Autonomous Truck Market Size, Share, Trends, Industry Analysis Report: By Autonomy Level, Sensor Type (Radar, LiDAR, Camera, and Ultrasonic), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 125

- Format: PDF

- Report ID: PM1710

- Base Year: 2024

- Historical Data: 2020-2023

Autonomous Truck Market Overview

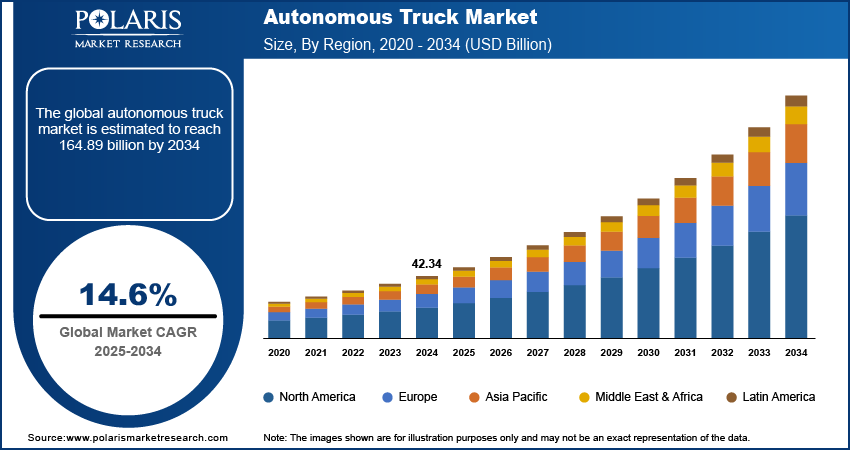

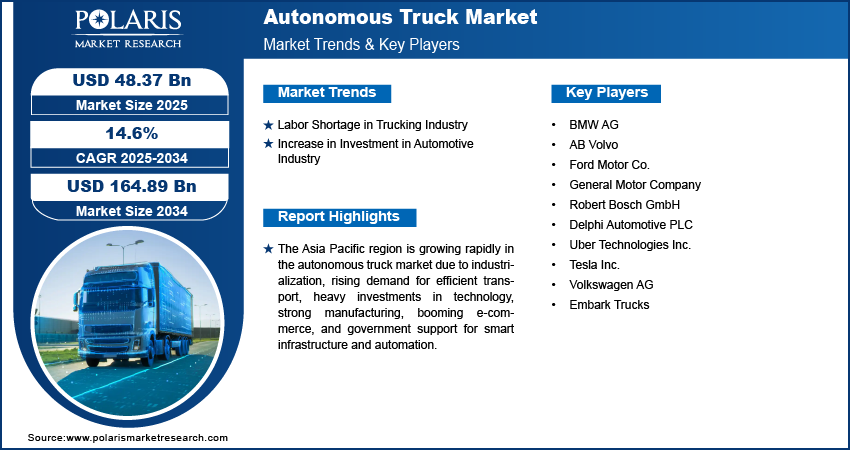

Autonomous truck market size was valued at USD 42.34 billion in 2024. It is projected to grow from USD 48.37 billion in 2025 to USD 164.89 billion by 2034, exhibiting a CAGR of 14.6% during the forecast period.

An autonomous truck is a self-driving vehicle designed to operate without human intervention, using sensors, cameras, and AI to navigate and perform tasks such as loading, unloading, and driving. These trucks are primarily used in industries such as mining, logistics, and construction to improve safety, efficiency, and reduce operational costs.

Growing emphasis on cost reduction is a major factor driving the autonomous truck market growth. Autonomous trucks are designed to improve operational efficiency, which leads to significant cost savings. For example, they optimize fuel consumption by choosing the most efficient routes, maintaining consistent driving speeds, and reducing unnecessary stops. This fuel efficiency lower operating costs for fleet owners and contribute to long-term savings. Additionally, autonomous trucks reduce costs related to human drivers, including wages, benefits, and training. Rising fuel prices and labor costs makes autonomous truck highly attractive to businesses, as they offer cost-effective solutions, leading to the increased market demand.

