Autonomous Train Market Share, Size, Trends, Industry Analysis Report, By Level of Automation (GoA 1, GoA 2, GoA3 & GoA 4); By Technology; By Component; By Train Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4716

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

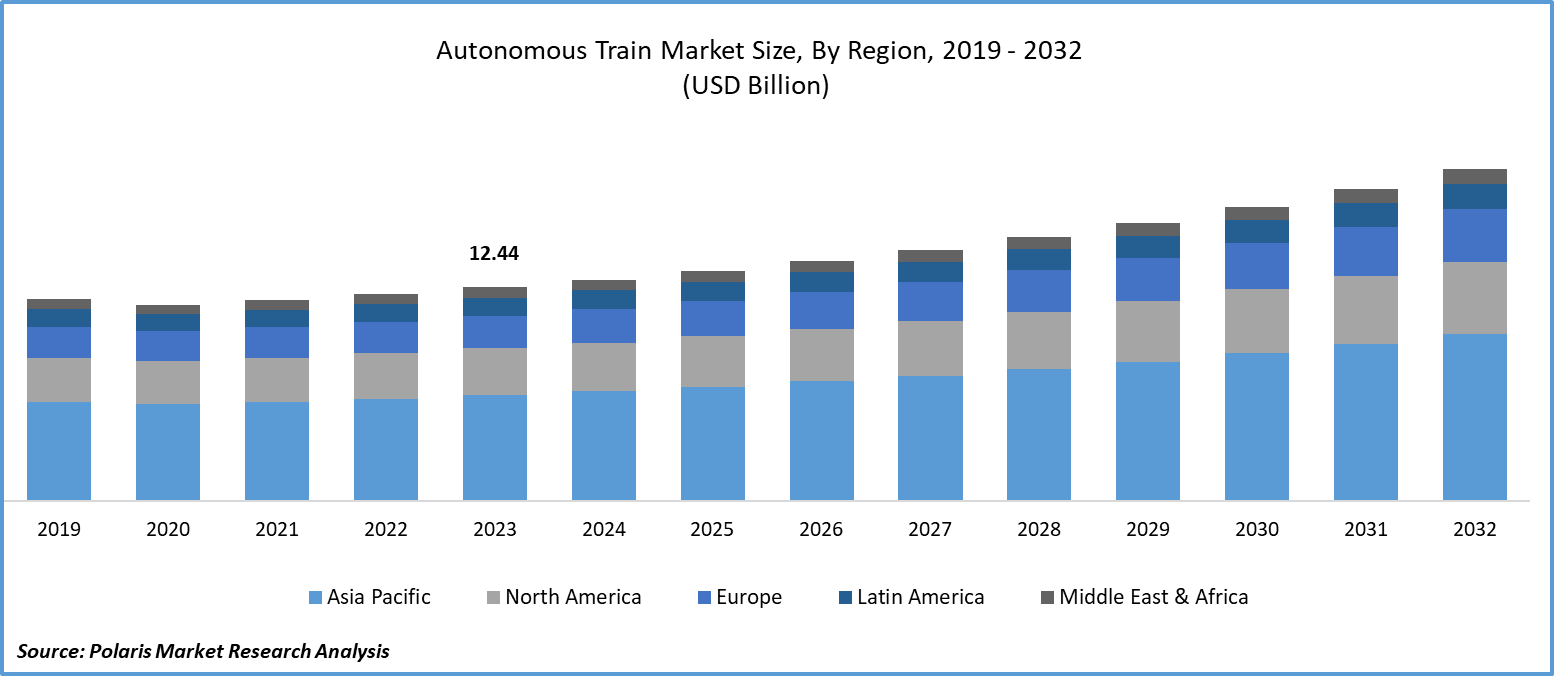

Global autonomous train market size was valued at USD 12.44 billion in 2023. The market is anticipated to grow from USD 12.89 billion in 2024 to USD 19.33 billion by 2032, exhibiting the CAGR of 5.2% during the forecast period

Autonomous Train Market Overview

Following roads, trains have been at the forefront of transportation automation, particularly in terms of electrification. This has played a crucial role in advancing automated transport methods across the global transportation industry. In industries such as mining and heavy-haul, where distances can be extensive, reaching up to 2000 km or more, automated locomotives offer a competitive alternative to traditional diesel locomotives. Autonomous trains are generally well-regarded in most regions and large countries. However, the level of automation is often influenced by local regulations, which can impose limitations and hinder progress in railway automation.

For instance, in January 2024, Wabtec Corporation created the energy-management program Trip Optimizer to operate trains for more than 1 billion vehicle miles in an effective manner. The software regulates the locomotive's throttle and dynamic brakes automatically in order to minimize fuel consumption and optimize train handling.

