Autonomous Tractors Market Size, Share, Trends, Industry Analysis Report: By Horsepower (Up to 30HP, 31HP to 100HP, and Above 100HP), Automation, Technology, Application, Crop Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM3518

- Base Year: 2024

- Historical Data: 2020-2023

Autonomous Tractors Market Overview

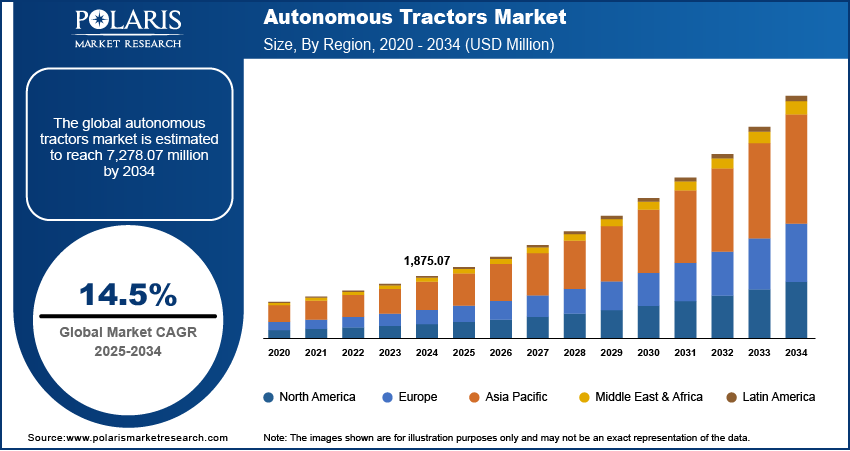

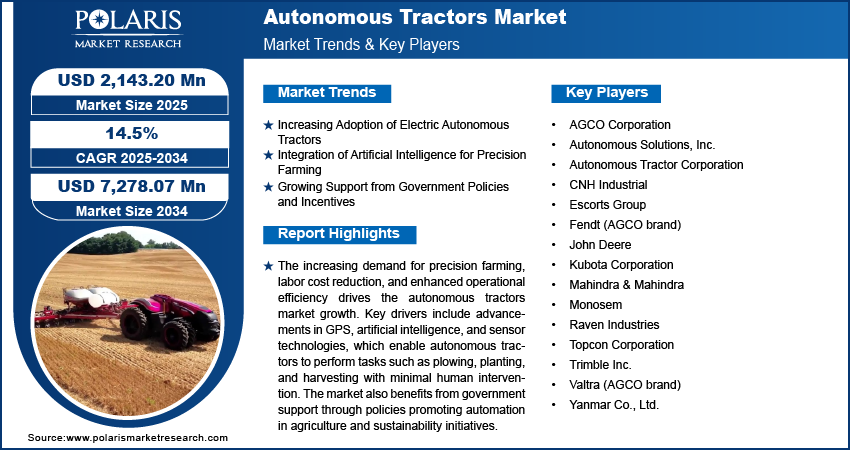

The autonomous tractors market size was valued at USD 1,875.07 million in 2024. The market is projected to grow from USD 2,143.20 million in 2025 to USD 7,278.07 million by 2034, exhibiting a CAGR of 14.5% during 2025–2034.

The autonomous tractors market focuses on the development and adoption of self-driving tractors used in agricultural operations. These tractors leverage advanced technologies such as GPS, artificial intelligence (AI), and machine learning to automate tasks, including plowing, seeding, and harvesting. The increasing demand for precision farming, the need to reduce labor costs, and the push for higher efficiency and productivity in agriculture drive the market growth. Additionally, autonomous tractors market trends such as the integration of IoT devices, the development of electric autonomous tractors, and regulatory support for automation in agriculture are expected to propel market expansion during the forecast period. The growing emphasis on sustainable farming practices and the potential for autonomous tractors to optimize resource use also contribute to the market evolution.

