Automotive Gears Market Size, Share, Trends, Industry Analysis Report: By Application Type, Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle), Material Type, Gear Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast (2025–2034)

- Published Date:Nov-2024

- Pages: 129

- Format: PDF

- Report ID: PM5159

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Gears Market Overview

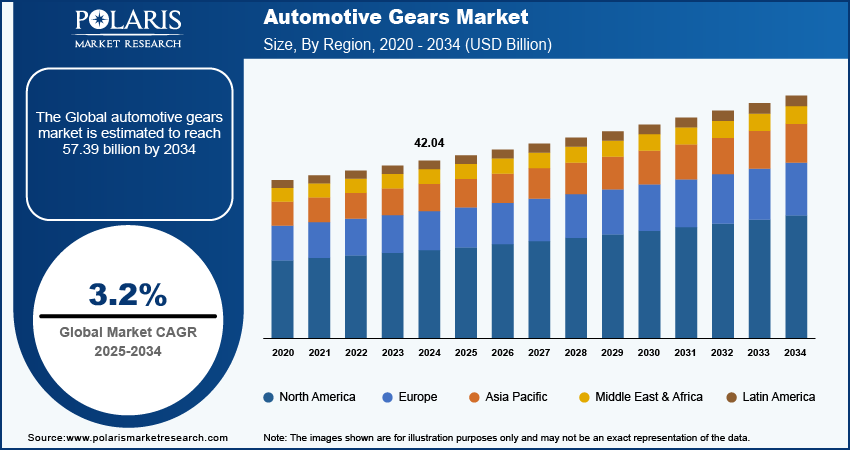

The global automotive gears market size was valued at USD 42.04 billion in 2024. The market is projected to grow from USD 43.30 billion in 2025 to USD 57.39 billion by 2034, exhibiting a CAGR of 3.2% during 2025–2034.

Automotive gears are crucial components in vehicle transmission systems. They enable smooth power transfer from the engine to the wheels, which allows vehicles to operate efficiently by adjusting torque and speed as needed, ensuring optimal performance under different driving conditions. Different gear types such as spur gears, helical gears, bevel gears, and planetary gears are employed depending on the vehicle type and transmission system, each serving specific functions.

The demand for automotive gears has increased due to advancements in transmission technologies, which improve fuel efficiency, lower emissions, and improve driving comfort. The innovations in transmission technologies optimize power distribution and ensure smoother gear shifts, contributing to better vehicle performance. Additionally, the shift toward electric vehicles (EVs) has driven the need for more efficient, quiet, and lightweight gear systems, as EVs require specific gear configurations to handle high torque without compromising efficiency.

To Understand More About this Research: Request a Free Sample Report

Automotive Gears Market Trends

Technological Advancements in Transmission Systems

Advancements in automotive transmission systems, particularly in dual-clutch (DCT) and continuously variable transmissions (CVT), are significantly driving demand for high-performance gears. DCT systems use two clutches to enable quicker, smoother gear shifts, reducing transition times and enhancing efficiency. This requires highly precise and durable gears to handle high torque and speed. CVTs, which offer seamless transitions across infinite gear ratios, improve fuel efficiency and driving comfort but require specialized pulley systems and robust gears to support continuous adjustments.

Nissan introduced updates to its CVT technology for hybrid vehicles with an aim to enhance fuel efficiency. The new CVT systems feature better torque handling and a more refined driving experience, reflecting the growing demand for gears that can efficiently manage continuous adjustments in hybrid and EV systems. Nissan's updates to its CVTs were driven by regulatory pressures for improved fuel efficiency. As technological advancements in transition systems improve fuel economy and reduce emissions, their increasing adoption in electric and hybrid vehicles is expected to fuel the demand for advanced gear systems in the coming years.

Regulatory Push for Fuel Efficiency and Emission Reduction

Governments from across the world increasingly impose stringent fuel efficiency and emissions regulations. Such regulations force automakers to develop advanced gear technologies. For instance, The European Union set new rules in 2021 to lower CO₂ emissions, and the US EPA updated its fuel efficiency standards, requiring a 15% reduction in emissions from more energy-efficient trailers by 2030 compared to 2025. This has pushed manufacturers to work on reducing power losses and improving fuel economy.

Advanced gears, such as those used in CVTs and DCTs, optimize energy transfer, lowering emissions and improving efficiency. These innovations are particularly crucial for EVs, where maximizing energy efficiency directly impacts driving range. As regulations tighten, demand for high-quality, precision-engineered gears continues to grow, pushing automakers to invest in R&D to meet regulatory and environmental standards. Thus, regulatory push for fuel efficiency and emission reduction is projected to drive the automotive gears market growth during the forecast period.

