Autonomous Mobile Robot Market Share, Size, Trends & Industry Analysis Report

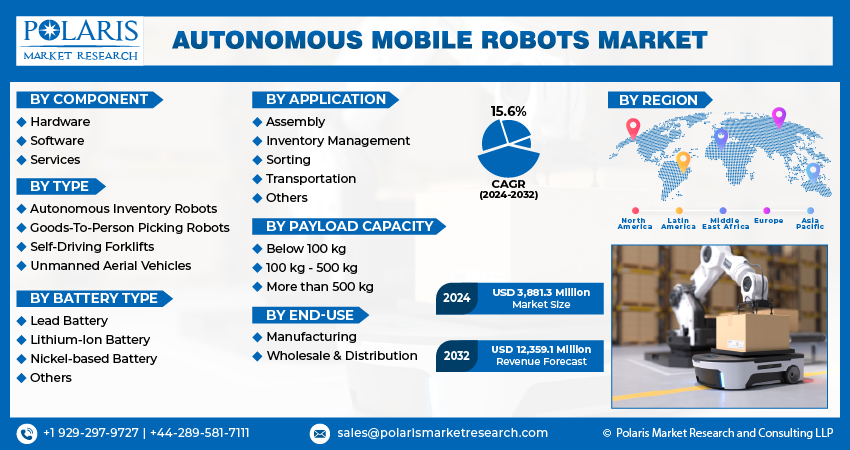

By Component (Hardware, Software, Services); By Type; By Application; By Battery Type; By Payload Capacity; By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM2728

- Base Year: 2024

- Historical Data: 2020-2023

The global Autonomous Mobile Robot Market was valued at USD 2.9 billion in 2024 and is projected to grow at a CAGR of 23.80% from 2025 to 2034. Adoption in warehousing, logistics, and manufacturing automation is a key growth driver.

The autonomous mobile robots market is driven by increasing investment by companies for expanding robotics offerings to the global market. Companies are advancing the capabilities of autonomous mobile robots by channeling funds into design, development, and expansion to enhance the reach of products.

For instance, in June 2020, OTTO Motors, a unit of Clearpath Robotics, secured $29 Billion in Series C funding to develop its autonomous mobile robots platform. The allocation of funds facilitates the enhancement of the global delivery partner network. It expedites the development of a product roadmap tailored for industrial clients, with a specific focus on advancing autonomous technology. Furthermore, the investment results in heightened competition that accelerates technological advancements driving the market industry.

To Understand More About this Research: Request a Free Sample Report

Moreover, the government initiatives to implement Industry 4.0 manufacturing technologies are fueling the sales of the autonomous mobile robots market. The initiatives are aimed at enhancing the efficiency, productivity, and competitiveness of the manufacturing sector by promoting the integration of advanced digital technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and robotics.

For instance, in November 2022, the Economic Growth Institute’s Industry 4.0 Initiative provided up to USD 25,000 for integrating Industry 4.0 manufacturing technologies for small manufacturers in Michigan. The program received funding from the collaboration between the Michigan Economic Development Corporation and the Manufacturing Growth Alliance. Thus, the support and initiatives by the government accelerate the development and deployment of autonomous mobile robots, which are integral parts of building smart manufacturing ecosystems, further boosting the autonomous mobile robots market growth.

Autonomous Mobile Robots Market Trends:

New Product Introductions are Driving the Autonomous Mobile Robots Market Growth

In the autonomous mobile robots market outlook, companies are investing substantially in research and development to introduce innovative and efficient robots to the global market outlook. For instance, in February 2024, OMRON Automation Americas launched the MD Series of autonomous mobile robots, further extending its range of autonomous robots to address diverse part and material transport applications. The new series is engineered to enhance operational efficiency at production sites and represents a significant development in industrial automation solutions. The new products feature high payload capacity and easy integration with user production management systems. Further, the influx of new and improved products maintains competitiveness in the market. It encourages firms to adopt autonomous mobile robots and expand their footprints in the autonomous mobile robots market.

Growing Need to Streamline Intralogistics in the Automotive Sector is Propelling the Autonomous Mobile Robots Market Size

The automotive industry has complex supply chains and high demands for precision and efficiency. Autonomous mobile robots can manage the transportation of parts and components within manufacturing plants, reducing the reliance on manual labor and minimizing the risk of errors.

