Bare Die Shipping & Handling and Processing & Storage Market Size, Share, Trends, Industry Analysis Report: By Product (Shipping Tubes, Trays, Carrier Tapes, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5551

- Base Year: 2024

- Historical Data: 2020-2023

Bare Die Shipping & Handling and Processing & Storage Market Overview

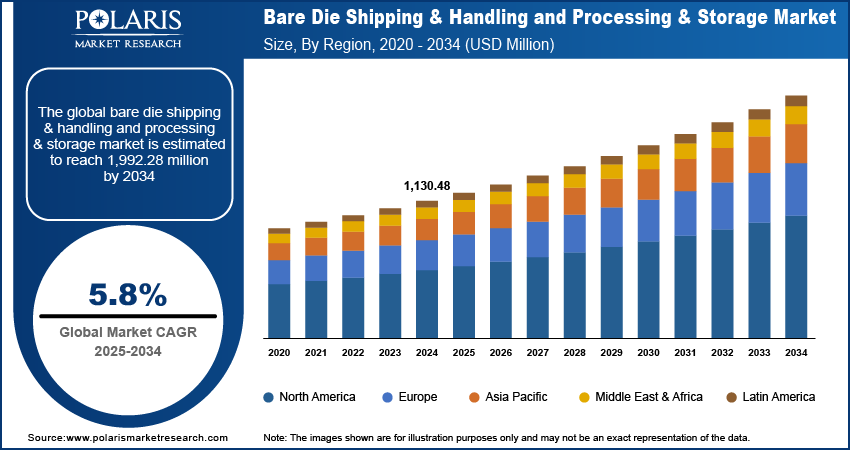

The bare die shipping & handling and processing & storage market size was valued at USD 1,130.48 million in 2024 and is expected to reach USD 1,195.37 million by 2025 and USD 1,992.28 million by 2034, exhibiting a CAGR of 5.8% during 2025–2034.

The bare die shipping & handling and processing & storage market refers to the industry that provides specialized solutions for the safe transportation, handling, processing, and storage of bare semiconductor dies. These dies, which are unpackaged and highly sensitive, require advanced technologies such as wafer-level packaging, precision carriers, automated handling systems, and controlled storage environments to prevent contamination, damage, and electrostatic discharge.

The rapid deployment of 5G networks and AI-driven applications is increasing the production of high-performance semiconductors, requiring advanced logistics and storage solutions, which are supporting the bare die shipping & handling and processing & storage market growth. Additionally, innovations in wafer-level packaging (WLP), 3D stacking, and chip-scale packaging (CSP) are increasing the complexity of bare die processing, which is fueling market demand for specialized handling and storage solutions.

To Understand More About this Research: Request a Free Sample Report

The integration of robotics, AI, and automation in semiconductor manufacturing enhances precision and efficiency in die handling and processing, contributing to bare die shipping & handling and processing & storage market growth. Furthermore, the expansion of semiconductor fabrication plants and backend processing facilities worldwide is increasing the demand for efficient logistics solutions to streamline die shipping, handling, and storage.

Bare Die Shipping & Handling and Processing & Storage Market Dynamics

Growth in Automotive Electronics & EVs

The growth in automotive electronics and EVs is significantly driving the bare die shipping & handling and processing & storage market development. According to the International Energy Agency, in 2023, approximately 14 million new electric vehicles (EVs) were registered worldwide, elevating the total circulating fleet to around 40 million units. This represents an annual sales surge of 3.5 million EVs compared to 2022, translating to a robust year-on-year growth rate of 35%. Electric vehicles (EVs), advanced driver assistance systems (ADAS), and automotive power modules increasingly depend on high-performance semiconductors. As a result, the demand for the secure and efficient handling, storage, and transportation of bare dies is rising significantly. These critical components require precise processing to ensure reliability and performance in automotive applications, necessitating advanced protective packaging, contamination-free storage, and automated handling solutions. This rising adoption of semiconductors in next-generation vehicles is contributing to the bare die shipping & handling and processing & storage market demand.

Rising Demand for Miniaturized Electronics

The rising demand for miniaturized electronics is significantly contributing to the bare die shipping & handling and processing & storage market growth. The adoption of compact and high-performance semiconductor devices in smartphones, wearables, IoT devices, and medical electronics accelerates the need for precise and contamination-free handling, shipping, and storage solutions. In November 2024, Valens Semiconductor launched an advanced connectivity solution for next-generation single-use endoscopes at Medica 2024, enhancing data transmission and integration for modern medical imaging applications. These advanced applications require ultra-thin, high-density semiconductor components, increasing the complexity of bare-die processing and necessitating specialized protective packaging and automated handling solutions. This trend is driving investments in innovative storage technologies and logistics solutions, which is boosting the bare die shipping & handling and processing & storage market growth.

