Automotive Tinting Film Market Share, Size, Trends, Industry Analysis Report, By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs)); By Application; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3172

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

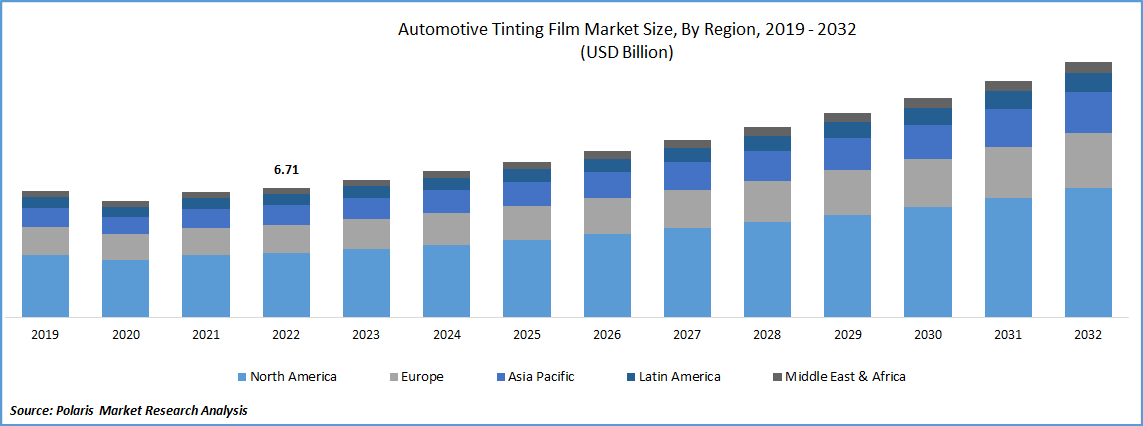

The global automotive tinting film market was valued at USD 7.12 billion in 2023 and is expected to grow at a CAGR of 7.2% during the forecast period. The environmental benefits these films offer as well as rising consumer safety concerns are expected to stimulate the market. By blocking UV radiation, automotive tinting shields interior car parts from fading, warping, and scratching. Metal, crystals, carbon, ceramics, and dyes must be utilized to make vehicle tinting film. Normally, this film is transparent, but some install colored films for the windows, also known as vehicle tinted film, increase privacy and block the sun. Because window film is a lamination that has been darkened, it can be utilized to block things like light.

Know more about this report: Request for sample pages

Vehicle demand is expected to be fueled by technology advancements like the introduction of bio-based polyester films and rising consumer spending power. Additionally, it is anticipated that within the anticipated period, consumer knowledge of the product's benefits would increase along with a quick recovery in the automotive industry. It is projected that limitations on visible light transmission will obstruct industrial growth.

For instance, according to a research report by Andrew P. Nowak et al. released in 2022, as autonomous vehicles get more advanced and developed, they integrate more sensors, producing numerous data streams that describe their surroundings. As part of the continuous and consistent transmission of data, lenses and windows for sensors must be protected from environmental abrasion over a range of wavelengths, including visible, near-infrared, and thermal. In this study, they present a cross-linked poly(oxalamide) that is transparent in numerous IR and visible (400-750 nm) bands and is made of di-oxalate species and aliphatic amine monomers. The cross-linked network contributes to durability and the ability to protect delicate substrates by reflecting mechanical toughness and network resilience to fluids and heat exposure.

The global industry suffered in 2020 as a result of the COVID-19 pandemic. Due to the government-imposed closure, which was implemented to restrict the virus's spread, vehicle facilities had to temporarily close. The output of plastic feedstock has been significantly reduced, which has had a significant influence on the global industry.

Industry Dynamics

Growth Drivers

To improve security and lessen the chance that passengers may sustain injuries in a collision, the window glass has been concentrated in one place. Therefore, it is anticipated that a key element propelling the growth of the worldwide automotive tinting film market would be the growing emphasis on vehicle security and protection. Additionally, nanomaterials extend the life and safety of vehicles due to their unique physical and chemical properties. Due to recent technological advancements, producers are now offering improved versions of their products to the market for vehicle tinting films.

For instance, the premium nano-ceramic window film NEX, made by American film technology company STEK Automotive, contains graphene, tungsten, and antimony tin oxide. Thanks to our industry leading hydrophobic & Self Heal top-coat technology & extra glossy factor, STEK offers a film for any driving style to keep up with the people’s vehicle a beautifully protected part of their personality. Nevertheless, it is projected that the sector would grow as a result of advancements in tinting film technology.

Report Segmentation

The market is primarily segmented based on vehicle type, application, and region.

|

By Vehicle Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Passenger car vehicle type is expected to dominate the industry's market sector in 2022.

