Automotive Refinish Coating Market Size, Share, Trends, Industry Analysis Report: By Resin (Acrylic, Alkyd, Polyurethane, and Others), Technology, Product, Vehicle Age, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 133

- Format: PDF

- Report ID: PM5172

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Refinish Coating Market Overview

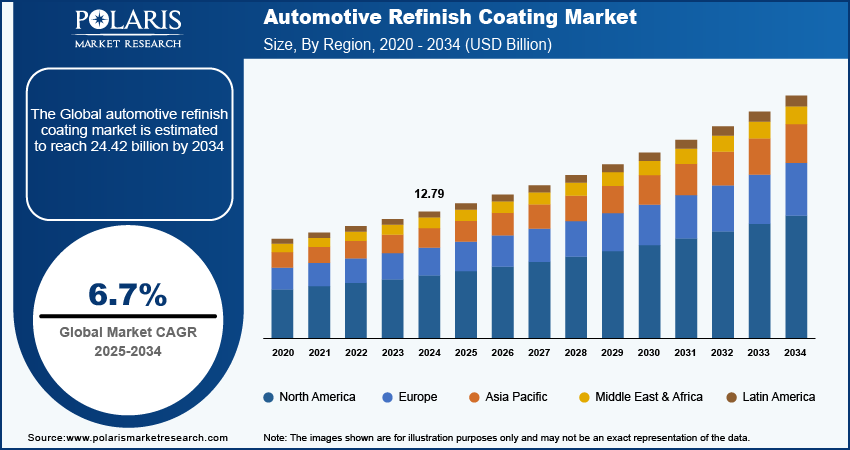

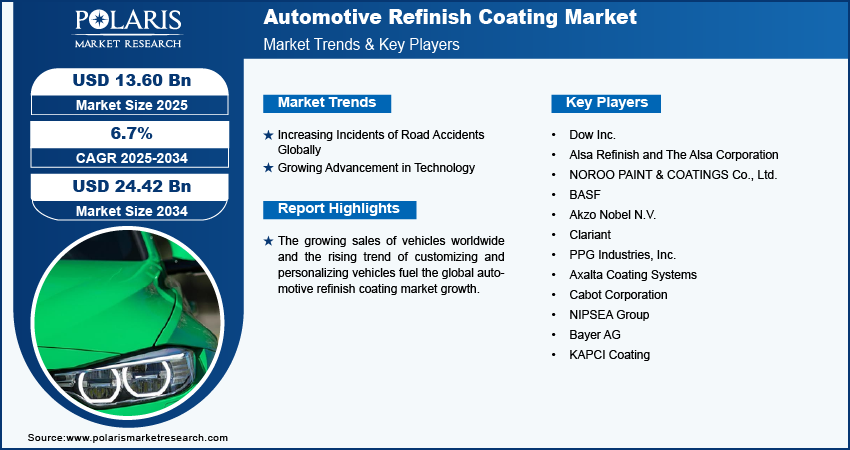

The automotive refinish coating market size was valued at USD 12.79 billion in 2024. The market is projected to grow from USD 13.60 billion in 2025 to USD 24.42 billion by 2034, exhibiting a CAGR of 6.7% during 2025–2034.

Automotive refinish coating plays a crucial role in maintaining and enhancing the appearance and durability of vehicles. This market encompasses a wide range of products designed to address issues such as wear, tear, and paint fading on cars, trucks, and commercial vehicles.

The growing sales of vehicles worldwide drive the automotive refinish coating market growth. According to a report published by the European Automobile Manufacturers' Association, global new car sales grew by almost 10% in 2023 after remaining stable in 2022. The frequency of accidents, scratches, and general wear and tear rises as vehicle ownership or adoption increases. This creates a high need for repair and maintenance services, including refinishing, which drives demand for refinishing coatings. Thus, as the adoption of vehicles increases, the demand for coating refinish also spurs.

The growing trend of customizing and personalizing vehicles is projected to fuel the global automotive refinish coating market growth during the forecast period. Consumers often choose custom paint jobs, wraps, and finishes as they seek to customize and personalize their vehicles. This demand for diverse colors and finishes drives the need for high-quality refinish coatings.

To Understand More About this Research: Request a Free Sample Report

The automotive refinish coating market is driven by the rising average age of vehicles worldwide. Vehicles are more prone to wear and tear as they age, which prompts vehicle owners to seek refinishing services to restore their vehicles’ appearance and maintain their value, leading to higher demand for refinish coatings.

Automotive Refinish Coating Market Driver Analysis

Increasing Incidents of Road Accidents Globally

The increasing number of road accidents across the globe is propelling the global automotive refinish coating market. As per the data published by the World Health Organization (WHO), between 20 and 50 million nonfatal injury cases are reported every year around the globe due to road traffic crashes. Road accidents often result in body damage that requires repainting and refinishing, leading to a higher need for quality refinish coatings to restore vehicles to their original condition.

