Autonomous Networks Market Size, Share, Trends, Industry Analysis Report – By Offering (Solutions and Services), End User (Service Providers and Verticals), and Region; Segment Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 117

- Format: PDF

- Report ID: PM5142

- Base Year: 2023

- Historical Data: 2019-2022

Autonomous Networks Market Outlook

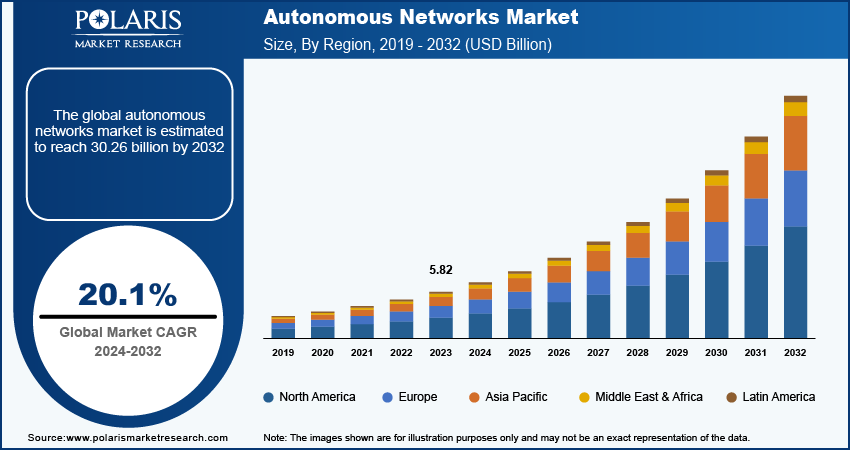

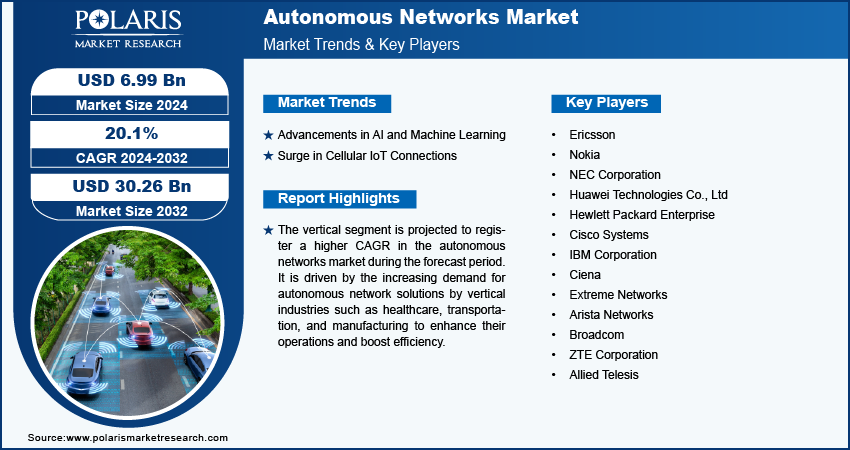

The autonomous networks market size was valued at USD 5.82 billion in 2023. The market is anticipated to grow from USD 6.99 billion in 2024 to USD 30.26 billion by 2032, exhibiting a CAGR of 20.1% during 2024–2032.

Autonomous Networks Market Overview

The autonomous networks market is growing due to the rising levels of network complexity, necessitating the need for advanced technologies such as machine learning (ML) and artificial intelligence (AI) to manage processes effectively. Moreover, the rapid penetration of cloud computing and IoT has propelled the market growth. The autonomous network uses AI, 5G, ML, virtualization, and edge computing to enhance user experiences with the provision of “zero-wait” or “zero-touch” interactions. For instance, in March 2024, industry pioneers such as George Glass, CTO of TM Forum; Executive VP of China Mobile, Li Huidi, Yang Chaobin, Huawei Board Member; and Juan Manuel Caro and others introduced the Level 4 autonomous networks initiative at the autonomous networks summit held in Spain and the US during the Mobile World Congress.

To Understand More About this Research: Request a Free Sample Report

AI-based intent-driven operations, implemented through managed services platforms, enable market players to enhance network automation, optimization, and real-time management. These platforms translate complex business requirements into executable network tasks, facilitating seamless network integration. Thus, by leveraging this technology, operators are unlocking the full potential of premium 5G services, driving operational efficiency and delivering superior user experiences through intelligent, adaptive networks. For instance, in February 2024, Ericsson launched AI-based operations within its managed services Ericsson Operations Engine platform to enable differentiated 5G services for consumers.

