Automotive Polymer Composites Market Size, Share, Trends, Industry Analysis Report: By Material, Manufacturing Process, Product, Application, End User (Conventional Vehicles, Electrical Vehicles, and Trucks & Buses), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5418

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Polymer Composites Market Overview

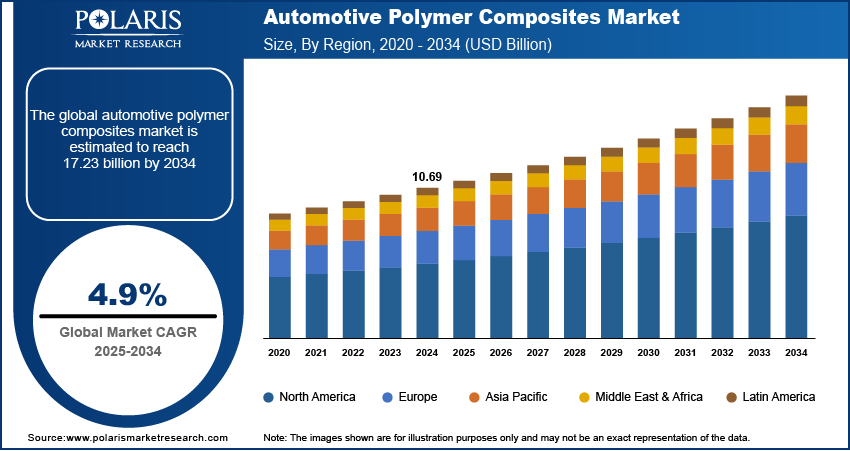

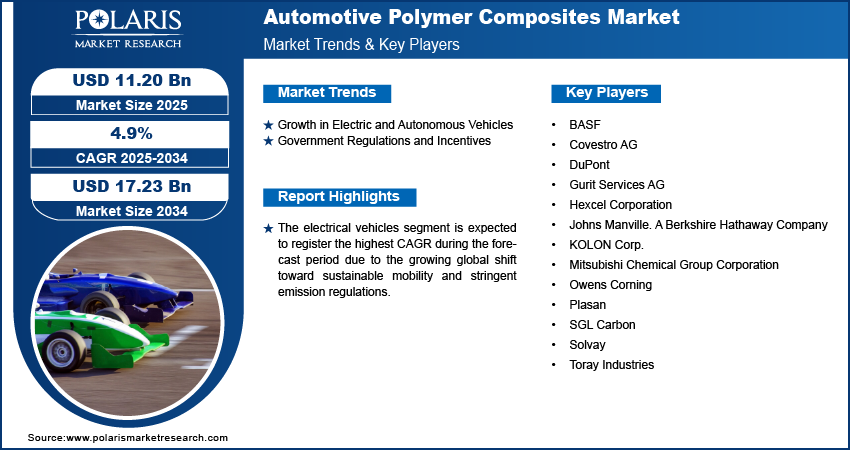

The global automotive polymer composites market size was valued at USD 10.69 billion in 2024 and is expected to reach USD 11.20 billion by 2025 and 17.23 billion by 2034, exhibiting a CAGR of 4.9% during 2025–2034.

The automotive polymer composites market focuses on the development, production, and application of polymer-based composite materials in the automotive sector. These composites are typically made by combining a polymer matrix (such as thermosetting or thermoplastic resins) with supporting materials such as carbon fibers, glass fibers, or natural fibers.

To Understand More About this Research: Request a Free Sample Report

The growing demand for lightweight vehicle designs, combined with advancements in fuel efficiency and stringent regulations on emissions reduction, is significantly propelling automotive polymer composites market development. Increasing adoption in structural components (e.g., chassis and roof panels) and non-structural parts (e.g., dashboards and interior trims) due to their high strength-to-weight ratio, corrosion resistance, and design flexibility is driving the automotive polymer composites market demand.

The increasing focus on sustainability, alongside the development of recyclable thermoplastic composites and natural fiber supports, is driving a significant transformation in the automotive sector. The shift toward eco-friendly manufacturing processes is playing a pivotal role in the automotive polymer composites market demand. Furthermore, automotive polymer composites offer exceptional impact resistance, crashworthiness, and thermal stability, meeting rigorous safety standards. These properties make them suitable for applications such as bumpers and door panels, thereby fueling automotive polymer composites market growth.

