Autonomous Port Operations Systems Market Size, Share, Trends, Industry Analysis Report: By Autonomy (Fully Autonomous, Remotely Operated, and Partially Autonomous), Port Type, Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 117

- Format: PDF

- Report ID: PM5426

- Base Year: 2024

- Historical Data: 2020-2023

Autonomous Port Operations Systems Market Overview

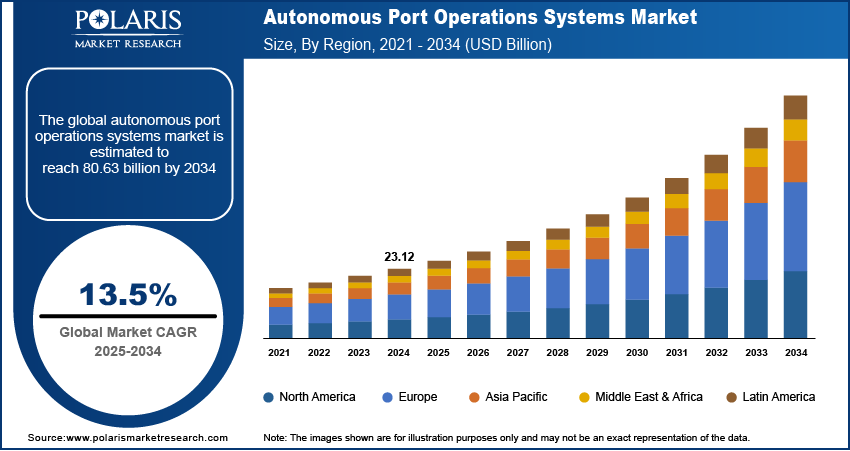

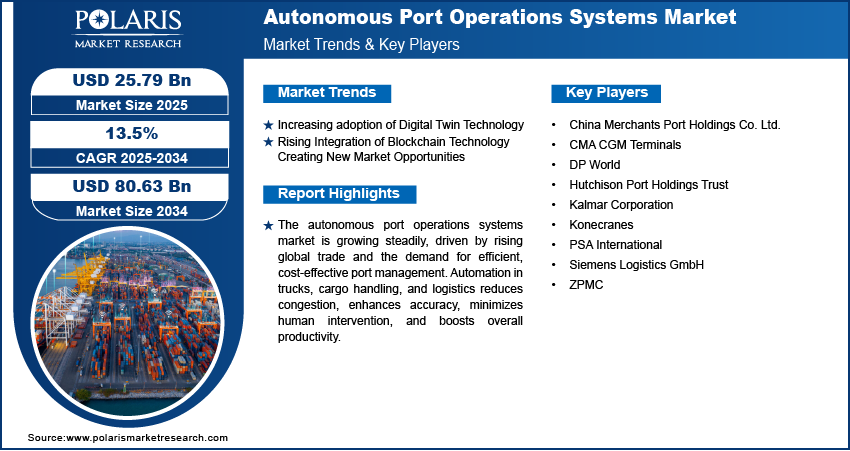

The global autonomous port operations systems market size was valued at USD 23.12 billion in 2024. The market is projected to grow from USD 25.79 billion in 2025 to USD 80.63 billion by 2034, exhibiting a CAGR of 13.5% during 2025–2034.

The autonomous port operations systems market is experiencing a steady growth rate, driven by the increasing demand for efficient and cost-effective port management solutions. The trade volume is rising across the world due to the growing world population and increasing product demand from consumers. Therefore, an efficient method for handling port management is in demand, which is being fulfilled by introducing automation in ports. Automation at multiple levels, including trucks and cargo handling systems, logistics supports, and others, has helped in reducing congestion in the ports. Also, automation in the ports has improved operational accuracy and minimized human intervention, leading to increased productivity. In addition, the adoption of artificial intelligence (AI)-powered navigation, IoT-enabled tracking systems, and automated cargo handling systems is ensuring faster turnaround times and enhanced safety, contributing to the autonomous port operations systems market growth.

