Automotive Lighting Market Size, Share, & Industry Analysis Report

By Vehicle Type (Passenger Cars and Commercial Vehicles), By Application Type, By Technology, By Sales Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM1438

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

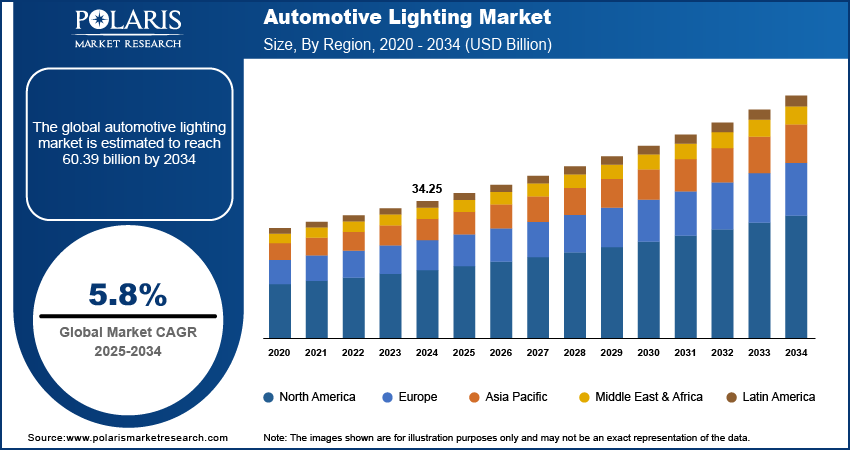

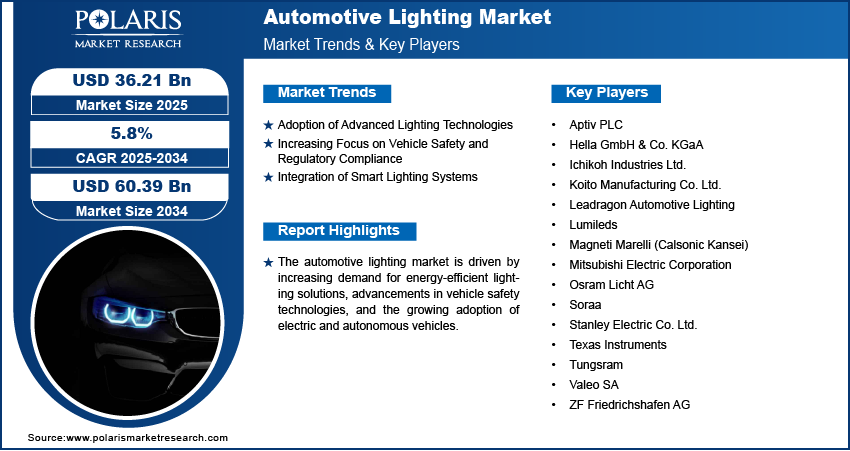

The global automotive lighting market size was valued at USD 34.25 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2034. The market is primarily driven by growing demand for progressive lighting solutions such as LED and OLED technologies, which provide enhanced energy efficacy, prolonged lifespan, and improved visibility.

Key Insights

- The passenger car segment witnessed the largest market revenue share in 2024.

- The exterior lighting segment holds the largest share due to growing demand for advanced headlight systems such as LED, OLED, and flexible lighting technologies.

- The European automotive lighting market holds the largest market share because of the region's robust automotive manufacturing establishment, high demand for advanced lighting technologies, and stringent regulatory norms for vehicle safety and environmental performance.

- Asia Pacific is growing rapidly, driven by increased demand from emerging nations such as China, India, and Japan, whereby countries like China have acquired notable leadership in advanced lighting technologies, especially in the growing EV sector.

Industry Dynamics

- Advanced lighting technologies such as LED lighting, OLED, and laser lighting provide several benefits involving improved energy efficiency, longer lifespans, and superior illumination, driving the market growth.

- Regulatory norms globally are becoming stringent, especially regarding headlight illumination, light dissemination, and pedestrian security, which is driving market demand.