To Understand More About this Research: Request a Free Sample Report

Autonomous Tractors Market Dynamics

Increasing Adoption of Electric Autonomous Tractors

The shift toward electric autonomous tractors is gaining momentum in the agricultural industry. As environmental concerns grow, electric-powered machinery offers a sustainable alternative to traditional diesel-powered tractors. These tractors reduce greenhouse gas emissions and lower fuel costs, making them more appealing to farmers. In a 2022 study by the International Energy Agency (IEA), electric vehicles, including agricultural machinery, were highlighted as a key solution for reducing carbon footprints in the agricultural sector. Electric autonomous tractors also benefit from advancements in battery technology, which extend operational hours and improve efficiency. The adoption of electric autonomous tractors is expected to increase as governments implement stringent environmental regulations and provide incentives for clean energy solutions, which would boost the autonomous tractors market demand in the coming years.

Integration of Artificial Intelligence for Precision Farming

Artificial intelligence (AI) plays a pivotal role in enhancing the capabilities of autonomous tractors. By integrating AI, tractors can perform tasks with high precision, including soil analysis, crop monitoring, and optimal resource management. AI allows for better decision-making in real time, ensuring that tractors adjust their operations based on soil conditions, weather, and crop health. The rise of AI-driven technology in farming is leading to more efficient use of fertilizers, water, and seeds, thereby increasing yield while reducing costs. Thus, the rising integration of AI for precision farming is projected to fuel the autonomous tractors market development during the forecast period.

Growing Support from Government Policies and Incentives

Government policies and incentives are critical in driving the adoption of autonomous tractors. Various governments worldwide are introducing regulations that encourage automation in agriculture to boost productivity, deal with labor shortages, and improve sustainability. For example, the US Department of Agriculture (USDA) has been working on initiatives to support smart farming technologies through grants and funding for research and development. In Europe, the European Commission's Green Deal emphasizes the need for technological advancements to achieve sustainable farming practices. These supportive policies are creating a favorable environment for innovation and reducing the financial barriers for farmers to adopt autonomous solutions. Hence, growing support from the government through policies and incentives propels the autonomous tractor market growth.

Autonomous Tractors Market Segment Insights

Autonomous Tractors Market Outlook – Horsepower-Based Insights

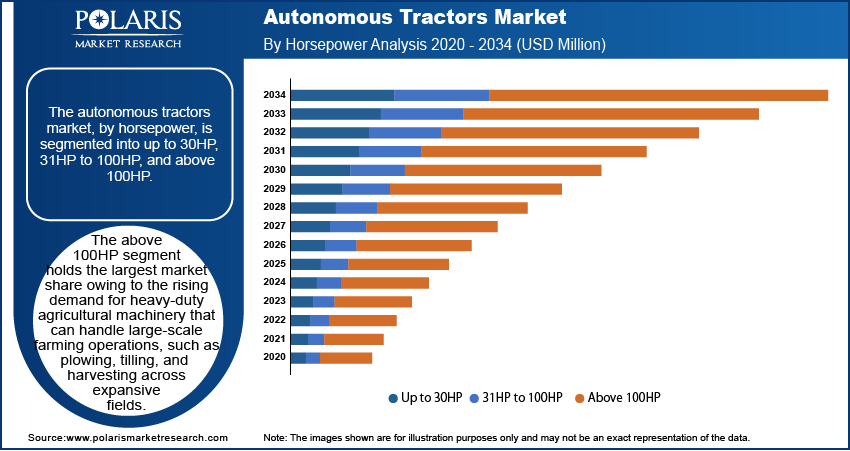

The autonomous tractor market, by horsepower, is segmented into up to 30HP, 31HP to 100HP, and above 100HP. The above 100HP segment holds the largest market share owing to the rising demand for heavy-duty agricultural machinery that can handle large-scale farming operations, such as plowing, tilling, and harvesting across expansive fields. These tractors can perform numerous tasks with greater efficiency, making them suitable for commercial and industrial farming. The robust capabilities of these high-horsepower tractors in terms of both performance and endurance have made them the preferred choice for large farms seeking automation solutions to improve productivity. Moreover, this segment is registering the highest growth as the rising adoption of precision farming techniques and technological advancements continue to push the boundaries of what is achievable with autonomous machinery.