To Understand More About this Research: Request a Free Sample Report

The rising investments in smart port infrastructure are expected to present growth opportunities for automated technology providers. Automated port systems enable real-time tracking and predictive maintenance, which helps streamline logistics, thereby reducing operational costs while maximizing the output rate. Furthermore, integrating 5G connectivity with autonomous cranes and robotic container handling enhances operational precision, making ports more resilient to disruptions. The adoption of blockchain in supply chain management also strengthens security and transparency, further fueling the autonomous port operations systems market demand. Thus, the implementation of these technological advancements helps in improving productivity, which leads to revenue generation for solution providers.

Autonomous Port Operations Systems Market Dynamics

Increasing adoption of Digital Twin Technology

The increasing use of digital twins and AI-driven analytics in port operations is expected to emerge as a major autonomous port operations systems market trend. These technologies create virtual replicas of port activities, enabling operators to simulate various scenarios, optimize resource allocation, and proactively address maintenance issues. For instance, the Port of Rotterdam’s implemented digital twin technology in the year 2018 to improve port’s operational efficiency by enhancing productivity and sustainability. Moreover, the implementation of automation in coordination with artificial intelligence (AI) continues to help in the growth of maritime logistics. In conclusion, the market is expected to showcase sustained expansion during the forecast period, supported by ongoing technological advancements and increasing global adoption.

Rising Integration of Blockchain Technology

The integration of blockchain technology is generating added security to the security and transparency within port operations. The integration of blockchain has played an important role in minimizing the risks associated with fraud, data breaches, and inefficiencies. The technology facilitates secure exchange of information across the entire supply chain, enhancing trust between parties and thereby ensuring accurate and smooth documentation processes. Thus, the adoption of blockchain improves the port productivity rate, which ultimately reduces downtime and enhances scalability. Furthermore, the evolution of such technologies helps in the generation of market revenue for the ports that are moving toward automation. Further, the increased adoption of blockchain technology has attracted public and private investments, further fueling the autonomous port operations systems market development and providing a strong foundation for long-term profitability.

Autonomous Port Operations Systems Market Segment Analysis

Autonomous Port Operations Systems Market Assessment by Autonomy

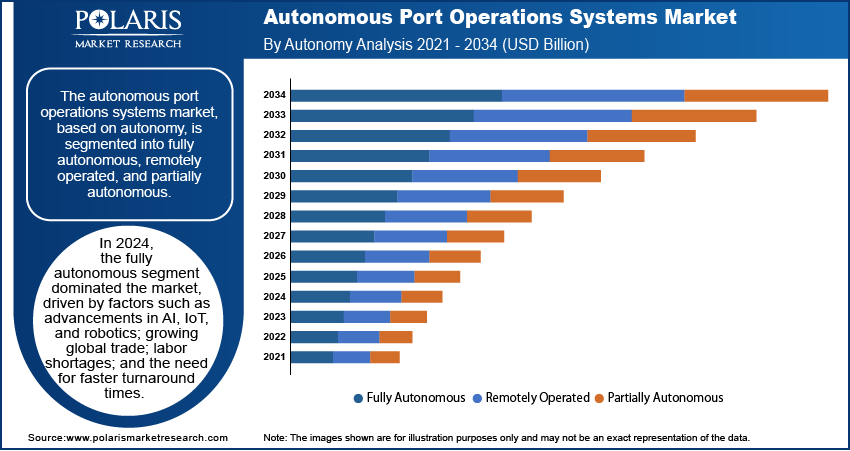

The autonomous port operations systems market segmentation, based on autonomy, includes fully autonomous, remotely operated, and partially autonomous. The fully autonomous segment dominated the autonomous port operations systems market share in 2024, driven by factors such as rising technology advancements, including the Internet of Things (IoT) and smart sensors. The growing focus on operational efficiency is propelling the demand for innovative solutions such as autonomous cranes, robotic vehicles, and AI-driven cargo handling systems. These systems offer considerable improvements in speed, safety, and cost-effectiveness, allowing them to be implemented in large-scale ports to streamline operations. Moreover, considering the future of industry ecosystems, which are expected to lean toward complete automation, the market expansion for the fully autonomous segment is projected to grow during the forecast period. The continuous evolution of AI, IoT, and 5G connectivity is further propelling the demand for automation contributing to more reliable, scalable, and efficient operations. In conclusion, the evaluation of trending technologies will generate an increasing investment in fully autonomous solutions in the ports during the forecast period.

