Automotive Plastics Market Share, Size, Trends, Industry Analysis Report: By Product, By Process (Injection Molding, Blow Molding, Thermoforming, Others), By Vehicle Type, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM1545

- Base Year: 2023

- Historical Data: 2019-2022

Automotive Plastics Market Overview

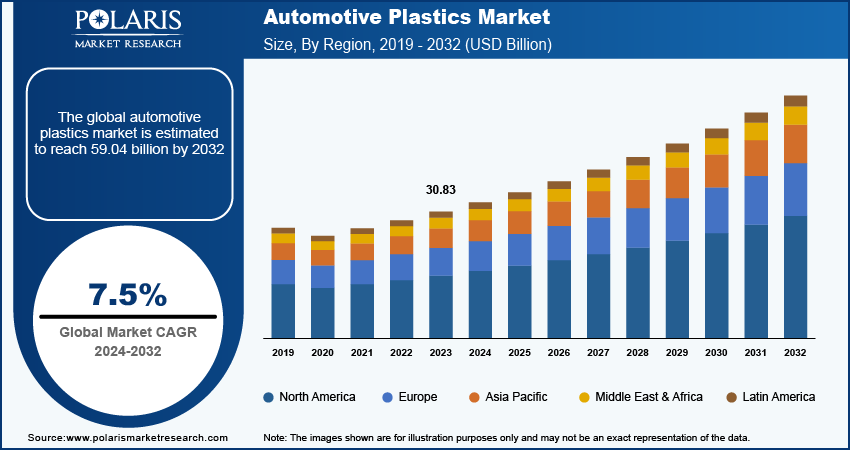

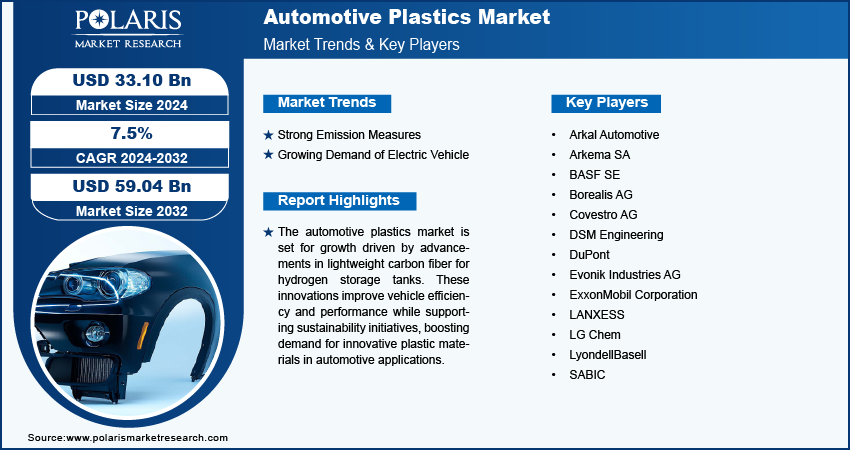

The automotive plastics market size was valued at USD 30.83 billion in 2023. The market is projected to grow from USD 33.10 billion in 2024 to USD 59.04 billion by 2032, exhibiting a CAGR of 7.5% during 2024–2032. The automotive plastics market encompasses the production and use of plastic materials in vehicle manufacturing. These lightweight plastics enhance fuel efficiency, reduce weight, and improve sustainability, playing a critical role in modern automotive design and innovation for various components and systems.

The automotive plastics market is experiencing robust growth, driven by the increasing demand for lightweight materials in vehicle manufacturing aimed at enhancing fuel efficiency and reducing emissions. A significant trend is the rising emphasis on environmental sustainability, pushing automakers toward eco-friendly and recyclable plastic solutions. Innovations in polymer technology, combined with a heightened focus on interior aesthetics, are expected to propel market expansion during the forecast period. For instance, FORVIA’s new “Skin Light Panel,” made from mono-material polymer (PU) through 3D carving, achieves a weight reduction of 20-30%. Additionally, Marelli's collaboration with Covestro in 2023, to create a lightweight polyurethane foam has led to a 40% weight reduction in the main cockpit panel, highlighting an increase in demand for lightweight materials, positively impacting the growth of the automotive plastics market.

