Base Metal Mining Market Share, Size, Trends, Industry Analysis Report

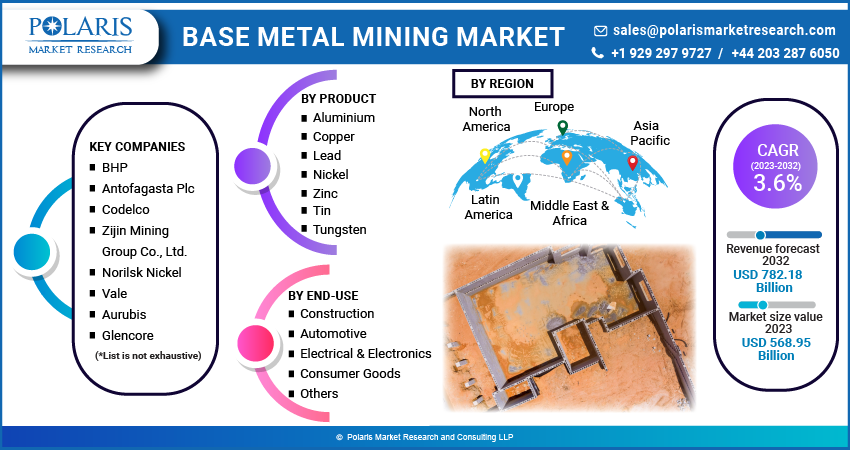

By Product (Aluminum, Copper, Zinc, Lead, Nickel, Zinc, Tin, Tungsten); By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:May-2023

- Pages: 115

- Format: PDF

- Report ID: PM3221

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

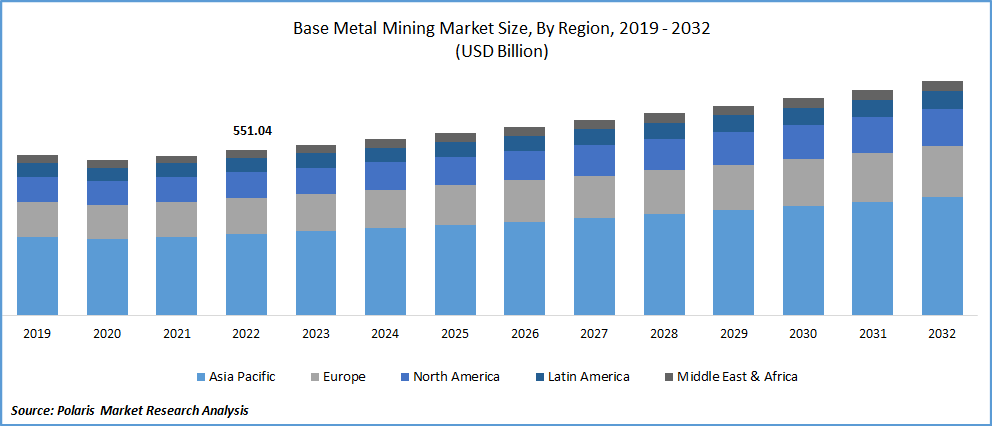

The market for base metal mining was estimated at USD 551.04 billion in 2022, and it is anticipated to increase at a CAGR of 3.6% from 2023 to 2032. The electrical & electronics and automotive industries' rising demand for base metals is anticipated to propel market expansion. Electrical and electronic component manufacture frequently uses base metals. For instance, after silver, copper has the best electrical conductivity of all the metals. Due to its corrosion resistance and strong thermal conductivity, copper is an ideal material for use in a variety of electrical and electronic applications. Hence, throughout the projection period, increasing demand for electrical and electronic goods is anticipated to support product demand.

Know more about this report: Request for sample pages

One of the world's top producers and consumers of base metals is China. Several different producers and end users are present throughout the nation, electronics manufacturing is rising, building activity is expanding, and the usage of electric vehicles (EVs) is becoming more and more common. These and other causes are responsible for the market's expansion.

The consumption of goods is anticipated to rise during the projection year as a result of increased government efforts to resuscitate the construction and infrastructure sector. For instance, the Chinese government declared in July 2022 that it will establish a CNY 500 billion (US$ 74.69 billion) national infrastructure investment fund in order to boost infrastructure spending and hence boost the economy.

The effects of the coronavirus outbreak first became apparent in March 2020. The average share price of the mining and metals sector fell by about 10%, while many standalone businesses lost between 40 and 50 percent of their market value. The impact of COVID-19 increased rapidly from a moderate level in March 2020 to a high level in April 2020. Due to partial shutdowns claimed by several of the industry's main players, including BHP Billiton, Rio Tinto, and Anglo American, the industry has so far almost recorded a production loss of more than 30%

Additionally, it is projected that increased worldwide EV manufacturing would present profitable prospects for metals like nickel, copper, and aluminum. For instance, the American president signed an executive order in August 2021 calling for all new cars to be 50% electric by 2030. As a result, numerous automakers are turning their attention to the creation of EVs. For instance, Bentley Motors declared in October 2021 that all of its vehicles would likely be electric by 2030 and plug-in hybrids by 2026.

