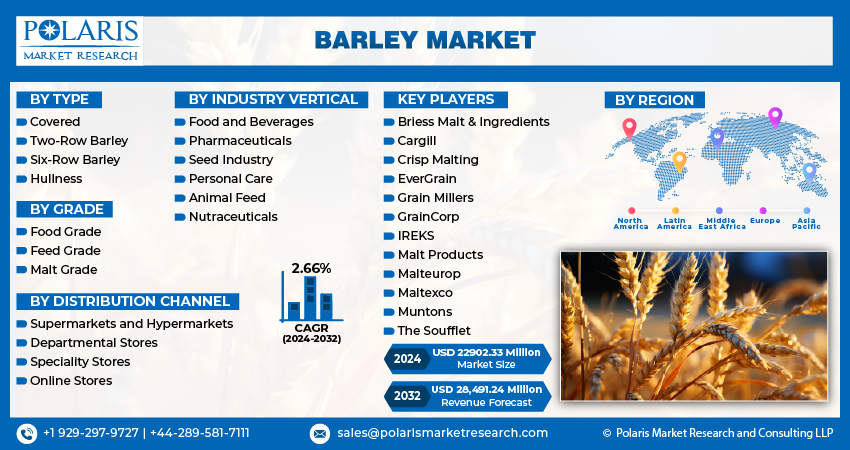

Barley Market Share, Size, Trends, Industry Analysis Report, By Type (Covered, Two-Row Barley, Six-Row Barley, Hullness); By Grade; By Distribution Channel; By Industry Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3474

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

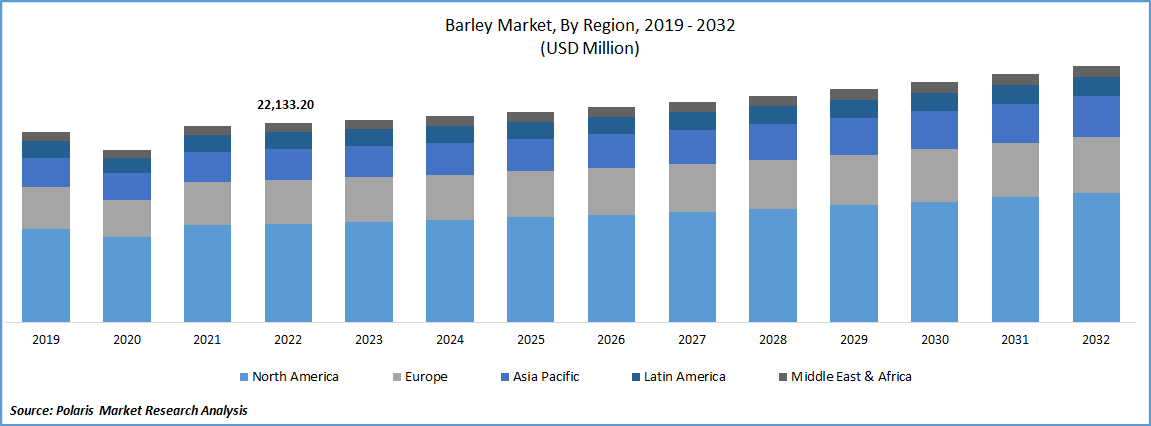

The global barley market was valued at USD 22491.36 million in 2023 and is expected to grow at a CAGR of 2.66% during the forecast period. The growing world barley production is driving the growth of the barley market due to the increasing demand for food products, the increasing popularity of beer and other alcoholic beverages, the increasing demand for animal feed, the increasing use of barley in the biofuel industry, and the increasing adoption of sustainable agricultural practices.

To Understand More About this Research: Request a Free Sample Report

The United States Department of Agriculture (USDA) forecasts that the world's barley production will reach 149.53 million metric tonnes in 2022/2023, up about 0.53 million tonnes from the estimate made last month. The amount of barley produced in the last year was 145.47 million tonnes. This will further create a wide range of opportunities for the growth of the market in the years to come.