Automotive Polymer Composites Market Dynamics

Growth in Electric and Autonomous Vehicles

The growth of electric and autonomous vehicles is significantly driving demand for lightweight and durable materials, as these vehicles require advanced components with enhanced performance capabilities. According to the International Energy Agency, in 2023, electric vehicle registrations in the US reached 1.4 million, marking over 40% growth from 2022. Polymer composites are increasingly used for battery enclosures to reduce weight and improve thermal management, which is critical for maximizing range and efficiency in electric vehicles. Similarly, in autonomous vehicles, polymer composites are ideal for housing sensitive equipment such as sensors, cameras, and radar systems due to their excellent strength-to-weight ratio, durability, and ability to withstand harsh environmental conditions. This trend highlights the vital role of polymer composites in supporting the technological advancements and performance requirements of EVs and autonomous vehicles, which is contributing to the automotive polymer composites market growth.

Government Regulations and Incentives

Governments worldwide are playing a pivotal role in driving the adoption of automotive polymer composites through strict emission regulations and sustainability initiatives. In March 2024, the Environmental Protection Agency finalized more stringent Multi-Pollutant Emissions Standards for medium-duty and light-duty vehicles starting with model year 2027. These standards aim to significantly reduce harmful air pollutants, enhancing air quality and public health. Stringent fuel efficiency standards and carbon emission targets are pushing automakers to use lightweight materials such as polymer composites to reduce vehicle weight and enhance fuel economy. Additionally, various government incentives, including tax benefits and subsidies, are encouraging the integration of sustainable and recyclable materials in vehicle manufacturing. These regulatory pressures and financial support are accelerating the shift toward polymer composites, making them indispensable for meeting environmental compliance and achieving green mobility goals. Hence, government regulations and incentives propel the automotive polymer composites market demand.

Automotive Polymer Composites Market Segment Insights

Automotive Polymer Composites Market Assessment by Material Outlook

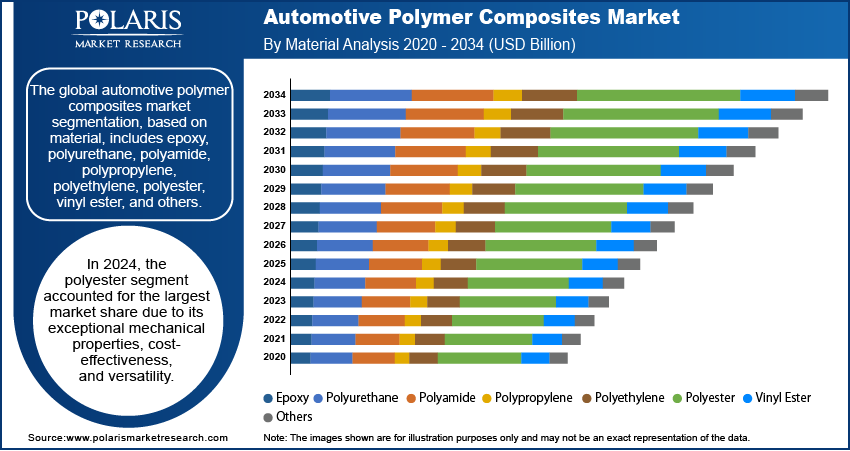

The global automotive polymer composites market segmentation, based on material, includes epoxy, polyurethane, polyamide, polypropylene, polyethylene, polyester, vinyl ester, and others. In 2024, the polyester segment accounted for the largest automotive polymer composites market share due to its exceptional mechanical properties, cost-effectiveness, and versatility. Polyester composites offer high strength, durability, and resistance to corrosion, making them ideal for structural and non-structural automotive components. Additionally, advancements in resin technology have enhanced polyester's performance, particularly in lightweight applications, supporting with the industry's focus on fuel efficiency and emissions reduction. Polyester’s affordability and wide availability further contribute to its extensive adoption across the automotive sector.

