Automotive Plastic Compounding Market Size, Share, Trends, Industry Analysis Report: By Product, Application (Interior, Exterior, Under the Hood, Structural Parts, and Electrical Components & Lighting), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 136

- Format: PDF

- Report ID: PM5221

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Plastic Compounding Market Overview

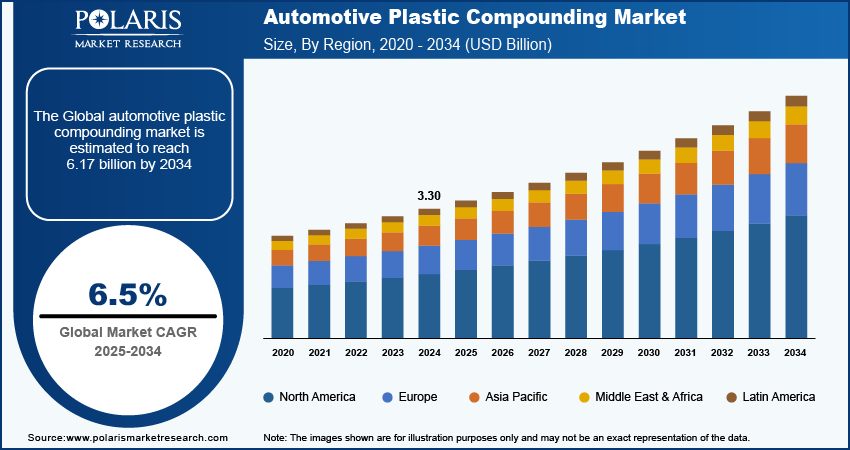

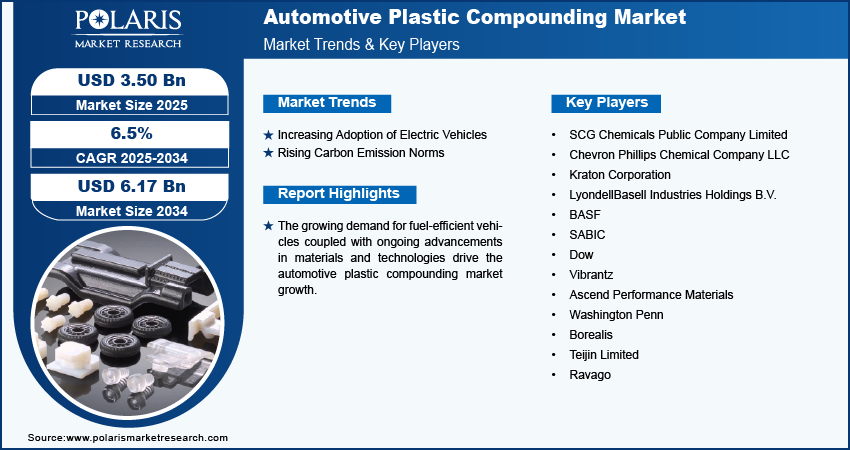

The automotive plastic compounding market size was valued at USD 3.30 billion in 2024. The market is projected to grow from USD 3.50 billion in 2025 to USD 6.17 billion by 2034, exhibiting a CAGR of 6.5% during 2025–2034.

Automotive plastic compounding is a specialized process that involves blending various polymers with additives to create tailored plastic materials specifically for automotive applications. This method enhances the physical, thermal, and aesthetic properties of plastics, making them suitable for diverse automotive components. The compounding process begins with selecting a base polymer, including polypropylene (PP), polyethylene (PE), or polyvinyl chloride (PVC), which are then mixed with additives such as colorants, stabilizers, and reinforcements to achieve desired characteristics.

The growing demand for fuel-efficient vehicles is driving the automotive plastic compounding market. Manufacturers are increasingly turning to lightweight plastic materials such as polypropylene, polycarbonate, and ABS from metal as they prioritize to comply with stringent fuel economy standards and meet consumer preferences for more fuel-efficient vehicles.

