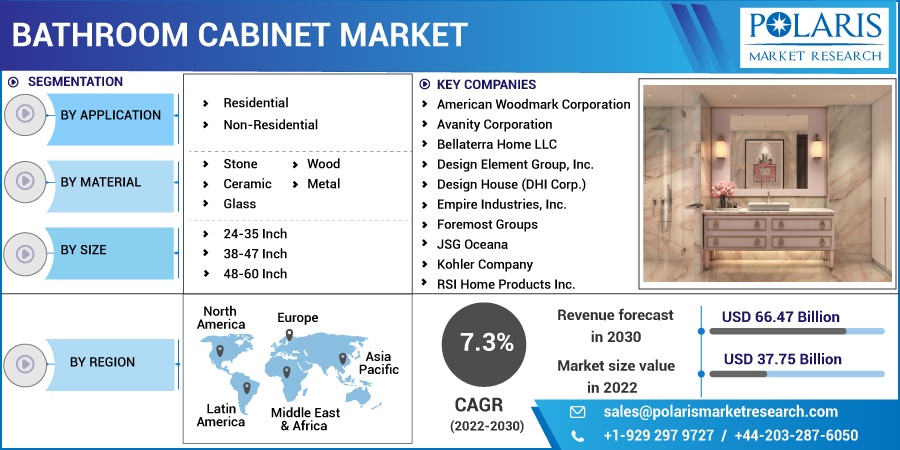

Bathroom Cabinets Market Share, Size, Trends, Industry Analysis Report, By Application (Residential, Non-Residential); By Material; By Size; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2896

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

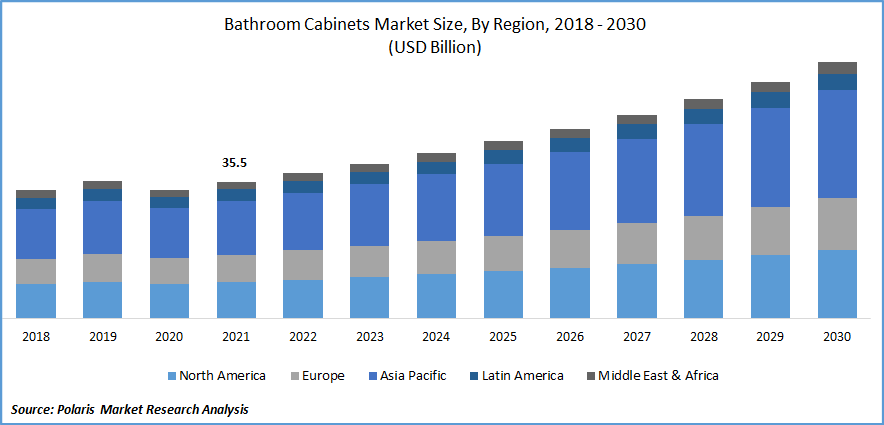

The global bathroom cabinets market was valued at USD 35.5 billion in 2021 and is expected to grow at a CAGR of 7.3% during the forecast period. The expanding leisure and hospitality industries are driving global market demand. Furthermore, the market for bathroom vanities is expected to grow in the coming years due to a rise in disposable income and changes in consumer lifestyles in regions such as Asia Pacific and Europe.

Know more about this report: Request for sample pages

The coronavirus pandemic has badly affected industry growth. According to the Amperity COVID-19 Retail Monitor, which tracks consumer behavior across categories and channels of 100 North American retail brands, overall retail demand was down 90% year on year as of April 6th, 2020. The temporary closure of retail stores is primarily to blame for the losses. However, online revenue fell 74% yearly, posing a significant challenge to the supply.

According to the U.S. Census Bureau, of the 903,000 single-family homes completed in 2019, 32,000 had 1.5 or fewer bathrooms, and 296,000 had three or more bathrooms. This pattern is expected to increase demand for the market. Government initiatives to develop infrastructures, such as airports, buildings, railway stations, and shopping malls, are also expected to fuel market growth.

Furthermore, as a result of rapid urbanization, the market is expected to expand rapidly over the projected period. Furthermore, the thriving cAgainonstruction industry, particularly in the hospitality sector, which includes hotels, resorts, and hospitals, is increasing demand for better utility services near sinks.

The growing preference for elegant, stylish, modern, and fancy bathrooms is expected to broaden the range of high-quality bathroom vanities over the forecast period. Because it lacks a rigid supply chain model, e-commerce or direct-to-consumer sales offer enormous potential for market entrants. Due to the growing consumer demand for online shopping due to convenience and flexibility, industry players have increased their focus on e-tailing. For example, a key player like Kohler Co. provides this type of convenience store retailing to broaden their market reach and scope of operations.

The COVID-19 pandemic outbreak has brought about several unexpected changes in the world economy, and its repercussions have been felt across all industries. Furthermore, COVID-19 has impacted every industry worldwide, with the hotel industry suffering the most. Travel restrictions and lockdowns have impacted the commercial bathroom vanities industry. The travel industry as a whole has seen a significant downturn as a result of ongoing health issues from the ongoing epidemic and the weakening economy.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The surge in demand for customized bath cabinets such as granite, marble, lava stone, and engineered stone, among others, is expected to drive market growth over the forecast period due to price affordability and aesthetic appeal. To address this industry trend, key industry players are launching major initiatives and expanding their product portfolios to include products made of advanced materials. For example, HiB, a leading bathroom product supplier, launched an Isoe bath cabinet in December 2021 with enhanced functionality, adaptable design, and a plethora of features and made available in 50cm, 60cm, and 80cm size options.