To Understand More About this Research: Request a Free Sample Report

The automotive plastics market is set for significant growth, driven by advancements in hydrogen storage technologies as the industry shifts toward hydrogen vehicles. Carbon fiber, known for its lightweight and strong properties, is essential in manufacturing hydrogen storage tanks. This material helps reduce vehicle weight, enhancing fuel efficiency and overall performance. The demand for innovative plastics is rising due to increasing adoption of hydrogen as a clean fuel alternative. The automotive plastics market is expected to play a vital role in creating more efficient and sustainable vehicles for the future with ongoing research and developments in materials.

Automotive Plastics Market Trends

Strong Emission Measures

Strong emission measures are driving significant change in the automotive plastics market as manufacturers strive to meet stringent environmental regulations. Governments worldwide are implementing stricter emissions standards to combat climate change and reduce air pollution, prompting automakers to seek innovative solutions. Lightweight plastics, such as carbon fiber and advanced composites, are increasingly utilized to produce more efficient vehicles that consume less fuel and emit fewer pollutants. These materials help lower overall vehicle weight, enhancing fuel economy and performance while aligning with sustainability goals. Additionally, consumer demand for greener vehicles further encourages manufacturers to adopt these measures. As a result, the automotive plastics market is evolving rapidly, focusing on materials that support compliance with strong emission regulations and promote a cleaner, more sustainable future.

Growing Demand of Electric Vehicle

The increase in demand for electric vehicles (EVs) has increased the adoption of lightweight materials, including automotive plastics, to enhance the efficiency and pulling capacity of EV engines. Factors such as increasing environmental consciousness, government support and incentives, and rising investments by OEMs have accelerated the adoption of EVs, further boosting the automotive plastics market. Major automotive companies entering the EV market have also contributed to the growing demand for automotive plastics. As a result, the automotive plastics market is expected to experience significant growth in the coming years due to the increasing demand for EVs.

Know more about this report: request for sample pages

Automotive Plastics Market Segment Insights

Automotive Plastics Market Breakdown – Product Insights

The global automotive plastics market, based on product, is segmented into acrylonitrile butadiene styrene (ABS), polypropylene (PP), polyurethane (PU), polyvinyl chloride (PVC), polyethylene (PE), polybutylene terephthalate (PBT), polycarbonate (PC), polymethyl methacrylate (PMMA), polyamide (PA), and others. In 2023, the polypropylene (PP) segment dominated the market. PP is widely used in rigid and flexible packaging due to its favorable physical and chemical properties. It exhibits excellent chemical and electrical resistance, even at high temperatures. It is semi-rigid and translucent and offers an integral hinge property. Additionally, PP is lighter than many other plastics, making it a popular choice in the automotive industry.

Automotive Plastics Breakdown – Application Insights

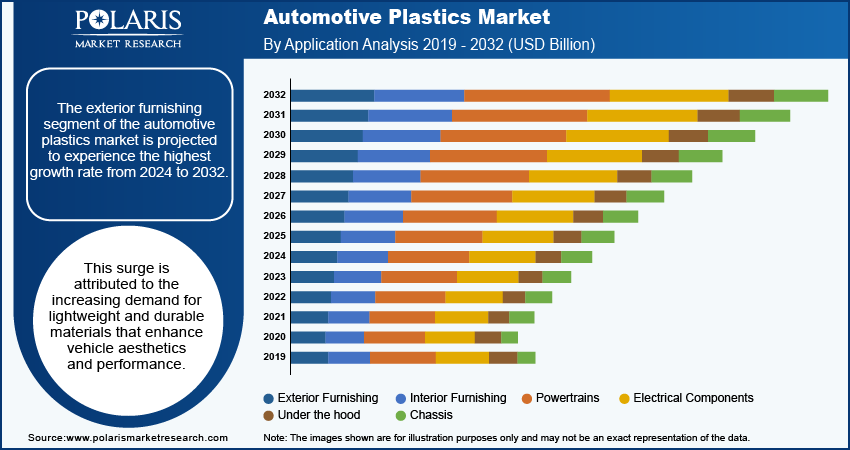

The global automotive plastics market, based on application, is segmented into powertrains, electrical components, interior furnishing, exterior furnishing, under-the-hood, and chassis.