Automotive Polymer Composites Market Evaluation by End User Outlook

The global automotive polymer composites market segmentation, based on end user, includes conventional vehicles, electrical vehicles, and trucks & buses. The electrical vehicles segment is expected to register the highest CAGR during the forecast period due to the growing global shift toward sustainable mobility and stringent emission regulations. EV manufacturers are increasingly adopting polymer composites to reduce vehicle weight, enhancing battery efficiency and driving range. Additionally, the rising demand for lightweight, high-performance materials to support advanced battery systems and improve thermal management has boosted the use of polymer composites in EV production. Government incentives and expanding EV infrastructure also contribute to this rapid growth.

Automotive Polymer Composites Market Regional Analysis

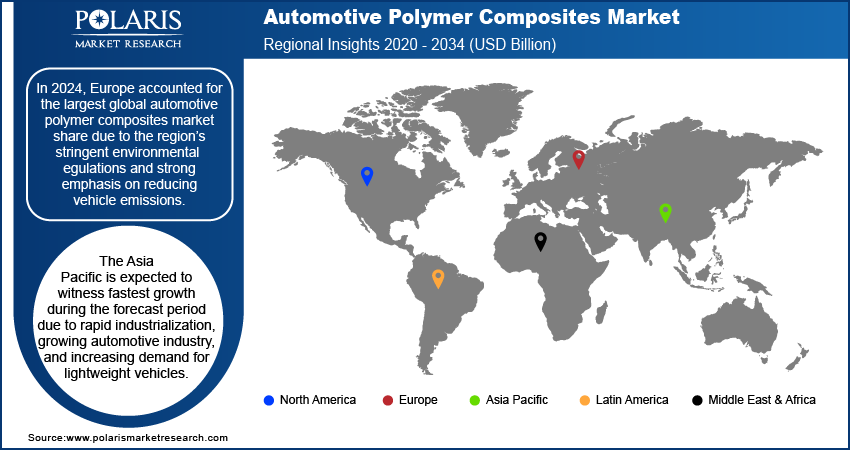

By region, the study provides automotive polymer composites market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe accounted for the largest market share due to the region's stringent environmental regulations and a strong emphasis on reducing vehicle emissions. European automakers are increasingly adopting lightweight materials such as polymer composites to meet these standards and enhance fuel efficiency. Government incentives for electric vehicles and sustainable materials have also contributed to the widespread adoption of polymer composites across the region. For instance, the European Union has allocated at least USD 23.76 billion to enhance the electric vehicle ecosystem, primarily through grants. Furthermore, the presence of established automotive manufacturers, coupled with advancements in composite manufacturing technologies, has driven market growth.

The Asia Pacific automotive polymer composites market is expected to witness fastest growth during the forecast period due to rapid industrialization, growing automotive industry, and increasing demand for lightweight vehicles. According to the India Brand Equity Foundation, the Indian passenger car market, valued at about USD 32.70 billion in 2021, is expected to grow to USD 54.84 billion by 2027, driven by rising consumer demand and urbanization. The region's growing adoption of electric vehicles (EVs), driven by supportive government policies, subsidies, and infrastructure development, is fueling the need for advanced composite materials. Additionally, rising consumer awareness of fuel efficiency, coupled with the availability of cost-effective manufacturing solutions and abundant raw materials, is further accelerating the automotive polymer composites market expansion in Asia Pacific.

Automotive Polymer Composites Market – Key Players & Competitive Analysis Report

The competitive landscape of the automotive polymer composites market is characterized by the presence of numerous global and regional players focused on innovation, product development, and strategic collaborations to strengthen their market position. Key companies, such as Toray Industries, SGL Carbon, Hexcel Corporation, and Solvay, are actively investing in research and development to introduce advanced composite materials with enhanced performance characteristics. Partnerships with automotive manufacturers to co-develop lightweight solutions and sustainable materials are common strategies. Additionally, competition is intensifying as emerging players leverage cost-effective production techniques and tap into the growing demand for polymer composites in electric vehicles, particularly in developing regions such as Asia Pacific. This dynamic landscape highlights the importance of technological advancements, sustainability, and customization in gaining a competitive edge.

