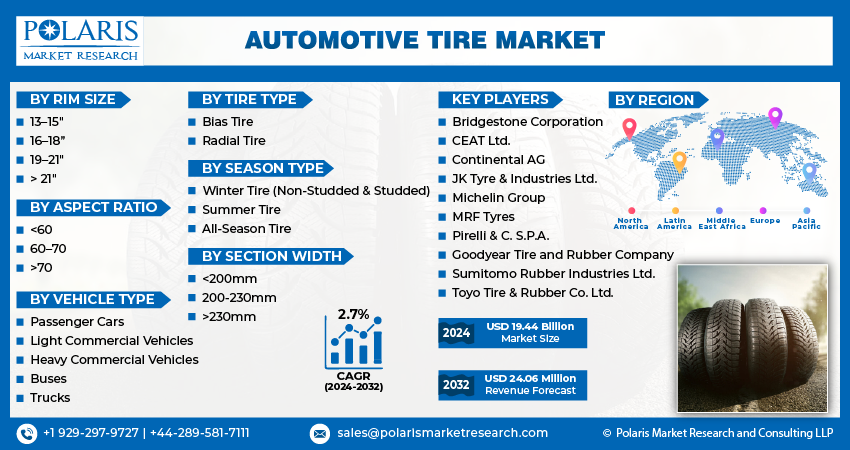

Automotive Tire Market Share, Size, Trends, Industry Analysis Report, By Rim Size (13-15”, 16-18”, 19-21” and >21”); By Aspect Ratio; By Vehicle Type; By Tire Type; By Season Type; By Section Width; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM1441

