Automotive Plastic Fasteners Market Size, Share, Trends, Industry Analysis Report: By Function, Vehicle Type (Passenger Cars and LCVs), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 125

- Format: PDF

- Report ID: PM5181

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Plastic Fasteners Market Overview

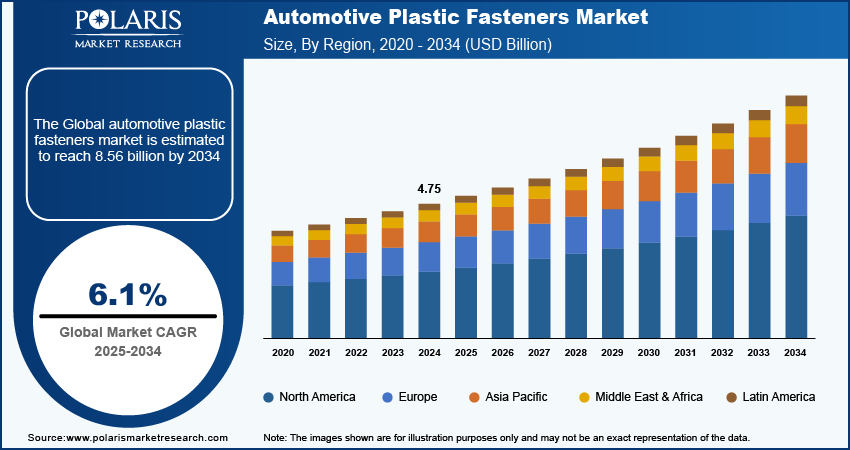

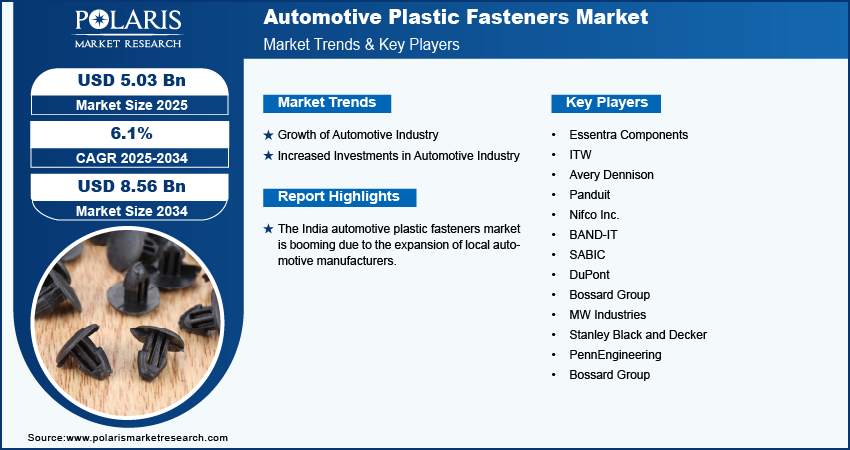

The automotive plastic fasteners market size was valued at USD 4.75 billion in 2024. The market is projected to grow from USD 5.03 billion in 2025 to USD 8.56 billion by 2034, exhibiting a CAGR of 6.1% during 2025–2034. Automotive plastic fasteners are components used to securely join various parts of a vehicle, typically made from durable plastic materials. They offer lightweight, corrosion-resistant solutions that help reduce vehicle weight and improve overall performance while ensuring reliable connections in automotive assemblies.

The automotive plastic fastener market is experiencing growth due to the rising demand for lightweight vehicles. Manufacturers are constantly improving fuel efficiency to reduce emissions. Thus, they are turning to plastic fasteners as they are significantly lighter than traditional metal options. According to the US Energy Department, a 10% reduction in vehicle weight can result in a 6%–8% fuel economy improvement. Additionally, lightweight designs contribute to lower production costs and improved sustainability. As a result, the demand for innovative plastic fastening solutions is rising, driving the growth of the automotive plastic fasteners market.

The automotive plastic fasteners market is expected to grow during the forecast period due to an increase in mergers between key players in the automotive industry. These mergers are expected to benefit the market through new vehicle launches and expansion of production to meet consumer demands. For instance, in October 2023, Renault Group merged with Volvo for the development of electric vans. Such mergers are expected to drive the demand for automotive fasteners since expanding production facilities will require advanced base materials such as plastic fasteners.

Automotive Plastic Fasteners Market Driver Analysis

Growing Production of Motor Vehicles

The growing production of motor vehicles worldwide is propelling the global automotive plastic fasteners demand. According to data published by the European Automobile Manufacturers' Association, in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Plastic fasteners are essential components in the production of motor vehicles, used to secure various parts and assemblies such as body panels, engine components, interior elements, and others. Therefore, as the production of motor vehicles increases, the demand for automotive plastic fasteners also spurs.

