Aviation Analytics Market Share, Size, Trends, Industry Analysis Report, By Component (Services, Solutions); By Deployment (On-premise, Cloud); By Business Function; By Application; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 119

- Format: PDF

- Report ID: PM2710

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

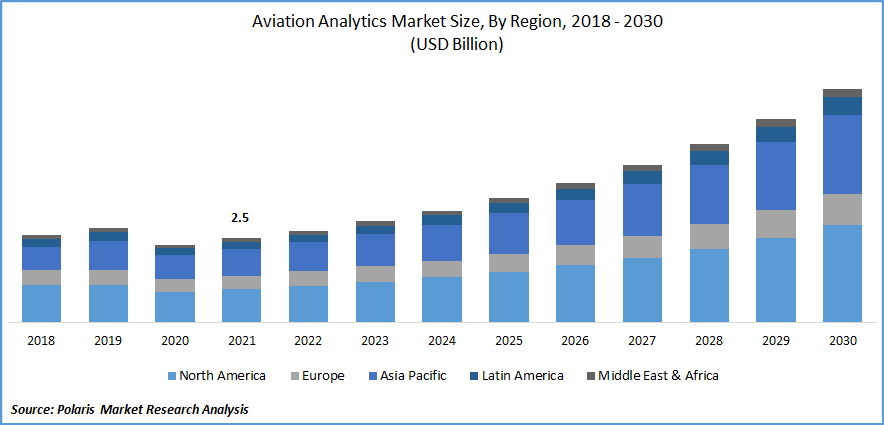

The global aviation analytics market was valued at USD 2.5 billion in 2021 and is expected to grow at a CAGR of 12.3% during the forecast period. The growing demand for aviation analytics is expected to be driven by the increasing penetration of analytical solutions to update aircraft fleets and operations to ensure flight safety.

Know more about this report: Request for sample pages

Technological advancement in aeronautics analytics solutions has increased demand in the airline industry to reduce cost, automate their process and boost customer experience, which is expected to drive market growth. Moreover, the growing demand for a structural analytical solution to achieve high sales and profitable operations also offers strategic planning and a clear understanding, which helps in decision-making fueling the market growth.

The COVID-19 pandemic had a negative impact on the growth of the market. The aviation industry was severely impacted as operations of many airlines were halted, and many national and international flights remained grounded. In addition, due to the rise in infection, demand for air travel was also reduced, halting the aviation analytics market.

The shift from conventional to modern aviation devices requires a huge investment, and deployment of a new solution is time-consuming and expensive, which hampers the market. Moreover, aviation analytics use a large volume of data which requires a skilled workforce; lack of technical and analytical skills is a major factor in restraining the market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing disposable income of the middle-class population and the development of budget-friendly airlines are expected to drive market growth. In addition, the increase in airline passengers has generated a huge amount of data which has resulted in the demand for aviation analytics, ultimately boosting the market growth.

Furthermore, the increasing demand to recognize consumer preference to provide suitable solutions to provide a unique customer experience is likely to have a positive impact on the market growth for the product.

The rising adoption of analytics in the aviation industry is due to steadily increasing airport congestion with the emergence of new flight routes and aircraft providers. Aviation analytics ensure the best tools and approaches to manage such huge traffic and suggest the best-operating models for data collection regarding ticket pricing, runway bandwidth, terminal capacity, and many more; such factors propel the market growth.

Report Segmentation

The market is primarily segmented based on component, deployment, business function, application, end-use, and region.

|

By Component |

By Deployment |

By Business Function |

By Application |

By End-Use |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Solutions segment is anticipated to lead the market in 2021

The solution market segment is anticipated to lead the market over the forecast period owing to the rising need for a customized aviation analytics solution that can address industry issues. In addition, the solution also assists in improving operational productivity, maintenance, and profitability in the business.

Moreover, this technology helps understand customer preferences and gather meaningful data when customers book tickets and could target a specific audience to offer personalized discounts.

Furthermore, through aviation analytics, real-time data could be gathered, which helps airlines to understand their passenger’s tastes, and needs and could offer them a unique experience that is likely to complement market growth over the forecast period.

