Automotive Telematics Market Size, Share, Trends, Industry Analysis Report: By Channel Type (OEM and Aftermarket), Service (Infotainment & Navigation, Fleet Management, Safety & Security, and Diagnostics), Technology Type, Vehicle Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Feb-2025

- Pages: 119

- Format: PDF

- Report ID: PM3345

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Telematics Market Overview

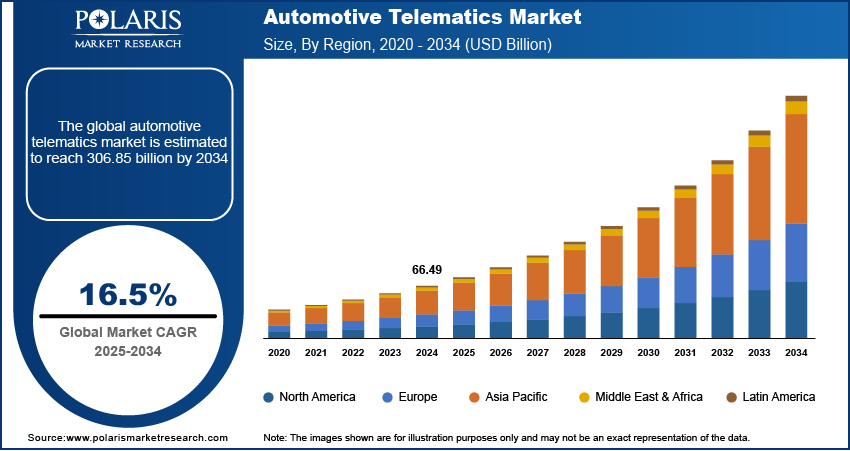

The automotive telematics market size was valued at USD 66.49 billion in 2024. The market is projected to grow from USD 77.33 billion in 2025 to USD 306.85 billion by 2034, exhibiting a CAGR of 16.5% during 2025–2034.

The automotive telematics market refers to the integration of telecommunications and vehicle technologies to provide various services related to vehicle management, safety, and user experience. It involves the use of embedded systems, sensors, and software to collect, transmit, and analyze vehicle data in real time. Key drivers of market growth include the increasing demand for connected vehicles; advancements in 5G technology; and rising consumer preference for enhanced safety and convenience features such as real-time navigation, remote diagnostics, and vehicle tracking. Automotive telematics market trends such as the development of autonomous vehicles and the growing adoption of electric vehicles are also contributing to the market expansion. Additionally, regulatory support for vehicle safety and environmental standards is promoting the market growth.

To Understand More About this Research: Request a Free Sample Report

Automotive Telematics Market Dynamics

Growing Demand for Connected Vehicles

Connected vehicles use telematics technology to link the car with other devices and networks, enabling services such as real-time navigation, remote diagnostics, and advanced safety features. A key factor contributing to this trend is the increasing consumer demand for more integrated and smart features in vehicles. The growing availability of 5G connectivity is enhancing the capabilities of connected vehicles, allowing for faster data transmission and more reliable communication between vehicles and infrastructure. Therefore, the rise of connected vehicles is one of the major trends driving the automotive telematics market development.

Integration with Autonomous Vehicle Technologies

The integration of telematics with autonomous vehicle systems is rapidly shaping the future of transportation. Autonomous vehicles rely heavily on telematics for real-time data transmission between vehicles and their surroundings to ensure safety, navigation, and decision-making. This trend is particularly evident in the ongoing development of self-driving cars by major manufacturers, including Tesla, Waymo, and others. The global push for reducing road accidents and enhancing transportation safety further accelerates the integration of telematics in autonomous vehicles. Hence, the integration of telematics with autonomous vehicle systems boosts the automotive telematics market demand.

Advancements in Vehicle Safety and Driver Assistance Systems

Telematics is playing a critical role in enhancing vehicle safety and supporting the development of advanced driver assistance systems (ADAS). ADAS includes features such as lane departure warnings, automatic emergency braking, adaptive cruise control, and parking assistance. The increasing demand for these safety features is driving the adoption of telematics in vehicles. A 2022 study by the European Commission revealed that ADAS technologies helped reduce traffic accidents by 15–20%, prompting more vehicle manufacturers to integrate these systems. Additionally, regulations in various regions are pushing for the inclusion of safety features in new vehicles, further expanding the role of telematics in improving vehicle safety. This trend is expected to continue as consumers increasingly prioritize safety when purchasing vehicles. Therefore, the advancements in vehicle safety and ADAS are projected to boost the demand for automotive telematics systems in the coming years.

