Automotive Suspension Market Size, Share, Trends, Industry Analysis Report: By System, Vehicle Type, Component, Damping (Hydraulic and Electromagnetic), Geometry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 –2034

- Published Date:Mar-2025

- Pages: 128

- Format: PDF

- Report ID: PM1446

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Suspension Market Overview

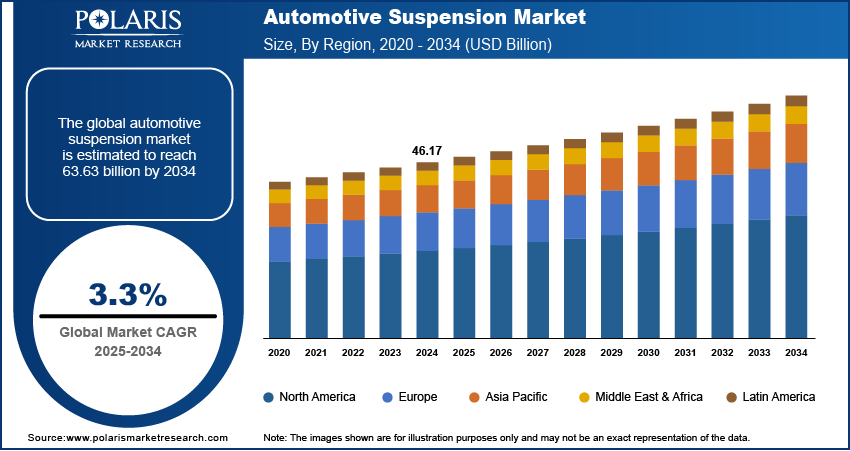

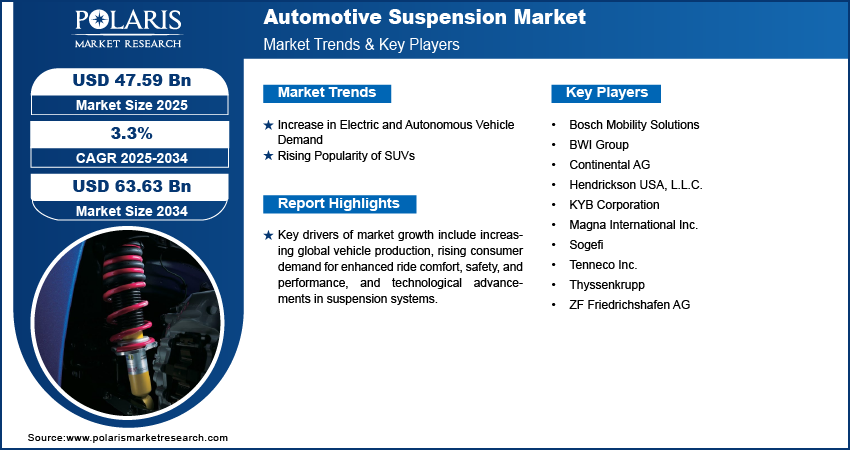

Global automotive suspension market size was valued at USD 46.17 billion in 2024. The market is projected to grow from USD 47.59 billion in 2025 to USD 63.63 billion by 2034, exhibiting a CAGR of 3.3% during the forecast period.

The automotive suspension market involves design, production, and integration of suspension systems that support a vehicle's weight, absorb shock, and maintain tire contact with the road for optimal handling and comfort. Key drivers of market growth include increasing global vehicle production, rising consumer demand for enhanced ride comfort, safety, and performance, and technological advancements in suspension systems.

Significant automotive suspension market trends will include the shift towards electric vehicles (EVs), the need for specialized suspension to accommodate different weight distributions, and the adoption of adaptive, active, and air suspension systems. Additionally, growing consumer preference for advanced driver assistance systems (ADAS) and the need for fuel efficiency and emission reduction are propelling innovations in lighter, more durable suspension materials, such as carbon fiber and composites.

To Understand More About this Research: Request a Free Sample Report

Automotive Suspension Market Dynamics

Increase in Electric and Autonomous Vehicle Demand

The increasing demand for electric and autonomous vehicles (EVs and AVs) is a key driver of the automotive suspension market. As these vehicles gain popularity, there is a growing need for specialized suspension systems to address the unique requirements of electric drivetrains, such as different weight distributions and battery placements. EVs tend to be heavier due to the battery packs, which require advanced suspension solutions to ensure stability, comfort, and safety. Additionally, autonomous vehicles, with their focus on enhanced passenger comfort and safety are driving the adoption of adaptive, active, and air suspension systems. These systems provide greater control, precision, and customization in response to the dynamic needs of both electric and autonomous vehicles.