Automotive Gears Market Segment Insights

Automotive Gears Market Breakdown, by Application Type Outlook

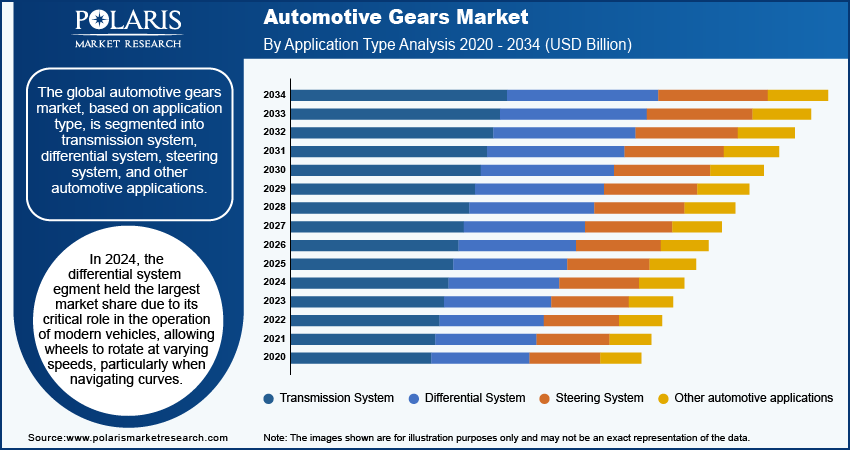

The global automotive gears market, based on application type, is segmented into transmission system, differential system, steering system, and other automotive applications. In 2023, The differential system segment held the largest market share due to its critical role in the operation of modern vehicles, allowing wheels to rotate at varying speeds, particularly when navigating curves. The rise in the adoption of electric vehicles further amplifies the need for more efficient and precise differential gear systems. Additionally, these systems are indispensable in off-road and commercial vehicles, which operate under extreme conditions. As a result, the demand for durable and reliable differential gear systems is projected to continue growing in the future. Moreover, the market for planetary gears is expected to expand, owing to the increasing adoption of automatic transmission systems in traditional and electric vehicles, highlighting their significant role in vehicle operation.

The transmission system segment is estimated to be the fastest-growing in the automotive gears market, primarily due to the essential function of gears in transferring power from the engine to the wheels. The rising demand for automatic and dual-clutch transmissions, driven by manufacturers’ focus on enhancing vehicle performance and fuel efficiency, is further propelling this segment. Additionally, the increasing adoption of electric and hybrid vehicles, along with innovations in gear materials and manufacturing processes is further driving the growth during forecast period.

Automotive Gears Market Breakdown, by Vehicle Type Outlook

The global automotive gears market segmentation, based on vehicle type, includes passenger car, light commercial vehicle, and heavy commercial vehicle. The global automotive gears market for the passenger car segment is growing significantly as the production and sales volume of passenger cars worldwide is more than other vehicle types, especially in key markets such as China, India, Europe, and North America. The rising trend toward urbanization and improved living standards in emerging economies have increased mobility demands, contributing to further growth in this segment. Moreover, consumers are increasingly seeking fuel-efficient, comfortable, and technologically advanced cars, leading to a higher adoption of automatic transmission systems and advanced gear technologies, which are crucial components of passenger cars.

The ongoing shift toward vehicle electrification, particularly electric and hybrid passenger vehicles, has sustained demand for automotive gears. These vehicles require complex gear systems for efficient performance. Despite the significance of light commercial and heavy commercial vehicles, their lower production volumes compared to passenger cars result in a smaller share of the overall gears market.

Automotive Gears Market Breakdown, by Material Type Outlook

The global automotive gears market segmentation, based on material type, includes metallic and non-metallic. The metallic segment dominated the market in 2024 due to its performance and durability requirements in automotive applications. Metallic gears, usually made of materials such as steel, aluminum, and cast iron, offer superior strength, durability, and heat resistance compared to non-metallic gears. These properties are crucial in high-stress applications such as transmission and differential systems, where gears must withstand significant torque and wear over extended periods. Additionally, metallic gears are widely preferred in high-performance and heavy-duty vehicles, where strength and reliability are critical.