Automotive Telematics Market Segment Insights

Automotive Telematics Market Outlook – Channel Type-Based Insights

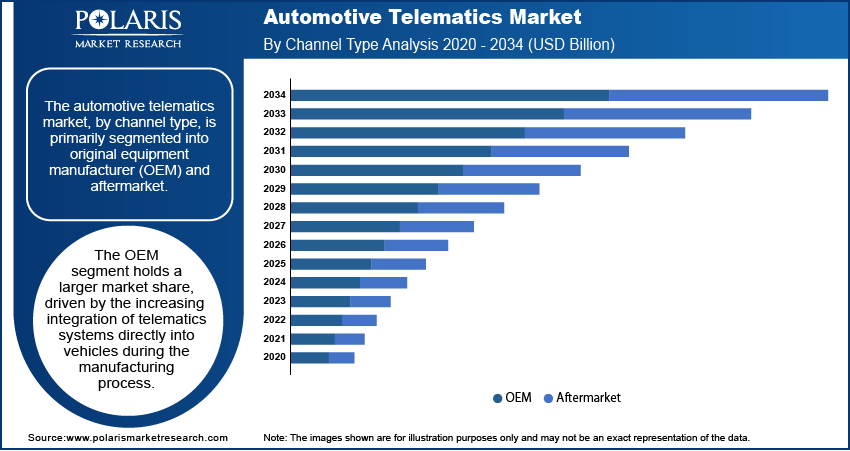

The automotive telematics market, by channel type, is primarily segmented into original equipment manufacturers (OEM) and aftermarket. The OEM segment holds a larger market share, driven by the increasing integration of telematics systems directly into vehicles during the manufacturing process. This segment benefits from the growing demand for connected and autonomous vehicles, where telematics are considered essential for enhancing functionality, safety, and user experience. OEMs are investing heavily in telematics technology to meet consumer expectations for features such as real-time navigation, remote diagnostics, and ADAS. Additionally, regulatory support for safety and emissions standards is encouraging OEMs to include telematics systems as part of standard vehicle offerings.

The aftermarket segment, while smaller in market share compared to OEM, is registering a higher growth rate. This can be attributed to the increasing availability of telematics solutions that can be retrofitted into existing vehicles, catering to consumers who want to enhance their vehicle's connectivity without purchasing a new vehicle. The rise in demand for fleet management solutions, vehicle tracking, and real-time diagnostics in the aftermarket sector is contributing to this growth. Moreover, the widespread adoption of smartphones and mobile apps has enabled easier integration of telematics devices in older vehicle models, further driving the growth of this segment.

Automotive Telematics Market Assessment – Service-Based Insights

The automotive telematics market, by service type, is segmented into infotainment & navigation, fleet management, safety & security, and diagnostics. The infotainment & navigation segment holds the largest market share, as consumers increasingly demand connected and entertainment features in their vehicles. This includes in-car navigation, real-time traffic updates, multimedia streaming, and hands-free communication, all of which are now seen as essential for enhancing the driving experience. As more vehicles incorporate sophisticated infotainment systems, this segment remains critical to the growth of automotive telematics, driven by consumer preferences for convenience and entertainment while driving.

The fleet management segment is witnessing the highest growth rate due to the increasing need for businesses to manage vehicle fleets efficiently, optimize routes, reduce costs, and enhance operational productivity. Telecommunication and real-time data analysis provided by telematics are vital in offering comprehensive fleet management solutions, which is particularly appealing to logistics and transportation industries. The rising focus on efficiency, sustainability, and regulatory compliance is further accelerating this segment's expansion. Additionally, the adoption of telematics in fleet management supports data-driven decision making and improves overall fleet performance, making it a key growth driver in the automotive telematics space.