Industry Dynamics

Growth Drivers

Barley is an important ingredient in animal feed, particularly for livestock such as cattle and pigs. As global demand for meat products increases, so does the demand for animal feed, driving up demand for barley. The United Nations Food and Agricultural Organization (FAO) projects that between 2010 and 2050, production of animal proteins will increase by about 1.7% annually, with meat production expected to increase by 90% in aquaculture, 55% in dairy, and almost 70% in agriculture. By 2050, the FAO predicts that there will be a 60% increase in global food demand. Barley is a nutritious and high-energy feed ingredient for livestock, making it an important crop for the animal feed industry. As the demand for meat and other animal products, such as milk and eggs, continues to grow, so does the demand for animal feed, including barley. The increasing demand for animal feed is driving the growth of the barley market.

Report Segmentation

The market is primarily segmented based on type, grade, distribution channel, industry vertical, and region.

|

By Type |

By Grade |

By Distribution Channel |

By Industry Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Covered Barley Segment is Expected to Witness Fastest Growth During Forecast Period

Covered barley segment is projected to experience faster growth in the study period. This type of barley is considered as a healthy food due to its high fiber content and low glycemic index, which makes it a popular choice for health-conscious consumers. As more people adopt plant-based diets, the demand for grains such as covered barley is expected to increase. Covered barley is an ancient grain that has been cultivated for thousands of years, and it is gaining popularity as a result of the growing interest in traditional and heritage grains. As consumers seek to diversify their diets and try new foods, covered barley is likely to benefit from increased awareness and exposure. These factors will further drive the growth of the market in coming years.

Malt Grade Segment Witnessed Largest Market Share in 2022

Malt Grade segment registered with the larger market share in 2022, It is a key ingredient in the production of a variety of food and beverage products, including beer, whiskey, malted milk, and malted breakfast cereals. As the demand for these products increases, so does the demand for malt-grade barley. It has specific characteristics that make it ideal for malting, including high enzyme content and low protein content. This makes it easier to extract fermentable sugars during the malting process, which is crucial for the production of beer and other malt-based products. This barley typically commands a premium price compared to feed-grade barley, due to its specific characteristics and use in high-value products. This premium pricing provides an incentive for farmers to produce more malt-grade barley, which in turn drives market growth.

Supermarkets and Hypermarkets Segment is Expected to Hold the Significant Revenue Share in 2022

Supermarkets and Hypermarkets segment is projected to witness larger revenue share for the market in coming years. These have a wider distribution network than smaller retailers, which allows for greater market penetration and exposure for barley products. Consumers are increasingly looking for convenience and accessibility when shopping for groceries, and supermarkets and hypermarkets offer a one-stop shopping experience that is convenient for many shoppers. These distribution channels also have strong brand recognition and consumer trust, which can increase the likelihood that consumers will purchase barley products from these retailers. Supermarkets and hypermarkets often invest in promotional activities and advertising campaigns to promote their products, including barley products. This can increase awareness and drive sales for barley products.

Food and Beverages Segment is Expected to have a Higher Growth in the Study Period

Food and Beverages segment is projected to witness higher growth in coming years. Barley is a healthy and natural ingredient that is rich in fiber, protein, and other nutrients. As consumers become increasingly health-conscious and seek out natural ingredients in their food and beverages, the demand for barley-based products is expected to increase. It has a diverse range of applications in the food and beverage industry, including as a cereal grain, flour, and malt. It can be used in a variety of products, such as bread, breakfast cereals, snacks, and beverages. The non-alcoholic beverages market is experiencing significant growth, and barley-based beverages such as barley water and barley tea are gaining popularity as healthy alternatives to traditional soft drinks.