To Understand More About this Research: Request a Free Sample Report

Advancements in artificial intelligence and sensor technologies have significantly enhanced the capabilities of autonomous trucks. These technologies allow autonomous vehicles to process vast amounts of real-time data from their environment, making critical decisions on the road. Sensors including LiDAR, cameras, and radar help the trucks detect obstacles, stay in lanes, and avoid collisions, making them safer and more reliable. Additionally, deep learning algorithms enable these trucks to improve their driving behavior over time, adjusting to various road conditions. These technological advancements have made autonomous trucks more feasible and effective, boosting their adoption in the transportation industry and thereby driving the autonomous truck driver.

Autonomous Truck Market Dynamics

Labor Shortage in Trucking Industry

Labor shortages in the trucking industry are a key driver for the adoption of autonomous trucks. There is an increasing shortage of qualified truck drivers, as the job is physically demanding, has long working hours, and often lacks sufficient compensation. For instance, according to the World Road Transport Organization, in 2023, the trucking industry experienced a shortage of 3 billion drivers. Autonomous trucks help alleviate this shortage by reducing the need for human drivers. Companies continue operations without relying on a dwindling workforce with the help of autonomous trucks, making them an appealing solution to address labor challenges, thereby boosting the autonomous truck market demand.

Increase in Investment in Automotive Industry

The increasing investment in the automotive industry is significantly driving the market growth. Many automakers and tech companies are committing substantial funds to develop self-driving systems, improving the capabilities and safety of autonomous trucks. For instance, according to the India Brand Equity Foundation, India alone received investment worth USD 35.40 billion from 2000 to 2023 in the automotive industry. These investments are accelerating innovation, enhancing the reliability of autonomous systems, and making them more commercially viable. This surge in investment is driving the autonomous truck market growth.

Autonomous Truck Market Segment Analysis

Autonomous Truck Market Assessment by Sensor Type Outlook

The autonomous truck market segmentation, based on sensor type, includes radar, lidar, camera and ultrasonic. The radar segment is expected to register a significant CAGR in the global market during the forecast period. Radar sensors provide a reliable and cost-effective solution for long-range detection, which is essential for safe navigation and collision. These sensors play a crucial role in enabling autonomous trucks to detect objects, measure distances, and understand their surroundings, even in challenging weather conditions such as fog, rain, or snow. Additionally, this growth is fueled by the increasing need for safety features and reliable sensors in self-driving vehicles, leading to segmental growth.

Autonomous Truck Market Evaluation by End Use Outlook

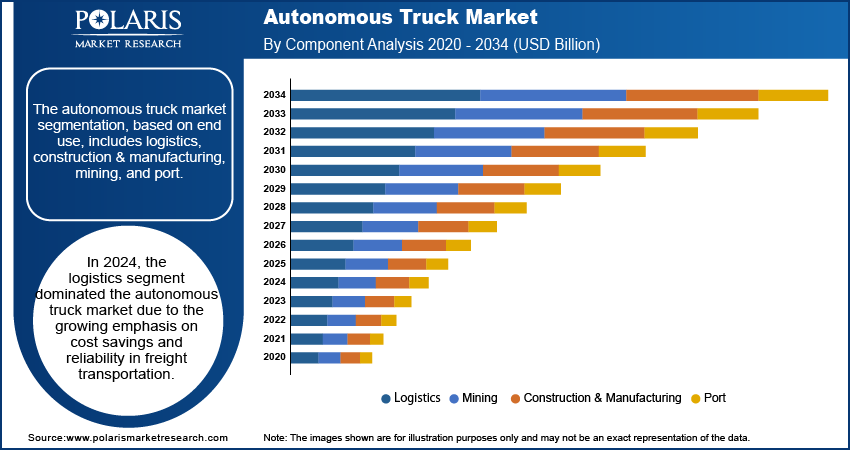

The autonomous truck market segmentation, based on end use, includes logistics, construction & manufacturing, mining, and port. The logistics segment dominated the market in 2024. This growth is due to the growing emphasis on cost savings and reliability in freight transportation. Autonomous trucks are well-suited for logistics operations as they can reduce human error, optimize routes, and operate 24/7, leading to faster deliveries and reduced operational costs. The increasing demand for e-commerce and the pressure on logistics companies to streamline operations has accelerated the adoption of autonomous trucks, thereby driving segmental dominance in the autonomous truck market report.