As the focus on sustainability and operational efficiency grows, the segment of tractors with horsepower ratings up to 30HP and 31HP to 100HP is also experiencing increased interest, particularly in smaller and medium-scale farms. These segments are seeing a steady rise due to their cost-effectiveness and versatility for various agricultural tasks. While they do not yet hold the largest share, their potential for growth is significant, driven by the desire for smaller, more affordable autonomous tractors that can be used for specific tasks such as tilling, planting, and crop monitoring in less expansive fields. This shift toward adopting autonomous tractors in smaller operations indicates the autonomous tractor market expansion across various farm sizes.

Autonomous Tractors Market Assessment – Automation-Based Insights

The autonomous tractor market, by automation, is bifurcated into fully automated and semi-automated. The fully automated segment holds a larger market share. This segment benefits from the increasing demand for advanced technology that minimizes the need for human intervention in farming operations. Fully automated tractors are equipped with sophisticated sensors, AI systems, and GPS technologies that allow them to autonomously perform various tasks such as navigation, task execution, and operational adjustments. The growing emphasis on maximizing operational efficiency and reducing labor costs is propelling the adoption of fully automated tractors, particularly in large-scale farming operations. This segment is also registering the highest growth, driven by technological advancements and the desire for higher precision in agricultural tasks, as well as favorable government policies supporting automation in agriculture.

The semi-automated segment is experiencing growth at a slower pace compared to fully automated tractors. Semi-automated tractors still require human involvement for certain tasks, such as steering or monitoring, but they offer automation for specific functions such as seed planting or fertilizer application. This segment appeals to farmers who seek a balance between automation and traditional manual labor, offering a more cost-effective solution while still improving productivity. The semi-automated tractors segment is gaining traction in smaller to medium-sized farms where the investment in fully automated systems may not be as feasible. Despite not having the same growth rate as the fully automated segment, the semi-automated segment is expected to see continued demand as technology improves and more affordable options become available.

Autonomous Tractors Market Evaluation – Technology-Based Insights

The autonomous tractor market, by automation, is segmented into GPS guidance, sensor-based, and remote control. The GPS guidance segment holds the largest market share owing to the widespread adoption of GPS-based technologies in agricultural machinery. GPS guidance systems are integral to autonomous tractors as they enable precise navigation, accurate positioning, and efficient route planning, significantly enhancing operational efficiency. These systems allow for seamless execution of various farming tasks such as field mapping, seeding, and harvesting, by providing real-time location data. The increasing demand for precision agriculture, which focuses on optimizing inputs such as water, fertilizers, and seeds, is a key factor driving the growth of GPS-guided autonomous tractors. Furthermore, as GPS technology continues to improve in terms of accuracy and cost-effectiveness, the segment is witnessing consistent growth.

The sensor-based technology segment is growing rapidly, largely driven by its ability to provide real-time data for decision-making processes in farming operations. Sensors, including LiDAR, radar, and optical sensors, are used in autonomous tractors to monitor crop conditions, detect obstacles, and enhance the tractor's ability to perform tasks autonomously in diverse environments. This segment is registering strong growth due to its potential to improve the accuracy of operations, reduce the risk of human error, and enhance safety in automated farming. Sensor-based systems enable autonomous tractors to gather and analyze data, thus improving overall farm management and productivity. While the sensor-based segment is expanding, GPS guidance remains the dominant technology, though advancements in sensor technology are expected to drive increased adoption in the coming years.

Autonomous Tractors Market Outlook – Application-Based Insights

The autonomous tractor market, by application, is segmented into tillage, harvesting, planting & seeding, and others. The tillage application segment holds the largest market share. Tillage is a critical process in preparing the soil for planting, and autonomous tractors are increasingly being used to perform this task with high precision and efficiency. The ability of autonomous tractors to automate tillage operations reduces labor costs, minimizes soil compaction, and optimizes soil health by ensuring consistent and uniform operations. As the demand for precision farming grows, tillage automation is being prioritized by large-scale farms looking to enhance operational efficiency. The advancements in tillage-related technologies, such as GPS guidance and sensor-based systems, are further driving the growth of this segment, as they enable autonomous tractors to perform tillage tasks more accurately and with greater productivity.