Autonomous Port Operations Systems Market Evaluation by Port Type

In terms of port type, the autonomous port operations systems market is divided into seaports, inland ports, and dry ports. The seaport segment is expected to experience the fastest growth rate during the forecast period due to its crucial role in global trade. The increasing demand for operational efficiency is expected to significantly boost the market potential as these ports are primary hubs for cargo handling and their large-scale operations. Seaports can enhance their rate of delivery owing to advancements in AI, robotics, and IoT. It ultimately reduces operational costs and improves safety, thus generating expansion opportunities for the market. Additionally, seaports are witnessed as key drivers of economic growth, offering substantial market growth factors for autonomous port operations systems. The changing economic landscape resulting from trading activities among regions, including Europe and the Middle East, is influencing both governments and private players to invest in untapped markets to boost their economic growth. In conclusion, the rising focus on automation in seaports is projected to provide new growth opportunities for the ports that adopt advanced technologies, thus allowing the segment to hold prominent market share during the forecast period.

Autonomous Port Operations Systems Market Regional Analysis

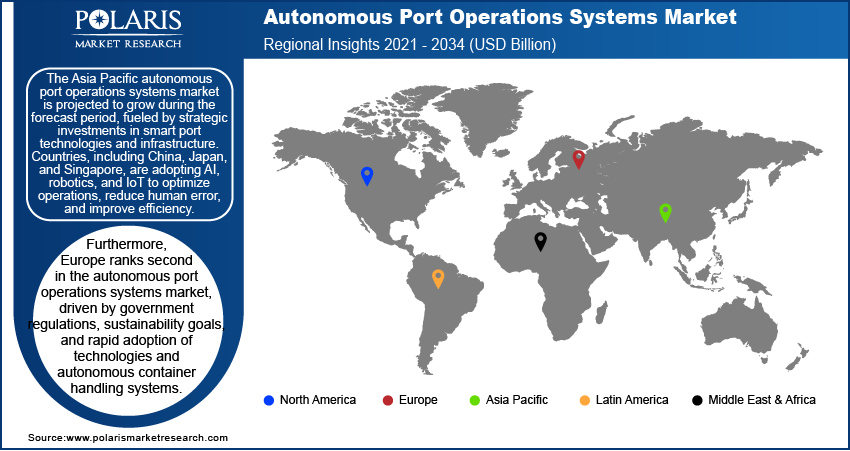

By region, the study provides the autonomous port operations systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest share of the global autonomous port operations systems market revenue in 2024, driven by rapid industrialization among countries such as China, India, and ASEAN nations. The region holds among the largest seaports globally, such as China (Hong Kong and Shanghai) and Singapore, which are increasingly adopting automation technologies to handle high volumes of cargo more efficiently. The demand for autonomous systems in the region is being driven by the growing need to optimize port operations, reduce congestion, and enhance safety.

The Asia Pacific autonomous port operations systems market is expected to witness the fastest growth rate during the forecast period due to rapid technological advancements, such as the adoption of the Industrial Internet of Things (IIoT), in industries. Countries such as China, Japan, and South Korea are continuously expanding their port automation capabilities for self-economic growth, driven by public and private sector investments, which propel regional market growth. Further, the increasing adoption of 5G and AI technologies in autonomous port operation systems is expected to fuel the Asia Pacific autonomous port operations systems market expansion during the forecast period.

Europe held the second dominating position in the autonomous port operations systems market due to the strong focus of the government on implementing port operational regulations. European ports are rapidly integrating technologies such as AI, IoT, robotics, and autonomous container handling systems to optimize operations, reduce human intervention, and improve supply chain logistics. Moreover, factors including the region's commitment towards sustainability and carbon neutrality have led countries to adopt autonomous port operations systems within the ports.

Singapore leads in port automation in Asia Pacific due to its strategic location as a global maritime hub. The country's maritime project, such as the Tuas Port project, is expected to be a fully automated port by 2040, which will enhance the country's trading platform globally. The port is designed with the integration of technologies such as AI, digital twins, and autonomous cargo handling that will support investments in maritime AI solutions and blockchain-based logistics systems.