Furthermore, manufacturers including Ford, BMW, and Faurecia implemented autonomous mobile robots to optimize intralogistics flows by handling material delivery between warehouses, production areas, and line-side assembly. For instance, in April 2024, 27 AGILOX AMRs autonomously handled bodywork processes and load carriers at BMW Regensburg plant, communicating and navigating independently.

Additionally, Faurecia's German plant incorporated MiR500 and MiR200 robots to achieve automated component transport between welding, paint, and assembly shops. These autonomous mobile robots were integrated with Faurecia's ERP (Enterprise Resource Planning) system to facilitate the automatic receipt of transport orders. Thus, the increasing demand for streamlined and automated processes in the automotive sector is boosting the demand for autonomous mobile robots, contributing to the robust growth of the market.

Autonomous Mobile Robots Market Segment Insights:

Autonomous Mobile Robots Application Insights:

The global autonomous mobile robots market segmentation, based on application, includes assembly, inventory management, sorting, transportation, and others. The assembly segment dominated the autonomous mobile robots market in 2023 due to its increasing adoption by several industries, including automotive, pharmaceuticals, and FMCG. In the automotive sector, autonomous mobile robots facilitate complex assembly processes, ensuring precision and efficiency in the handling and integration of various components.

For instance, in April 2024, Xiaomi Automobile Co., an automotive OEM based in China, integrated 94 autonomous mobile robots provided by robotics company Guozi into its assembly plant. These robots are being utilized to perform over 100 material handling and assembly tasks within the factory. Therefore, the increasing adoption and the efficiency offered by autonomous mobile robots in assembly applications are driving the segment's dominance in the market.

Autonomous Mobile Robots End-Use Insights:

The global autonomous mobile robots market segmentation, based on end use, includes manufacturing and wholesale & distribution. The wholesale & distribution segment in the autonomous mobile robots market is anticipated to grow with a significant CAGR during the forecast period due to its increasing usage in warehouses and logistics operations. The demand for faster and more efficient order fulfillment is rising, particularly due to e-commerce growth, and businesses are turning to autonomous mobile robots to enhance intralogistics processes.

For instance, Amazon Inc. has over 750,000 robots, including Sparrow, Cardinal, Proteus, and Sequoia, working collaboratively with its employees. These robots automate tasks such as picking, sorting, and transporting goods to improve operational efficiency, reduce labor costs, and minimize errors. Consequently, the growing reliance on autonomous mobile robots for optimized logistics and storage solutions is expected to drive growth in the wholesale and distribution segment of the market.