Increase in Investments in Automotive Industry

Increased investments in the automotive industry support manufacturers to spend more on sophisticated automotive parts and accessories. According to the Indian Ministry of Information and Broadcasting, the automotive industry accounted for 5.48% of total foreign direct investment in India from 2000 to 2022, showcasing a rise in investment. Additionally, this growth in investment is aimed at the production of more lightweight and fuel-efficient vehicles, due to which more manufacturers prefer plastic fasteners. Thus, an increase in investments in the automotive industry is driving the growth of the automotive plastic fastener market.

Automotive Plastic Fasteners Market Segment Analysis

Automotive Plastic Fasteners Market Breakdown by Vehicle Type Outlook

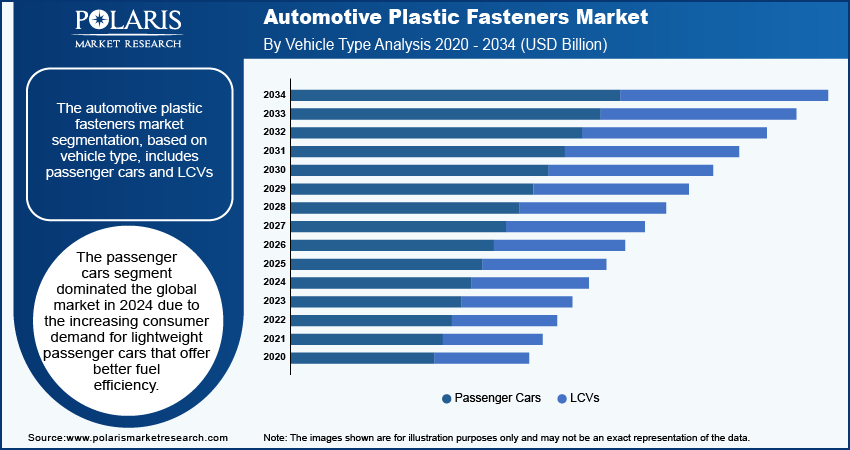

The automotive plastic fasteners market segmentation, based on vehicle type, includes passenger cars and LCVs. In 2024, the passenger cars segment dominated the global market. This growth is driven by increasing consumer demand for lightweight passenger cars that offer better fuel efficiency. The shift toward lighter vehicles are largely influenced by rising fuel prices and growing government taxes on heavier passenger cars. As a result, the demand for lightweight passenger cars is propelling the market growth for this segment.

Automotive Plastic Fasteners Market Breakdown by Application Outlook

The automotive plastic fasteners market segmentation, based on application, includes interior, exterior, electronics, powertrain, chassis, wire harnessing, and others. The wire harnessing segment dominated the market in 2024 due to the growing demand for sophisticated infotainment systems. Automotive manufacturers are integrating advanced infotainment systems to maintain a competitive edge within the market, which is leading to the increase in demand for plastic fasteners for wire harnessing.

Automotive Plastic Fasteners Market Breakdown by Regional Outlook

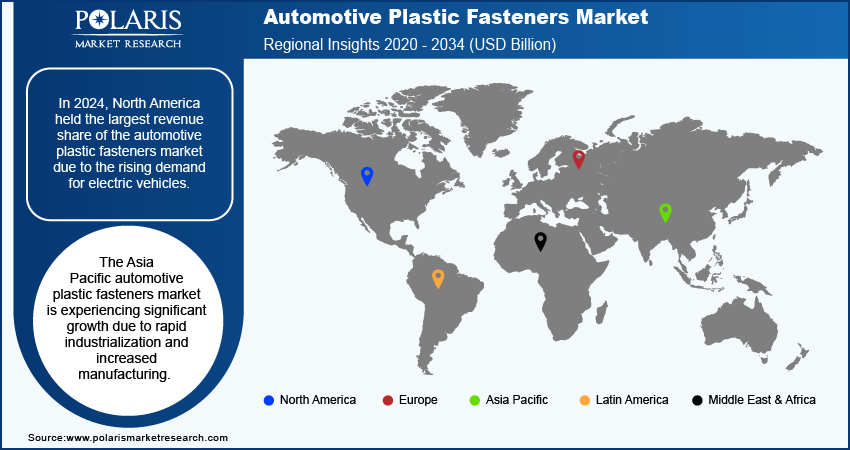

By region, the study provides the automotive plastic fasteners market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest revenue share in the market due to the rising demand for electric vehicles (EVs). Electric vehicles rely on lightweight components for better distance range and battery efficiency, which is driving the demand for plastic fasteners in the region. According to the Federal Reserve Bank of Chicago, in 2021, EV sales reached 1.4 million in the US, highlighting significant demand for electric vehicles. Additionally, the integration of more sophisticated infotainment systems in EVs is driving the automotive plastic fastener market growth in North America.

The Asia Pacific automotive plastic fasteners market is experiencing significant growth due to rapid industrialization in the region. Asia Pacific has transformed into a major manufacturing hub for major industries, including automotive manufacturing. More manufacturers are setting up their plants in the region, which has led to an increase in demand for automotive plastic fasteners in the region. Additionally, growing government investments in manufacturing boost this transformation by expanding production capacities and entry of new players in the automotive manufacturing industry, which is creating heightened demand for base materials such as plastic fasteners. Therefore, rapid industrialization in the Asia Pacific is driving the regional automotive plastic fastener market growth.