Rising Popularity of SUVs

The rising popularity of SUVs is significantly fueling the automotive suspension market expansion. As consumers increasingly prefer SUVs for their higher ground clearance, larger cabin space, and off-road capabilities, there is a growing demand for suspension systems that can handle the unique demands of these vehicles. SUVs often require more robust suspension setups to provide a smooth ride, stability, and handling, especially when navigating uneven terrains. This has led to greater adoption of advanced suspension technologies, such as air suspension systems and multi-link rear suspensions, which can offer better comfort and performance for these larger, heavier vehicles. For instance, in September 2022, XPENG Inc. unveiled the fourth generation of its G9 flagship SUV in China. This new series includes three versions with different driving ranges and offers six configurations: the RWD 570G, RWD 570E, and RWD 702E; the 4WD Performance 650E and 650X; and the Launch Edition 650X. These advanced models incorporate advanced suspension technologies, such as air suspension and adaptive damping systems. As the SUV market continues to expand, the need for advanced suspension solutions will remain a key driver in the automotive suspension sector.

Automotive Suspension Market Segment Insights

Automotive Suspension Market Assessment by System

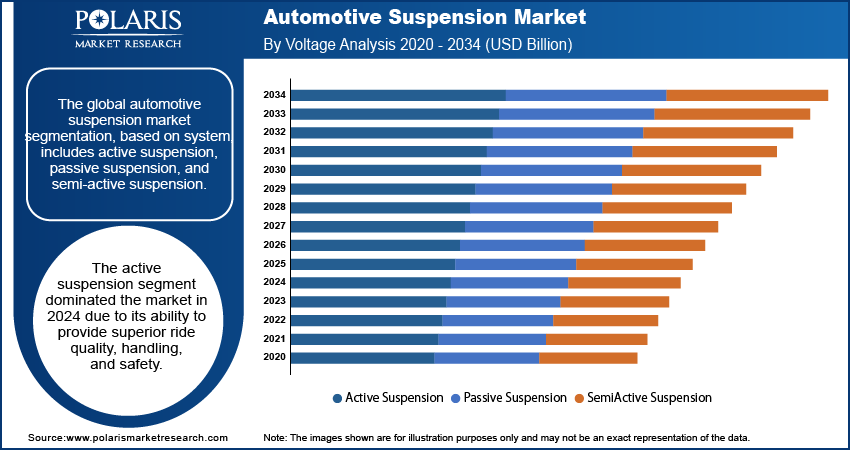

The global automotive suspension market segmentation, based on system, includes active suspension, passive suspension, and semi-active suspension. The active suspension segment dominated the market in 2024 due to its ability to provide superior ride quality, handling, and safety. Active suspension systems use electronically controlled dampers and sensors to adjust the suspension in real-time, continuously adapting to road conditions, vehicle speed, and driving style. This allows for a smoother, more comfortable ride by reducing body roll, improving stability, and enhancing cornering performance. For instance, in December 2023, ClearMotion provided active suspension technology for Nio's upcoming ET9 electric vehicle, with a contract covering 750,000 units. The system, which reduces motion inside the car by 75%, will significantly enhance ride comfort. Additionally, ClearMotion plans to expand its production capabilities and secure additional automaker clients in the future. As consumers demand higher levels of comfort, performance, and safety, active suspension systems are increasingly integrated into premium vehicles and high-performance models, driving their dominance in the market.

The passive suspension segment is also projected to experience the highest automotive suspension market CAGR during the forecast period. This growth is due to its cost-effectiveness, simplicity, and widespread application in a variety of vehicle types. While active and adaptive systems offer advanced performance, passive suspensions, which include traditional shock absorbers and struts, remain a popular choice for budget-friendly and mass-market vehicles. Their reliability, lower maintenance costs, and ease of integration make them an attractive option for automakers looking to balance performance with affordability. As the demand for more economical vehicles continues to rise, particularly in emerging markets, the passive suspension segment is expected to see significant growth.

Automotive Suspension Market Evaluation by Vehicle Type

The automotive suspension market is segmented by vehicle type into passenger cars, light commercial vehicles, and heavy commercial vehicles. Passenger cars hold the largest automotive suspension market share due to their widespread adoption and essential role in everyday transportation. With the global demand for personal vehicles continuing to rise, the need for high-performance, comfortable, and reliable suspension systems in passenger cars has surged. Suspension systems are crucial for enhancing ride quality, handling, and safety, making them a key component in passenger vehicle design. The growth of the automotive industry, along with increasing consumer preference for advanced features such as active and adaptive suspension systems, further drives the demand for suspension components in passenger cars. This significant market share is also supported by the ongoing advancements in automotive technologies and the production of both conventional and electric passenger vehicles.

Automotive Suspension Market Regional Insights

By region, the study provides the automotive suspension market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific dominated the automotive suspension market in 2024 due to the region's strong presence in automotive manufacturing and growing consumer demand for vehicles. Countries such as China, India, Japan, and South Korea are major hubs for vehicle production, with a large number of both domestic and global automakers operating in the region. Rapid industrialization, increasing disposable incomes, and expanding middle class in emerging markets such as China and India are driving demand for passenger vehicles, which in turn boosts the need for advanced suspension systems. Additionally, the region's strong focus on technological advancements and innovations in automotive design, including electric vehicles (EVs) and autonomous vehicles, further strengthens its position in the market.