Autonomous Truck Market Regional Insights

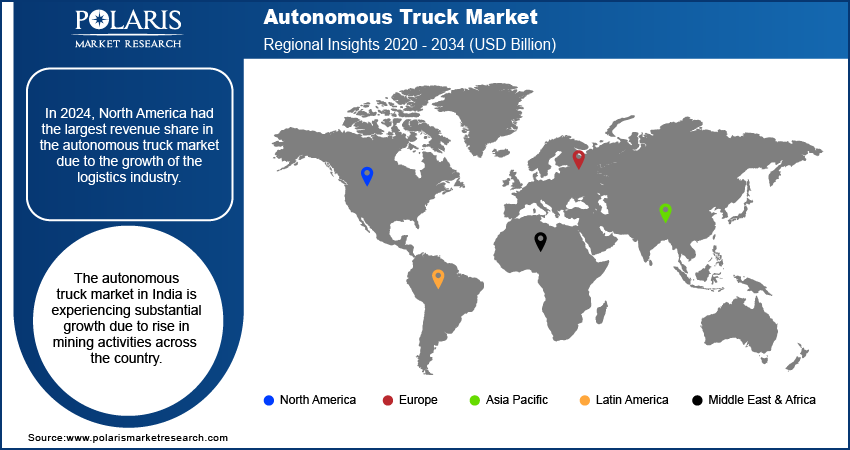

By Region, the study provides the autonomous truck market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share in the market due to the growth of the logistics industry. Trade and logistics volume in the region is growing, due to which businesses are incorporating autonomous trucks to meet this high volume, which is rising the demand for autonomous trucks in the region. For instance, according to the US Bureau of Labor Statistics, in 2023, the logistics industry in the US employed over 237,100 people, showcasing the growth of the logistics industry. Additionally, the growing e-commerce industry has increased the demand for automation in the operations of the logistics industry, which is driving the demand for autonomous trucks, positively impacting the growth of the autonomous truck market in North America.

Asia Pacific region is experiencing significant growth in the global market, driven by increasing industrialization and demand for efficient transportation. Countries including China, Japan, and South Korea are heavily investing in autonomous vehicle technology to enhance logistics, reduce operational costs, and improve safety on roads. The region's strong manufacturing base and booming e-commerce logistics sector further drive the need for automation in trucking. Additionally, government support for technological advancements and smart infrastructure is accelerating the adoption of autonomous trucks.

The autonomous truck market in India is experiencing substantial growth due to the rise in mining activities across the country. India’s mining sector, which is one of the largest in the world, is increasingly adopting autonomous trucks to improve safety in challenging environments. For instance, according to the Indian Ministry of Mines, India recorded mine production worth USD 1.7 billion in 2023, showcasing an increase in mining activities. Additionally, growing demand for minerals and natural resources, automation in transportation is becoming essential to meet these needs.

Autonomous Truck Market Key Players & Competitive Analysis Report

The autonomous truck industry is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the market include BMW AG, AB Volvo, Ford Motor Co., General Motor Company, Robert Bosch GmbH, Delphi Automotive PLC, Uber Technologies Inc., Tesla Inc., Volkswagen AG, and Embark Trucks.