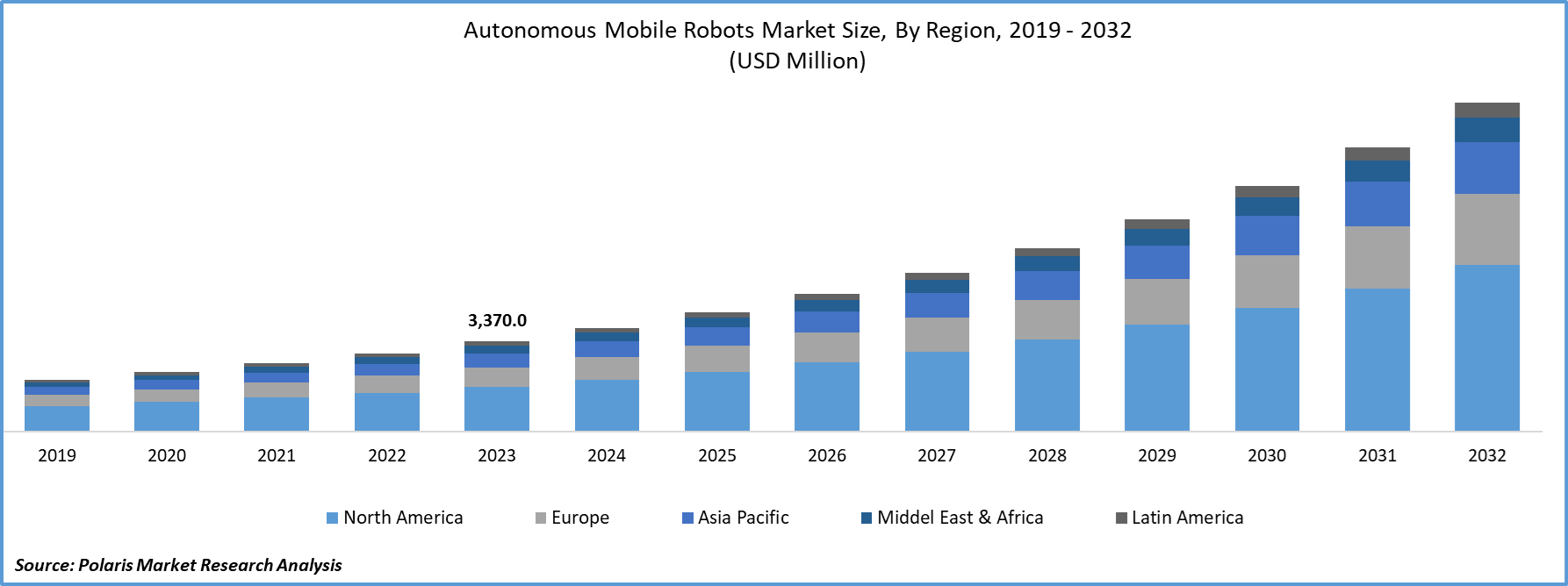

Autonomous Mobile Robots Regional Insights:

By region, the study provides the autonomous mobile robots market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America autonomous mobile robots market held the highest revenue share in the global market due to the presence of a robust healthcare industry and the launches of healthcare-specific robots by automation companies. North America's advanced healthcare infrastructure, along with high investment in medical technologies, is creating a facilitative environment for the adoption of autonomous mobile robots.

Furthermore, robotics companies based in North America are continuously innovating and launching new autonomous mobile robot solutions tailored for the healthcare sector.

For instance, in June 2024, Richtech Robotics launched the autonomous mobile robot, Medbot. The advanced robot is designed to provide medication deliveries for pharmacy operations autonomously. Thus, the synergy between a strong healthcare sector and the robotics industry drives the extensive adoption and integration of autonomous mobile robots, resulting in the dominance of North America in the global market.

Further, the major countries studied in the market report are the US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Asia Pacific autonomous mobile robots (AMR) market is anticipated to grow significantly, driven by the presence of a concentrated automotive industry. The automotive sector in countries such as China, Japan, South Korea, and India is developed, with several manufacturing plants and assembly lines requiring advanced automation solutions to enhance efficiency, precision, and productivity.

Furthermore, China's national and provincial governments subsidized the adoption of robots and other automation technology. The investments and subsidies resulted in the increased installation of industrial robots in the country.

For instance, according to International Federation of Robotics (IFR), in 2022, China accounted for 52% of global industrial robot installations, marked an increase from 14% a decade earlier. Thus, the Asia Pacific autonomous mobile robots (AMR) market is anticipated to grow at a substantial CAGR over the forecast period.

Autonomous Mobile Robots Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their offerings, which will help the autonomous mobile robots market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market climate, the autonomous mobile robots industry must offer innovative solutions.

The autonomous mobile robots market is fragmented, with the presence of numerous global and regional market players. The leading companies are continuously developing advanced autonomous mobile robot solutions to cater to diverse industries, including logistics, manufacturing, healthcare, and retail. These companies focus on enhancing robot capabilities such as navigation, artificial intelligence, and sensor integration to offer more efficient and adaptable solutions. Major players in the autonomous mobile robots market, including ABB, BALYO, Bastian Solutions, LLC, Boston Dynamics, Clearpath Robotics, Inc. (Rockwell Automation Company), Crown Equipment Corporation, Daifuku Co., Ltd., GreyOrange, Harvest Automation, Hyster-Yale Materials Handling, Inc., inVia Robotics, Inc., JBT, Jungheinrich AG, Karter, KUKA AG, LexxPluss, MITSUBISHI LOGISNEXT CO., LTD., Mobile Industrial Robots, Omron Corporation, Onward Robotics, Richtech Robotics, Toyota Material Handling, WEG, and Zhejiang Guozi Robotics Co., Ltd.

ABB Ltd. is a global manufacturer and seller of electrification, automation, robotics, and motion products. The company operates in several segments, including electrification, robotics and discrete automation, motion, and process automation, to serve a diverse range of industries. The robotics & discrete automation division specializes in industrial robots, autonomous mobile robots, software, and digital services. It offers solutions based on programmable logic controllers, industrial PCs, transport systems, servo motion, and machine vision. In October 2022, ABB launched an initial series of rebranded Autonomous Mobile Robots (AMRs) after acquiring mobile robot company ASTI Mobile Robotics in 2021.