Europe is expected to grow significantly due to the region's strong automotive industry, which includes major key players such as Volkswagen, BMW, Mercedes-Benz, and Renault. The shift towards electric vehicles (EVs), coupled with increasing demand for higher performance, safety, and comfort in vehicles, drives the adoption of advanced suspension systems. Europe’s focus on sustainable mobility, stringent emission regulations, and technological innovations, including adaptive and semi-active suspension systems, further propel automotive suspension market growth. Additionally, the presence of a well-established automotive aftermarket and ongoing research into improving ride quality and vehicle dynamics contribute to the market growth in Europe.

Automotive Suspension Key Market Players & Competitive Insights

Leading market players are making significant investments in research and development to expand their product offerings and further drive the automotive suspension market growth. These companies are also engaging in various strategic activities to increase their global presence, including launching innovative products, forming international partnerships, increasing investments, and engaging in mergers and acquisitions. To thrive in the increasingly competitive market environment, the industry needs to provide cost-effective solutions.

The automotive suspension market faces competition from major global players, fueled by rising demand from the steel and cast-iron industries. The major players dominate the market with their extensive production capacities and advanced technologies. Competition is further heightened by fluctuating raw material prices, stringent environmental regulations, and the necessity for technological advancements to improve efficiency and reduce emissions. Major players in the automotive suspension industry include Continental AG, ZF Friedrichshafen AG, Magna International Inc., Tenneco Inc., Bosch Mobility Solutions, BWI Group, KYB Corporation, Hendrickson USA, L.L.C., Thyssenkrupp, and Sogefi.

Continental AG is a global provider of automotive technology and components, operating across various segments, including Automotive Technologies, Rubber Technologies, and Industrial Solutions. The company offers a diverse range of automotive suspension systems, including shock absorbers, struts, and advanced suspension modules designed to enhance vehicle performance and comfort. Additionally, Continental provides innovative solutions in braking systems, tires, and electronic components. In recent developments, Continental AG has been actively expanding its portfolio through new product launches and strategic partnerships to strengthen its market position and meet evolving customer needs.In January of 2023, Continental and Ambarella announced a strategic partnership to develop AI-based full-stack solutions for assisted and automated driving at CES 2023. Their collaboration aims to deliver scalable, energy-efficient systems for vehicles by 2026, enhancing safety and performance.

ZF Friedrichshafen AG is a technology company specializing in mobility systems for passenger cars, commercial vehicles, and industrial technology. The company operates across four key technology domains: Vehicle Motion Control, Integrated Safety, Automated Driving, and Electric Mobility. ZF operates 162 production sites in 31 countries. ZF's growth strategy focuses on expanding its product portfolio and enhancing its technological capabilities through strategic investments and an efficient organizational structure.In June 2024, ZF showcased advanced innovations at Global Technology Day 2024, highlighting advancements in vehicle motion control, safety, and electric mobility. The event emphasized ZF's commitment to transforming mobility through sustainable and advanced technologies.

Key Companies in Automotive Suspension Market

- Bosch Mobility Solutions

- BWI Group

- Continental AG

- Hendrickson USA, L.L.C.

- KYB Corporation

- Magna International Inc.

- Sogefi

- Tenneco Inc.

- Thyssenkrupp

- ZF Friedrichshafen AG

Automotive Suspension Market Developments

April 2024: BWI Group and ThyssenKrupp Steering announced a partnership to develop Electro-Mechanical Brake (EMB) systems, enhancing chassis-by-wire technology for Level-3 and above autonomous driving.

July 2023: Hendrickson introduced air mechanical suspensions for trailers in India, designed to address local terrain challenges and enhance performance and adaptability in the region.

Automotive Suspension Market Segmentation

By System (Revenue - USD Billion, 2020 - 2034)

- Active Suspension

- Passive Suspension

- Semi-Active Suspension

By Vehicle Type (Revenue - USD Billion, 2020 - 2034)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Component (Revenue - USD Billion, 2020 - 2034)

- Strut

- Shock Absorber

- Leaf Spring

- Ball Joint

- Air Spring

- Control Arm

- Coil Spring

- Others

By Damping (Revenue - USD Billion, 2020 - 2034)

- Hydraulic

- Electromagnetic

By Geometry (Revenue - USD Billion, 2020 - 2034)

- Independent Suspension

- Semi-Independent Suspension

- Dependent Suspension

By Regional (Revenue - USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Suspension Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 46.17 billion |

|

Market size Value in 2025 |

USD 47.59 billion |

|

Revenue Forecast in 2034 |

USD 63.63 billion |

|

CAGR |

3.3% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automotive suspension market size was valued at USD 46.17 billion in 2024 and is projected to grow to USD 63.63 billion by 2034.

The global market is projected to register a CAGR of 3.3% during the forecast period.

Asia Pacific is expected to dominate the automotive suspension market.

The key players in the market are Continental AG, ZF Friedrichshafen AG, Magna International Inc., Tenneco Inc., Bosch Mobility Solutions, BWI Group, KYB Corporation, Hendrickson USA, L.L.C., Thyssenkrupp, Sogefi

The active suspension segment dominated the market in 2024 due to its ability to provide superior ride quality, handling, and safety.