China is expected to hold a significant share of the regional autonomous port operations systems market revenue during the forecast period, driven by factors such as high trade volumes and investments in smart port infrastructure. Ports of Shanghai and Tianjin, among China's major and world's largest ports, are witnessing automated operation driven by the adoption of AI, 5G connectivity, and IoT-based cargo tracking, thereby enhancing the port's efficiency and productivity.

Autonomous Port Operations Systems Market – Key Players & Competitive Analysis Report

Major market players are significantly investing in research and development to expand their product offerings, which will further drive the autonomous port operations systems market growth during the forecast period. Additionally, these market participants are engaging in various strategic activities to increase their global presence. Key developments in the market include innovative technology advancements, international collaborations, increased investments, and mergers and acquisitions between private and public sectors.

The autonomous port operations systems market is consolidated, with the presence of limited numbers of key global and regional market players. A few major players in the market include DP World; Konecranes; Siemens Logistics GmbH; Kalmar Corporation; ZPMC (Shanghai Zhenhua Heavy Industries Co., Ltd.); PSA International; CMA CGM Terminals; China Merchants Port Holdings Co. Ltd.; and Hutchison Port Holdings Trust.

China Merchants Port Holdings Co. Ltd. is a port developer, investor, and operator. China Merchants Port manages a vast network of ports across China and has expanded internationally to 46 ports in 26 countries. CM Port operates container terminals, bulk cargo facilities, and logistics services, handling over 137.48 billion TEUs of containers and 557 billion tons of bulk cargo in 2023. The company has extensive port services, fueled by factors such as innovation and strategic growth that enhance global trade and logistics.

Hutchison Port Holdings Trust (HPH Trust) is a deep-water container terminal operator located in South China. The company operates key ports in Hong Kong, such as Hong Kong International Terminals, COSCO-HIT, Asia Container Terminals. In Mainland China, it operates ports such as Yantian and Huizhou International Container Terminals. The Hong Kong ports focus on transshipment due to free port status, while Shenzhen operations handle origin and destination cargo. Hutchison Port Holdings Trust holds 38 berths that managed 21.3 billion TEUs in 2023.

List of Key Companies in Autonomous Port Operations Systems Market

- China Merchants Port Holdings Co. Ltd.

- CMA CGM Terminals

- DP World

- Hutchison Port Holdings Trust

- Kalmar Corporation

- Konecranes

- PSA International

- Siemens Logistics GmbH

- ZPMC (Shanghai Zhenhua Heavy Industries Co., Ltd.)

Autonomous Port Operations Systems Industry Developments

December 2023: DP World completed the third phase of its USD 218.30 million investment plan at the Antwerp Gateway Terminal. This phase included the commissioning of three quay cranes, six automatic stacking cranes, and nine hybrid straddle carriers aimed to modernize and decarbonize terminal operations.

September 2024: Kalmar completed an agreement with DP World Southampton to supply 14 additional hybrid straddle carriers. This order aimed to continue both companies’ joint efforts in improving eco-efficiency and reducing the carbon footprint of terminal operations.

Autonomous Port Operations Systems Market Segmentation

By Autonomy Outlook (Revenue, USD Billion, 2021–2034)

- Fully Autonomous

- Remotely Operated

- Partially Autonomous

By Port Type Outlook (Revenue, USD Billion, 2021–2034)

- Seaports

- Inland Ports

- Dry Ports

By Application Outlook (Revenue, USD Billion, 2021–2034)

- Terminal Planning and Operations

- Cargo Storage

- Inventory Management

- Security and Security Controls

- Others

By End User Outlook (Revenue, USD Billion, 2021–2034)

- Line-fit & Newbuild

- Retrofit

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Autonomous Port Operations Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 23.12 billion |

|

Market Size Value in 2025 |

USD 25.79 billion |

|

Revenue Forecast by 2034 |

USD 80.63 billion |

|

CAGR |

13.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 23.12 billion in 2024 and is projected to grow to USD 80.63 billion by 2034.

The global market is projected to register a CAGR of 13.5% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few of the key players in the market are DP World; Konecranes; Siemens; Kalmar Corporation; ZPMC (Shanghai Zhenhua Heavy Industries Co., Ltd.); PSA International; CMA CGM Terminals; China Merchants Port Holdings Co. Ltd.; and Hutchison Port Holdings Trust.

The fully autonomous segment dominated the market share in 2024.