Growing Advancements in Technology

Technological advancements lead to the development of higher-quality coatings that offer better durability, UV resistance, and chemical protection, driving consumers to invest in these advanced refinish products. Additionally, the integration of smart technologies in automotive repairs, such as augmented reality for training or diagnostic tools, streamlines the refinishing process and enhances the quality of work, increasing demand for innovative coatings. Therefore, the rising technological advancements in coating solutions fuel the global automotive refinish coating market growth.

Automotive Refinish Coating Market Segment Insights

Automotive Refinish Coating Market Breakdown by Resin Insights

Based on resin, the automotive refinish coating market is segmented into acrylic, alkyd, polyurethane, and others. The polyurethane segment dominated the market in 2024 due to its superior performance characteristics. Polyurethane coatings offer exceptional durability, chemical resistance, and a high-gloss finish, making them ideal for various automotive applications. These coatings excel in protecting vehicles from harsh environmental conditions, UV radiation, and mechanical wear, which are significant factors for consumers and professionals in the automotive repair industry. Additionally, the automotive industry's shift toward higher-quality materials and coatings in response to consumer preferences has reinforced polyurethane’s strong market position.

The acrylic segment is expected to grow at a robust pace in the coming years, owing to the rising demand for eco-friendly and versatile coating solutions. Acrylic resins offer excellent adhesion, quick drying times, and a broad range of colors, making them attractive for customization and repairs. The growing emphasis on sustainable practices and the use of low-VOC formulations align well with the properties of acrylic coatings, appealing to environmentally conscious consumers and manufacturers. Furthermore, advancements in acrylic technology have led to improved performance attributes, such as enhanced scratch resistance and weather ability, positioning acrylic as a key segment in the automotive refinishing market.

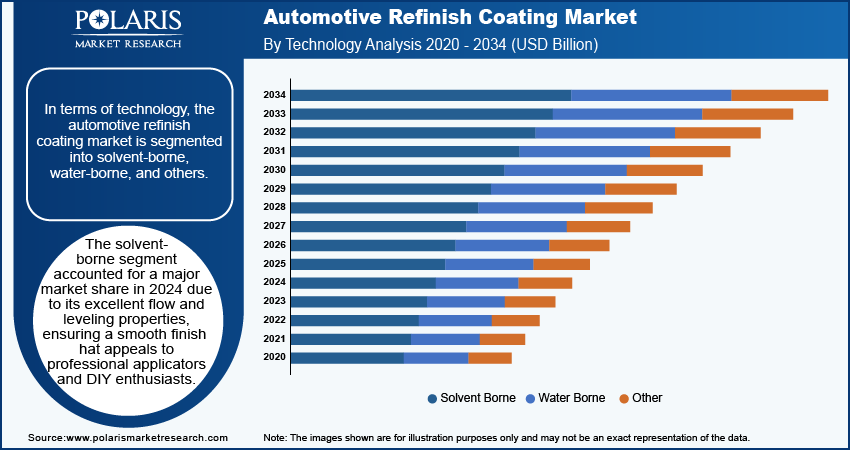

Automotive Refinish Coating Market Breakdown by Technology Insights

In terms of technology, the automotive refinish coating market is segmented into solvent-borne, water-borne, and others. The solvent-borne segment accounted for a major market share in 2024 due to its established performance and versatility. Solvent-borne coatings deliver excellent flow and leveling properties, ensuring a smooth finish that appeals to professional applicators and DIY enthusiasts. These coatings provide strong adhesion and robust durability, making them suitable for various environmental conditions and mechanical stresses. The rapid application and quick drying times further enhance their attractiveness, allowing workshops to complete jobs efficiently and meet customer demands. Additionally, solvent-borne formulations often offer a wider range of color options and finishes, catering to consumers' desire for personalization and aesthetics, which has contributed to their dominant position in the market.

The water-borne segment is estimated to grow at a rapid pace during the forecast period owing to the rising stringent environmental regulations and increasing consumer preferences toward eco-friendly solutions. Water-borne coatings produce lower VOC emissions, aligning with the increasing focus on sustainability within the automotive industry. The growing awareness among consumers about environmental impact, coupled with regulatory pressure, drives demand for these coatings.

Automotive Refinish Coating Market Regional Insights

By region, the study provides the automotive refinish coating market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest market share in 2024 due to rapid urbanization, increasing vehicle ownership, and a booming automotive aftermarket. The automotive sector in countries such as China and India has witnessed significant growth, with rising disposable incomes leading to more consumers investing in vehicle customization and maintenance. The expanding middle-class population in these countries fuels the demand for high-quality refinishing products as individuals seek to enhance the aesthetics and longevity of their vehicles. Additionally, the presence of numerous manufacturers and suppliers in the region facilitates access to advanced coatings technologies, further supporting market growth.