Bare Die Shipping & Handling and Processing & Storage Market Segment Insights

Bare Die Shipping & Handling and Processing & Storage Market Assessment by Product Outlook

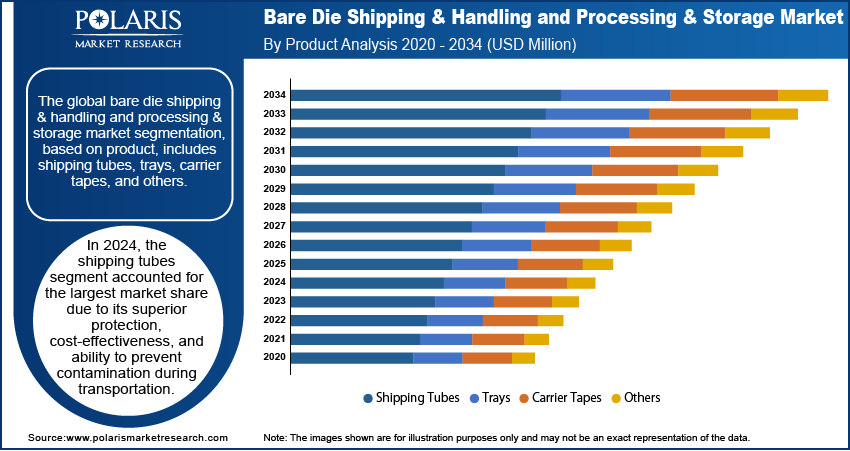

The global bare die shipping & handling and processing & storage market segmentation, based on product, includes shipping tubes, trays, carrier tapes, and others. In 2024, the shipping tubes segment accounted for the largest market share due to its superior protection, cost-effectiveness, and ability to prevent contamination during transportation. Shipping tubes offer secure storage and handling, reducing the risk of physical damage, electrostatic discharge (ESD), and moisture exposure, which are critical concerns in semiconductor logistics. Their stackability and ease of automation further enhance their appeal for large-scale semiconductor manufacturing and distribution, driving their widespread adoption across the industry.

Bare Die Shipping & Handling and Processing & Storage Market Evaluation by Application Outlook

The global bare die shipping & handling and processing & storage market segmentation, based on applications, includes communications, computers, consumer electronics, automotive, industrial & medical, and defense. In 2024, the consumer electronics segment accounted for the largest market share due to the increasing demand for miniaturized and high-performance semiconductor devices in smartphones, wearables, tablets, and smart home appliances. The need for specialized handling and storage solutions to maintain product integrity has grown. The growth in advanced consumer electronics production, along with the expanding Internet of Things (IoT) ecosystem, has significantly increased the volume of bare die shipments as manufacturers aim for smaller, more power-efficient chips, thus fueling market growth for this segment.

Bare Die Shipping & Handling and Processing & Storage Market Regional Analysis

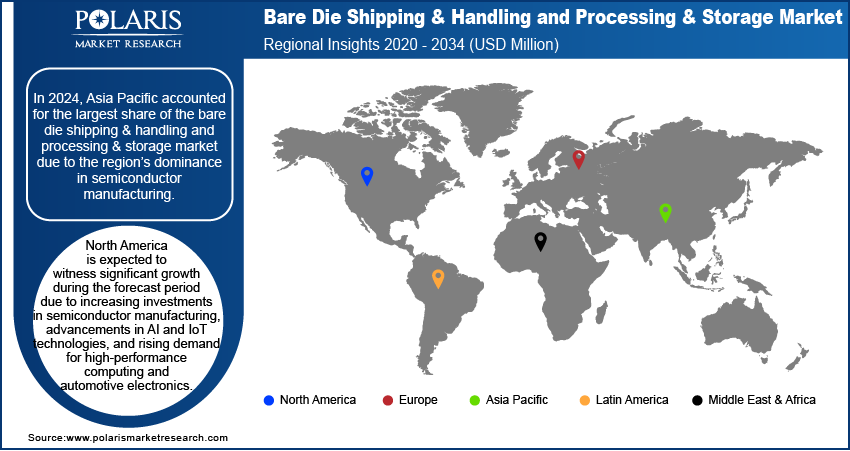

By region, the study provides bare die shipping & handling and processing & storage market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest share of the bare die shipping & handling and processing & storage market revenue due to the region’s dominance in semiconductor manufacturing. Moreover, a strong electronics production base and growing demand for advanced packaging solutions are also driving market expansion in the region. Countries such as China, Taiwan, South Korea, and Japan are home to leading semiconductor foundries and OSAT (Outsourced Semiconductor Assembly and Test) providers, driving the need for efficient bare die handling and storage solutions. In 2023, global semiconductor sales were about $526.8 billion, according to the Semiconductor Industry Association. China made up 29% of these sales, while the rest of the Asia-Pacific region (excluding China and Japan) accounted for 26%. Additionally, the rapid expansion of consumer electronics, automotive electronics, and 5G infrastructure further strengthens Asia Pacific’s dominance in the global market.

The bare die shipping & handling and processing & storage market in North America is expected to witness significant growth over the forecast period due to increasing investments in semiconductor manufacturing, advancements in AI and IoT technologies, and rising demand for high-performance computing and automotive electronics. Government initiatives to strengthen domestic chip production, coupled with the expansion of EV and ADAS technologies, are driving the need for efficient bare-die shipping, handling, and storage solutions. For instance, according to the Semiconductor Industry Association, as of August 2024, over 90 new semiconductor manufacturing projects have been announced in the US since the CHIPS Act, with total investments nearing USD 450 billion across 28 states. Additionally, the presence of leading semiconductor companies and growing R&D activities in the region contribute to the North America bare die shipping & handling and processing & storage market expansion.