To Understand More About this Research: Request a Free Sample Report

The ongoing advancements in materials and technology fuel the automotive plastic compounding market growth. Innovations in material science have led to the development of high-performance plastics that meet the rigorous demands of modern automotive applications. These advanced materials, which include composites and engineered thermoplastics, offer superior strength, lightweight properties, and enhanced durability compared to traditional materials. The appeal and adoption of these technologically advanced plastic compounds increase as manufacturers seek to create vehicles that are lighter, more efficient, and more resilient.

Automotive Plastic Compounding Market Dynamics

Automotive Plastic Compounding Market Driver Analysis

Increasing Adoption of Electric Vehicles

The demand for electric vehicles is rising across the world. For instance, according to the International Energy Agency, ∼14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million. EVs typically require lightweight materials to counterbalance the weight of their battery systems. Batteries are one of the heaviest components in electric vehicles, which encourages manufacturers to turn to plastic compounds to reduce overall vehicle weight. The use of plastic compounds enhances performance and handling, as well as improves energy efficiency and extends driving range, making plastic compounding essential in EVs. Therefore, the increasing adoption of EVs fuels the global automotive plastic compounding market growth.

Rising Carbon Emission Norms

Stringent regulations aimed at reducing greenhouse gas emissions are pushing automotive manufacturers to develop lighter vehicles. The introduction of lightweight vehicles is one of the most effective strategies to enhance fuel efficiency and reduce carbon emissions. This drives manufacturers to adopt plastic compounds that are lighter and maintain the strength and durability required for vehicle performance. Therefore, rising carbon emission norms boost the global automotive plastic compounding market growth.

Automotive Plastic Compounding Market Segment Analysis

Automotive Plastic Compounding Market Breakdown – by Product Insights

Based on product, the automotive plastic compounding market is segmented into polypropylene (PP), polyethylene (PE), thermoplastic elastomers (TPE), polybutylene terephthalate (PBT), polyamide (PA), polycarbonate (PC), acrylonitrile butadiene systems (ABS), styrene acrylonitrile (SAN), polymethyl methacrylate (PMMA), polyoxymethylene (POM), and blends (PC/ABS, ABS/PBT, and PS/PP). The polypropylene (PP) segment accounted for a major share of the market in 2024 due to its exceptional balance of performance and cost-effectiveness. Automakers prefer PP for various applications such as interior components, bumpers, and dashboards, as it offers excellent chemical resistance, lightweight properties, and good impact strength. The material's versatility allows for easy processing, which enhances its appeal in mass production. Additionally, the growing focus on fuel efficiency and weight reduction in vehicles drives the demand for PP, as its lightweight nature contributes to improved fuel economy.

The polycarbonate (PC) segment is expected to grow at a rapid pace during the forecast period, owing to its outstanding transparency, impact resistance, and lightweight characteristics. The rising adoption of EVs and autonomous driving technology fuels the demand for advanced materials such as PC, as these vehicles require high-performance components that withstand varying environmental conditions while maintaining safety and durability. Furthermore, advancements in PC formulations that enhance UV stability and thermal resistance position it as a top choice for innovative automotive designs.