DuPont is a US provider of purification and specialty-separation technologies, delivering advanced membrane science and ion exchange solutions. Its core product portfolio includes fabrics, construction materials, fibers & nonwovens, personal protective equipment, packaging materials & solutions, solar/photovoltaic materials, water solutions, medical devices & materials, electronics & industrial, and adhesives. The company also offers this product in various sectors, such as automotive, building & construction, military, water management, law enforcement & emergency response, energy, safety & protection, packaging & printing, and government & public sector. DuPont is engaged in automotive polymer composites business, offering advanced materials that enhance vehicle performance and reduce weight. The company provides high-strength, lightweight composites such as thermoplastic and thermoset resins, which are used in a wide range of automotive components for improved fuel efficiency and durability.

BASF is a chemical corporation that operates all over the world. The company operates through seven segments—chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. BASF is actively engaged in providing high-performance polymer composites for the automotive industry, focusing on lightweight, durable materials to enhance vehicle efficiency. The company offers innovative solutions, such as reinforced thermoplastic composites, to help automakers meet fuel economy, safety, and sustainability goals.

List of Key Companies in Automotive Polymer Composites Market

- BASF

- Covestro AG

- DuPont

- Gurit Services AG

- Hexcel Corporation

- Johns Manville. A Berkshire Hathaway Company

- KOLON Corp.

- Mitsubishi Chemical Group Corporation

- Owens Corning

- Plasan

- SGL Carbon

- Solvay

- Toray Industries

Automotive Polymer Composites Industry Developments

In January 2025, BASF launched a new grade of Ultramid specifically engineered for electric vehicle applications. This innovative material is designed to meet the demanding requirements of the EV sector, offering enhanced performance characteristics and optimized properties suitable for various components of electric vehicles.

In March 2023, BASF and Toyota launched a new line of automotive interior trims made from Ultramid Deep Gloss grade. This innovative material combines superior aesthetics with enhanced durability, making it ideal for high-performance applications and showcasing the role of advanced engineering plastics in improving vehicle design and functionality.

Automotive Polymer Composites Market Segmentation

By Material Outlook (Revenue USD Billion 2020–2034)

- Epoxy

- Polyurethane

- Polyamide

- Polypropylene

- Polyethylene

- Polyester

- Vinyl Ester

- Others

By Manufacturing Process Outlook (Revenue USD Billion 2020–2034)

- Compression Molding

- Injection Molding

- Sheet Molding

- Resin Transfer Molding

By Product Outlook (Revenue USD Billion 2020–2034)

- Glass Fiber Reinforced Polymer Composite

- Natural Fiber Reinforced Polymer Composite

- Carbon Fiber Reinforced Polymer Composite

By Application Outlook (Revenue USD Billion 2020–2034)

- Interior Components

- Exterior Components

- Structural Components

- Powertrain Components

By End Use Outlook (Revenue USD Billion 2020–2034)

- Conventional Vehicles

- Electrical Vehicles

- Trucks & Buses

By Regional Outlook (Revenue USD Billion 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Polymer Composites Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.69 billion |

|

Market Size Value in 2025 |

USD 11.20 billion |

|

Revenue Forecast by 2034 |

USD 17.23 billion |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automotive polymer composites market size was valued at USD 10.69 billion in 2024 and is projected to grow to USD 17.23 billion by 2034

The global market is projected to register a CAGR of 4.9% during the forecast period.

In 2024, Europe accounted for the largest market share due to the region's stringent environmental regulations and strong emphasis on reducing vehicle emissions.

A few of the key players in the market are BASF, Covestro AG, DuPont, Gurit Services AG, Hexcel Corporation, Johns Manville. A Berkshire Hathaway Company, KOLON Corp., Mitsubishi Chemical Group Corporation, Owens Corning, Plasan, SGL Carbon, Solvay, and Toray Industries.

In 2024, the polyester segment accounted for the largest market share due to its exceptional mechanical properties, cost-effectiveness, and versatility.

The electrical vehicles segment is expected to register the highest CAGR during the forecast period due to the growing global shift toward sustainable mobility and stringent emission regulations.