Automotive Telematics Market Regional Insights

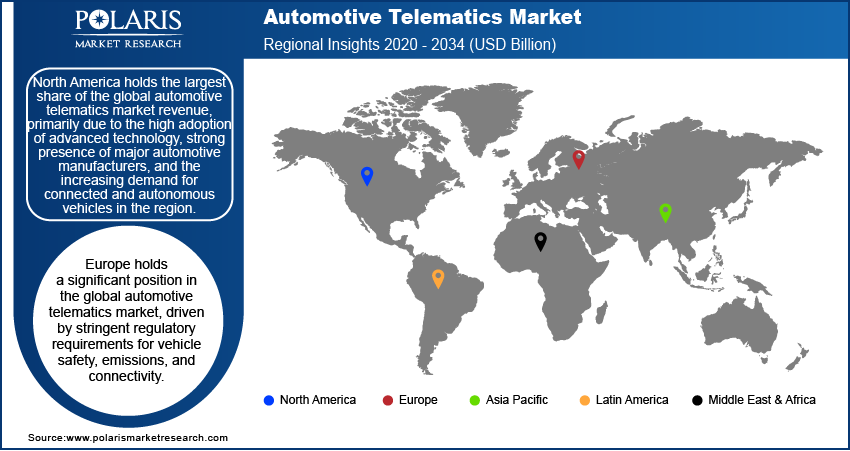

By region, the study provides automotive telematics market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, primarily due to the high adoption of advanced technology, strong presence of major automotive manufacturers, and the increasing demand for connected and autonomous vehicles in the region. The US, in particular, is a leader in the integration of telematics systems, driven by consumer preferences for safety, convenience, and entertainment features, as well as regulatory support for vehicle connectivity and safety. Additionally, the region's strong infrastructure for 5G networks and advancements in autonomous driving technologies contribute significantly to the market's growth. Europe and Asia Pacific are also notable markets, driven by regulatory mandates and the rapid development of electric and autonomous vehicles. However, North America remains the dominant player due to its established automotive industry and technological advancements.

Europe holds a significant position in the global automotive telematics market, driven by stringent regulatory requirements for vehicle safety, emissions, and connectivity. The European Union's regulations promoting vehicle safety features, such as eCall and advanced driver assistance systems (ADAS), have accelerated the adoption of telematics technologies in new vehicles. Additionally, the region is home to several leading automotive manufacturers such as Volkswagen, BMW, and Daimler, which are increasingly integrating telematics systems into their vehicles. The growing demand for electric vehicles (EVs) and the rise of autonomous vehicle technologies further support the automotive telematics market expansion in Europe, as these advancements require robust telematics solutions for vehicle management, navigation, and safety.

The Asia Pacific automotive telematics market is growing rapidly owing to the strong presence of key automotive manufacturers, particularly in countries such as Japan, China, and South Korea. The region is witnessing significant investments in the development of connected and autonomous vehicles, with governments in countries such as China offering substantial support for smart transportation initiatives. The increasing adoption of electric vehicles (EVs) in the region also drives the demand for advanced telematics systems to manage vehicle performance, energy consumption, and maintenance. Furthermore, the growing focus on fleet management and logistics in countries such as India and China is propelling the expansion of telematics services, particularly in the commercial vehicle sector.

Automotive Telematics Market – Key Market Players and Competitive Insights

A few key players in the automotive telematics market include Continental AG, Bosch, Garmin, Delphi Technologies (now part of Aptiv), Panasonic Corporation, Verizon Communications, Visteon, Harman International (a subsidiary of Samsung Electronics), Magna International, TomTom, ZF Friedrichshafen, AT&T, Geotab, Autotalks, and Blackberry QNX. These companies are actively engaged in the development and integration of telematics systems, offering solutions for vehicle safety, navigation, fleet management, infotainment, and diagnostics. Harman International and Bosch provide embedded telematics solutions, whereas other companies such as Verizon and AT&T focus on providing connectivity and data services for connected vehicles. These players are also investing in innovative technologies, such as 5G connectivity and artificial intelligence, to enhance the functionality and performance of telematics systems.

In terms of competition, the automotive telematics market is highly dynamic, with key players focusing on strategic partnerships, technology advancements, and product diversification to gain a competitive edge. Companies such as Continental and Bosch are working closely with automotive manufacturers to integrate telematics systems into vehicles at the OEM level. However, other players, such as Geotab, are capitalizing on the growing demand for fleet management solutions. Additionally, players such as Garmin and TomTom focus on providing navigation and infotainment solutions that cater to both OEMs and the aftermarket. As the demand for connected and autonomous vehicles increases, companies are also exploring opportunities to expand their portfolios to include advanced driver assistance systems (ADAS) and telematics platforms that support autonomous driving.

The competitive landscape is evolving as companies work to enhance the value proposition of their telematics solutions. As the market moves toward greater vehicle connectivity, advancements in 5G, artificial intelligence, and cloud computing are expected to play a major role in shaping competition. Players are also seeking to capture opportunities in emerging markets, where the demand for connected vehicles and fleet management services is growing rapidly. Collaboration between telematics providers and automotive manufacturers, along with a focus on data-driven services, is likely to define future competition in the market. With regulatory pressures and consumer preferences pushing for more safety and connectivity features, companies that can deliver cost-effective, reliable, and innovative telematics solutions are poised for success.

Continental AG is a major player in the automotive telematics market, known for providing a range of products, including vehicle control systems, sensors, and telematics solutions. The company has been actively working on integrating advanced connectivity and safety features in vehicles. One of their recent initiatives is their focus on autonomous driving technologies, where they are developing systems that help vehicles interact with their surroundings.

Harman International, a part of Samsung Electronics, provides connected car solutions, including telematics systems, infotainment, and in-vehicle networking services. Harman has a strong presence in the OEM and aftermarket segments, offering integrated solutions for vehicle manufacturers and consumers.