WEG, a global manufacturer of energy-efficient electric motors and power transmission equipment, operates in 37 countries, including the United States, Australia, China, France, Germany, Russia, the UK, and the United Arab Emirates. The company is divided into several business segments, such as industrial electric motors and gearboxes, commercial electric motors and appliances, automation, digital & systems, transmission and distribution, power generation, and industrial coatings and varnishes. In March 2023, WEG introduced the WMR (WEG Mobile Robot), an autonomous robot designed to enhance operational efficiency in industrial settings requiring internal transport.

Key Companies in the Autonomous Mobile Robots Market include:

- ABB

- BALYO

- Bastian Solutions, LLC

- Boston Dynamics

- Clearpath Robotics, Inc. (Rockwell Automation Company)

- Crown Equipment Corporation

- Daifuku Co., Ltd.

- GreyOrange

- Harvest Automation

- Hyster-Yale Materials Handling, Inc.

- inVia Robotics, Inc.

- JBT

- Jungheinrich AG

- Karter

- KUKA AG

- LexxPluss

- MITSUBISHI LOGISNEXT CO., LTD.

- Mobile Industrial Robots

- Omron Corporation

- Onward Robotics

- Richtech Robotics

- Toyota Material Handling

- WEG

- Zhejiang Guozi Robotics Co., Ltd

Autonomous Mobile Robots Industry Developments

- April 2024: LexxPluss, a Japanese autonomous mobile robot (AMR) conveyance systems provider, announced its investment plans in the United States to offer its advanced conveyance systems to American customers.

- July 2023: Karter, a subsidiary of Weighpack, launched three advanced autonomous mobile robot (AMR) solutions designed for diverse applications such as manufacturing, intralogistics, agriculture, and the transportation of heavy products and components.

- March 2022: Oceaneering International launched a comprehensive overhaul of its autonomous mobile robotics product line and the debut of three new mobile robots in North America.

- June 2022: Amazon introduced a fully autonomous mobile robot, Proteus, designed to lift and transport carts carrying packages within its facilities autonomously.

Autonomous Mobile Robots Market Segmentation:

Autonomous Mobile Robots Component Outlook

- Hardware

- Software

- Services

Autonomous Mobile Robots Type Outlook

- Autonomous Inventory Robots

- Goods-To-Person Picking Robots

- Self-Driving Forklifts

- Unmanned Aerial Vehicles

Autonomous Mobile Robots, Battery Type Outlook

- Lead Battery

- Lithium-Ion Battery

- Nickel-based Battery

- Others

Autonomous Mobile Robots, Application Outlook

- Assembly

- Inventory Management

- Sorting

- Transportation

- Others

Autonomous Mobile Robots, Payload Capacity Outlook

- Below 100 kg

- 100 kg - 500 kg

- More than 500 kg

Autonomous Mobile Robots, End-Use Outlook

- Manufacturing

- Aerospace

- Automotive

- Chemical

- Defense

- Electronics

- FMCG

- Healthcare

- Plastics

- Others

- Wholesale & Distribution

- E-commerce

- Retail Chains/Conveyance Stores

- Others

Autonomous Mobile Robots Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Autonomous Mobile Robots Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.9 Billion |

|

Market Size Value in 2025 |

USD 3.6 Billion |

|

Revenue Forecast in 2034 |

USD 21.4 Billion |

|

CAGR |

23.80% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global autonomous mobile robots market size was valued at USD 2.9 Billion in 2024 and is projected to grow to USD 21.4 Billion by 2034.

The global market is projected to grow at a CAGR of 23.80% during the forecast period, 2025-2034.

North America had the largest share of the global market

The key players in the market are ABB, BALYO, Bastian Solutions, LLC, Boston Dynamics, Clearpath Robotics, Inc. (Rockwell Automation Company), Crown Equipment Corporation, Daifuku Co., Ltd., GreyOrange, Harvest Automation, Hyster-Yale Materials Handling, Inc., inVia Robotics, Inc., JBT, Jungheinrich AG, Karter, KUKA AG, LexxPluss, MITSUBISHI LOGISNEXT CO., LTD., Mobile Industrial Robots, Omron Corporation, Onward Robotics, Richtech Robotics, Toyota Material Handling, WEG, and Zhejiang Guozi Robotics Co., Ltd.

The assembly segment dominated the autonomous mobile robots market in 2024.

The wholesale & distribution is projected for significant growth in the global market.