Avionics Market Share, Size, Trends, Industry Analysis Report

By System; By Fit; By Platform (Commercial, Military, General); By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 114

- Format: PDF

- Report ID: PM2722

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

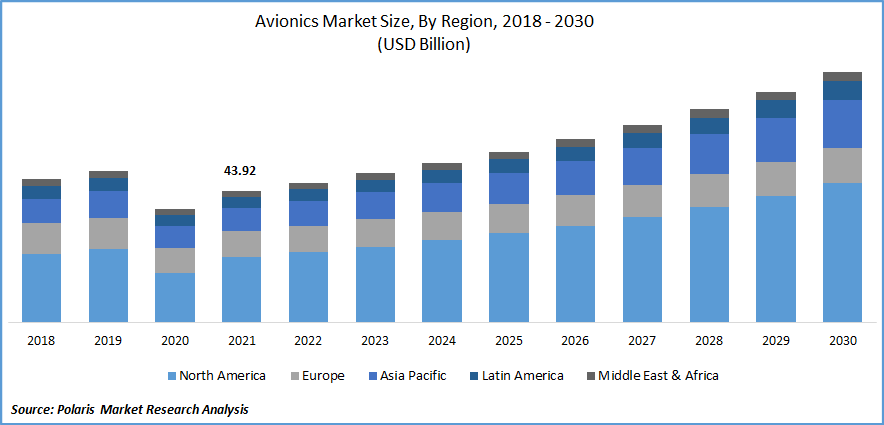

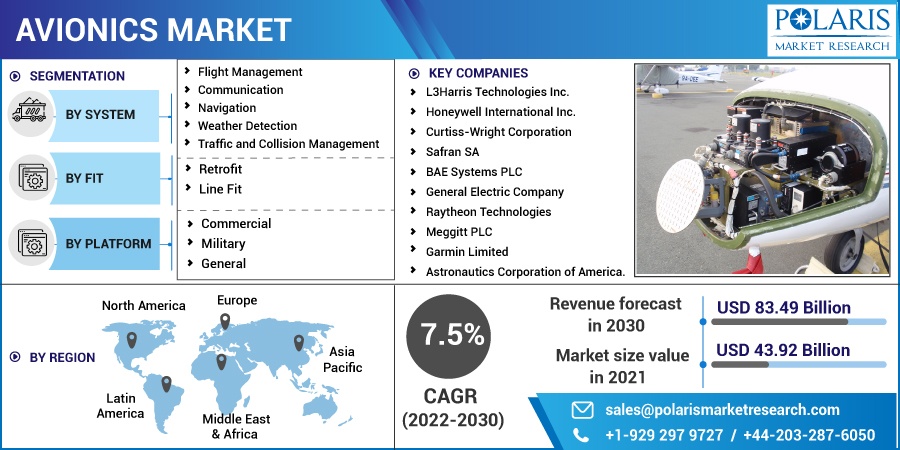

The global avionics market was valued at USD 43.92 billion in 2021 and is expected to grow at a CAGR of 7.5% during the forecast period. The market is driven by continuous R&D to modernize the existing avionics and the growing implementation of an advanced aircraft computer system to overcome the air passenger traffic. Furtherly, the rising demand for military aircraft from emerging nations also propels market growth.

Know more about this report: Request for sample pages

Technological advancements will play a major role in the growth of the overall market in the coming years. Many players are focused on R&D to develop new products integrated with data analytics to improve the safety and fuel efficiency of aircraft.

For instance, in 2021, Honeywell launched a cloud-based aircraft cockpit system named Anthem. This system enables the disjointed systems that support an aircraft to work together more seamlessly to deliver critical information to pilots.

The COVID-19 pandemic had a negative impact on the market. Many manufacturing, production, and logistics units were standstill owing to the global lockdown imposed by the government.

In addition, the movement of raw materials required for the manufacturing of electric components resulted in supply chain disruption owing to strict government regulation. Moreover, many airlines were shut down, which resulted in the downfall of market demand.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The avionics market is likely driven by increasing demand for commercial aircraft deliveries, and high government investment to improve the grid infrastructure are some of the factors complementing the market growth. The rising shift toward enhancing the infrastructure of private airports, along with favorable regulations by the government, may support market growth.