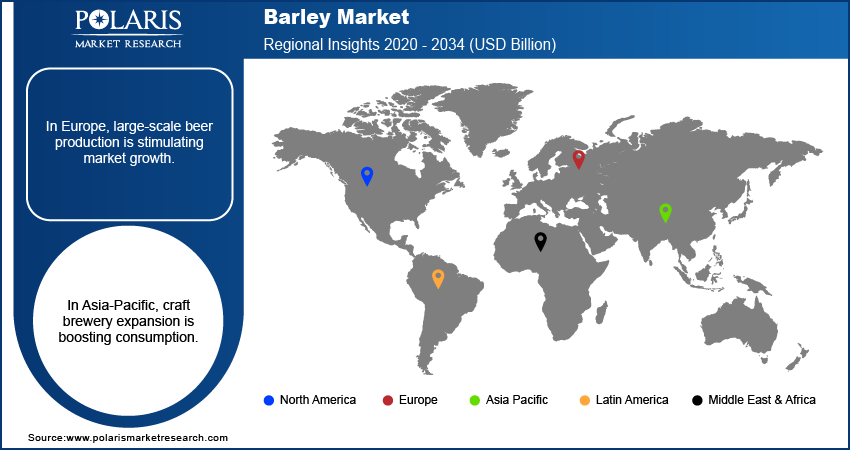

Apac Registered with the Highest Growth Rate in the Study Period

APAC is projected to witness higher growth in the study period. The region has the largest population in the world, and as the population continues to grow, so does the demand for food and beverages, including barley-based products. Currently, and by a significant margin, China is the biggest importer of barley. China bought 10.8 million tonnes of barley in 2020–21, and 2021/22 is, at least so far, ahead of that pace. The growing number of diabetic patients in China is fueling the growth of the barley market. According to Statista, almost 141 million individuals in China have diabetes, making it the nation with the greatest percentage of diabetics worldwide. There will likely be 174 million diabetics living in China by the year 2045. According to studies, consuming barley can lower insulin and blood sugar levels in people with diabetes. Barley is a wise choice for diabetes individuals because it also has a low gi level(28). This will further fuel the growth of the market in coming years.

Europe Accounted for the Larger Revenue Share in the Forecast Timeframe

Europe is expected to have a larger revenue share for the market in coming years. Europe has a long history of beer production, which is a major end-use application for barley. The region is home to some of the world's largest beer producers, for instance, with around 85 million hectoliters in 2021, Germany will produce the most beer in Europe and as a result, there is high demand for barley in the region. The climate in Europe is favorable for barley cultivation, particularly in countries such as France, Germany, and the UK. This has resulted in high production levels of barley in the region, which in turn is driving demand.

According to Statista, Barley production in the European Union is anticipated to reach 51.5 million metric tonnes in the marketing year 2022–2023, making it by far the greatest producer in the world. The European Commission's new Common Agricultural Policy seeks to assist European farmers in transforming their agricultural sector into one that is more resilient and sustainable while retaining the uniqueness of rural communities. This will further drive the production of barley in this region in coming years.

Competitive Insight

Some of the major players operating in the global market include Briess Malt & Ingredients, Cargill, Crisp Malting, EverGrain, Grain Millers, GrainCorp, IREKS, Malt Products, Malteurop, Maltexco, Muntons & The Soufflet.

Recent Developments

- In January 2023, James Wilks, champion of Ultimate Fighter, and EverGrain, InBev's sustainable ingredient company, announced the introduction of FYTA, the first portfolio of high-performance sports nutrition powders created from recycled barley protein.

- In January 2023, EverGrain, a sustainable ingredient company, collaborated with an AI pioneer PIPA to investigate into the nutritional potential of up-cycled barley protein.

Barley Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 22902.33 million |

|

Revenue forecast in 2032 |

USD 28,491.24 million |

|

CAGR |

2.66% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Grade, By Distribution Channel, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Briess Malt & Ingredients, Cargill Incorporated, Crisp Malting, EverGrain, Grain Millers, GrainCorp, IREKS, Malt Products, Malteurop, Maltexco, Muntons & The Soufflet. |

FAQ's

key companies in barley market are Briess Malt & Ingredients, Cargill, Crisp Malting, EverGrain, Grain Millers, GrainCorp, IREKS, Malt Products, Malteurop, Maltexco.

The global barley market is expected to grow at a CAGR of 2.66% during the forecast period.

The barley market report covering key segments are type, grade, distribution channel, industry vertical and region.

key driving factors in barley market are increasing awareness about the health benefits.

The global barley market size is expected to reach USD 28,491.24 Million by 2032.