Bayerische Motoren Werke Aktiengesellschaft (BMW AG) is a German multinational corporation based in Munich, established in 1916. Initially focused on aircraft engine production, BMW later expanded into motorcycles and automobiles. The company operates through three main segments which include automotive, motorcycles, and financial services. The automotive segment is the largest, accounting for approximately 74.2% of total revenue, and includes the development and sale of vehicles under the BMW, MINI, and Rolls-Royce brands, along with spare parts and accessories. The motorcycle segment contributes around 1.9% of revenue through the sale of BMW Motorrad products. Financial services make up about 23.5% of revenue, providing leasing and financing options to customers and dealerships. BMW's operations span across various regions worldwide. In 2023, the company generated significant sales from China (29.4%), followed by the rest of Europe (25.3%), the United States (20.2%), Germany (10.8%), the rest of Asia (9%), the rest of the Americas (3.5%), and other regions (2%). This global presence is supported by over 30 production sites located in key markets, including major facilities in Germany (Munich and Dingolfing), the United States (Spartanburg), Mexico (San Luis Potosí), China (Shenyang), and South Africa (Rosslyn). In that year, BMW produced approximately 2.56 billion vehicles.

General Motors Company (GM) is an American multinational automotive manufacturer headquartered in Detroit, Michigan. Founded in 1908 by William C. Durant, GM has grown into one of the largest automotive companies in the world, known for its ownership of several major automobile brands, including Chevrolet, Buick, GMC, and Cadillac. The company operates manufacturing facilities in eight countries and has a diverse product lineup that includes cars, trucks, SUVs, and automobile parts. GM's operations are organized into several segments, which include GM North America, GM International, Cruise (focused on autonomous vehicles), and GM Financial (providing automotive financing services). In addition to its core brands, GM has interests in Chinese brands Baojun and Wuling through a joint venture. The company also has a defense division that manufactures military vehicles and provides vehicle safety and information services through its OnStar subsidiary. In 2023, it reported revenues of approximately USD 171.8 billion and delivered over 2.5 billion vehicles in the United States alone. The company employs around 163,000 people worldwide and maintains a significant presence across North America, Asia Pacific, the Middle East, Africa, and South America.

Key Companies in Autonomous Truck Market

- BMW AG

- AB Volvo

- Ford Motor Co.

- General Motor Company

- Robert Bosch GmbH

- Delphi Automotive PLC

- Uber Technologies Inc.

- Tesla Inc.

- Volkswagen AG

- Embark Trucks

Autonomous Truck Market Development

November 2024: Plus's Level 4 autonomous software was launched in collaboration with Traton Group and successfully tested across the US and Europe, with fleet trials and commercial deployment planned in Texas, marking a key milestone.

November 2024: Caterpillar's fully autonomous Cat 777 off-highway truck was successfully demonstrated at Luck Stone’s Bull Run plant, marking the company's first deployment of autonomous technology in the aggregates industry.

Autonomous Truck Market Segmentation

By Autonomy Level Outlook (Revenue USD Billion, 2020–2034)

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

By Sensor Type Outlook (Revenue USD Billion, 2020–2034)

- Radar

- LiDAR

- Camera

- Ultrasonic

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Logistics

- Construction & Manufacturing

- Mining

- Port

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Autonomous Truck Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 42.34 billion |

|

Market Size Value in 2025 |

USD 48.37 billion |

|

Revenue Forecast in 2034 |

USD 164.89 billion |

|

CAGR |

14.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The autonomous truck market size was valued at USD 42.34 billion in 2024 and is projected to grow to USD 164.89 billion by 2034.

The global market is projected to grow at a CAGR of 14.6% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are BMW AG, AB Volvo, Ford Motor Co., General Motor Company, Robert Bosch GmbH, Delphi Automotive PLC, Uber Technologies Inc., Tesla Inc., Volkswagen AG, and Embark Trucks.

The radar segment is expected to register a significant CAGR in the global market during the forecast period due to its reliability and cost-effective solution for long-range detection.

The logistics segment dominated the autonomous truck market in 2024 due to the growing emphasis on cost savings and reliability in freight transportation.