Growth Drivers

Advancements in AI and Machine Learning

Various technologies such as AI and machine learning continue to improve to support autonomous networks in self-configuration, monitoring, and repairs. These technologies enable real-time data analysis via pattern recognition and certain optimization decisions toward performance improvement. Moreover, AI-driven autonomous networks help save time and prevent errors. It also reduces operational expenses and enhances the attractiveness and functionality of the networks. Therefore, advancements in AI and ML play a significant role in the growth of the autonomous networks market.

Surge in Cellular IoT Connections

Autonomous networks are becoming essential due to the increasing demand for real-time network systems in IoT connections via cellular networks. According to the GSMA report on the mobile economy in North America, the number of cellular Internet of Things (IoT) connections in the region is projected to exceed 535 million by 2030. The United States is the largest contributor, accounting for over 90% of all cellular IoT connections in North America. As IoT adoption continues to rise, autonomous networks are critical for providing seamless connectivity that is effective, reliable, and secure, all while minimizing the need for human intervention.

Restraining Factors

High Investments in Technological Advancements

Higher investments in advanced technology, driven by the complexity of data integration, hinder the growth of the autonomous networks market. Additionally, the significant expenses associated with research and development, as well as deployment, restrict innovation and negatively impact overall market expansion.

Report Segmentation

The autonomous networks market is primarily segmented on the basis of offering, end user, and region.

|

By Offering |

By End User |

By Region |

|

|

|

By Offering Analysis

Solutions Segment Accounted for Larger Market Share in 2023

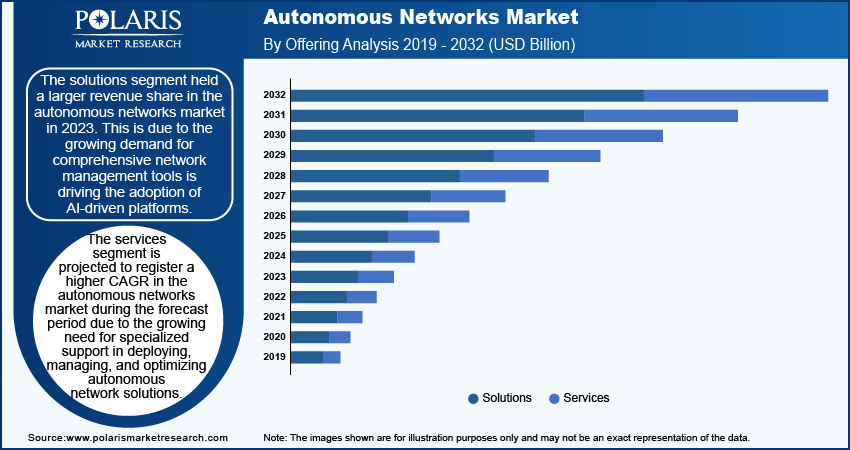

The solutions segment held a larger revenue share in the autonomous networks market in 2023. This is due to the growing demand for comprehensive network management tools is driving the adoption of AI-driven platforms. These solutions enable network automation, self-optimization, and self-healing capabilities, which are becoming increasingly crucial as networks become more complex due to the proliferation of 5G and IoT. Businesses are prioritizing these advanced solutions to streamline operations, reduce manual intervention, and enhance overall network performance. The ability of these solutions to seamlessly integrate with existing infrastructure while offering scalability and real-time decision-making capabilities has further accelerated their adoption, leading to significant revenue growth in this segment.

The services segment is projected to register a higher CAGR in the autonomous networks market during the forecast period due to the growing need for specialized support in deploying, managing, and optimizing autonomous network solutions. Businesses are increasingly adopting AI-driven networks. Thus the demand for professional services such as consulting, integration, and managed services is rising. These services help companies navigate the complexities of transitioning to autonomous systems, ensuring seamless implementation and continuous performance monitoring. Additionally, as networks evolve with technologies like 5G and IoT, ongoing maintenance, upgrades, and technical expertise are crucial, further driving the growth of the services segment.

By End User Analysis

Verticals Segment to Witness Higher Growth Rate During Forecast Period

The vertical segment is projected to register a higher CAGR in the autonomous networks market during the forecast period. It is driven by the increasing demand for autonomous network solutions by vertical industries such as healthcare, transportation, and manufacturing to enhance their operations and boost efficiency. The rising number of sectors are demanding personalized and effective user experiences, which has raised the bar for the entry of new players into this segment.

The service providers segment also accounted for a larger revenue share in the autonomous networks market. Service providers often use autonomous network technologies to optimize their network operations and improve their customer experience. For instance, in July 2022, Cisco implemented a new Route-to-Market model for service providers with partners in Wholesale Webex to meet changing requirements from small and medium-sized businesses (SMBs).

