Automotive Sun Visor Market Size, Share, Trends, Industry Analysis Report: By Component (Conventional and LCD), Vehicle Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5316

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Sun Visor Market Overview

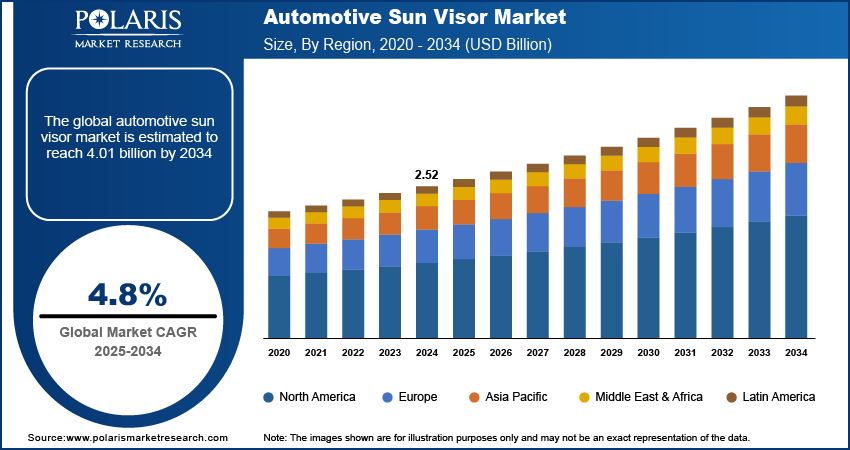

The global automotive sun visor market size was valued at USD 2.52 billion in 2024. The market is projected to grow from USD 2.63 billion in 2025 to USD 4.01 billion by 2034, exhibiting a CAGR of 4.8% during 2025–2034.

An automotive sun visor is a movable panel located on the interior roof of a vehicle, designed to block sunlight and reduce glare while driving. It fits with various angles and includes a mirror, with some models offering additional features such as an extension for better coverage.

The growing emphasis on driver safety is significantly driving the demand for automotive sun visors. The awareness about road safety is increasing, due to which automakers are prioritizing features that improve driver comfort and reduce distractions, making sun visors an essential component. Sun visors help reduce glare from the sun, which improves visibility and prevents accidents caused by impaired vision. Additionally, regulations requiring vehicles to meet certain safety standards are positively impacting the automotive sun visor market demand.

To Understand More About this Research: Request a Free Sample Report

Technological advancements in sun visors are expected to fuel the automotive sun visor market growth during the forecast period. Innovations such as electrochromic or smart sun visors, which automatically adjust to light conditions to provide better glare protection and convenience, are anticipated to drive the demand for automotive sun visors. Additionally, materials are becoming lighter, more durable, and UV-resistant, improving both functionality and aesthetics. Features such as built-in LED lights or integrated mirrors are also adding value, which is making modern sun visors more versatile and appealing to consumers.

Automotive Sun Visor Market Driver Analysis

Growth of Automotive Industry

The rising production and sale of vehicles are propelling the need for essential interior components such as sun visors. According to the International Organization of Motor Vehicle Manufacturers, vehicle sales globally increase by 12% between 2022 and 2023, highlighting the growth of the automotive industry. Additionally, the expansion of the automotive industry in emerging regions such as India and Africa is driving greater demand for affordable and feature-rich vehicles. Therefore, the growth of the automotive industry is fueling the automotive sun visor market expansion.

Rising Disposable Income

An increase in disposable income is supporting the general population to spend more on luxury. According to the US Bureau of Economic Analysis, in the US alone, disposable income rose by 0.1% from August to September 2024. Additionally, higher income levels have enabled consumers to invest in premium vehicles or aftermarket modifications, including improved sun visors. Therefore, the rising disposable income of the general population is driving the automotive sun visor market development.

Automotive Sun Visor Market Segment Analysis

Automotive Sun Visor Market Assessment by Component Outlook

The automotive sun visor market segmentation, based on component, includes conventional and LCD. The conventional segment is expected to experience a significant CAGR in the global market during the forecast period due to its lightweight materials such as fabric and plastic. It remains popular due to its affordability and simplicity. Many consumers prefer these basic models for their practicality and effectiveness in blocking sunlight. Automakers continue to include conventional sun visors in a wide range of vehicle models, driving demand for conventional sun visors.

Automotive Sun Visor Market Evaluation by Vehicle Type Outlook

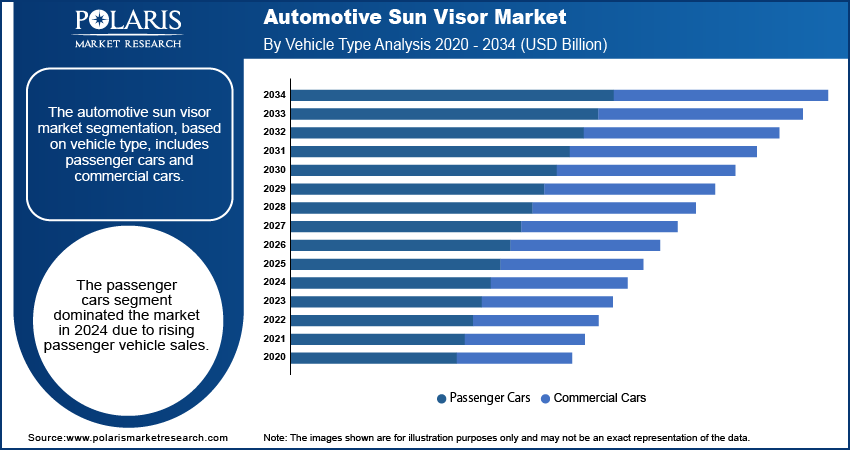

The automotive sun visor market segmentation, based on vehicle type, includes passenger cars and commercial cars. The passenger cars segment dominated the automotive sun visor market share in 2024, due to the rising passenger vehicle sales. Increased demand for personal transportation, coupled with the growing middle-class population in emerging regions, has led to higher passenger car sales. Sun visors are a standard feature in nearly all passenger vehicles. Therefore, growing passenger vehicle sales are leading to segmental dominance in the global market.