The exterior furnishing segment of the automotive plastics market is projected to experience the highest growth rate from 2024 to 2032. This surge is attributed to the increasing demand for lightweight and durable materials that enhance vehicle aesthetics and performance. Plastics like polypropylene and polycarbonate are becoming essential for exterior components such as bumpers, grilles, and trims as manufacturers focus on reducing weight to improve fuel efficiency and comply with stringent emission regulations.

Additionally, advancements in surface finishing technologies allow for more diverse designs and finishes, further driving the appeal of plastic materials in exterior applications. The trend toward electric vehicles (EVs) also contributes to this growth, as automakers seek to optimize the overall weight and efficiency of their vehicles. The automotive plastics market's exterior furnishing segment is well-positioned for robust expansion in the coming years with consumers increasingly favoring stylish and eco-friendly vehicles.

Automotive Plastics Market –

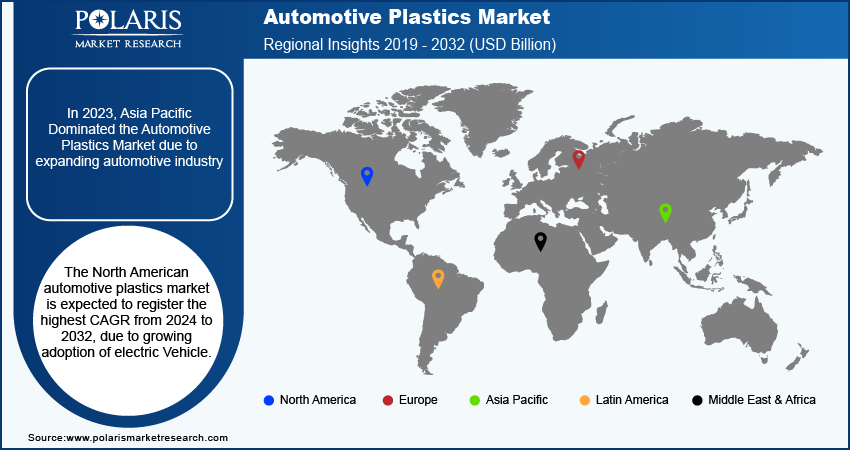

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific dominated the global automotive plastics market in 2023, driven by the availability of affordable labor, land, and resources, as well as the expanding automotive industry in emerging economies such as India, China, Vietnam, Indonesia, and Thailand. For example, data from the China Association of Automobile Manufacturers (CAAM) reveals that from January to October 2023, China's automobile production and sales grew by 8% and 9.1% year-on-year, respectively. Notably, the production and sales of New Energy Vehicles (NEVs) surged by 33.9% and 37.8%, capturing a substantial 30.4% market share. NEV exports also reached 995,000 units, reflecting a remarkable 99.1% year-on-year increase.

This expanding manufacturing base, coupled with increased investments in technological advancements related to vehicle production, is anticipated to further boost the automotive sector in the region. Automotive plastics offer numerous advantages, including toughness, recyclability, durability, thermal stability, design flexibility, corrosion resistance, resilience, and lightweight properties, making them an attractive choice for manufacturers aiming to enhance vehicle performance and sustainability.

The North American automotive plastics market is expected to register the highest CAGR from 2024 to 2032.

North America serves as a major hub for automotive manufacturing, hosting numerous vehicle assembly plants operated by domestic and international automakers. The region's strong automotive industry fuels the demand for automotive plastics to meet the diverse requirements of vehicles produced locally. Automakers in North America are increasingly prioritizing vehicle lightweight to enhance fuel efficiency and comply with regulatory standards for emissions and fuel economy.

North America is experiencing a growing adoption of electric vehicles (EVs) owing to large consumer and policymaker emphasis on sustainability and environmental protection. EVs require lightweight materials with electrical insulation for components such as battery enclosures, thermal management systems, and interior features. For instance, in June 2024, new EV registrations in United States rose by 3.1% compared to the same month in the previous year, totaling 108,026 vehicles.