On-premise segment is expected to spearhead the market growth

The demand for the on-premise segment is driven by the rising demand for customizable and sole ownership solutions in the industry. In addition, data security is the major factor for the deployment of on-premise, and many airlines would prefer in-house software infrastructure and services that guarantee data protection which is offered by the on-premise solution, which drives the market growth.

Finance segment is expected to witness faster growth

The demand for finance is expected to surge significantly over the forecast period as it offers airlines improved investment returns. In addition, the growing demand to organize several financial-related tasks, such as managing risk, stocks, and investment portfolios, has created a huge demand for aviation analytics which is expected to drive market growth.

Sales and marketing are the second-largest segments projected to grow over the forecast period. Aviation analytics allows management to collect data associated with their passengers from several sources on customer purchasing and advertising and targeting those customers while booking tickets about their recent offers and discounts, contributing to revenue growth over the forecast period.

Wealth management segment is expected to account for the largest share in 2030

The wealth management segment is expected to dominate the market over the forecast period. Aviation analytics provides a solution for airport management, real-time monitoring of airport operations, mobile maintenance, and decision-making solutions in managing wealth which is likely to have a positive impact on revenue growth over the forecast period.

In addition, this solution plays an important role in planning portfolios, according to the financial reports, which reduces cost and increases effectiveness which supports segment growth.

Airlines segment is expected to grow at a highest CAGR during forecast period

The airline segment is attributed to growing at the highest CAGR over the forecast period owing to the increase in disposable income of the middle-class population and emerging airlines. In addition, small airlines are expected to grow significantly owing to the number of aviation passengers, availability of low-cost airlines, and demand for solutions to maintain flight data & customer analytics boosts the market growth.

Asia Pacific is expected to dominate and witness fastest growth over the forecast period

The Asia Pacific is expected to witness faster growth over the forecast period owing rising aviation industry with better operational & cost-effectiveness and better consumer experience across the countries like China, India, South Korea, Japan, and Malaysia.

In addition, the rising investments and developments in cloud technologies are expected to drive demand over the forecast period. Moreover, adopting modern technologies with digital transformation to improve operation and aircraft safety across these regions supports segment growth.

Competitive Insight

Some of the major players operating in the global market include Atheer, Inc., Aviation Intelligence Ltd, Beep Analytics Aps, Booz Allen Hamilton, Capgemini, Genral Electric, Graymatter Software Services Pvt Ltd, Hexaware Technologies Limited, Honeywell International Aviation Analytics Ltd, IBM Corporation, Ins Software, Ifs, Innodatatics Inc, Lufthansa Technik, Mercator, Mu Sigma, Oracle Corporation, Ramco Systems, Relx Group Plc, Rusada, Sap Se, Asas Institute Inc, Swiss Aviation Software Ltd, Windward Islands Airways International N.V, and Zestiot.

Recent Developments

In July 2022, General Electric signed a memorandum of understanding with Teradata and Microsoft to work on a designed solution to reduce carbon emissions. The companies will work on a product that will provide pilots with equipment to monitor emissions, report, and take immediate action to minimize them.

In July 2022, Malaysia Airlines extended its partnership with SITA to complete its upgrade that offers secure, speedy, and consistent network connectivity between its hub in Kuala Lumpur and its overseas operations. In addition, SITA will help travelers to reduce the cost of connectivity and enhance service quality to access new services.

Aviation Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2.73 billion |

|

Revenue forecast in 2030 |

USD 6.92 billion |

|

CAGR |

12.3% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Deployment, By Business Function, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Atheer, Inc., Aviation Intelligence Ltd, Beep Analytics Apps, Booz Allen Hamilton, Capgemini, General Electric, Graymatter Software Services Pvt Ltd, Hexaware Technologies Limited, Honeywell International Aviation Analytics Ltd, IBM Corporation, Ins Software, Ifs, Innodatatics Inc, Lufthansa Technik, Mercator, Mu Sigma, Oracle Corporation, Ramco Systems, Relx Group Plc, Rusada, Sap Se, Asas Institute Inc, Swiss Aviation Software Ltd, Windward Islands Airways International N.V, and Zestiot. |