- The rise of self-driving cars and the integration of smart lighting systems is opening possibilities for automotive lighting as manufacturers continue to innovate to meet both consumer expectations and regulatory requirements.

- The high voltage sensitivity of LED lights may hinder market growth.

Market Statistics

2024 Market Size: USD 34.25 billion

2034 Projected Market Size: USD 60.39 billion

CAGR (2025-2034): 5.8%

Europe: Largest Market in 2024.

AI Impact on Automotive Lighting Market

- AI enables adaptive lighting systems that adjust beam patterns in real-time based on road conditions, weather, and surrounding traffic.

- AI-powered sensors and vision algorithms enhance night-time visibility and pedestrian detection by optimizing headlamp intensity and direction.

- Predictive maintenance supported by AI identifies potential lighting system failures before they occur, improving vehicle safety and uptime.

- AI integrates with V2X (Vehicle-to-Everything) communication to synchronize lighting cues for autonomous driving and vehicle signaling.

To Understand More About this Research: Request a Free Sample Report

The market is primarily driven by the increasing demand for advanced lighting solutions, such as LED and OLED technologies, which offer improved energy efficiency, longer lifespans, and enhanced visibility. The growing focus on vehicle safety and the implementation of stricter regulations on vehicle lighting standards are also key factors contributing to the overall growth.

Automotive lighting refers to the production and supply of lighting systems for vehicles, including headlights, tail lights, interior lights, and other lighting components. Trends such as the rise of self-driving cars and the integration of smart lighting are shaping the future of automotive lighting, as manufacturers continue to innovate to meet consumer and regulatory demands. The shift towards electric vehicles (EVs) is further promoting the use of energy-efficient lighting technologies.

Market Dynamics

Adoption of Advanced Lighting Technologies

Advanced lighting technologies, such as LED lighting, OLED, and laser lighting, offer numerous advantages, including higher energy efficiency, longer lifespans, and better illumination. LEDs are particularly popular due to their low power consumption and high brightness, making them ideal for both interior and exterior lighting in vehicles. OLED lighting is also gaining traction due to its flexibility and ability to create unique lighting designs, especially in high-end vehicles. The shift towards these technologies is largely driven by consumer demand for better energy efficiency and aesthetics.

Increasing Focus on Vehicle Safety and Regulatory Compliance

Regulatory standards around the world are becoming stricter, particularly concerning headlight brightness, light distribution, and pedestrian safety. For instance, the European Union’s regulations on headlight alignment and beam patterns have pushed manufacturers to develop more precise and adaptable lighting systems. Adaptive headlights, which adjust the direction of the beam based on vehicle speed, steering angle, and elevation, are becoming a standard feature in modern vehicles. These systems help enhance visibility in various driving conditions, thereby reducing the likelihood of accidents. The National Highway Traffic Safety Administration (NHTSA) in the US has also been working on regulations for advanced lighting technologies to improve road safety.

Integration of Smart Lighting Systems

Smart lighting systems are becoming an integral part of modern vehicles, offering features such as adaptive lighting, automatic dimming, and personalized interior lighting. These systems use sensors, cameras, and AI algorithms to adjust the lighting based on environmental conditions, vehicle speed, and driver preferences. The integration of smart lighting systems is further supported by advancements in the Internet of Things (IoT) and vehicle connectivity. In particular, vehicles equipped with advanced driver assistance systems (ADAS) increasingly rely on smart lighting to enhance both safety and comfort. The trend aligns with the shift towards autonomous vehicles, where lighting plays a critical role in communication between the vehicle and its environment.