Bare Die Shipping & Handling and Processing & Storage Market – Key Players & Competitive Analysis Report

The competitive landscape of the bare die shipping & handling and processing & storage market is characterized by the presence of key global and regional players focusing on technological advancements, strategic partnerships, and capacity expansions to strengthen their market position. Leading companies are investing in high-efficiency and low-emission boiler technologies to align with stringent environmental regulations and evolving industry standards. Mergers and acquisitions are prominent strategies that enable firms to expand their product portfolios and market reach. Additionally, research and development efforts are accelerating innovations in supercritical and ultra-supercritical boiler systems, enhancing operational efficiency and sustainability. Competition remains intense, driven by growing power demand and the transition toward cleaner energy sources.

3M Company is engaged in the manufacturing and distribution of a wide range of industrial products and solutions, specializing in advanced materials and consumer goods. The company was founded in 1902 and is headquartered in St. Paul, Minnesota, USA. 3M's product portfolio includes adhesives, abrasives, laminates, personal protective equipment, and various healthcare solutions. The services provided by 3M encompass technical support, product development, and customized solutions across multiple industries such as automotive, electronics, healthcare, and safety. The company operates in over 70 countries. In the bare die shipping & handling and processing & storage, 3M offers specialized packaging solutions that ensure the safe transport and storage of sensitive semiconductor components. Their innovative materials help protect bare die from contamination and damage during handling, which is critical for maintaining product integrity in semiconductor manufacturing.

Central Semiconductor LLC is engaged in the manufacturing of discrete semiconductors, specializing in innovative and reliable semiconductor solutions for various applications. The company was founded in 1974 and is headquartered in Hauppauge, New York, USA. Central Semiconductor's product portfolio includes a wide range of discrete devices such as diodes, transistors, and custom semiconductor solutions tailored to meet specific customer needs. The services provided by Central Semiconductor encompass custom design, engineering support, and a commitment to delivering high-quality products on time. Central Semiconductor operates primarily in North America but has a global reach through its distribution network. Furthermore, in the bare die shipping & handling and processing & storage, the company offers specialized packaging solutions that ensure the safe transport and storage of sensitive semiconductor components. Their bare die products are shipped in various formats to meet customer requirements while maintaining product integrity during handling and processing.

List of Key Companies in Bare Die Shipping & Handling and Processing & Storage Market

- 3M

- Achilles USA Inc.

- Advantek

- Central Semiconductor LLC.

- Daitron Incorporated

- Dalau Ltd

- Entegris

- ITW-ECPS

- Kostat, Inc.

- Thomas H. Lee Partners, L.P. (Brooks Automation, Inc.)

- TT ENGINEERING & MANUFACTURING SDN BHD

Bare Die Shipping & Handling and Processing & Storage Industry Developments

In February 2025, 3M enhanced its investments in the semiconductor industry by entering the US-JOINT Consortium, a group of 12 suppliers. This partnership aims to advance research in next-generation semiconductor packaging and back-end processing technologies.

In April 2024, Lintec launched a new Bump Support Film that improves the durability and dependability of semiconductor chips by using a specialized resin to protect the ball bump interconnections between the die and substrate. This BSF is designed as a tape that integrates with back grinding tape for improved packaging efficiency.

Bare Die Shipping & Handling and Processing & Storage Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Shipping Tubes

- Trays

- Waffle Packs

- Metal Trays

- Gel Packs

- Carrier Tapes

- Others

By Application Outlook (Revenue – USD Million, 2020–2034)

- Communications

- Computers

- Consumer Electronics

- Automotive

- Industrial & Medical

- Defense

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bare Die Shipping & Handling and Processing & Storage Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,130.48 million |

|

Market Size Value in 2025 |

USD 1,195.37 million |

|

Revenue Forecast in 2034 |

USD 1,992.28 million |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global bare die shipping & handling and processing & storage market size was valued at USD 1,130.48 million in 2024 and is projected to grow to USD 1,992.28 million by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

In 2024, Asia Pacific accounted for the largest share due to the region’s dominance in semiconductor manufacturing.

A few of the key players in the market are 3M; Achilles USA Inc.; Advantek; Central Semiconductor LLC.; Daitron Incorporated; Dalau Ltd; Entegris; ITW-ECPS; Kostat, Inc.; Thomas H. Lee Partners, L.P. (Brooks Automation, Inc.); and TT ENGINEERING & MANUFACTURING SDN BHD.

In 2024, the shipping tubes segment accounted for the largest market share due to its superior protection, cost-effectiveness, and ability to prevent contamination during transportation.

In 2024, the consumer electronics segment accounted for the largest market share due to the increasing demand for miniaturized and high-performance semiconductor devices in smartphones, wearables, tablets, and smart home appliances.