Automotive Sun Visor Market Regional Analysis

By region, the study provides the automotive sun visor market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share of the market due to the rising demand for electric vehicles in the region. Manufacturers are expanding their production capacities to fulfil the demand from the general population, due to which the demand for automotive sun visors is increasing. According to the Federal Reserve Bank of Chicago, in 2021, EV sales reached 1.4 million in the US, highlighting significant demand for electric vehicles. Additionally, growing disposable income in the region is driving the demand for electric vehicles, further propelling the automotive sun visor market growth in North America.

The Asia Pacific automotive sun visor market is experiencing significant growth due to growing mergers and acquisitions between major automotive players aimed at the expansion of production capacities. Automotive manufacturers in the region are strategically acquiring and partnering with key competitors for the expansion of manufacturing capacity. Additionally, these mergers and acquisitions have led to the exchange of resources and technology aiming at broader market reach. Further, the increasing sales of vehicles are driving the demand for automotive sun visors in Asia Pacific.

The automotive sun visor market in India is experiencing substantial growth due to the expansion of local automotive manufacturers. These automotive manufacturers are expanding their production capacities to meet consumer demand, due to which the demand for automotive sun visors is rising. Tata Motors, an Indian multinational automotive company, sold 215,034 passenger vehicles in the second quarter of FY 2024–2025, highlighting the expansion of their operations. Additionally, government incentives for local automotive manufacturers are driving this expansion, positively impacting the automotive sun visors market demand in India.

Automotive Sun Visor Market – Key Players and Competitive Analysis

The automotive sun visor market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the automotive sun visor market are Irvin Automotive Products, Inc.; Grupo Antolin; GUMOTEX; KASAI KOGYO CO., LTD.; Atlas Holdings; FOMPAK; Hayashi Telempu Corporation; Benecke-Kaliko AG; BRACE; Grios s.r.o.; OTOTRIM Panel Industry and Trade SA; ContiTech AG; Magna International Inc.; ACME Specialty Manufacturing; and Mirror Lite Company, Inc.

Irvin Automotive Products, Inc. is a manufacturer of the automotive components. The company's offering lies in three primary product segments—automotive lighting, electrical systems, and interior components. In the automotive lighting segment, Irvin offers solutions such as headlights, taillights, and interior lighting systems. The electrical systems division focuses on components such as wiring harnesses and connectors. Additionally, Irvin produces a variety of interior components, including dashboard assemblies and seating systems. These diverse offerings cater to original equipment manufacturers (OEMs) and aftermarket suppliers. Irvin Automotive Products operates primarily in North America, with a strong presence in the US, but it also extends its operations internationally to markets in Europe and Asia.

KASAI KOGYO CO., LTD. is a Japanese manufacturing company established in 1944, specializing in automotive interior and exterior trim components. The company’s product portfolio primarily includes interior trim components such as dashboard assemblies, door panels, and console components. Additionally, KASAI KOGYO manufactures exterior trim components such as bumpers and grilles, which contribute to the vehicle's design and aerodynamics. KASAI KOGYO operates on a global scale, with a geographical footprint that spans multiple regions. Its headquarters in Japan serves as the hub for its manufacturing capabilities, while production facilities across Asia cater to the growing demand for automotive components. The company also has a strong presence in North America.

List of Key Companies in Automotive Sun Visor Market

- Irvin Automotive Products, Inc.

- Grupo Antolin

- GUMOTEX

- KASAI KOGYO CO., LTD.

- FOMPAK

- Hayashi Telempu Corporation

- Benecke-Kaliko AG

- BRACE

- Grios s.r.o.

- OTOTRIM Panel Industry and Trade SA

- ContiTech AG

- Magna International Inc.

- ACME Specialty Manufacturing

- Mirror Lite Company, Inc.

Automotive Sun Visor Market Development

In December 2023, Bosch launched Virtual Visor, an innovative sun visor, featuring AI technology and a transparent LCD panel. It was recognized for enhancing driver safety by reducing sun glare during critical times.

In March 2024, Japanese electric car competitors Nissan and Honda revealed their intention to form a strategic partnership in the electric vehicle sector.

Automotive Sun Visor Market Segmentation

By Component Outlook (Revenue USD Billion, 2020–2034)

- Conventional

- LCD

By Vehicle Type Outlook (Revenue USD Billion, 2020–2034)

- Passenger Cars

- Commercial Cars

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Sun Visor Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.52 billion |

|

Market Size Value in 2025 |

USD 2.63 billion |

|

Revenue Forecast by 2034 |

USD 4.01 billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.52 billion in 2024 and is projected to grow to USD 4.01 billion by 2034.

The global market is projected to register a CAGR of 4.8% during 2025–2034.

North America had the largest share of the global market in 2024.

A few key players in the market are Irvin Automotive Products, Inc.; Grupo Antolin; GUMOTEX; KASAI KOGYO CO., LTD.; Atlas Holdings; FOMPAK; Hayashi Telempu Corporation; Benecke-Kaliko AG; BRACE; Grios s.r.o.; OTOTRIM Panel Industry and Trade SA; ContiTech AG; Magna International Inc.; ACME Specialty Manufacturing; and Mirror Lite Company, Inc.

The conventional segment is expected to experience significant CAGR in the global market during the forecast period due to its affordability and simplicity.

The passenger car segment dominated the market in 2024 due to the rising passenger vehicle sales.