The non-metallic segment, including gears made of advanced plastics and composites, is projected to register a significant CAGR during the forecast period due to the lightweight properties and corrosion resistance of these gears. They are primarily used in low-stress applications, such as interior mechanisms, or where noise reduction is essential. However, owing to the rising need for robustness in critical vehicle systems, metallic gears remain the dominant choice, especially in passenger cars and commercial vehicles.

Automotive Gears Market Breakdown by Gear Type Outlook

The global automotive gears market segmentation, based on gear type, includes planetary gears, bevel gears, rack and pinion gears, hypoid gears, worm gears, helical gears, spur gears, pinion gears, and non-metallic gears. In 2024, the bevel gears segment held the largest market share due to their ability to efficiently transmit power between shafts at right angles, which is essential in applications such as differentials and transmission systems. Their compact design allows for space-saving arrangements, making them crucial in vehicles where space is limited.

Bevel gears handle high loads and torque, making them suitable for the demanding environments of automotive applications. They are versatile and can be used in various systems, including steering mechanisms and power steering pumps, making them appealing to manufacturers. Continuous advancements in manufacturing techniques and materials have improved their precision, quality, and durability, further solidifying their position in the market. As the automotive sector continues to grow, especially in emerging markets, the demand for reliable and efficient gear systems such as bevel gears is increasing, reinforcing their dominant status.

Automotive Gears Market Breakdown, by Regional Outlook

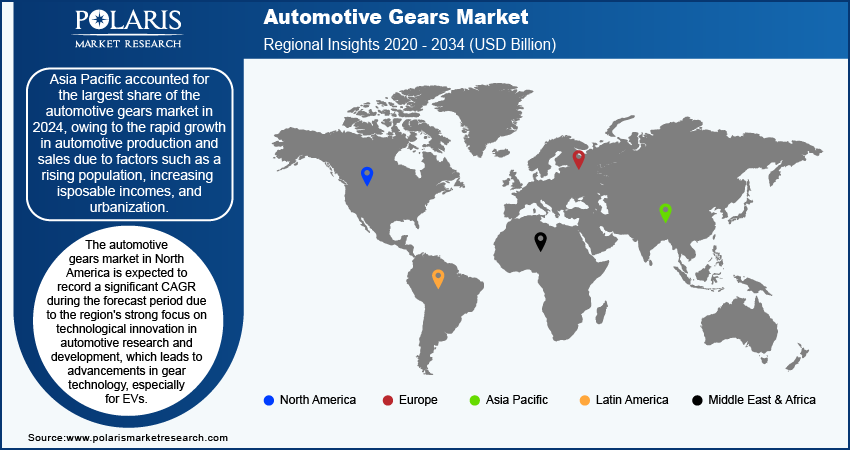

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest market share in 2024, owing to the rapid growth in automotive production and sales. This robust growth in the automotive sector has significantly boosted the demand for various automotive components, including gears. The automotive gears market trends in the region is anticipated to witness the highest growth rate, driven by a strong presence of electric vehicle (EV) manufacturers; enhanced technological capabilities in EVs; and advancements in transmission, steering, and differential assembly features. For instance, In 2023, BYD’s car sales surpassed 3.02 million units, with exports increasing year-on-year. To date, BYD has sold over 7.6 million new energy vehicles (NEVs). Such developments are expected to positively impact the sales of automotive gears. The well-established automotive industry in the region, coupled with advancements in automotive technology, fuels the Asia Pacific automotive gears market growth.

The automotive gears market in North America is expected to register a significant CAGR during the forecast period due to the region's strong focus on technological innovation in automotive research and development, which leads to advancements in gear technology, especially for EVs. The strong automotive industry, along with rising disposable incomes and shifting consumer preferences, is boosting the demand for high-performance gear systems in vehicles. The automotive gears market is growing to meet these needs as more people afford cars and seek better performance. Additionally, government initiatives promoting fuel efficiency and the growing trend of vehicle customization boost the regional market growth.

Automotive Gears Market – Key Players and Competitive Insights

The competitive landscape of the automotive gears market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the market, such as American Axle and Manufacturing Holdings Inc, Bharat Gears Ltd, and Robert Bosch GmbH, leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of advanced automotive gear products. These companies focus on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of automotive gear providers. Additionally, smaller and regional companies are increasingly entering the market, offering specialized and niche products that cater to needs or specific local market demands. Competitive strategies often include mergers and acquisitions, partnerships with automotive institutions, and investments in emerging markets to expand reach and enhance market presence. A few major players are American Axle and Manufacturing Holdings Inc., Bharat Gears Ltd., GKN Powder Metallurgy, JTEKT Corporation, Robert Bosch GmbH, Hitachi Astemo, IMS Gear, Univance Corporation, Eaton, Cummins Inc, RSB Global, Schaeffler India, Toyota, and ZF.