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

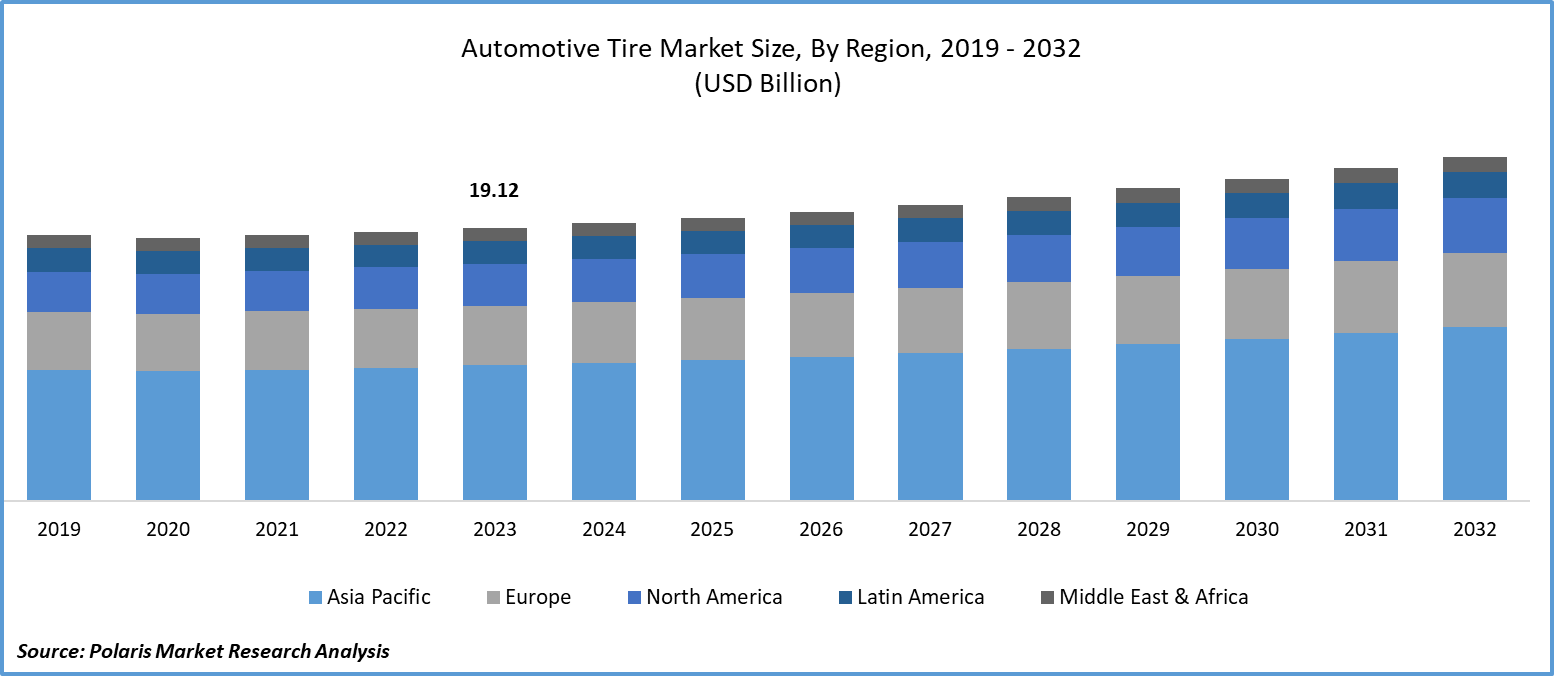

The global automotive tire market size was valued at USD 19.12 billion in 2023. The market is anticipated to grow from USD 19.44 billion in 2024 to USD 24.06 billion by 2032, exhibiting a CAGR of 2.7% during the forecast period.

Automotive Tire Market Overview

The growth of the automotive tires market is driven by rising car ownership across the globe, which has led to an increased demand for tires. Additionally, there is a growing demand for high-performance automobiles, which require specialized tires for optimal performance. Moreover, the expansion of the automotive manufacturing sector has also contributed to the growth of the tire market, as more vehicles are being produced and require tires.

For instance, in January 2024, Toyo Tires developed a concept tire using 90% sustainable materials.

To Understand More About this Research:Request a Free Sample Report

To address the changing market demands, leading companies are heavily investing in research and development (R&D) to enhance efficiency and produce high-quality tires. These investments aim to introduce innovative tire technologies that enhance performance, longevity, and eco-friendliness. A notable trend is the development of lightweight, specialized tires tailored for electric and hybrid vehicles. As the popularity of these vehicles grows, tire manufacturers are concentrating on producing tires that are tailored to their unique characteristics, including weight distribution and driving behaviors. This market segment offers substantial growth potential for tire manufacturers, encouraging ongoing innovation and R&D investment.

The automotive tire industry is experiencing a significant shift driven by stringent tire performance standards and the increasing demand for fuel-efficient vehicles. This has prompted tire producers to develop new tires that offer enhanced wet grip and lower rolling resistance, meeting the evolving needs of consumers and regulatory requirements. As a result, the automotive tire market demand for such tires is growing rapidly. Technological advancements in the car tire sector, including the use of innovative materials and manufacturing processes, are further fueling this growth. This trend highlights the industry's commitment to developing high-performance, eco-friendly tires that cater to the changing preferences of consumers and the broader automotive tire market outlook.

Automotive Tire Market Dynamics

Market Drivers

Rising Demand for Convenience and Focus on Fuel Economy

The automotive tire market growth is experiencing a boost due to several factors. Primarily, there is an increasing emphasis on fuel economy, driving consumers to seek tires that offer better fuel efficiency. Convenience is driving growth in the automotive tire market, with demand for all-season tires eliminating the need for seasonal changes. Moreover, the high maintenance or replacement costs of conventional tires are leading consumers to opt for more durable and cost-effective alternatives, boosting the demand for innovative tire solutions. Furthermore, original equipment manufacturers (OEMs) are adopting advanced manufacturing technology to differentiate their products, offering tires that are more sustainable, durable, and affordable, thus meeting the evolving needs of consumers and further driving the automotive tire market growth.

Rise in the Average Lifespan of Vehicles and the Yearly Mileage Driven by Light-Duty Vehicles

Due to enhancements in road infrastructure, driving conditions, technology, and other factors, the average lifespan of vehicles has extended in recent times. This increase in vehicle longevity, along with higher annual mileage, has created growth opportunities for aftermarket tire manufacturers. According to the US Department of Transportation's Federal Highway Administration, the average passenger car travels 13,476 miles per year, equivalent to over 1,000 miles per month. The automotive tire sector has felt the impact of vehicles lasting longer and driving more miles. Despite facing reduced tire demand, the industry has responded by boosting research and development spending, leading to a stronger focus on tire performance and sustainability.

Market Restraints

Fluctuating Prices of Raw Materials and Extended Tire Lifespan are Impacting Aftermarket Sales

In the automotive tire industry, raw material costs play a crucial role in determining component prices. Materials such as steel, fabric, plasticizers, carbon black, natural rubber, and synthetic rubber are used in tire manufacturing. The price and availability of rubber, both synthetic and natural, have a significant impact on tire costs. Natural rubber, in particular, is an important raw material, and the Association of Natural Rubber Producing Countries reported a shortage of 700,000 metric tons in 2017. However, there was an increase of 991,000 tons in the world's natural rubber supply in May 2022. The fluctuating cost of natural rubber over the past decade has had a notable impact on tire manufacturers and the pricing of automobile tires.