Automotive Plastic Compounding Market Breakdown – by Application Insights

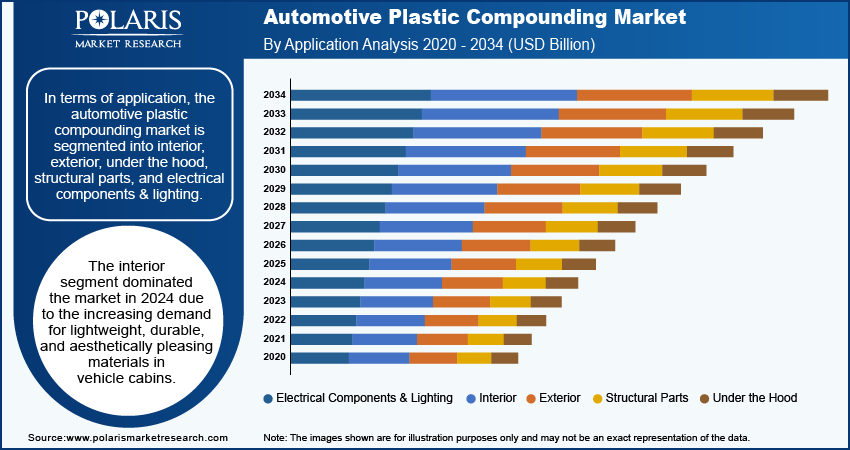

In terms of application, the automotive plastic compounding market is segmented into interior, exterior, under the hood, structural parts, and electrical components & lighting. The interior segment dominated the market in 2024 due to the increasing demand for lightweight, durable, and aesthetically pleasing materials in vehicle cabins. Automakers focus on enhancing passenger comfort and experience, leading to a surge in the use of advanced plastics for dashboards, seat components, door panels, and trim pieces. The ability of plastics to be easily molded into complex shapes and finishes enables designers to create attractive interiors that also contribute to noise reduction and insulation. Additionally, the trend toward customization and luxury features in vehicles fuels the demand for high-quality plastic compounds that offer functionality and style.

The electrical components & lighting segment is estimated to grow at a rapid pace in the coming years owing to the growing demand for EVs and the increasing integration of advanced technologies, such as LED lighting and infotainment systems in vehicles. Plastics, especially those with excellent thermal and electrical insulating properties, play a crucial role in ensuring the reliability and safety of these components. Moreover, innovations in lighting technologies, such as adaptive lighting systems, require lightweight and durable materials, further propelling the use of plastics in this application.

Automotive Plastic Compounding Market Regional Outlook

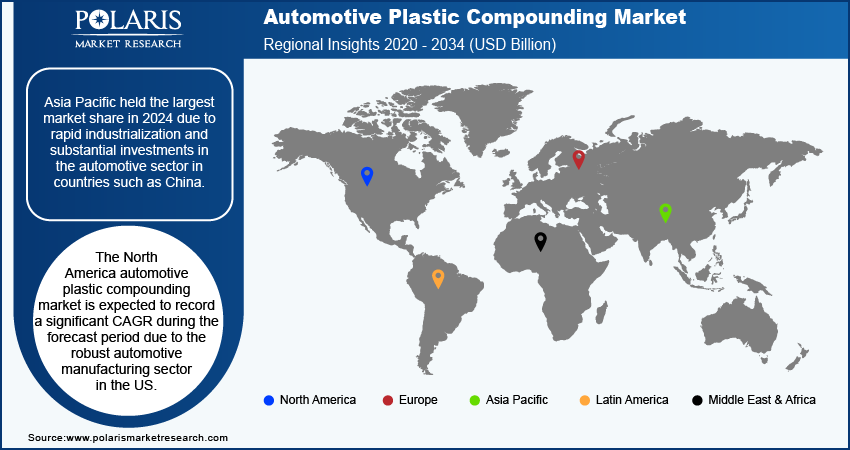

By region, the study provides the automotive plastic compounding market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest market share in 2024 due to rapid industrialization and substantial investments in the automotive sector in countries such as China. The country's shift toward electric vehicles and a growing middle-class population looking for advanced and feature-rich cars boost the demand for automotive components. Additionally, the increasing focus on sustainability and recycling in automotive production aligns with the capabilities of modern plastic compounds, making them an attractive choice for manufacturers.

The North America automotive plastic compounding market is expected to register a significant CAGR during the forecast period due to the robust automotive manufacturing sector in the US. The country’s strong emphasis on innovation and technology adoption significantly influences the demand for advanced plastic materials in vehicle production. Automakers in the US increasingly prioritize lightweight materials to enhance fuel efficiency and comply with stringent environmental regulations. Additionally, the growing trend toward electric vehicles and autonomous technologies in the region accelerates the need for specialized plastic compounds in various automotive applications. The presence of a well-established supply chain network and major automotive manufacturers such as General Motors, Ford, and Tesla contributes to the market growth in the region.