Autonomous Networks Market Regional Insights

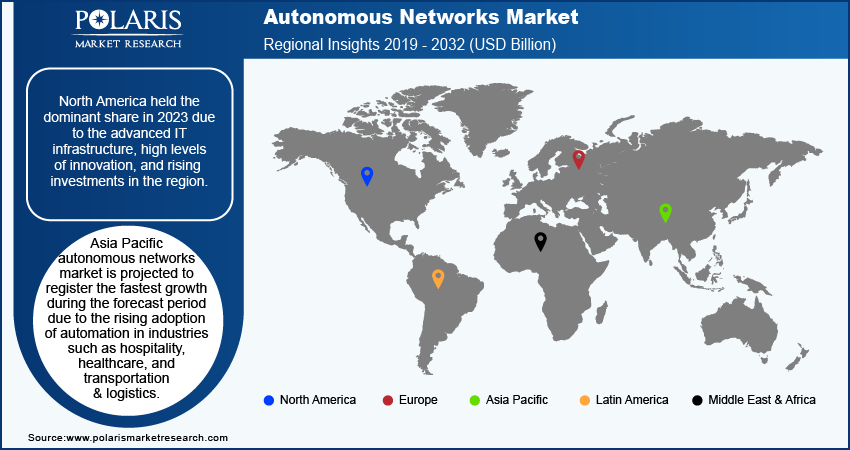

North America Registered Largest Share in 2023

North America held the dominant share in 2023 due to the advanced IT infrastructure, high levels of innovation, and rising investments in the region. Major players in the US launched their labs to the advanced technology of autonomous networks which further drive the regional market growth. For instance, in April 2024, Extreme Networks, an autonomous network solution provider in the US, launched Extreme Labs to encourage innovation in the sphere of autonomous networks.

Asia Pacific autonomous networks market is projected to register the fastest growth during the forecast period due to the rising adoption of automation in industries such as hospitality, healthcare, and transportation & logistics. Moreover, growing investments in technologies including AI and IoT contribute to the market landscape. For instance, in May 2024, the Japanese technology conglomerate SoftBank announced its plans to spend USD 150 million on Indian data centers and industrial robotics companies to endorse the infrastructure required for artificial intelligence (AI).

Key Market Players and Competitive Insights

The autonomous networks market is fragmented. The growing investments in autonomous technology favor the global market. Further, the ongoing expansion initiatives are fueling competition in the marketplace. In February 2021, Hewlett Packard Enterprise (HPE) selected One Network Enterprises (ONE) to support the digital transformation agenda. HPE selected One Network because of the comprehensive features it offers, its robust execution architecture, and the superior services provided by One Network, which will help in the achievement of HPE’s digital transformation objectives.

List of Key Players in Autonomous Networks Market

- Ericsson

- Nokia

- NEC Corporation

- Huawei Technologies Co., Ltd

- Hewlett Packard Enterprise

- Cisco Systems

- IBM Corporation

- Ciena

- Extreme Networks

- Arista Networks

- Broadcom

- ZTE Corporation

- Allied Telesis

Recent Developments in Industry

- April 2024: Allied Telesis announced a technology collaboration with Hanwha Vision America. Allied Telesis is integrating with Hanwha Vision America’s Video Management Software (VMS) plug-in, creating a complete solution for physical security and simplifying network and IP camera management for security applications.

- March 2024: Cloudera collaborated with NVIDIA to integrate NVIDIA NIM microservices into Cloudera Machine Learning data platform services for AI/ML workflow.

Report Coverage

The autonomous networks market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, offering, end users, and their futuristic growth opportunities.

Autonomous Networks Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.99 billion |

|

Revenue Forecast in 2032 |

USD 30.26 billion |

|

CAGR |

20.1% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global autonomous networks size was valued at USD 5.82 billion in 2023 and is projected to grow to USD 30.26 billion by 2032.

The global market is projected to register a CAGR of 20.1% during the forecast period

North America held the dominant share in 2023 due to the advanced IT infrastructure, high levels of innovation, and rising investments in the region.

A few key players in the market are Ericsson; Nokia; NEC Corporation; Huawei Technologies Co., Ltd; Hewlett Packard Enterprise; Cisco Systems; IBM Corporation; Ciena; Extreme Networks; Arista Networks; Broadcom; ZTE Corporation; Allied Telesis.

The solutions segment held a larger revenue share in the autonomous networks market in 2023. This is due to the growing demand for comprehensive network management tools is driving the adoption of AI-driven platforms

The vertical segment is projected to register a higher CAGR in the autonomous networks market during the forecast period. It is driven by the increasing demand for autonomous network solutions by vertical industries such as healthcare, transportation, and manufacturing to enhance their operations and boost efficiency.