Segment Insights

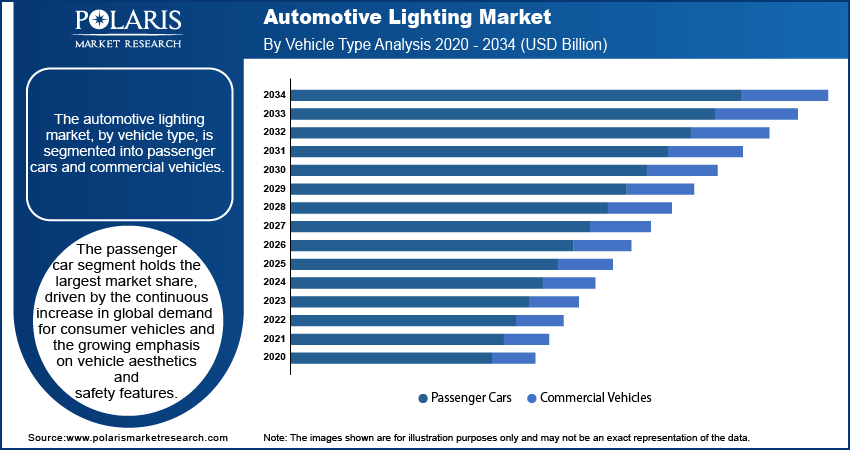

Market Evaluation Based on Vehicle Type Insights

The automotive lighting market evaluation, by vehicle type, is segmented into passenger cars and commercial vehicles. The passenger car segment holds the largest share, driven by the continuous increase in global demand for consumer vehicles and the growing emphasis on vehicle aesthetics and safety features. As consumers prioritize advanced lighting technologies such as LED and OLED for their energy efficiency and design flexibility, passenger vehicles are increasingly adopting these innovations in both interior and exterior lighting. Additionally, the rising trend of EVs and the integration of smart lighting systems contribute to the growth of this segment.

The commercial vehicle segment, while smaller in comparison, is seeing substantial growth due to the increasing demand for transportation services and the adoption of advanced lighting technologies aimed at improving safety and visibility in heavy-duty vehicles. The shift towards compliance with stricter regulations on lighting standards for commercial fleets, particularly in regions such as North America and Europe, is further driving this growth. Both segments are benefiting from innovations in lighting technology. Still, the passenger car segment is anticipated to continue holding the largest share while registering the highest growth rate due to higher consumer adoption of new automotive lighting solutions.

Market Assessment Based on Application Type Insights

The automotive lighting market assessment, by application type, is segmented into interior lighting and exterior lighting. The exterior lighting segment holds the largest share, primarily driven by the growing demand for advanced headlight systems, such as LED, OLED, and adaptive lighting technologies. Exterior lighting plays a crucial role in enhancing vehicle safety by improving visibility for drivers and pedestrians, which has led to a substantial increase in adoption across passenger and commercial vehicles. The exterior lighting segment continues to dominate as regulations become stricter and consumers demand higher performance and energy-efficient lighting solutions. Additionally, the rise of electric vehicles, which often feature more sophisticated exterior lighting designs, has contributed to the overall growth.

The interior lighting segment, while smaller in comparison, is also experiencing steady growth due to the rising focus on in-car comfort and luxury. Consumer preferences for personalized lighting systems, such as ambient lighting and color-adjustable LEDs, are contributing to the demand for interior lighting. The growth in premium vehicle sales and the integration of smart lighting technologies in cabin designs are expected to further drive the expansion.

Market Outlook Based on Technology Insights

The automotive lighting market outlook, by technology, is segmented into halogen, xenon, LED, and other technologies. The LED segment holds the largest share and are increasingly being used for both exterior and interior lighting in vehicles, due to its superior energy efficiency, longer lifespan, and higher brightness compared to traditional halogen and xenon technologies. As consumers and manufacturers demand more energy-efficient and aesthetically flexible lighting solutions, LED technology continues to dominate. The xenon segment, while smaller, is still in demand for certain high-end vehicles due to its brighter output and better light quality compared to halogen. However, its share is gradually declining as LEDs are becoming more cost-effective and versatile.

The halogen segment, once the most common technology in automotive lighting, is witnessing a decline in adoption due to its lower energy efficiency and shorter lifespan compared to newer technologies like LED. The other technologies segment, which includes OLED and laser lights, is growing, especially in premium and luxury vehicles, as these technologies offer distinct design and performance advantages, contributing to an innovative shift in automotive lighting. The LED segment is expected to continue leading as it becomes the preferred choice for manufacturers and consumers alike.

