Automotive Hypervisors Market Share, Size, Trends, Industry Analysis Report, By Type (Type 1, Type 2); By Vehicle Type; By Bus System; By End User; By Mode of Operation; By Sales Channel; Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4172

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

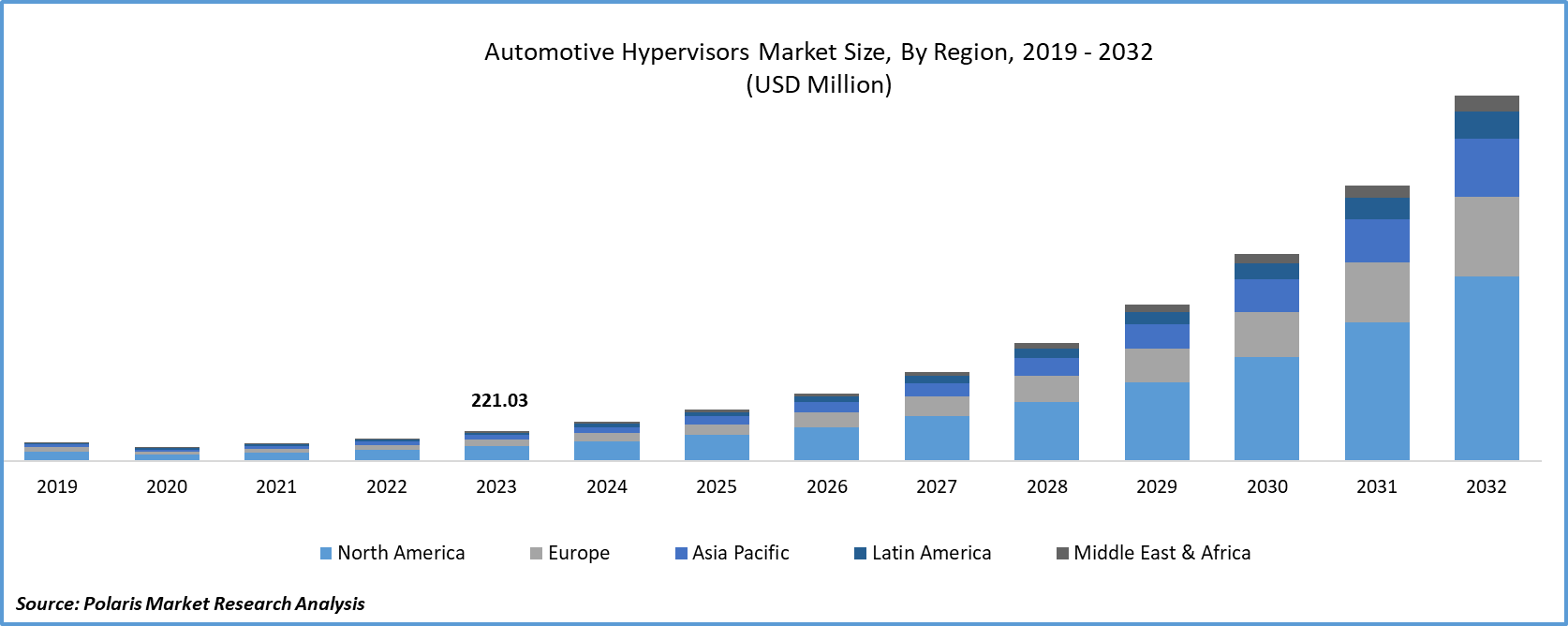

The global automotive hypervisors market was valued at USD 221.03 million in 2023 and is expected to grow at a CAGR of 32.4% during the forecast period.

An automotive hypervisor is a machine abstraction platform that sanctions manifold applications to operate simultaneously on a solitary hardware gadget. It is a software coating that perches between the hardware and the operating system, permitting manifold operating systems to operate on a solitary hardware gadget. The automotive hypervisors market size is expanding as this technology is aspiring to be favored in the automotive industry, particularly in contemporary vehicles. The usage of hypervisors in vehicles is pushed by the requirement for more progressive systems that can present manifold functions.

Type 1 hypervisors are more productive and safer than type 2 hypervisors. They offer an instant approach to the hardware sanctioning applications to operate at indigenous presentations. Type 1 hypervisors are normally utilized in momentous systems such as aircraft and medical gadgets. Type 2 hypervisors, alternatively, are less productive and less steady than Type 1 hypervisors. They operate on the apex of an operating system, which can initiate supplemental expenses and decrease performance. But, Type 2 hypervisors are simpler to position and sustain than Type 1 hypervisors.