To Understand More About this Research:Request a Free Sample Report

With automated functionalities and enhanced safety attributes, these trains could transform the transportation sector. Progress in artificial intelligence, LiDAR sensors, and communication technologies is crucial for ensuring seamless and effective operations, allowing trains to navigate tracks, identify obstacles, and make instantaneous decisions. The increasing need for eco-friendly transportation is propelling industry expansion. This requirement can be met by developing autonomous trains that operate on renewable energy sources, lessening dependence on fossil fuels, and promoting a more environmentally friendly and sustainable tomorrow.

However, the autonomous train market growth suffered substantial setbacks due to the COVID-19 pandemic. Disruptions in supply chains, project delays, and financial constraints all contributed to difficulties in implementing autonomous train systems. However, the pandemic underscored the importance of safe and contactless transportation solutions, which is expected to drive increased adoption of autonomous trains in the future.

Autonomous Train Market Dynamics

Market Drivers

Rising Demand for Digitalization of Railways and Quick Transit is Projected to Spur the Product Demand

The global railway industry is experiencing a steady rise in rail traffic, leading to a continuous need for robust safety systems. This trend is expected to drive an increase in railway budgets worldwide, supporting the expansion of the autonomous train market development. With the growing number of railways globally, there is a growing expectation for autonomous technologies to enter the market, further fueling market growth. Moreover, the anticipated period is expected to offer significant opportunities for market expansion. This is attributed to ongoing improvements in railway infrastructure, particularly in emerging economies, which are enhancing the overall efficiency and safety of rail transportation. Additionally, there is a noticeable shift towards using trains for freight transfer, which is expected to drive the demand for autonomous train technologies further.

Enhanced Operational Safety Benefits

Highly automated trains offer better speed control, efficient traffic management, and reduce accidents caused by human error. Lawsuits for train accidents due to driver negligence are expensive. The European Union and the rail industry support Shift2Rail, aiming for safety, interoperability, and reliability in the European rail network. Automated Train Operation enhances operational safety by automating train operations, with the Grade of Automation (GOA) indicating the level of automation up to GOA level 4, where trains operate autonomously without onboard personnel. ATO is mainly used in transit and rapid transit systems for easier safety management, often with a driver present for emergencies.

Market Restraints

Growing Preference for Alternative Transportation Modes Owing to Exorbitant Cost

In most metropolitan areas, there is competition among various modes of transportation, including rail transportation and alternatives such as bus transit, ride-hailing, ride-sharing, and personal commuting. The bus rapid transit (BRT) system, designed to enhance capacity and reliability compared to traditional buses, features bus-only lanes on public streets and prioritizes buses at junctions, increasing efficiency and reducing delays. This competitive landscape challenges the market for rail transportation.

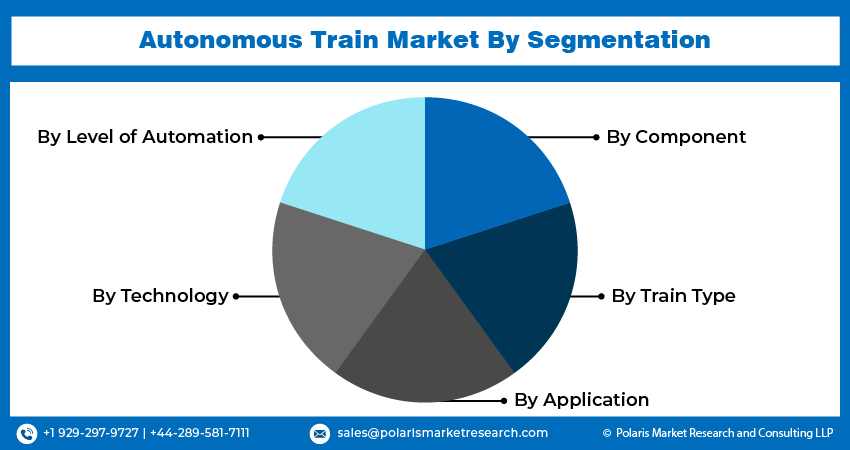

Report Segmentation

The market is primarily segmented based on level of automation, technology, component, train type, application, and region.

|

By Level of Automation |

By Technology |

By Component |

By Train Type |

By Application |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Autonomous Train Market Segmental Analysis

By Level of Automation Analysis

The GoA 2 segment is expected to dominate the market share during the autonomous train market forecast period. One of the core levels of train automation is represented by this market segment, which is present in several train classifications.

The GoA 4 segment is anticipated to grow at the fastest CAGR during the autonomous train market forecast period. The main factors driving the growth of the GOA 4 segment are the need for increased safety as well as cost savings and rail network optimization, in addition to other current projects and national investments in transportation and infrastructure.