The harvesting segment is experiencing significant growth, driven by the need to optimize the harvesting process for higher yields and reduced crop loss. Autonomous tractors equipped with advanced sensors and AI systems can efficiently harvest crops, reducing the dependence on manual labor, which is often scarce during peak harvest periods. The integration of automation in harvesting provides advantages such as faster operation, more accurate timing, and the ability to work under various environmental conditions, all of which are essential for large-scale and precision agriculture. As technologies improve and autonomous solutions become more cost-effective, the harvesting segment is expected to witness strong growth, particularly as farmers seek to automate more time-sensitive processes such as harvesting to reduce labor costs and improve overall productivity.

Autonomous Tractors Market Regional Analysis

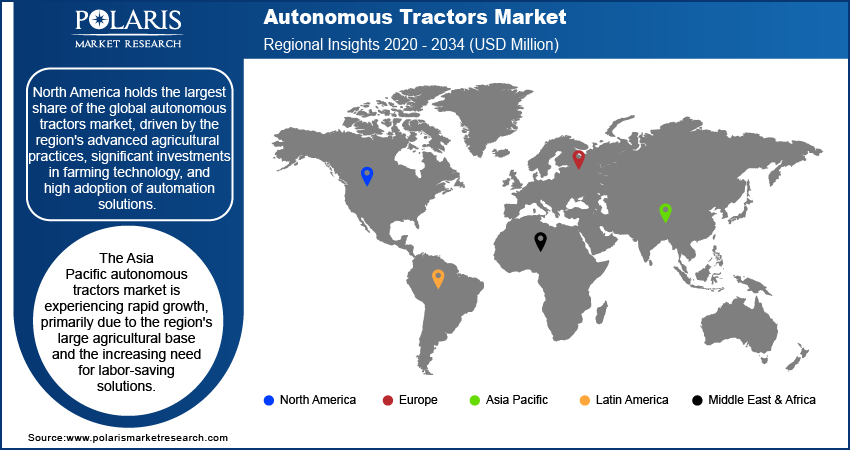

By region, the study provides autonomous tractor market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share of the global autonomous tractors market revenue, driven by the region's advanced agricultural practices, significant investments in farming technology, and high adoption of automation solutions. The US, in particular, leads the market due to its large-scale commercial farming operations and a strong focus on improving agricultural efficiency through automation. Government incentives and a favorable regulatory environment also contribute to the rising adoption of autonomous tractors in the region. Additionally, the increasing demand for precision farming to optimize resource use and reduce labor shortages further accelerates the autonomous tractor market expansion. While Europe and Asia Pacific are also growing rapidly due to advancements in technology and agricultural needs, North America remains the dominant market owing to its well-established agricultural infrastructure and adoption of innovative farming technologies.

The Europe autonomous tractors market is witnessing steady growth owing to increasing investments in precision farming and the region's push for sustainable agriculture. Countries such as Germany, France, and the UK are early adopters of autonomous farming technologies due to their advanced agricultural sectors and favorable government policies supporting automation. The European Union's Green Deal, which aims to reduce carbon emissions and promote sustainable farming practices, has further spurred the adoption of autonomous tractors. Additionally, the region's emphasis on reducing labor shortages in agriculture and improving operational efficiency is contributing to the growth of this regional market. The growing demand for automation in various farming applications such as tillage, planting, and harvesting is expected to continue fueling market expansion in Europe.