Market Outlook Based on Sales Channel Insights

The automotive lighting market is segmented by sales channel into OEM and aftermarket. The OEM segment holds the largest share, driven by the continuous production of new vehicles incorporating advanced lighting technologies. As automotive manufacturers integrate advanced lighting solutions such as LEDs, adaptive headlights, and smart lighting systems into their vehicles, the demand for OEM lighting components remains robust. This segment also benefits from the increasing production of passenger and commercial vehicles, particularly electric vehicles, which are often equipped with state-of-the-art lighting technologies as standard.

The aftermarket segment is also experiencing growth, particularly due to the increasing number of vehicle owners opting for upgrades and replacements of lighting systems. Aftermarket lighting components are particularly popular among consumers looking to enhance vehicle aesthetics or replace damaged lights in older vehicles. Factors such as rising consumer awareness about the benefits of advanced lighting technologies, along with the availability of a wide range of lighting products for customization, are driving the growth of the segment.

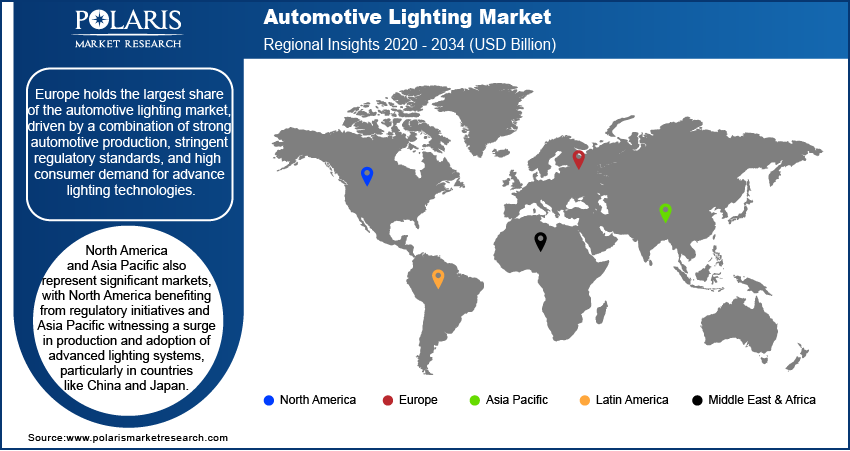

Regional Analysis

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Europe automotive lighting market holds the largest share. This dominance is primarily due to the region's strong automotive manufacturing base, high demand for advanced lighting technologies, and strict regulatory standards for vehicle safety and environmental performance. Europe is home to several major automotive manufacturers, which consistently integrate advanced lighting solutions such as LEDs, OLEDs, and adaptive lighting systems into their vehicles. Additionally, the region's focus on sustainability and the growing adoption of EVs drives the demand for energy-efficient lighting technologies. North America and Asia Pacific also represent significant growth, with North America benefiting from regulatory initiatives and Asia Pacific witnessing a surge in production and adoption of advanced lighting systems, particularly in countries like China and Japan. Latin America and the Middle East & Africa are comparatively smaller shareholders but are experiencing gradual growth due to increasing automotive production and modernization of vehicle fleets.

The growing shift towards electric vehicles (EVs) and the adoption of energy-efficient technologies further support the demand for innovative lighting systems in Europe. The region’s focus on sustainability and vehicle safety ensures that Europe remains a key player.

Asia Pacific automotive lighting industry is a rapidly growing, driven by strong demand from emerging countries like China, India, and Japan. China, as the one of the largest automotive hub in the world, is seeing significant adoption of advanced lighting technologies, particularly in the growing EV sector. Japanese manufacturers, such as Toyota and Honda, are also integrating advanced lighting systems in their new models, contributing to the regional growth. Additionally, the increasing production of both passenger and commercial vehicles in countries like India and South Korea drives the demand for automotive lighting. With a focus on energy-efficient solutions and enhanced vehicle aesthetics, Asia Pacific is expected to register significant growth in the coming years, driven by both local production and rising consumer demand for advanced lighting systems.

