Automotive Pumps Market Share, Size, Trends, Industry Analysis Report

By Vehicle Type (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles); By Type; By Electric Vehicle Type; By Sales Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 111

- Format: PDF

- Report ID: PM2457

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

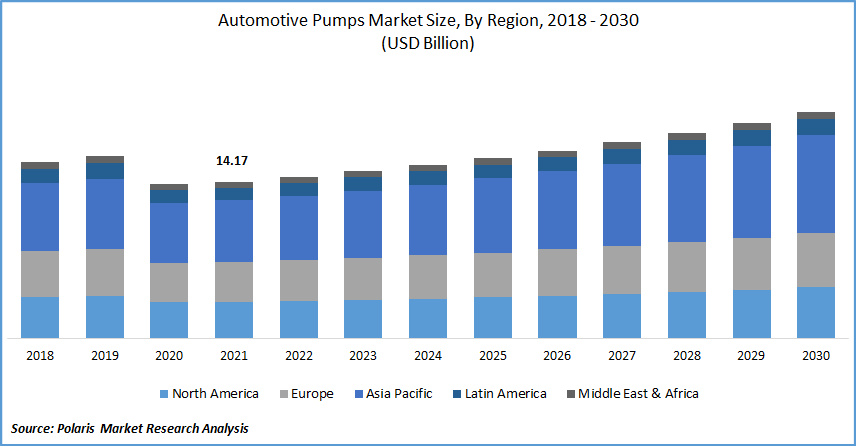

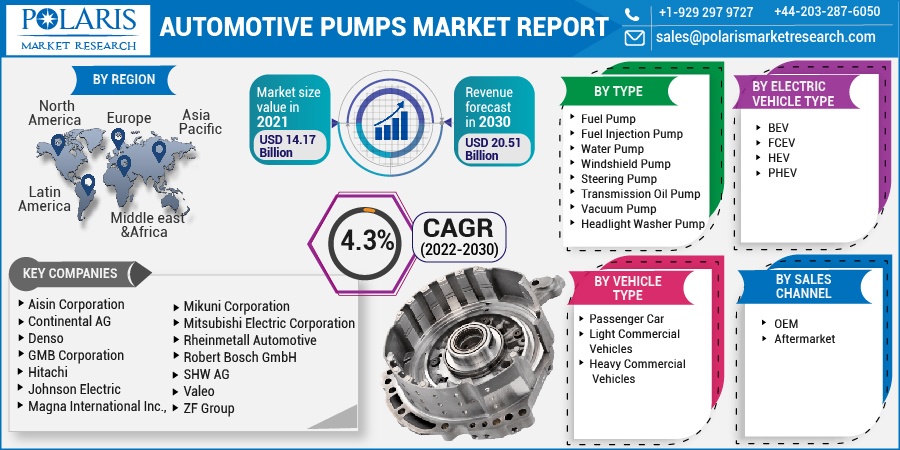

The global automotive pumps market was valued at USD 14.17 billion in 2021 and is expected to grow at a CAGR of 4.3% during the forecast period. The key factors such as the rising vehicle manufacturing, improved execution of environmental regulations, and growing acceptance of advanced automotive technologies are impelling the global automotive pumps industry growth over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The rising application of automotive pumps, such as spraying release agents, pumping liquefied gases, and the distribution of paint and solvents on centralized systems is further projected to accelerate the growth of the industry. In addition, automotive pumps are widely used to transfer tropicalizing liquids for radiators, pumping fuel, and additives for fuel.

The outbreak of the Covid-19 pandemic had a negative impact on the growth of the automotive pumps market. Production at Original Equipment Manufacturers (OEM) was halted as a result of the pandemic. It also caused a global disruption of the entire value chain of key industries, affecting the production of automotive replacement parts in micro, small, and medium-sized businesses.

Furthermore, lower customer demand for passenger automobiles resulted in revenue losses and a severe liquidity crisis in the industry. The industry saw a dramatic drop in vehicle demand, with worldwide passenger car sales falling to 60.5 million units in 2020 from a record of 79.6 million units in 2017.