American Axle & Manufacturing, Inc. is an American manufacturer of automobile driveline and drivetrain components and systems based in Detroit, US. The company announced a $10 million investment in the Global Strategic Mobility Fund (GSMF) in May 2023, a venture capital fund managed by EnerTech Capital. Due to this, AAM has access to EnerTech vast network of mobility businesses, which will help enhance AAM’s business.

Suzuki Motor Corporation is a Japanese multinational mobility manufacturer headquartered in Hamamatsu, Shizuoka. It manufactures automobiles, motorcycles, all-terrain vehicles, outboard marine engines, wheelchairs, and a variety of other small internal combustion engines. In January 2023, Suzuki signed a joint development agreement with Inmotive Inc. to develop a 2-speed EV transmission for a future Suzuki electric vehicle. This agreement aims to enhance the EV range by efficiently using motor torque, reducing costs through a smaller electric powertrain unit, and improving driving performance in various scenarios.

Key Companies in Automotive Gears Market

- American Axle and Manufacturing Holdings Inc.

- Bharat Gears Ltd.

- GKN Powder Metallurgy

- JTEKT Corporation

- Suzuki

- Robert Bosch GmbH

- Hitachi Astemo

- IMS Gear

- Univance Corporation

- Eaton

- Cummins Inc

- RSB Global

- Schaeffler India

- Toyota

- ZF

Automotive Gears Industry Developments

In June 2024, Schaeffler India launched an innovative Planetary Gear System (PGS) designed specifically for Dedicated Hybrid Transmission (DHT) vehicles in India. The system is aimed at enhancing vehicle performance and offering various benefits to OEM partners. By manufacturing these systems locally, Schaeffler India is providing a strong value proposition to their OEM partners.

In September 2024, The GR Corolla lineup is growing for the 2025 model year with the introduction of the 8-speed GAZOO Racing Direct Automatic Transmission (DAT) with paddle shifters. This new option caters to hardcore enthusiasts who prefer the excitement of a manual transmission and those who prioritize dynamic handling with an automatic transmission.

In February 2024, ZF announced that the first PowerLine 8-speed automatic transmissions rolled off the production line in late 2023 at its Gray Court, South Carolina manufacturing facility. As part of a USD 200 million investment announced in 2021, ZF is now ramping up production to 200,000 transmissions per year by 2025 to meet the demand from US commercial vehicle manufacturers, including three US-based customers.

Automotive Gears Market Segmentation

By Application Type Outlook (Revenue – USD Billion, 2020–2034)

- Transmission System

- Automatic Transmission

- Automated Manual Transmission

- Manual Transmission

- Dual-Clutch Transmission

- Differential System

- Steering System

- Other Automotive Applications

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Material Type Outlook (Revenue – USD Billion, 2020–2034)

- Metallic

- Non-Metallic

By Gear Type Outlook (Revenue – USD Billion, 2020–2034)

- Planetary Gears

- Bevel Gears

- Rack and Pinion Gears

- Hypoid Gears

- Worm Gears

- Helical Gears

- Spur Gears

- Pinion Gears

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Gears Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 42.04 billion |

|

Market Size Value in 2025 |

USD 43.30 billion |

|

Revenue Forecast by 2034 |

USD 57.39 billion |

|

CAGR |

3.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global automotive gears market size was valued at USD 42.04 billion in 2024 and is projected to grow to USD 57.39 billion by 2034

The global market is projected to register a CAGR of 3.2% during the forecast period.

In 2024, Asia Pacific led the global automotive gears market, driven by a growing population, rising disposable incomes, and rapid urbanization, fueling demand for advanced gear systems in vehicles.

A few key players in the market are American Axle and Manufacturing Holdings Inc., Bharat Gears Ltd., GKN Powder Metallurgy, JTEKT Corporation, Robert Bosch GmbH, Hitachi Astemo, IMS Gear, Univance Corporation, Eaton, Cummins Inc, RSB Global, Schaeffler India, Toyota, and ZF.

In 2024, the bevel gears segment dominated the market due to their ability to efficiently transmit power between shafts at right angles, which is essential in applications such as differentials and transmission systems.

The transmission system segment is estimated to be the fastest-growing in the automotive gears market, primarily due to the essential role gears play in efficiently transferring power from the engine to the wheels