Key Players and Competitive Insights

The competitive landscape of the global arena is shaped by rapid innovation, strategic realignments, and an increasing focus on intelligent mobility solutions. Industry analysis reveals that companies are leveraging these expansion strategies such as alliances and joint ventures to enhance their technological capabilities and global footprint. Mergers and acquisitions continue to be a prevalent approach to gain access to advanced lighting technologies like adaptive headlights, OLEDs, and laser-based systems. Launches of energy-efficient and aesthetically advanced lighting systems have become key to differentiation. Post-merger integration efforts are streamlining production and R&D operations, allowing faster development of smart lighting systems aligned with autonomous and electric vehicle trends. Technology advancements, particularly in LED matrix systems, ambient interior lighting, and ADAS-integrated illumination, are driving innovation cycles. Manufacturers are also emphasizing sustainable and lightweight materials to meet regulatory standards and improve vehicle efficiency. The competitive intensity is further reinforced by rising demand for vehicle personalization, safety-enhancing lighting systems, and connected automotive technologies.

Key players like Hella GmbH & Co. KGaA, Valeo SA, Magneti Marelli (Calsonic Kansei), Koito Manufacturing Co. Ltd., Stanley Electric Co. Ltd., Osram Licht AG, Aptiv PLC, ZF Friedrichshafen AG, Texas Instruments, Leadragon Automotive Lighting, Mitsubishi Electric Corporation, Lumileds, Soraa, Ichikoh Industries Ltd., and Tungsram. These companies are involved in the development, manufacturing, and supply of automotive lighting components, including LED, halogen, and xenon lighting systems. They are actively competing to meet the demand for advanced vehicle lighting solutions. Several of these players focus on the adoption of energy-efficient technologies, with a significant portion of their efforts dedicated to LEDs and smart lighting solutions.

In terms of strategy, many companies are investing heavily in research and development to meet the demand for autonomous vehicle lighting, which includes adaptive and sensor-integrated lighting systems. Firms like Osram Licht AG and Stanley Electric are at the forefront of introducing lighting systems with intelligent features, such as dynamic lighting that adjusts based on the road environment.

Hella is a prominent manufacturer of automotive lighting and electronic components. The company is known for developing advanced lighting systems, including LED and adaptive headlights, catering to both OEM and aftermarket segments. It has a strong global presence, supplying lighting solutions to major automotive manufacturers.

Koito Manufacturing is a key player specializing in automotive lighting systems, including LEDs, halogen lamps, and adaptive headlights. The company is heavily focused on developing innovative solutions for energy efficiency and vehicle safety. Koito collaborates with global automotive OEMs, providing lighting systems for a wide range of vehicle models.

List of Key Companies

- Aptiv PLC

- Hella GmbH & Co. KGaA

- Ichikoh Industries Ltd.

- Koito Manufacturing Co. Ltd.

- Leadragon Automotive Lighting

- Lumileds

- Magneti Marelli (Calsonic Kansei)

- Mitsubishi Electric Corporation

- Osram Licht AG

- Soraa

- Stanley Electric Co. Ltd.

- Texas Instruments

- Tungsram

- Valeo SA

- ZF Friedrichshafen AG

Automotive Lighting Industry Developments

- In April 2025: Marelli showcased its newest automotive lighting innovations at Auto Shanghai 2025. Among these innovations were the company’s Thin Lit Line Headlamp and OLED TFT applied to the Pixel Rear Lamp.

- In April 2025: Stanley Electric signed an integration agreement with Mitsubishi Electric Company. According to Mitsubishi, the new agreement focuses on the establishment of a joint venture company for the lamp system business for next-generation vehicles.

- In November 2023, Hella announced the expansion of its production facility in Mexico to meet the growing demand for energy-efficient lighting solutions in North and South America. This expansion aligns with the company's strategy to strengthen its manufacturing capabilities in key regions.

- In October 2023, Koito introduced a new LED headlamp technology designed to enhance visibility in adverse weather conditions, highlighting its commitment to safety and innovation.