Industry Dynamics

Growth Drivers

The automotive pumps market is predicted to grow due to an expanding fleet of electric and hybrid vehicles, rising consumer spending, supporting legislative frameworks, and the expansion of EV technologies such as full battery-electric and plug-in hybrid electric models. In 2020, consumer expenditure on electric vehicle purchases surged to USD 120 billion, and governments across the globe paid USD 14 billion to boost electric vehicle sales, up 25% from 2019.

Growing vehicle electrification, stricter enforcement of environmental laws, and increased integration of current automation technologies such as automatic transmission and gasoline turbocharged direct injection into vehicles to reduce vehicular emissions are all contributing to the development of the pump.

Vehicles nowadays are equipped with cutting-edge technology and intelligent features that meet the most stringent safety, quality, emission, and performance requirements. Several modern technologies, such as power steering, gasoline direct injection, gasoline turbochargers, and automatic transmission, have started to be incorporated into vehicles by manufacturers.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on type, electric vehicle type, vehicle type, sales channel, and region.

|

By Type |

By Electric Vehicle Type |

By Vehicle Type |

By Sales Channel |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Vehicle Type

Based on the vehicle type segment, the passenger car segment is expected to dominate the automotive pumps market. The demand for the market segment is driven by the rising per capita income of consumers coupled with the adoption of advanced technologies such as the Advanced Driver Assistance System (ADAS) is anticipated to accelerate the growth of the auto pumps industry.

The demand for passenger cars is predicted to rise as the significance of mobility grows due to ever-increasing distances between home, work, educational institutions, shopping, and recreational facilities. As a result, the demand for autonomous pumps is expected to grow over the forecast period.

Insight by Sales Channel

Based on the sales channel segment, the aftermarket segment is expected to account for a significant share in the industry. The segment demand is driven by the post-sale replacement of automotive parts or components, which is included in the automotive aftermarket to maintain a vehicle's efficiency and mobility economical throughout its life.

Geographic Overview

Asia Pacific is expected to witness the largest market share over the forecast period. Consumer demand for fuel-efficient vehicles is growing, providing lucrative prospects for manufacturers in the industry. The high growth rate of the Asia Pacific region is attributed to growing vehicle production in emerging nations such as China and India in the region.

Furthermore, the impetus offered to hybrid car manufacturers contributes significantly to the growth of the automotive pumps. The paradigm change from new car sales to the rapid advancement of hybrid vehicles in the country offers attractive opportunities in the emerging market.

North America is expected to account for a significant share over the forecast period. The demand for the pumps market in the region is driven by the growing stringent emission norms, a paradigm shift of automakers more toward vehicle electrification, and the growing demand for commercial vehicles from the logistics and e-commerce industries are projected to contribute to the industry growth in the region.

Competitive Insight

Some of the major players operating in the global market include Aisin Corporation, Continental AG, Denso, GMB Corporation, Hitachi, Johnson Electric, Magna International Inc., Mikuni Corporation, Mitsubishi Electric Corporation, Rheinmetall Automotive, Robert Bosch GmbH, SHW AG, Valeo, and ZF Group.

In 2020, Aisin Corporation expanded its production system for electrification products -Aisin Tohoku in order to begin producing small and medium-sized motor products, mainly electric water pumps, in 2022. The electric water pumps to be newly produced are a product that contributes to the fuel efficiency of vehicles through thermal management, such as battery temperature control, for the maximized performance of components in hybrid electric vehicles and electric vehicles.

Automotive Pumps Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 14.17 billion |

|

Revenue forecast in 2030 |

USD 20.51 billion |

|

CAGR |

4.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Electric Vehicle Type, By Vehicle Type, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Aisin Corporation, Continental AG, Denso, GMB Corporation, Hitachi, Johnson Electric, Magna International Inc., Mikuni Corporation, Mitsubishi Electric Corporation, Rheinmetall Automotive, Robert Bosch GmbH, SHW AG, Valeo, and ZF Group. |