Automotive Finance Market Share, Size, Trends, Industry Analysis Report, By Type (Indirect, Direct); By Service Type (New Vehicles, Used Vehicles, Others); By Vehicle Type (Passenger Vehicles, Commercial Vehicles); By Purpose (Leasing, Loan, Others); By Provider; By Regions; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 111

- Format: PDF

- Report ID: PM1815

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

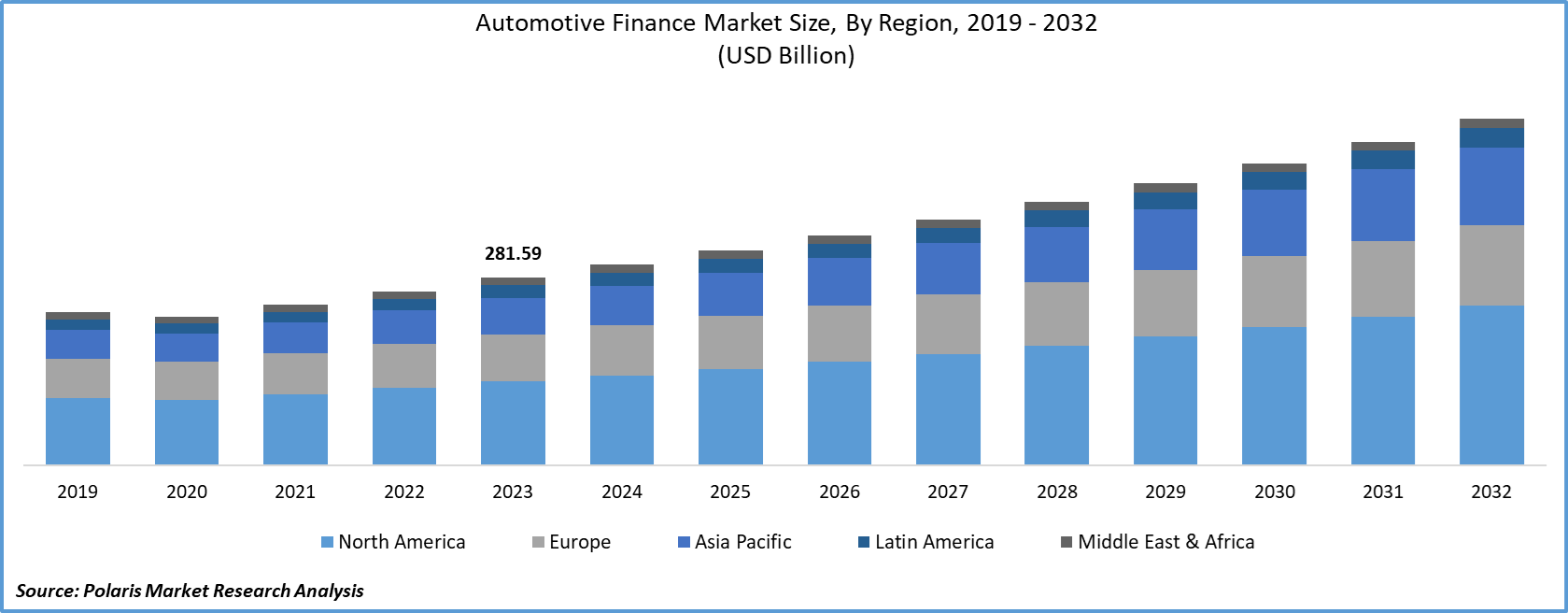

The global automotive finance market size was valued at USD 281.59 billion in 2023. The market is anticipated to grow from USD 301.30 billion in 2024 to USD 521.19 billion by 2032, exhibiting the CAGR of 7.1% during the forecast period.

Automotive financing enables consumers to acquire a car without outright payment. Automotive finance is provided by banks and financial institutions to enable consumers to buy vehicles through direct or indirect lending options.

The rising demand for passenger vehicles, growing adoption of alternative-fuel vehicles, and proactive government initiatives to promote the use of electric vehicles are expected to boost the growth of the Automotive Finance market. Lenders are taking efforts to enhance customer experience, business growth, and operational capabilities through digital platforms. There has been the emergence of pure digital automotive lenders, accelerating the market competition.

The growth in digitalization in the automotive sectors has encouraged lenders to integrate digital technologies into their business model for improved revenue generation. Services such as credit approval, car search, and selection, pricing, contracting, and engaging directly with lenders are offered online to provide timely services and improved customer experience.

Financers are focusing on providing a seamless experience by combining the financing process with the car buying process. Digital platforms offer more control to customers through search tools for specific monthly payments, pre-approved online, and electronic contracting.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

There has been an increasing adoption of green vehicles, driving the growth of the automotive finance market. The growth in production volume of electric vehicles, increasing need for fuel-efficient vehicles, and stringent government regulations have increased the penetration of electric passenger vehicles. The use of electric vehicles in the commercial sector reduces congestion and pollution while increasing efficiency. The increasing need to reduce maintenance costs of transportation of commercial goods majorly drives the growth of this market.