Automotive Lighting Market Segmentation

By Vehicle Type Outlook (Revenue-USD Billion, 2020 – 2034)

- Passenger Cars

- Commercial Vehicles

By Application Type Outlook (Revenue-USD Billion, 2020 – 2034)

- Interior Lighting

- Exterior Lighting

By Technology Outlook (Revenue-USD Billion, 2020 – 2034)

- Halogen

- Xenon

- LED

- Other Technologies

By Sales Channel Outlook (Revenue-USD Billion, 2020 – 2034)

- OEM

- Aftermarket

By Regional Outlook (Revenue-USD Billion, 2020 – 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Lighting Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 34.25 billion |

|

Market Size Value in 2025 |

USD 36.21 billion |

|

Revenue Forecast by 2034 |

USD 60.39 billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The automotive lighting market has been segmented into detailed segments of vehicle type, application type, technology, and sales channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth strategy in the automotive lighting market revolves around innovation, strategic partnerships, and regional expansion. Manufacturers are investing in research and development to create advanced technologies like adaptive headlights, OLEDs, and smart lighting systems to meet consumer and regulatory demands. Collaborations with automotive OEMs enable seamless integration of lighting systems into new vehicle models. Companies are also focusing on expanding their presence in emerging markets, such as Asia Pacific and Latin America, where automotive production and demand for advanced lighting are growing. Additionally, the aftermarket segment is being targeted with customizable and energy-efficient lighting solutions to cater to vehicle personalization trends.

FAQ's

? The automotive lighting market size was valued at USD 34.25 billion in 2024 and is projected to grow to USD 60.39 billion by 2034.

? The market is projected to register a CAGR of 5.8% during the forecast period.

? Europe had the largest share of the market in 2024.

? A few of the key players in the automotive lighting market include manufacturers like Hella GmbH & Co. KGaA, Valeo SA, Magneti Marelli (Calsonic Kansei), Koito Manufacturing Co. Ltd., Stanley Electric Co. Ltd., Osram Licht AG, Aptiv PLC, ZF Friedrichshafen AG, Texas Instruments, Leadragon Automotive Lighting, Mitsubishi Electric Corporation, Lumileds, Soraa, Ichikoh Industries Ltd., and Tungsram.

? The passenger cars segment accounted for the largest share of the market in 2024.

? The exterior lighting segment accounted for the largest share of the market in 2024

? Automotive lighting refers to the lighting systems used in vehicles to provide illumination for safety, visibility, and communication. These systems include exterior lights such as headlights, tail lights, fog lights, and turn signals, as well as interior lights for the dashboard, cabin, and ambient lighting. Automotive lighting serves critical functions such as enhancing visibility for drivers, making vehicles visible to others, and improving overall road safety. Modern automotive lighting incorporates advanced technologies like LEDs, OLEDs, and adaptive lighting systems to improve energy efficiency, durability, and performance while meeting regulatory standards.

? A few key trends in the automotive lighting market are described below: Shift to Energy-Efficient Technologies: Growing adoption of LED, OLED, and laser lighting due to their energy efficiency, longer lifespan, and improved performance over traditional halogen and xenon lights. Focus on Vehicle Safety: Increasing integration of advanced lighting systems like adaptive headlights and matrix lighting to enhance visibility and comply with stricter safety regulations. Rising Adoption of Smart Lighting Systems: Implementation of sensor-based and connected lighting technologies that adjust to driving conditions, vehicle speed, and environmental factors. Growth of Electric and Autonomous Vehicles: Expansion of lighting solutions tailored for EVs and autonomous vehicles, including communication-centric lighting for interaction with pedestrians and other vehicles.

? A new company entering the automotive lighting market could focus on advanced and emerging technologies, such as energy-efficient OLED, laser lighting, and adaptive systems for autonomous and electric vehicles. Investing in smart lighting solutions, including IoT-enabled and AI-driven systems that enhance safety and personalization, can provide a competitive edge. The company could also target the growing aftermarket segment with customizable lighting products for vehicle aesthetics. Establishing partnerships with automotive OEMs and exploring opportunities in high-growth regions like Asia Pacific would strengthen market positioning. Prioritizing compliance with global safety and environmental regulations is essential to building credibility and meeting consumer demands.

? Companies manufacturing, distributing, or purchasing automotive lighting and related products, and other consulting firms must buy the report.