The changing consumer preferences in line with technological advancements are enabling most industries and product manufacturers to diversify and renovate earlier products, including the automotive industry. This sector is adopting the latest technologies to meet consumer expectations of autonomous driving, increased safety, electrification, and shared mobility. Automotive hypervisors play a huge role in this digital transformation of vehicles as they provide software to operate several operating systems in a virtual environment. Companies in automotive hypervisors are creating cost-effective open models for vehicle manufacturers, reducing the need to licence proprietary software per vehicle.

To Understand More About this Research: Request a Free Sample Report

For instance, in November 2022, Xen Hypervisors, an open-source project supported by the EPAM, introduced the configuration of Renesas' R-Car S4 systems-on-chip to permit guest operating systems access to the processors embedded in automotive functionalities and peripherals.

Moreover, the technological transformation in vehicle manufacturing, including Electronic Control Unit (ECU) consolidation, is growing. Hypervisors have the capability to consolidate multiple functions of the ECU into a single hardware platform, driving demand for them in the coming years.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Automotive Hypervisors Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

However, the rising attack and data breaches among the virtualization technology adopters are likely to hamper the demand for automotive hypervisors. According to the article published in Tech Target, CrowdStrike noticed the increasing ransomware attacks on VMware's ESXi bare-metal hypervisor servers.

Growth Drivers

The Growing Technological Evolution

Hypervisors are efficient in creating and running virtual machines, enforcing the running of various systems, including infotainment, powertrain and engine control units, autonomous driving, and others, on a common hardware platform. It is driving innovations in the automotive industry by integrating artificial intelligence, the Internet of Things (IoT), and 5G in vehicles manufacturing of high-end central car computers.

Report Segmentation

The market is primarily segmented based on type, vehicle type, bus system, end user, mode of operation, sales channel, and region.

|

By Type |

By Vehicle Type |

By Bus System |

By End User |

By Mode of operation |

By Sales Channel |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Type 2 Segment is Expected to Witness the Highest Growth During the Forecast Period

The type 2 segment is projected to grow at a CAGR during the projected period, mainly driven by its flexibility and cost-effectiveness. This type is also known as hosted hypervisors, which run on conventional operating systems as an application or software layer, reducing the need for real-time operating systems and contributing to lower costs in vehicle manufacturing.

By Vehicle Type Analysis

Passenger Car Segment Accounted for the Largest Market Share in 2023

The passenger car segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the forecast period. The increasing complexity of passenger car electronics, with the incorporation of infotainment, advanced driver assistance systems, and more, is facilitating the need for automotive hypervisors due to their ability to improve vehicle performance by consolidating their systems into one hardware solution.

By Bus System Analysis

Ethernet Segment Held the Significant Market Revenue Share in 2023

The Ethernet segment held the largest revenue share, primarily due to its ability to provide higher data transfer compared to the other bus systems, such as CAN, LIN, & Flexray. The growing popularity of smart cars is widely recognizing the benefits of Ethernet and CANBUS due to the quality of data processing, speed, and advantage of virtualization in vehicles.

By End User Analysis

Luxury Segment Held the Significant Growth Share in 2023

The luxury segment held significant growth in 2023, which was highly expected to be fueled by the continuous rise in demand for advanced automobiles. Consumers are willing to pay a premium amount for the additional features in vehicles, where the luxury segment comes into play. This is encouraging vehicle manufacturers to create a few premium models with advanced features, such as increased automation, connectivity, and user experience, in a way driving the demand for automotive hypervisors in the market.

By Mode of Operation Analysis

Semi-autonomous Vehicle Segment Dominated the Global Market in 2023

The semi-autonomous vehicle registered higher segmental growth in 2023, which is highly attributable to their affordability and safety. The increasing demand for semi-autonomous vehicles in the market is enabling auto manufacturers to produce these vehicles with advanced features to differentiate in the market space, driving the adoption of high-performance computing hardware systems to meet ongoing and future consumer needs. This trend is likely to stimulate the need for automotive hypervisors in the market during the forecast timeframe.

By Sales Channel Analysis

OEMs Segment Held Growth in 2023

The OEMs (original equipment manufacturers) segment held a positive share in 2022, which is highly accelerated due to the increasing investments by companies to provide advanced vehicles to consumers. The increasing demand for hypervisor-embedded vehicles is driving their adoption by OEMs, contributing to market expansion.