Automotive Plastic Compounding Market – Key Players and Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will boost the automotive plastic compounding market growth during the forecast period. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The automotive plastic compounding market is fragmented, with the presence of numerous global and regional market players. A few major players in the market are SCG Chemicals Public Company Limited, Chevron Phillips Chemical Company LLC, Kraton Corporation, LyondellBasell Industries Holdings B.V., BASF, SABIC, Dow, Vibrantz, Ascend Performance Materials, Washington Penn, Borealis, Teijin Limited, and Ravago.

SCG Chemicals Public Company Limited is ASIAN’s innovation company in chemicals. Its main business is the production of plastic resins or polymers molded into products used in everyday life, ranging from food packaging, automotive parts, medical equipment, and electrical appliances to infrastructures, such as pressure-resistant pipes and telecommunication cables. SCGC operates other businesses connected to the primary business, including SCGC floating solar solutions, clean energy solutions, emisspro coating solutions for industrial furnaces, and many more. In August 2024, SCGC partnered with Thailand Automotive Institute to drive Thailand toward a low-carbon automotive industry by offering plastic compounds such as polymers, polycarbonate, and others.

Kraton Corporation is a global producer of specialty polymers, particularly known for its innovative styrene block copolymers (SBCs), which are extensively utilized in automotive plastic compounding. Founded in the mid-20th century, Kraton has evolved from its origins in synthetic rubber production to become a major player in high-performance elastomers that offer superior flexibility, durability, and chemical resistance. The company's products are integral to various automotive applications, including bumpers, interior components, and exterior trims, where lightweight and robust materials are essential for enhancing vehicle performance and fuel efficiency.

List of Key Companies in Automotive Plastic Compounding Market

- SCG Chemicals Public Company Limited

- Chevron Phillips Chemical Company LLC

- Kraton Corporation

- LyondellBasell Industries Holdings B.V.

- BASF

- SABIC

- Dow

- Vibrantz

- Ascend Performance Materials

- Washington Penn

- Borealis

- Teijin Limited

- Ravago

Automotive Plastic Compounding Industry Developments

July 2024: LyondellBasell, a global player in the chemical industry, announced the launch of its new Schulamid ET100 product line, a revolutionary polyamide-based compound product designed for automotive interior structural solutions, such as door window frames.

June 2024: Borealis, a company that develops and provides polyolefin solutions and base chemicals for various industries, introduced Borcycle GD3600SY, a glass-fiber reinforced polypropylene (PP) compound with 65% post-consumer recycled (PCR) polymer content designed for demanding automotive applications

June 2024: Teijin Limited, a Japan-based chemical, pharmaceutical, and information technology company, announced a new, additional production line for its polycarbonate resin Panlite sheet and film, located at its Matsuyama plant in Ehime Prefecture. The company invested in this new line to meet the growing demand for high-quality automotive interior parts and in-vehicle electronic components, such as displays and touch screens.

Automotive Plastic Compounding Market Segmentation

By Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Polypropylene (PP)

- Polyethylene (PE)

- Thermoplastic Elastomers (TPE)

- Polybutylene Terephthalate (PBT)

- Polyamide (PA)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Systems (ABS)

- Styrene Acrylonitrile (SAN)

- Polymethyl Methacrylate (PMMA)

- Polyoxymethylene (POM)

- Blends (PC/ABS, ABS/PBT, and PS/PP)

By Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Interior

- Exterior

- Under the Hood

- Structural Parts

- Electrical Components & Lighting

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Plastic Compounding Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.30 Billion |

|

Market Size Value in 2025 |

USD 3.50 Billion |

|

Revenue Forecast by 2034 |

USD 6.17 Billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automotive plastic compounding market size was valued at USD 3.30 billion in 2024 and is projected to grow to USD 6.17 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are SCG Chemicals Public Company Limited, Chevron Phillips Chemical Company LLC, Kraton Corporation, LyondellBasell Industries Holdings B.V., BASF, SABIC, Dow, Vibrantz, Ascend Performance Materials, Washington Penn, Borealis, Teijin Limited, and Ravago.

The polycarbonate (PC) segment is projected for significant growth in the global market during the forecast period.

The interior segment dominated the market in 2024.