The Asia Pacific autonomous tractors market is experiencing rapid growth, primarily due to the region's large agricultural base and the increasing need for labor-saving solutions. Countries such as China, India, and Japan are leading in adopting automation to address labor shortages and improve agricultural productivity. In China, the government's push to modernize agriculture and enhance food security through technological advancements has driven significant interest in autonomous farming solutions. Similarly, in India, the growing demand for efficient farming practices in large-scale operations is accelerating the adoption of autonomous tractors. While the market in Asia Pacific is still developing compared to North America and Europe, rapid technological advancements and increasing government support are expected to drive strong growth of the regional market in the coming years.

Autonomous Tractors Market – Key Market Players and Competitive Insights

A few key players in the autonomous tractors market are John Deere, CNH Industrial, AGCO Corporation, Kubota Corporation, and Mahindra & Mahindra. Other notable companies are Trimble Inc.; Raven Industries; Monosem; Topcon Corporation; Yanmar Co., Ltd.; and Autonomous Solutions, Inc. Additionally, companies such as Escorts Group, Fendt (a brand under AGCO), Valtra (owned by AGCO), and Autonomous Tractor Corporation are active participants. These companies are focusing on integrating advanced technologies such as GPS guidance, AI, and sensor-based systems into their tractors, making them autonomous and capable of performing various agricultural tasks. Many of these firms are also working on collaborations and partnerships to enhance their technological offerings in the autonomous agriculture space.

In terms of competitive dynamics, the market is characterized by the presence of both established players and new entrants. Larger companies, such as John Deere and CNH Industrial, are capitalizing on their existing technological capabilities and extensive agricultural machinery portfolios to integrate autonomous solutions into their products. Meanwhile, newer players like Autonomous Tractor Corporation and Autonomous Solutions, Inc. are focusing on niche innovations, particularly in fully autonomous solutions for smaller and medium-scale farms. These companies are leveraging AI, machine learning, and sensor technologies to develop cost-effective and scalable solutions. The increasing demand for automation in agriculture is driving these companies to expand their product offerings, improve machine precision, and enhance overall system reliability.

Looking at market trends, key players are investing heavily in R&D to enhance their autonomous systems' capabilities and reduce costs. Furthermore, strategic collaborations and partnerships between technology companies and agricultural equipment manufacturers are becoming common. For instance, partnerships between tech companies and traditional equipment manufacturers are aimed at accelerating the integration of autonomous technologies into farming machinery. As the market grows, companies that can offer highly reliable, cost-effective, and easy-to-integrate autonomous solutions will likely have a competitive advantage. The rising focus on sustainability and efficiency in agriculture is prompting these players to introduce innovations that help farmers maximize productivity while minimizing environmental impact.

John Deere is one of the prominent companies in the autonomous tractors market. The company has been actively integrating advanced technologies such as GPS and sensor systems into its agricultural machinery to support automation. John Deere’s autonomous tractors are widely used in large-scale farming operations for various tasks such as planting, tilling, and harvesting.

CNH Industrial, through its brands such as Case IH and New Holland, is another key player in the autonomous tractors market. The company focuses on providing advanced solutions to farmers through automated machinery and precision farming technologies. CNH Industrial’s autonomous tractors are equipped with features that support operations such as tilling, planting, and harvesting with minimal human intervention.

List of Key Companies in Autonomous Tractors Market

- AGCO Corporation

- Autonomous Solutions, Inc.

- Autonomous Tractor Corporation

- CNH Industrial

- Escorts Group

- Fendt (AGCO brand)

- John Deere

- Kubota Corporation

- Mahindra & Mahindra

- Monosem

- Raven Industries

- Topcon Corporation

- Trimble Inc.

- Valtra (AGCO brand)

- Yanmar Co., Ltd.

Autonomous Tractors Industry Developments

- In October 2023, CNH Industrial introduced a new range of autonomous tractors designed to optimize field operations while reducing labor costs. The company continues to invest in research and development to advance its autonomous technologies, aiming to meet the growing demand for automation in agriculture.

- In September 2023, John Deere announced the expansion of its autonomous tractor lineup, introducing a new fully autonomous model designed for large farms. This model is part of the company’s ongoing efforts to enhance farming efficiency through automation and precision technology, further strengthening its position in the market.