By Technology Analysis

The CBTC segment is expected to grow at the fastest CAGR during the autonomous train market forecast period. Communication-based train control (CBTC) utilizes telecommunications between track equipment and trains for traffic management and infrastructure regulation, offering a more precise train position compared to traditional signaling systems. This improves railway traffic management in terms of efficiency and safety, allowing metros and other rail systems to increase headways while maintaining or improving safety levels. In modern CBTC systems, trains continuously calculate and transmit their status to wayside equipment along their route, including their exact location, speed, direction of travel, and braking distance. This information enables the calculation of the train's potential occupancy area on the track.

By Component Analysis

Based on the component analysis, the market has been segmented on the basis of the tachometer, doppler, accelerometer, camera, antenna, radio set, odometer, radar, and lidar. The camera segment is anticipated to hold the largest market size during the autonomous train market forecast period. To ensure safety, trains need to maintain clear tracks. External cameras mounted on trains serve multiple purposes, aiding operators in ensuring clear entrances to prevent accidents. They also help monitor the pantograph, crucial for trains drawing power from overhead lines, allowing operators to identify the cause and timing of any failures. The camera segment of the autonomous train market demand is expanding due to advancements in lens technology, enhancing safety and accident prevention.

Autonomous Train Market Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Market Share in 2023

The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. Asia-Pacific boasts one of the world's largest rail networks, with countries like India, China, and Japan hosting some of the longest rail lines. Public transportation, especially the metro system in India, is widely popular for daily commutes, highlighting the significance of the railway system to the region's economic development. The Asia-Pacific region encompasses a mix of developed and developing economies, including Indonesia, Bangladesh, Malaysia, and Singapore. The market in these countries is expected to be stimulated by new rail projects aimed at upgrading and maintaining the existing fleet, as well as enhancing urban passenger transportation.

The Europe region is expected to be the fastest-growing region, with a healthy CAGR during the projected period. Europe boasts one of the world's largest rail systems, with upcoming railway projects and innovations driving the autonomous train market opportunity in the region. Train travel is highly prevalent in many European countries, including Germany, where cities and villages alike are well-connected by a network of railway stations, indicating the widespread popularity of trains over other modes of transport like buses. Federal regulations in Germany restrict bus speeds to 100 km/h (62 mph). In comparison, "low-speed" trains can reach 160 km/h (99 mph), further emphasizing the importance of railways in Europe and bolstering the market for autonomous trains.

Competitive Landscape

The autonomous train market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ABB Ltd.

- Alstom SA

- American Equipment Company

- Beijing Traffic Control Technology

- Bombardier Transportation

- CRCC Corporation Limited

- General Electric

- Hitachi Rail STS

- Ingeteam Corporation SA

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries Ltd.

- Siemens AG

- Thales Group

- Wabtec Corporation.

Recent Developments

- In January 2024, Siemens AG inducted ETCS in trains within the Pääkaupunkiseudun Junakalusto Oy fleet as part of the Finnish DigiRail project. Sweden will test ETCS according to the latest standards in the European technical specification, TSI 2023.

- In December 2023, Alstom SA's Innovia monorail trains began operating in commercial capacity on Thailand's MRT Pink Line in Bangkok. The highly crowded Khae Rai will be connected to Min Buri by the 34.5 km Pink Line, which has 30 stations. The automated train operation (ATO) grade of operation 4 (GoA4), which enables the monorail to run entirely autonomously without the assistance of a driver or attendant, will be installed on the elevated new monorail.

- In July 2023, Hitachi Ltd. introduced the "Over and Back" testing solution as part of South East Queensland's Cross River Rail project in Brisbane, allowing for the quick and seamless transition between the current interlocking (a railway signaling system) and the soon-to-be-introduced new digital signaling system (European Train Control System, or ETCS L2).

Report Coverage

The autonomous train market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, level of automation, technology, component, train type, application, and their futuristic growth opportunities.

Autonomous Train Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.89 billion |

|

Revenue forecast in 2032 |

USD 19.33 billion |

|

CAGR |

5.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Level of Automation, By Technology, By Component, By Train Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle, East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Autonomous Train market size is expected to reach USD 19.33 billion by 2032

Key players in the market are ABB Ltd., Alstom SA, American Equipment Company, Hitachi Rail STS, Beijing Traffic Control Technology, CRCC Corporation Limited

Asia Pacific contribute notably towards the global Autonomous Train Market

Autonomous Train Market exhibiting the CAGR of 5.2% during the forecast period

The Autonomous Train Market report covering key segments are level of automation, technology, component, train type, application and region.