The North America automotive refinish coating market is expected to register a significant CAGR during the forecast period due to technological advancements and a strong focus on quality. The US, as a leading country in this region, plays a pivotal role in shaping market growth. The expansion of DIY culture and professional refinishing services in the country supports the market expansion in the region. Additionally, stringent environmental regulations in North America encourage the adoption of low-VOC and eco-friendly formulations, prompting manufacturers to innovate in water-borne and sustainable coatings, thereby fueling market growth.

Automotive Refinish Coating Market – Key Players and Competitive Insights

Major automotive refinish coating market players are investing heavily in research and development to expand their offerings, which will help the market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the automotive refinish coating industry players must offer innovative solutions.

The automotive refinish coating market is fragmented, with the presence of numerous global and regional market players. A few major players in the automotive refinish coating market are Dow Inc.; Alsa Refinish and The Alsa Corporation; NOROO PAINT & COATINGS Co., Ltd.; BASF; Akzo Nobel N.V.; Clariant; PPG Industries, Inc.; Axalta Coating Systems; Cabot Corporation; NIPSEA Group; Bayer AG; and KAPCI Coating.

NOROO PAINT & COATINGS Co., Ltd is a prominent player in the automotive refinish coating sector, headquartered in South Korea. NOROO has developed a diverse range of products that cater to the needs of the automotive industry, particularly focusing on refinish coatings that restore and enhance vehicle aesthetics. The company has positioned itself as a global player in the market by emphasizing advanced technology and eco-friendly solutions, aligning with global trends toward sustainability.

BASF, founded in 1865 and headquartered in Ludwigshafen, Germany, is a global chemical producer and a key player in the automotive refinish coating market. The company operates across six main segments—chemicals, materials, industrial solutions, surface technologies, nutrition & care, and agricultural solutions. With a workforce of ∼112,000 employees and operations in over 90 countries, BASF serves a vast array of industries such as automotive, construction, agriculture, and electronics. In the automotive sector, BASF is particularly renowned for its high-quality refinish coatings that meet the demands of vehicle manufacturers and repair shops worldwide. In April 2024, BASF's Coatings division announced the launch of a new generation of clearcoats and undercoats for the Asian Pacific refinish market. These new products have received approvals from leading automotive OEMs, demonstrating their sustainability and technical qualities.

List of Key Companies in Automotive Refinish Coating Market

- Dow Inc.

- Alsa Refinish and The Alsa Corporation

- NOROO PAINT & COATINGS Co., Ltd.

- BASF

- Akzo Nobel N.V.

- Clariant

- PPG Industries, Inc.

- Axalta Coating Systems

- Cabot Corporation

- NIPSEA Group

- Bayer AG

- KAPCI Coating

Automotive Refinish Coating Industry Developments

December 2022: BASF, a global chemical company, announced the launch of the first biomass balance automotive coatings in China using renewable raw materials.

June 2022: Kansai Paint Co., Ltd announced that Kansai Paint agreed to sell its Africa business to Akzo Nobel N.V., a global coatings company, under the Share Purchase Agreement.

September 2021: Axalta Coating Systems, a global supplier of liquid and powder coatings, announced that it had completed the previously announced acquisition of U-POL Holdings Limited. The acquisition of U-POL, a supplier of paint, protective coatings, and accessories primarily for the automotive aftermarket, strengthens Axalta's global refinish leadership position and supports its broader growth strategy.

Automotive Refinish Coating Market Segmentation

By Resin Outlook (Revenue, USD Billion, 2020–2034)

- Acrylic

- Alkyd

- Polyurethane

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Solvent-Borne

- Water-Borne

- Others

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Primer

- Basecoat

- Topcoat

- Fillers

- Others

By Vehicle Age Outlook (Revenue, USD Billion, 2020–2034)

- <5

- 5 to 10

- >10

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Refinish Coating Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.79 Billion |

|

Market Size Value in 2025 |

USD 13.60 Billion |

|

Revenue Forecast by 2034 |

USD 24.42 Billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automotive refinish coating market size was valued at USD 12.79 billion in 2024 and is projected to grow to USD 24.42 billion by 2034.

The global market is projected to register a CAGR of 6.7% during the forecast period.

Asia Pacific accounted for the largest share of the global market in 2024.

A few key players in the market are Dow Inc.; Alsa Refinish and The Alsa Corporation; NOROO PAINT & COATINGS Co., Ltd.; BASF; Akzo Nobel N.V.; Clariant; PPG Industries, Inc.; Axalta Coating Systems; Cabot Corporation; NIPSEA Group; Bayer AG; and KAPCI Coating.

The acrylic segment is projected for significant growth in the global market during the forecast period.

The solvent-borne segment dominated the market in 2024.