Passenger cars will dominate the market in 2022, accounting for majority of total sales. The industry is primarily being driven by the rising use of tinting films on passenger car windows and windscreens for UV protection. UV radiation is prevented while heat and glare are reduced by tinting films. A thin polyester film called automotive tinting film is applied to the inside of a car's window glass. It is utilized for glare reduction, UV protection, and privacy. Private cars, or PCs, are automobiles used solely for personal transportation and not for commercial purposes. Most often, they are owned by an individual or family.

Additionally, rapid urbanization, an increase in the number of workers, and rising disposable income have all contributed to an increase in the demand for passenger automobiles in developing nations. The condition of the economy in a country has a significant impact on its passenger vehicle market. As a result, it is anticipated that there will be an increase in demand for the product during the projected period.

Windshields application will account for a higher share of the market during projected timeframe.

Windshields dominated the market in 2022 and are expected to maintain this position all through the forecast period. The development of advanced glass technologies with scratch- and break-resistant properties is the main factor driving the market. Furthermore, improved UV protection and the rising popularity of laminated glass technologies are having a favorable impact on the market share of car front windscreens. Moreover, growing customer demand for smart glass solutions and technological improvements in the glass industry is expected to support the growth of the auto front windscreens market. The incorporation of advanced power electronics, glass, nanotechnology, and controlled light evacuation from outside the vehicle are all increasing industrial requirements.

For instance, In June 2022, protective Shield Windshield Protection for the automotive industry was released by Nano Magic, a well-known company in the cleaning sector powered by nanotechnology. This ground-breaking windscreen solution is simple to use and generates an imperceptible force field barrier that guards against risks including rain, salt, bird bombs, and others. Any automotive windscreen type is eligible for the treatment, which provides defense for a full year.

The demand in Asia Pacific is expected to witness significant growth during forecast period

The Asia Pacific region will generate majority of global revenue in 2022. In the upcoming years, the market is anticipated to grow at its fastest rate due to increased vehicle production, rising UV awareness among the general public, and expanded use of windscreens for displays. For instance, according to statistics provided by the International Organization of Motor Vehicles, the region produced 46 million cars overall in 2021, whereas 42 million vehicles were sold in the region.

The increasing exports of automobiles from multiple countries in the Asia Pacific area also contribute to the automotive tinting film market growth. China and India are anticipated to hold the largest share in this region due to the presence of significant players there. For instance, a CEIC research published in 2022 states that China's motor vehicle sales increased to 2,556,000 units in December 2022 from 2,327,721 units in November 2022.

By 2026, India is expected to be the third-largest automotive market in the world in terms of volume, creating new opportunities for commercial and electric vehicles. Between April and March 2020, the industry will produce 26 million vehicles, including passenger cars, light trucks, three-wheelers, two-wheelers, and quadricycles, 4.7 million of which will be exported. As a result, it is projected that the aforementioned factors would significantly affect the market in the following years.

Competitive Insight

Some of the major players operating in the global automotive tinting film market include 3M, Eastman Chemical, TintFit Window Films, Avery Dennison, Johnson Window Films, Madico, Saint-Gobain, TWF, Armolan, NEXFIL, Solar Screen International, Huper Optik USA, American Standard Window Tint, Garware Suncontrol & Hanita Coatings.

Recent Developments

- In April 2022, according to Map Group, new environmentally friendly polymers will be created for the European automotive industry using molecular recycling technologies from Eastman. As part of a multi-year strategic partnership with Eastman, Map Group, a global leader in the formulation and compound manufacture of plastics, recently unveiled ground-breaking compounds for innovative resins in the automotive industry. Eastman's molecular recycling technology is the foundation of the Cherbio line, which is offered by Map Compounding, the company's manufacturing division.

Automotive Tinting Film Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.56 billion |

|

Revenue forecast in 2032 |

USD 13.22 billion |

|

CAGR |

7.2% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Vehicle Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

3M, Eastman Chemical Company, TintFit Window Films, Avery Dennison Israel, Johnson Window Films, GLOBAL WINDOW FILMS, Madico, Saint-Gobain Performance Plastics Corp., TWF, Armolan, NEXFIL, Solar Screen International SA, Huper Optik USA, American Standard Window Tint, Garware Suncontrol and Hanita Coatings RCA |

FAQ's

Key companies in automotive tinting film market are 3M, Eastman Chemical, TintFit Window Films, Avery Dennison, Johnson Window Films, Madico, Saint-Gobain, TWF, Armolan, NEXFIL, Solar Screen International.

The global automotive tinting film market expected to grow at a CAGR of 7.12% during the forecast period.

The automotive tinting film market report covering key segments are vehicle type, application, and region.

key driving factors in automotive tinting film market are increasing demand for passenger vehicles and rising consumer safety concerns.

The global automotive tinting film market size is expected to reach USD 13.22 billion by 2032.