primary function will be to provide essential primary frequency regulation services for the national grid of Peru.

As the market witnesses the successful implementation of large-scale BESS projects in different regions, it encourages the expansion of the global market, indicates the need for battery energy storage systems, and drives innovation on a broader scale.

Key Takeaways

- Asia Pacific dominated the market and contributed over 32% of battery energy storage system market share in 2023

- By battery type category, the lithium-ion batteries segment dominated the battery energy storage system market share in 2023

- By energy capacity category, the above 500 MWh accounted for the largest battery energy storage system market share.

What are the market drivers driving the demand for the battery energy storage system market?

- The rising shift toward low-carbon energy generation is boosting the battery energy storage system (BESS) market growth.

The global transition to low-carbon energy is driving substantial growth in the Battery Energy Storage System (BESS) market, bolstered by investments aligning with green energy targets. Deployment across residential, non-residential, and utility sectors for storing power from solar and wind sources is evident. Key technologies such as flow batteries, solid-state batteries, pumped hydro storage, and thermal energy storage are facilitating energy storage. Initiatives by organizations to establish new plants and develop large-scale storage infrastructures with low emissions are expected to enhance battery energy storage systems industry growth further.

For instance, In March 2021, a global clean energy technology, Pacific Green company, declared a contract with infrastructure project developer TUPA Energy to establish a 1.1 GW battery energy storage system in the U.K. as part of the TUPA agreement. Additionally, Pacific Green acquired rights to 100MW of BESS in Kent, U.K., with plans to complete the remaining 1,000MW by 2023. These endeavors underscore the growing momentum towards sustainable energy solutions, further propelling the demand for battery energy storage systems in the market

Which factor is restraining the demand for Battery Energy Storage Systems?

- High initial investment costs of installing battery energy storage systems

Battery energy storage technologies like lithium-ion, flow, and lead-acid batteries require substantial initial investment due to their high energy density and performance capabilities, especially in electric vehicles. Lithium-ion batteries dominate EVs due to their lightweight nature and substantial capacity despite initial costs. Challenges persist, particularly in flow batteries, with high manufacturing costs hindering growth. Supporting infrastructure adds to system costs, especially for small- and medium-sized enterprises. The Energy Subsidy Reform Facility (ERSF) reviewed its activities in 2020 to improve subsidy reform effectiveness, including topical reports and a database on energy subsidy reforms in 77 countries. Despite challenges, ongoing R&D aims to enhance battery performance and reduce capital requirements, countering battery energy storage systems market growth hurdles.

Report Segmentation

The market is primarily segmented based on battery type, connection type, energy capacity, application, and region.

|

By Battery Type |

By Connection Type |

By Energy Capacity |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

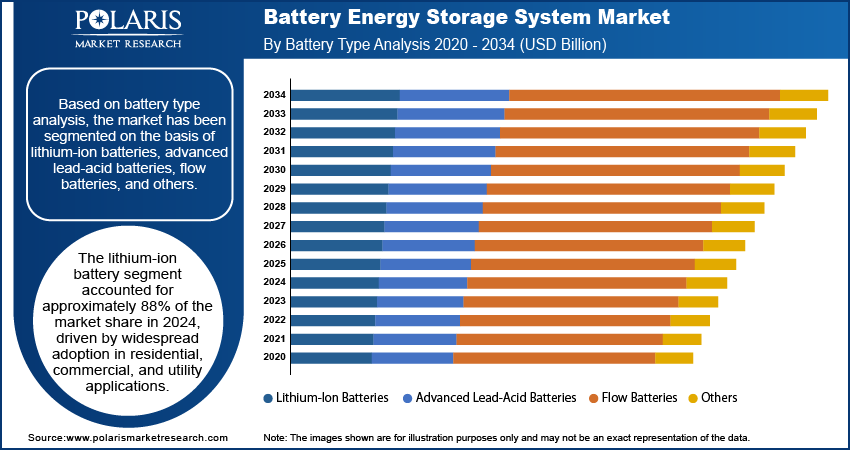

By Battery Type Insights

Based on battery type analysis, the market has been segmented on the basis of lithium-ion batteries, advanced lead-acid batteries, flow batteries, and others. The lithium-ion batteries segment held the largest battery energy storage system market share of around 88% in 2023. Lithium-ion (Li-ion) batteries are mainly metal or polymer-based batteries being employed for residential, commercial, and utility-based applications such as small appliances, electronic devices, electric vehicles, and medium-large-scale energy storage systems. The reason attributed to the rising demand for Li-ion batteries is due to its offering including high energy density and power disposal rate specifically designed for residential, commercial, and utility-based applications. In addition, Li-ion batteries have an important application in battery energy storage systems in providing backup power supply and solving issues that arise due to power supply problems in installations such as microgrids.

By Energy Capacity Insights

Based on energy capacity category analysis, the market has been segmented on the basis of below 100 MWh, between 100 to 500 MWh, and above 500 MWh. The above 500 MWh segment accounted for the largest battery energy storage system market share of around 56% in 2023. Battery capacity with more than 500 MWh is mainly installed for the areas having high energy demand, such as mega factories, oil and gas exploration companies, utility sector, among others. The battery above capacity is a convenient form to obtain a constant power supply for industrial applications. In addition, the key benefits offered by these batteries include grid stability and reliability, long-term cost savings, and promotes application of renewable sources of energy.