As cars continue to endure longer and cover fewer miles, the demand for replacement tires has declined due to their increased longevity. Consequently, the aftermarket tire market has experienced a decrease in sales. However, the need for tire maintenance and repair services has grown, given the longer lifespan of tires. Older tires are more prone to requiring repair, balancing, or rotation, leading to an increase in sales for these services within the aftermarket tire sector. Overall, despite the uptick in service sales, the aftermarket tire sector has faced an overall negative impact from the extended longevity of tires.

Report Segmentation

The market is primarily segmented based on rim size, aspect ratio, vehicle type, tire type, season type, section width, and region.

|

By Rim Size |

By Aspect Ratio |

By Vehicle Type |

By Tire Type |

By Season Type |

By Section Width |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Automotive Tire Market Segmental Analysis

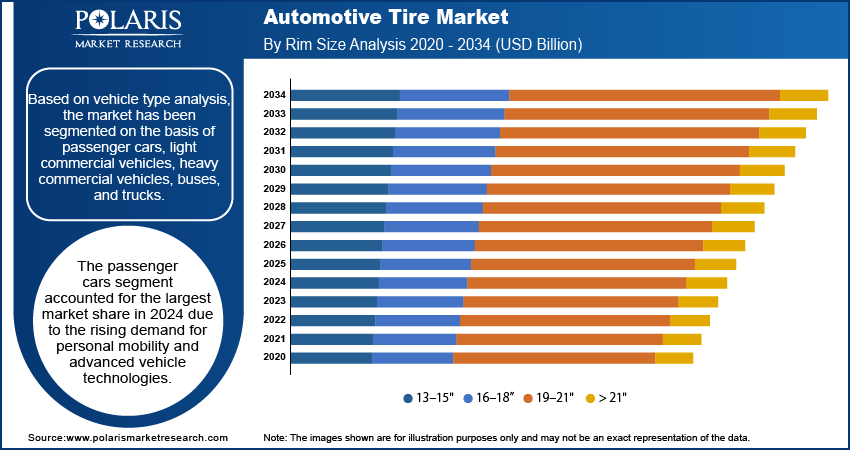

By Rim Size Analysis

The 13" -15" segment led the industry market with a substantial revenue share in 2023. The market for compact vehicles, such as hatchbacks and subcompacts, is growing. These vehicles generally have smaller wheels and tires compared to SUVs and trucks. Typically, these cars have rim diameters ranging from 13" to 15" and gross vehicle weight ratings (GVWR) under 3.0 tons. They are often utilized in shared transportation services such as Lyft, where smaller cars with 13" to 15" diameter tires are common. Models such as the Hyundai Avante, Volkswagen Rapid, and Hyundai Accent, and others frequently feature these rim sizes.

By Aspect Ratio Analysis

The >70 aspect ratio segment accounted for the largest market share in 2023 and is likely to retain its position throughout the automotive tire market forecast period. Due to their higher sidewall, these tires offer a more comfortable and smoother ride. Additionally, their larger footprint offers improved stability and traction. In large vehicles, higher aspect ratio tires offer superior protection for cargo, while in buses, they offer a more comfortable ride and safeguard against potholes on the road. Tires with an aspect ratio greater than 70 are frequently less expensive than tires with a lower ratio. This is a result of their simpler manufacturing. In addition, safety features like run-flat technologies are available on more recent tires with a greater aspect ratio.

Due to this technology, it is possible to drive on tires that have lost air pressure, potentially reducing the risk of accidents. Tires featuring aspect ratios greater than 70 are prevalent on 80%–90% of heavy commercial vehicles globally, and replacing them tends to incur higher costs compared to tires with lower aspect ratios. Consequently, in the coming years, the significant market share of trucks and buses is anticipated to be driven by the demand for tires with aspect ratios exceeding 70.

By Vehicle Type Analysis

Based on vehicle type analysis, the market has been segmented on the basis of passenger cars, light commercial vehicles, heavy commercial vehicles, buses, and trucks. The passenger cars segment dominates the automotive tire market. Since passenger cars are more likely to be owned than other vehicle types like buses and commercial trucks, the passenger car market is predicted to grow at a faster rate than other vehicle segments. Also, there is a wide variety of tire options available in the market because passenger cars are available in a variety of models, sizes, and styles, each having unique tire requirements to match their performance characteristics.