Furthermore, the growing number of initiatives launched by governments around the world to promote the construction industry, including China, Japan, India, and Indonesia, is expected to spur the development of new residential and commercial facilities. These factors are expected to boost market growth during the forecast period. The high design cost, on the other hand, is expected to stifle market growth.

The National Kitchen & Bath Association (NKBA) reported that the U.S. home remodeling index stood at 71.4, with more consumers around the world remodeling their homes. This trend is expected to continue and contribute to industry growth in the coming years. This is also expected to provide key market players with an opportunity to expand their product portfolio and meet rising consumer demand. The increased renovation and remodeling of residential spaces are expected to drive significant growth in developed economies such as the United States and Germany. This is expected to change consumer behavior toward various bathroom cabinets and drive market growth.

Rising raw material innovations and a shift in focus on designing comfortable and sturdy bath cabinet designs are also expected to support the market's development in North America in the coming years. LED-illuminated bathroom mirror cabinets are becoming more and more popular in the luxury market. LED lighting is becoming more reliable as infrared devices are used to activate it. Anti-rust alloys and LCD clocks are also gaining popularity.

Report Segmentation

The market is primarily segmented based on application, material, size, and region.

|

By Application |

By Material |

By Size |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Residential segment accounted for the maximum revenue in 2021

In terms of revenue, the residential segment dominated the market in 2021. The use of a bathroom cabinet is beneficial in keeping a bathroom clutter-free. Cabinets with mirror fronts and compartments to keep toiletries and other items organized are preferred in most residential areas, with significant growth predicted over the forecasted period. From 2022 to 2030, the non-residential segment is expected to grow at a high CAGR. Bathroom furniture with smart technology such as aroma diffuser, chromolite, and built-in sound is well received by hotel/resort guests and many people worldwide. These technological advances are expected to boost segment growth in the coming years.

Wood segment is expected to dominate over the forecast period

In terms of revenue, the wood segment dominated the industry. According to Houzz Inc., 30% of those who have recently renovated prefer wood bathroom vanities, particularly those with a matte finish, in 2022. It can be relatively neutral while adding warmth and comfort to the space. Over the forecast period, the glass segment is expected to grow at the fastest CAGR. Ceramic basin alternatives will also be incorporated into designs that use novel materials such as glass, concrete, pressured surfaces, and mineral cast basins.

38-47 Inch are expected to witness faster growth

The 37-48-inch segment has the largest market share in 2021 and is expected to impact market growth positively. Good storage capacity and the ability to fit effectively in small bathroom areas drive the segment. Medium-sized vanities are designed to be compact so that they do not take up the entire bathroom area and instead stand out in terms of aesthetic value. Over the forecast period, the 25–34-inch segment is expected to grow at the fastest CAGR. Bathroom vanities in the 24- to 35-inch range, preferred by consumers for residential use, support single-sink vanity tops. Small bathroom vanities are commonly preferred.

Asia-Pacific accounted for the most significant revenue in 2020

The Asia Pacific regional market accounted for the largest market share in 2021 and is expected to grow at the highest CAGR from 2022 to 2030. The rising population and rising standard of living have boosted the region's construction sector's growth prospects in recent years. Growing disposable income has triggered the region's overall retail market. Changing lifestyles and rapid trend shifts due to urbanization in emerging markets such as China and India are expected to boost regional market growth during the forecast period.

In 2021, North America will hold a significant share of the market. The increase is attributed to regional housing completion rates, which are expected to remain a key driving factor in the market over the forecast period. The large sums spent in the region on remodeling and retrofitting existing bathrooms are also expected to boost demand for bathroom vanities over the forecast period.

Competitive Insight

Key players in the market are American Woodmark Corporation, Avanity Corporation, Bellaterra Home LLC, Design Element Group, Inc., Design House (DHI Corp.), Empire Industries, Inc., Foremost Groups, JSG Oceana, Kohler Company, RSI Home Products Inc., Wilsonart International LLC, and DuPont.

Recent Developments

In October 2022, American Woodmark Corporation will increase the capacity of its stock kitchen and bathroom cabinets for east coast markets in October 2022. The project will require a total capital investment of $65 million over the next two years.

In Oct 2022: Kohler Co. received a Good Housekeeping 2022 Home Reno Award in several categories, including Maxstow Lighted Medicine Cabinets to modernize the bathroom while maximizing storage space.

Bathroom Cabinets Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 37.75 billion |

|

Revenue forecast in 2030 |

USD 66.47 billion |

|

CAGR |

7.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Application, By Material, By Size, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

American Woodmark Corporation, Avanity Corporation, Bellaterra Home LLC, Design Element Group, Inc., Design House (DHI Corp.), Empire Industries, Inc., Foremost Groups, JSG Oceana, Kohler Company, RSI Home Products Inc., Wilsonart International LLC, and DuPont |