Regional Insight

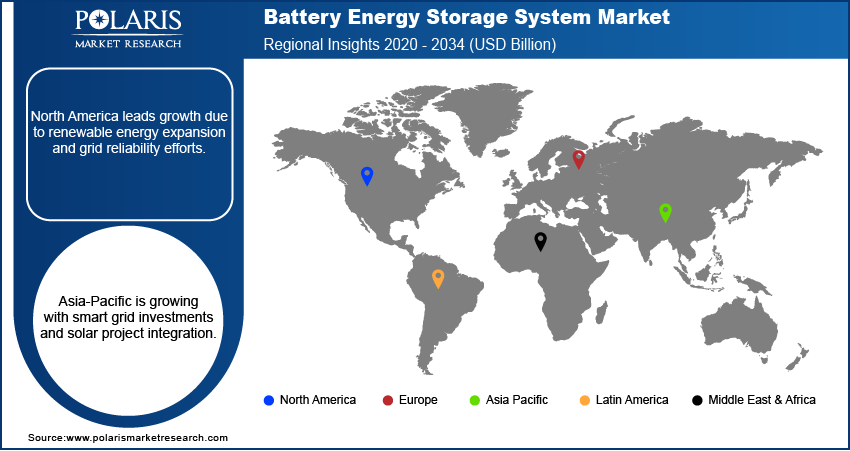

Asia Pacific

The Asia-Pacific battery energy storage market has experienced significant growth due to factors like renewable energy integration, grid stability concerns, and government clean energy initiatives. China, Japan, South Korea, and Australia lead market expansion in the region. Economic growth and urbanization drive demand for reliable energy storage. Supportive policies promoting renewable energy adoption and advancements in battery technologies, particularly lithium-ion, enhance system efficiency and cost-effectiveness. China plays a pivotal role, investing heavily in renewable energy and storage infrastructure. Ambitious government targets drive substantial investments, while China's dominance in battery manufacturing contributes to cost reductions and technology advancements, making energy storage solutions more accessible across the region. For instance, The Ming Yang Smart Energy-Tong Liao Hybrid Project and the Baotang Battery Energy Storage System, both located in China, boast capacities of 320,000kW and 300,000kW respectively, employing lithium-ion battery storage technology and set to be commissioned in 2024.

North America

The North American battery energy storage systems market is poised for growth driven by increasing adoption in industries for vital power supply during emergencies. Government investments in lithium-ion battery manufacturing infrastructure and commitments like the USD 2 million by the U.S. Department of Energy further boost the market. The integration of large-scale renewable energy sources in the U.S. economy drives deployment to address intermittency issues, aligning with environmental regulations. U.S. manufacturers experience growth due to rising electric vehicle adoption and demand for energy storage solutions. Breakthroughs in solid-state lithium-ion batteries, exemplified by Yoshino Technology's products, cater to off-grid applications, home backup systems, and small industrial machinery, complemented by solar PV panel compatibility, boosting market prospects.

Competitive Landscape

The battery energy storage systems market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant battery energy storage systems market share.

Some of the major players operating in the global market include:

- AB Volvo

- ABB

- BYD Company

- Contemporary Amperex Technology Co., Limited

- Fluence Energy, LLC

- General Electric

- Hitachi Energy Ltd.

- Honeywell International

- LG Energy Solutions, Ltd.

- Panasonic Holding Corporation

- Saft

- SAMSUNG SDI CO., LTD.

- Siemens AG

- Sunverge Energy Inc.

- Tesla Inc.

- Toshiba Corporation

- Vertiv Group Corp.

Recent Developments

- In January 2024, Vertech, a subsidiary of South Korea's LG Corporation under LG Energy Solutions, outlined its intentions to construct ten grid-scale battery storage facilities in the United States. This strategic initiative aimed to amass a cumulative storage capacity of 10 gigawatt-hours, showcasing LG's commitment to advancing large-scale energy storage solutions in the American market.

- In January 2024, BYD agreed with Spain's Grenergy to supply renewable energy power facilities, utilizing its blade-shaped batteries for a $1.4 billion energy storage venture in Chile's Atacama Desert. The collaboration asserts this undertaking as the largest of its kind globally.

- In September 2023, Tesla unveiled its latest residential battery backup system, the Powerwall 3, which boasts higher power throughput and a built-in solar inverter.

Report Coverage

The battery energy storage system market report emphasizes key regions across the globe to provide users with a better understanding of the product. The report also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, battery type, connection type, energy capacity, application, and futuristic growth opportunities.

Battery Energy Storage System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8,180.33 million |

|

Revenue Forecast in 2032 |

USD 54,340.12 million |

|

CAGR |

26.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Battery Type, By Connection Type, By Energy Capacity, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The key companies in Battery Energy Storage System Market include ABB, BYD Company, Contemporary Amperex Technology Co., Limited, General Electric

Battery Energy Storage System Market exhibiting a CAGR of 26.7% during the forecast period.

Battery Energy Storage System Market report covering key segments are battery type, connection type, energy capacity, application, and region.

The key driving factors in Battery Energy Storage System Market are Rising Shift Toward Low Carbon Energy Generation

Battery Energy Storage System Market Size Worth USD 54,340.12 Million By 2032.