The light commercial vehicles segment is growing with the fastest CAGR in the context of the automotive tire market opportunity. Approximately 26 liters of oil is required to make a new tire for a light commercial vehicle. But just 9 liters of oil, or about 34% of the new production process, is used in tire retreading. However, according to the Retread Tire Association, a brand-new set of four tires for a pickup truck is almost twice as expensive as retreaded tires. For instance, there are more than 1,700 tire retreading and maintenance locations for commercial trucks globally operated by the Goodyear Tire and Rubber Company (U.S.). Thus, in an effort to cut expenses, the practice of tire retreading on LCVs is steadily increasing.

Automotive Tire Market Regional Insights

The Asia Pacific Region Dominated the Global Market with the Largest Market Share in 2023

The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the automotive tire market forecast period. Asia Pacific has emerged as a hub for auto manufacturing, attracting established automakers such as BMW AG, Volkswagen Group, Tata, BYD, Nissan, and Mitsubishi. This trend is fueled by several factors, including the region's low production costs, abundant cheap labor, lenient safety and pollution regulations, and government incentives for foreign direct investment (FDI). Prominent tire manufacturers with a significant presence in the Asia Pacific region include Sumitomo Rubber Industries Ltd., Hankook Tyres, Kumho Tyre Co., Bridgestone Corporation, and other Tier-I suppliers. To keep pace with the increasing demand for car tires, companies in this region are investing in expanding their manufacturing facilities. For instance, in November 2022, Bridgestone allocated USD 250 million to renovate and expand its tire production plant in Heredia, Costa Rica. Therefore, these factors are anticipated to be the primary drivers behind the investments and advancements in the Asia-Pacific region.

The North America region is expected to hold a significant revenue share during the automotive tire market forecast period. North America boasts a large and diverse market for automobiles, ranging from passenger vehicles to commercial trucks, which significantly contributes to the demand for tires. With a high rate of vehicle ownership per capita compared to many other parts of the world, the region sees a consistent demand for replacement tires as vehicles age and require new ones. Moreover, North America is home to several leading tire manufacturers that invest heavily in research and development. This commitment has led to the development of innovative tire technologies, including run-flat tires, eco-friendly tires, and tires with advanced tread designs for improved performance. These factors collectively establish North America as a significant player in the automotive tire market outlook.

Competitive Landscape

The automotive tire market is fragmented and is anticipated to witness competition due to several players' presence. Major automotive tire providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product innovations, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- Bridgestone Corporation

- CEAT Ltd.

- Continental AG

- Goodyear Tire and Rubber Company

- JK Tyre & Industries Ltd.

- Michelin Group

- MRF Tyres

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries Ltd.

- Toyo Tire & Rubber Co. Ltd.

Recent Developments

- In January 2024, Sumitomo Rubber Industries is mass-producing tires at its Shirakawa plant in Fukushima, Japan, using hydrogen and solar energy. The company aims to produce 10,350 tons annually, demonstrating sustainable manufacturing practices.

- In June 2023, Continental AG introduced the UltraContact NXT, a new tire featuring 65% renewable materials derived from agricultural waste and certified by ISCC PLUS mass balance. Available in 19" sizes, these tires are designed for use in both electric and combustion engine vehicles. Models such as the Kia Niro, Volkswagen ID.3, Mercedes-Benz EQA, and Tesla Model 3 can be fitted with these innovative tires.

Report Coverage

The automotive tire market report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, rim size, aspect ratio, vehicle type, tire type, season type, section width, and their futuristic growth opportunities.

Automotive Tire Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 19.44 billion |

|

Revenue forecast in 2032 |

USD 24.06 billion |

|

CAGR |

2.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Rim Size, By Aspect Ratio, By Vehicle Type, By Tire Type, By Season Type, By Section Width, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Automotive Tire market size is expected to reach USD 24.06 billion by 2032

Key players in the market are MRF Tyres, J.K. Tyre & Industries Ltd., Continental AG, Bridgestone Corporation, Sumitomo Rubber Industries Ltd

Asia Pacific contribute notably towards the global Automotive Tire Market

Automotive Tire Market exhibiting the CAGR of 2.7% during the forecast period

The Automotive Tire Market report covering key segments are rim size, aspect ratio, vehicle type, tire type, season type, section width, and region.