Regional Insights

North America Region Witnessed the Largest Share in the Global Market in 2023

The North America region dominated the global market. This is attributable to the increasing demand for automotive vehicles in this region. The United States registered approximately 13% of the vehicle sales in the first half of 2023. Toyota Motors North America United witnessed a 7.13% increase in U.S. sales to 568,962 in the second quarter, while General Motors registered a 19% rise and reached sales of a total of 691,978. These data suggest increasing demand for automotive vehicles in the region, encouraging companies to innovate the most efficient vehicles with the latest technologies, which may fuel the demand for automotive hypervisors in the region throughout the study period.

The Asia Pacific region is expected to be the fastest growing region, owing to the growing adoption of electric vehicles in the region. Countries in the region, primarily India, Vietnam, and Bhutan, are emphasizing policies to promote the adoption of electric vehicles with a view to reducing greenhouse gas emissions in the region. For instance, India started the Faster Adoption and Manufacturing of Electric Vehicles (FAME) initiative as a measure to enhance the low-carbon economy. As hypervisors are essential in managing the operation functions of electric vehicles, there will be huge potential for hypervisor market expansion in this region.

Key Market Players & Competitive Insights

The automotive hypervisors market is fragmented and is expected to witness competition due to the presence of several players with potential to drive new innovations in the marketplace. Key players in the region are working on collaborations, partnerships, mergers, and acquisitions with a view to gaining a competitive advantage over their peers and increasing their potential to innovate effective software for vehicle manufacturers. For instance, Mimik Technology entered into a collaboration with Blackberry to fuel software-defined vehicles in the global space.

Some of the major players operating in the global market include:

- Blackberry

- Continental AG

- Green Hills Software LLC

- Mentor Graphics Corporation

- NXP Semiconductor N.V.

- Panasonic

- Renesas Electronics Corporation

- Sasken Technologies Ltd.

- Visteon Corporation

- Wind River System Inc.

Recent Developments

- In January 2024, Panasonic Automotive Systems introduced its High-Performance Compute (HPC) system named Neuron. The new solution is capable of aggregating multiple computing zones, thereby reducing the automobile’s weight, cost, and integration complexity by eliminating redundant components. The innovation aims at addressing the rapidly changing mobility requirements anticipated for software-defined vehicle advancements.

- In November 2023, Panasonic Automotive Systems Company, a tier-one automotive supplier, announced the availability of Virtual SkipGen, a virtual replica of the company’s 3rd generation Digital Cockpit solution. The new solution will allow engineers and developers to start earlier in the automotive development lifecycle without the need for physical hardware. With vSkipGen, automobile companies to separate software development from the hardware development lifecycle, thereby reducing time to market and improving software quality.

- In September 2023, TTTech Auto, & Mimik Technology, an expert in hybrid cloud solutions, entered into a partnership to boost safety and alter the driving experience of the next-generation cars.

- In May 2023, Blackberry unveiled QNX Software Development Platform (SDP) 8.0 to allow auto manufacturers and IoT system developers to deliver high-powered products at lower costs, along with the maintenance of high security, reliability, and safety.

- In February 2022, NXP Semiconductors unveiled the S32G GoldVIP to tackle challenges associated with the real-time and application development of software-based vehicles with its network processor. This pre-integrated software includes partners from Amazon Web Services, Elektrobit, & Airbiquity.

Automotive Hypervisors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 291.21 million |

|

Revenue forecast in 2032 |

USD 2,753.93 million |

|

CAGR |

32.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Vehicle Type, By Bus System, By End User, By Mode of Operation, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Gain profound insights into the 2022. Automotive Hypervisors Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Okara Market Size, Share 2024 Research Report

Soy Grits Market Size, Share 2024 Research Report

Backlit Displays Market Size, Share 2024 Research Report

FAQ's

The global automotive hypervisors market size is expected to reach USD 2.75 billion by 2032

Key players in the market are Blackberry, Continental, Mentor Graphics, NXP Semiconductor N.V., Panasonic

North America contribute notably towards the global automotive hypervisors market

The global automotive hypervisors market is expected to grow at a CAGR of 32.4% during the forecast period.

The automotive hypervisors market report covering key segments are type, vehicle type, bus system, end user, mode of operation, sales channel, and region.