List of Key Companies in Automotive Telematics Market

- AT&T

- Autotalks

- Blackberry QNX

- Bosch

- Continental AG

- Delphi Technologies (now part of Aptiv)

- Garmin

- Geotab

- Harman International (a subsidiary of Samsung Electronics)

- Magna International

- Panasonic Corporation

- TomTom

- Verizon Communications

- Visteon

- ZF Friedrichshafen

Automotive Telematics Industry Developments

- In September 2024, Continental announced the expansion of its collaboration with global automotive manufacturers to further enhance the development of telematics systems for connected and autonomous vehicles.

- In June 2024, Harman unveiled a new suite of telematics products designed to improve vehicle connectivity and driver assistance features. These products aim to enhance the overall driving experience by providing better navigation, safety, and real-time vehicle diagnostics.

Automotive Telematics Market Segmentation

By Channel Type Outlook

- OEM

- Aftermarket

By Service Outlook

- Infotainment & Navigation

- Fleet Management

- Safety & Security

- Diagnostics

By Technology Type

- Embedded

- Tethered

- Integrated

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Telematics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 66.49 billion |

|

Market Size Value in 2025 |

USD 77.33 billion |

|

Revenue Forecast by 2034 |

USD 306.85 billion |

|

CAGR |

16.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The automotive telematics market has been broadly segmented on the basis of channel type, service, technology type, and vehicle type. Moreover, the study provides the reader with a detailed understanding of the different segments at both global and regional levels.

Growth/Marketing Strategy

The automotive telematics market growth and marketing strategies are focused on technological innovation, strategic partnerships, and expanding product offerings to meet the growing demand for connected and autonomous vehicles. Companies are increasingly investing in advanced technologies such as 5G, artificial intelligence, and cloud computing to enhance their telematics solutions. Collaborations with automotive manufacturers are key to integrating telematics systems at the OEM level, while expanding aftermarket services such as fleet management are becoming a priority. Additionally, targeting emerging markets and developing cost-effective solutions are central to capturing new customer segments and driving market growth.

FAQ's

? The automotive telematics market size was valued at USD 66.49 billion in 2024 and is projected to grow to USD 306.85 billion by 2034.

? The market is projected to register a CAGR of 16.5% during the forecast period.

? North America held the largest share of the market in 2024.

? A few key players in the automotive telematics market are Continental AG, Bosch, Garmin, Delphi Technologies (now part of Aptiv), Panasonic Corporation, Verizon Communications, Visteon, Harman International (a subsidiary of Samsung Electronics), Magna International, TomTom, ZF Friedrichshafen, AT&T, Geotab, Autotalks, and Blackberry QNX.

? The OEM segment accounted for the largest market share in 2024.

? The infotainment & navigation segment accounted for the largest share of the market in 2024.

? Automotive telematics refers to the integration of telecommunications and vehicle technology to provide a variety of services related to vehicle management, safety, navigation, and infotainment. It involves the use of embedded systems, sensors, and software to collect, transmit, and analyze data from vehicles in real time. This technology enables services such as GPS navigation, vehicle tracking, remote diagnostics, emergency assistance, and advanced driver assistance systems (ADAS). Automotive telematics can enhance safety, improve driving efficiency, and offer a more connected and personalized driving experience.

A few key automotive telematics market trends are described below: Increasing Adoption of Connected Vehicles: Growing demand for in-car connectivity, including real-time navigation, remote diagnostics, and enhanced entertainment features. Integration with Autonomous Vehicle Technologies: The role of telematics in supporting autonomous driving systems through real-time data and vehicle-to-vehicle communication. Growth of Fleet Management Solutions: Rising demand for telematics systems in fleet management for route optimization, vehicle tracking, and performance analysis. Advancements in 5G Connectivity: The deployment of 5G networks enhances data transmission speed, enabling more reliable communication and improved telematics functionalities. Focus on Vehicle Safety and ADAS: Increasing integration of telematics with ADAS to improve vehicle safety, reduce accidents, and ensure regulatory compliance.

? A new company entering the automotive telematics market must focus on emerging technologies such as 5G connectivity and artificial intelligence to develop advanced telematics solutions that improve real-time data analysis, vehicle safety, and driver assistance features. By targeting the growing demand for electric vehicles (EVs), the company can create specialized telematics systems to monitor battery performance and optimize energy consumption. Additionally, offering scalable, cost-effective fleet management solutions could cater to businesses looking to enhance operational efficiency. Focusing on seamless integration with autonomous vehicle technologies and providing over-the-air (OTA) updates can also give the company a competitive edge in the evolving market.

? Companies manufacturing, distributing, or purchasing automotive telematics and related products, and other consulting firms must buy the report.