Autonomous Tractors Market Segmentation

By Horsepower Outlook

- Up to 30HP

- 31HP to 100HP

- Above 100HP

By Automation Outlook

- Fully Automated

- Semi-automated

By Technology Outlook

- GPS Guidance

- Sensor-Based

- Remote Control

By Application Outlook

- Tillage

- Harvesting

- Planting & Seeding

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Autonomous Tractors Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,875.07 million |

|

Market Size Value in 2025 |

USD 2,143.20 million |

|

Revenue Forecast by 2034 |

USD 7,278.07 million |

|

CAGR |

14.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The autonomous tractors market has been broadly segmented on the basis of horsepower, automation, technology, application, and crop type. Moreover, the study provides the reader with a detailed understanding of the different segments at both the and regional levels.

Growth/Marketing Strategy: The autonomous tractors market growth and marketing strategy focuses on increasing awareness of automation's benefits, such as improved efficiency, reduced labor costs, and higher precision in farming operations. Companies are investing heavily in R&D to enhance the capabilities of their autonomous systems, making them more reliable and cost-effective for farmers. Partnerships and collaborations with technology firms and agricultural organizations are being used to expand product offerings and accelerate market penetration. Additionally, marketing efforts emphasize the long-term economic benefits of autonomous tractors, including reduced operational costs and enhanced sustainability. Companies also aim to address concerns related to adoption costs by providing flexible financing and support options for farmers.

FAQ's

? The market size was valued at USD 1,875.07 million in 2024 and is projected to grow to USD 7,278.07 million by 2034.

? The market is projected to register a CAGR of 14.5% during the forecast period.

? North America had the largest share of the market in 2024.

? A few key players in the autonomous tractors market include John Deere, CNH Industrial, AGCO Corporation, Kubota Corporation, and Mahindra & Mahindra. Other notable companies are Trimble Inc.; Raven Industries; Monosem; Topcon Corporation; Yanmar Co., Ltd.; and Autonomous Solutions, Inc. Additionally, companies such as Escorts Group, Fendt (a brand under AGCO), Valtra (owned by AGCO), and Autonomous Tractor Corporation are active participants.

? The above 100HP segment accounted for the largest share of the market in 2024.

? The fully automated segment accounted for a larger market share in 2024.

? Autonomous tractors are farming machines that operate without human intervention, using advanced technologies such as GPS, sensors, and artificial intelligence (AI) to perform agricultural tasks. These tractors can autonomously navigate fields, plow, plant, fertilize, and harvest crops, making them highly efficient and capable of working continuously without rest. They are designed to reduce the need for manual labor; improve precision in agricultural operations; and optimize resource use such as water, seeds, and fertilizers. Autonomous tractors are part of the broader trend toward automation in agriculture, aiming to enhance productivity and sustainability in farming.

? A few key autonomous tractors market trends are described below: Integration of Electric Power: Growing interest in electric autonomous tractors as a more sustainable and cost-effective alternative to diesel-powered models. Advancement in AI and Machine Learning: Use of AI to improve decision-making, task automation, and operational efficiency in autonomous tractors. Precision Farming: Increasing adoption of autonomous tractors for precision farming to optimize resources such as water, fertilizers, and seeds. Government Support and Regulations: Favorable government policies and incentives promoting the adoption of automation in agriculture. Collaboration and Partnerships: Strategic partnerships between agricultural equipment manufacturers and technology firms to enhance autonomous systems.

? A new company entering the autonomous tractors market must focus on developing cost-effective and user-friendly solutions tailored for small- to medium-sized farms, which are often overlooked by larger players. Investing in advanced sensor technologies and AI-driven automation to enhance precision farming would help create a competitive edge. Additionally, providing strong customer support, including training and after-sales service, can build trust with farmers. Offering flexible financing options or subscription models could also lower adoption barriers. Lastly, building strategic partnerships with agricultural organizations or tech firms could help accelerate product development and market penetration

? Companies manufacturing, distributing, or purchasing autonomous tractors and related products, and other consulting firms must buy the report.