The automotive plastic fasteners market in India is experiencing substantial growth due to the expansion of local automotive manufacturers. This expansion of local manufacturers is driving the demand for plastic fasteners to meet consumer preference for lightweight and fuel-efficient vehicles. For instance, Tata Motors, a local automotive manufacturer, sold 215,034 passenger vehicles in the second quarter of FY 2024–2025, highlighting the expansion of their operations. Additionally, government regulations to curb greenhouse gas emissions have increased the adoption of plastic fasteners, leading to the growth of the automotive plastic fastener market in India.

Automotive Plastic Fasteners Market – Key Players and Competitive Insights

The automotive plastic fasteners market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are positively impacting the industry by introducing innovative products to meet the demand from the automotive industries. This competitive environment is amplified by continuous progress in product offerings. A few major automotive plastic fasteners market players are Essentra Components, ITW, Avery Dennison, Panduit, Nifco Inc., BAND-IT, SABIC, DuPont, Bossard Group, MW Industries, Stanley Black and Decker, PennEngineering, and Bossard Group.

DuPont de Nemours, Inc., commonly known as DuPont, is a chemical company founded in 1802 and headquartered in Wilmington, Delaware. The company operates globally in over 70 countries across North America, Europe, Asia Pacific, and Latin America. Originally established as a gunpowder manufacturer, DuPont has transformed into diversified segments focusing on technology-based materials and solutions across various industries, including chemicals, agriculture, electronics, and automotive sectors. The company operates through several key segments such as electronics & industrial for semiconductors and advanced printing, water & protection for water filtration and safety solutions, transportation & advanced polymers, high-performance polymer production for automotive applications, and nutrition & biosciences encompassing food ingredients and animal nutrition products. In the automotive sector, DuPont produces advanced polymer solutions such as plastic fasteners. These fasteners contribute to weight reduction in vehicles without compromising structural integrity.

SABIC, or Saudi Basic Industries Corporation, is a prominent global diversified chemicals company based in Riyadh, Saudi Arabia. The company was created to convert oil by-products into valuable chemicals, polymers, and fertilizers. The company operates across multiple continents, including the Middle East, Asia, Europe, and the Americas. SABIC drives significant production and R&D facilities, particularly in the Netherlands, the UK, and North America. It also integrates eco-friendly practices across its operations, strengthening its role as a key player in the global chemicals market. SABIC operates through four main business segments, including petrochemicals, agri-nutrients, specialties, and metals (Hadeed). The petrochemicals segment focuses on producing a wide range of commodity and performance chemicals and polymers that serve various industries such as packaging, automotive, and healthcare, while the agri-nutrients division is dedicated to manufacturing fertilizers and specialty nutrients to support agricultural productivity. The specialties unit caters to unique customer needs with specialized plastics and high-performance materials; on the other hand, the metals (Hadeed) segment produces long and flat steel products essential for construction and infrastructure projects.

Key Companies in the Automotive Plastic Fasteners Industry Outlook

- Essentra Components

- ITW

- Avery Dennison

- Panduit

- Nifco Inc.

- BAND-IT

- SABIC

- DuPont

- Bossard Group

- MW Industries

- Stanley Black and Decker

- PennEngineering

- Bossard Group

Automotive Plastic Fasteners Market Industry Devlopments

April 2024: TR Fastenings launched the Plas-Tech 30-20 screws, designed for automotive plastics, by improving performance with a finer pitch and reduced thread angle. These screws improved axial resistance and vibration resistance, providing a reliable fastening solution for various automotive applications in the industry.

Automotive Plastic Fasteners Market Segmentation

By Function Outlook (Volume, Billion Units, Revenue USD Billion, 2020–2034)

- Bonding

- NVH

By Vehicle Type Outlook (Volume, Billion Units, Revenue USD Billion, 2020–2034)

- Passenger Cars

- LCVs

By Application Outlook (Volume, Billion Units, Revenue USD Billion, 2020–2034)

- Interior

- Exterior

- Electronics

- Powertrain

- Chassis

- Wire harnessing

- Others

By Regional Outlook (Volume, Billion Units, Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Plastic Fasteners Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.75 billion |

|

Market Size Value in 2025 |

USD 5.03 billion |

|

Revenue Forecast by 2034 |

USD 8.56 billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Billion Units, Revenue in USD Billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report End User |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The automotive plastic fasteners market size was valued at USD 4.75 billion in 2024 and is projected to grow to USD 8.56 billion by 2034

The global market is projected to register a CAGR of 6.1% during 2025–2034.

North America accounted for the largest share of the global market in 2024.

A few key players in the market are Essentra Components, ITW, Avery Dennison, Panduit, Nifco Inc., BAND-IT, SABIC, DuPont, Bossard Group, MW Industries, Stanley Black and Decker, PennEngineering, and Bossard Group.

The passenger car segment experienced the highest CAGR in 2024.

The wire harnessing segment dominated the market in 2024 due to the growing demand for sophisticated infotainment systems.