According to International Civil Aviation Organization (ICAO), passenger traffic and freight volume will double by 2035. Increasing population density, high disposable income, and a rise in the adoption of low-cost airlines are collectively responsible for passenger growth worldwide. Hence it led to an increased number of commercial aircraft deliveries.

The growing need for aircraft upgrades to improve operational safety and fuel efficiency, thereby minimizing operating costs, is driving the adoption of advanced avionics.

Moreover, the latest technological developments, including stealth technology, advanced composite, and fifth-generation technology, plays important role in the field of avionics.

Many players are focusing on collaborating with other large-scale businesses. In June 2019, Pattonair signed a contract with Safran Ventilation Systems. It expanded Pattonair’s presence in the French and European aerospace sectors. This partnership will have a major global impact on market growth, mainly due to the company's extensive customer coverage across the globe.

Report Segmentation

The market is primarily segmented based on system, fit, platform and region.

|

By System |

By Fit |

By Platform |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Navigation systems accounted for the largest share in 2021

Navigation systems segment is projected to have the largest share owing to the rapidly increasing demand for components like air data computers and altimeters. The major airline is also expanding its fleet in order to meet demand; The outfitted fleet will be updated with advanced inertial reference systems and aeronautical data computers linked to other avionics systems to increase operational efficiency.

In addition, the technological development of navigational tools has significantly impacted the segment’s growth.

Line fit segment is expected to witness faster growth

Aircraft OEMs directly installed the line fit into the aircraft cockpit. The manufacturer can deliver an aircraft pretty much exactly as the airline desires. The biggest benefit to having a line-fit option is that passengers get access to Wi-Fi and other products and services the second the plane goes into service.

Fleet modernization strategies are expected to be influenced by growing laws aimed at improving safety features offered by aircraft and standardizing those offered by different aircraft types. All aforementioned factors boost the segment demand over the retrofit option.

Commercial segment is anticipated to witness faster growth

The commercial segment is expected to have the largest market share. With the growing number of domestic passengers, the demand for commercial aircraft is expected to witness robust growth in the coming years. According to the International Air Transport Association (IATA), as of December 2021, there were 231 narrow-body and 41 wide-body aircraft deliveries in North America. Furthermore, in 2022, 361 narrow-body and 52 wide-body aircraft are expected to be delivered to North American airlines.

Moreover, increased demand for advanced military aircraft and helicopters to enhance their defense capabilities accelerate segment growth.

North America is expected to dominate and witness fastest growth over the forecast period

North America is expected to dominate the market owing to the growing number of commercial aircraft in the US, strong implementation of avionics systems by major players, and increasing defense spending by the government supporting the market growth.

In addition, cargo carriers based in the region are also expanding and modernizing their fleets aggressively. For instance, Air Canada procured three dedicated freighter aircraft into its fleet in 2022. Implementing such plans are expected to aid the growth of this market during the forecast period.

Moreover, the increasing demand for data analytics in avionics systems drives the market in this region.

Competitive Insight

Some major players operating in the global market include L3Harris Technologies Inc., Honeywell International Inc., Curtiss-Wright Corporation, Safran SA, BAE Systems PLC, General Electric Company, Raytheon Technologies, Meggitt PLC, Garmin Limited, Astronautics Corporation of America.

Recent Developments

In Jan 2022: Honeywell launched Anthem; a cloud-connected integrated avionics system. It improves flight efficiency, operations, safety, and comfort.

In May 2022, Boeing launched the new 777-8 Freighter and expanded its market-leading 777X and freighter families of jetliners with orders for up to 50 aircraft from Qatar Airways.

Avionics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 46.65 billion |

|

Revenue forecast in 2030 |

USD 83.49 billion |

|

CAGR |

7.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By System, By Fit, By Platform, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

L3Harris Technologies Inc., Honeywell International Inc., Curtiss-Wright Corporation, Safran SA, BAE Systems PLC, General Electric Company, Raytheon Technologies, Meggitt PLC, Garmin Limited, and Astronautics Corporation of America. |