Automotive Plastics Market – Key Players and Competitive Insights

The automotive plastics market is in a high growth stage and expanding due to its moderately consolidated structure. The market is characterized by significant innovation, driven by the increasing demand for plastics due to their lightweight, versatility, and flexibility. These attributes enable technological advancements and design freedom, offering cost-efficiency and sustainability. Additionally, as the automotive industry faces economic challenges and cost pressures, thermoforming continues to be a crucial element in achieving efficient and economical manufacturing solutions, supporting ongoing growth and innovation in the automotive plastics sector.

Arkema SA, BASF SE, Borealis AG, DuPont, DSM Engineering, Evonik Industries AG, ExxonMobil Corporation, LANXESS, LG Chem, LyondellBasell, SABIC, Covestro AG, and Arkal Automotive are among the major players in the automotive plastics market.

Exxon Mobil Corporation, also known as ExxonMobil, is an American multinational oil and gas company based in Spring, Texas. It was established in 1999 following the merger of Exxon and Mobil, both of which were descendants of John D. Rockefeller's Standard Oil. ExxonMobil is among the largest integrated energy companies globally, engaging in all aspects of the oil and gas industry, including exploration, production, refining, and marketing. The company operates in various segments: Upstream, focusing on oil and gas exploration and extraction; Downstream, which encompasses the refining and marketing of petroleum products; and Chemical, producing petrochemicals and specialty products. With a workforce of around 88,300 employees, its operations span over 200 countries.

Covestro AG (Covestro), headquartered in Germany, specializes in high-tech polymers. The company focuses on the development and production of raw materials for polyurethanes, polycarbonates, and specialty chemicals. It operates through a global network of research laboratories, technical service centers, and sales offices, with a presence in North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Key Companies in Automotive Plastics Market

- Arkal Automotive

- Arkema SA

- BASF SE

- Borealis AG

- Covestro AG

- DSM Engineering

- DuPont

- Evonik Industries AG

- ExxonMobil Corporation

- LANXESS

- LG Chem

- LyondellBasell

- SABIC

Automotive Plastics

August 2024: AC Plastics announced the successful acquisition of two major contracts to injection mold components for upcoming models of two luxury car brands manufactured in the UK.

June 2024: Covestro, Neste, and Borealis agreed to transform discarded tires into high-quality plastics for the automotive industry. This partnership aims to improve circularity within the plastics value chain and enhance automotive applications.

June 2023: Borealis AG acquired Rialti., a prominent polypropylene (PP) compounding company specializing in recyclates. This strategic acquisition strengthens Borealis' position by incorporating significant expertise and expanding production capacity within its PP compounding business.

May 2023: Lear, a prominent automotive technology company, announced its plans to set up a connection systems facility in Morocco to produce components for automakers, suppliers, and its E-systems and seating divisions.

Automotive Plastics Market Segmentation

By Product Outlook

- Acrylonitrile Butadiene Styrene (ABS)

- Polypropylene (PP)

- PP LGF 20

- PP LGF 30

- PP LGF 40

- Others

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Rigid PVC

- Flexible PVC

- Polyethylene (PE)

- High-density Polyethylene (HDPE)

- Other PE Grades

- Polybutylene Terephthalate (PBT)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Polyamide (Nylon 6, Nylon 66)

- Others

By Process Outlook

- Injection Molding

- Blow Molding

- Thermoforming

- Others

By Vehicle Type Outlook

- Passenger Cars

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

By Application Outlook

- Powertrains

- Electrical Components

- Interior Furnishing

- IMD or IML

- Others

- Exterior Furnishing

- Under the hood

- Chassis

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Plastics

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 30.83 Billion |

|

Market Size Value in 2024 |

USD 33.10 Billion |

|

Revenue Forecast in 2032 |

USD 59.04 Billion |

|

CAGR |

7.5% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automotive plastics market size was valued at USD 30.83 billion in 2023 and is projected to grow to USD 59.04 billion by 2032.

The global market is projected to register a CAGR of 7.5% during 2023–2032

Asia Pacific accounted for the largest share of the global market in 2023.

Arkema SA, BASF SE, Borealis AG, DuPont, DSM Engineering, Evonik Industries AG, ExxonMobil Corporation, LANXESS, LG Chem, LyondellBasell, SABIC, Covestro AG, and Arkal Automotive are among the key players in the market

The polypropylene segment dominated the market in 2023 due to its favorable physical and chemical properties.