Laws and restrictions, however, obstruct the market's quick expansion. When mined, sulfide-containing mineral deposits like those for copper, gold, zinc, lead, and aluminium have the potential to release acid mine drainage. When these minerals are exposed to oxygen and water, sulfuric acid is created. Acid mine drainage may degrade water quality by lowering the ph and dissolved metal content of groundwater. Base metal mining is therefore subject to strict environmental regulations, which makes it difficult to conduct mining operations.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

The growing demand for base metals from the construction, electrical and electronics, and automotive sectors is the primary factor driving the worldwide base metal mining market. The construction of both residential and non-residential buildings is anticipated to increase demand for copper and aluminium products in Southeast Asia and other developing nations.

Also, the manufacturing of commercial vehicles and other types of vehicles is anticipated to support market expansion. The market's growth rate would be positively impacted by rising industrialization and rising copper demand globally. Other factors influencing the expansion of the base metal mining market include an increase in disposable income and the government's increased focus on mining-friendly laws. Also, a significant market driver is the expansion of the electronics and electrical sector. Lead, copper, aluminium, zinc, and other metals are frequently used in the electrical and electronic sector. Over the past ten years, the demand from industries such electronic utilities, consumer electronics, and general electronics has increased, driving the growth of the global market.

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

In 2022, the copper dominated the market, accounting for the largest market share.

The global copper reserves total 880 million tons, according to the USGS. The demand from the infrastructure and automotive industries is expected to drive up copper consumption globally during the upcoming years.

In 2022, aluminium had the second-largest market share worldwide. In 2022, 69,000 kilotons of aluminium were produced worldwide in smelters. There is enough bauxite in the planet to meet demand for the foreseeable future, with deposits estimated to be between 55 and 75 billion tonnes. Aluminum is a material that is commonly used in the automotive sector because of how lightweight it is. Hence, rising auto manufacturing and increased EV penetration.

The construction segment dominates for a higher share of the market.

Construction dominated the global market in 2022, accounting for a high revenue. In applications related to architecture, interior design, and building & construction, base metals are frequently employed. During the forecast period, rising investments in the development of smart cities around the globe are anticipated to increase base metal demand.

The demand in Asia Pacific is expected to witness significant growth.

The region's growing investments in a variety of end-use industries, including electrical & electronics, automotive, and construction, are to blame for the supremacy. For instance, the state of Bengal's government approved five new industrial parks and 18 units totaling INR 60 million (about $0.75 million) in august 2022. It is anticipated that the 18 apartments will be built in the current VIDYASAGAR industrial park.

In terms of revenue, North America is predicted to experience a high CAGR oduring the projection period. The expansion is anticipated to be fueled by the expanding use of EVS and the rising demand for consumer and electrical items. For instance, Ford Motor Company, General Motors, and STELLANTIS said in a joint statement in August 2021 that they aim for 40–50% of annual car sales in the United States to be electric by 2030.

Competitive Insight

Some of the major players operating in the global base metal mining market include BHP; Freeport-McMoRan, Inc.; Antofagasta Plc; Codelco; Zijin Mining Group Co., Ltd.; Norilsk Nickel; Vale; Aurubis; Glencore; Anglo American

Recent Developments

- In February 2022, develop, an Australian mining company agreed to buy the Woodlawn copper project for USD 243.8 million. With this acquisition and the Sulphur springs project, the company aims at holding major significance in the overall base metals industry.

Base Metal Mining Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 568.95 billion |

|

Revenue forecast in 2032 |

USD 782.18 billion |

|

CAGR |

3.6% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

BHP; Freeport-McMoRan, Inc.; Antofagasta Plc; Codelco; Zijin Mining Group Co., Ltd.; Norilsk Nickel; Vale; Aurubis; Glencore; Anglo American. |

FAQ's

The global base metal mining market size is expected to reach USD 782.18 billion by 2032.

Key players in the base metal mining market are BHP; Freeport-McMoRan, Inc.; Antofagasta Plc; Codelco; Zijin Mining Group Co., Ltd.; Norilsk Nickel; Vale; Aurubis; Glencore; Anglo American.

Asia Pacific contribute notably towards the global base metal mining market.

The base metal mining market anticipated to increase at a CAGR of 3.6% from 2023 to 2032.

The base metal mining market report covering key segments are product, end-use, and region.