These vehicles align with government policies and depend on subsidies. Several automotive lenders have collaborated with governments to offer attractive schemes to consumers on the sale of electric vehicles. Additionally, fleet operators offer personalized automotive finance options for the inclusion of electric and hybrid cars in the fleet. Volkswagen Grune Flotte and Daimler Ecostar program are initiatives that include leasing offers on low emission car models, driver training, emission reduction tips, and promoting the adoption of car sharing.

Market players are modifying their business models based on advancing technologies and changing consumer preferences. Growing modernization of vehicles, integration of vehicle connectivity, development of autonomous vehicles, the introduction of stringent vehicular regulations, and increasing penetration of luxury vehicles are some factors influencing the market for automotive finance.

Increasing awareness among consumers regarding traffic congestion and longer trip times has increased the adoption of mobility solutions such as car-sharing and multi-modal transportation, shifting the trend from car ownership to car users. Automotive finance companies are joining forces with automotive OEMs, car rental companies, and fleet operators for the expansion of business operations.

Automotive Finance Market Report Scope

The market is primarily segmented on the basis of type, service type, vehicle type, provider, purpose, and region.

|

By Type |

By Service Type |

By Vehicle Type |

By Provider |

By Purpose |

By Region |

|

|

|

|

|

|

Know more about this report: request for sample pages

Type Outlook

On the basis of type, the market is segmented into indirect automotive finance, and direct automotive finance. In 2019, the direct automotive finance segment accounted for the highest market share. The demand for direct automotive finance is high as it enables the consumer to submit financing requests directly to a bank or lender. The consumer is responsible for finalizing the terms of financing directly with the auto finance company. This financing option allows consumers to obtain pre-approved car financing.

Service Type Outlook

On the basis of service type, the market is segmented into new vehicles and used vehicles. Automotive loans for new vehicles take into consideration the manufacturer’s guarantee for certain years or the number of kilometers traveled, which results in disbursal of a higher loan amount as compared to a used car. The loan-to-value ratio is also higher for new vehicles. The loan process is easier for new vehicles with a higher insurance premium.

Vehicle Type Outlook

On the basis of vehicle type, the market is segmented into passenger vehicles, commercial vehicles, and others. Passenger cars can be classified into microcars, hatchbacks, sedans, SUVs, MUVs, and vans among others. The demand for automotive finance for passenger vehicles is expected to increase owing to rising disposable income, changing lifestyle of consumers, growth in automotive production volume, and increasing need for fuel-efficient vehicles.

Provider Outlook

On the basis of provider, the market is segmented into banks, OEMs, financial institutions, credit unions, and others. In 2019, the banks segment accounted for the highest market share. Some benefits offered by banks include low-interest rates, low EMI, minimal paperwork, and quick disbursement. Banks offer benefits such as long repayment tenure, and financing on ‘On-Road price’.

Purpose Outlook

On the basis of purpose, the market is segmented into loans, leasing, and others. In 2019, the loan segment dominated the global market. Some benefits offered by automotive loans include lesser payment over the long term, flexibility to trade or sell, and no restrictions on appearance. There is also no mileage limit on loans, which enables consumers to drive without capping the number of miles.

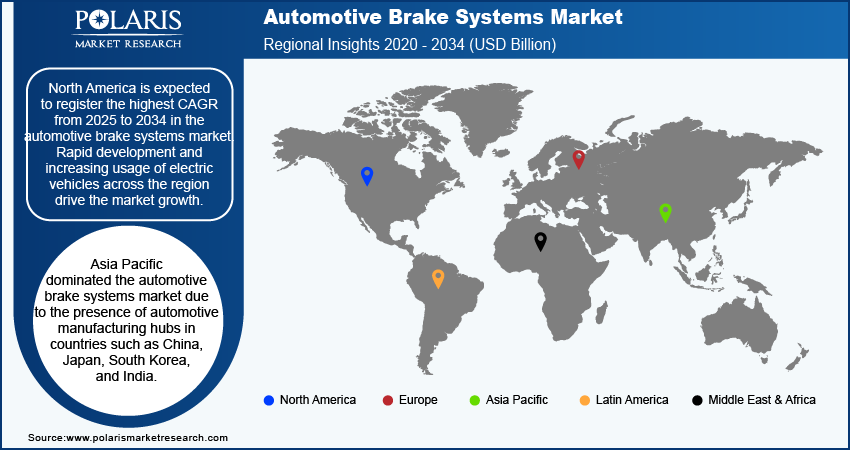

Geographic Overview

Asia Pacific accounted for a significant market share in 2020. The increasing population of vehicles, rising demand for technologically advanced luxury vehicles, and adoption of vehicular emission standards drive the market growth in the region. Significant investments in the automotive sector, extensive research & development activities, increasing adoption of electric vehicles, and development of autonomous vehicles are some factors fueling the market growth in the region.

Competitive Landscape

The leading players in the market for automotive finance include Bank of America, Chase Auto Finance, GM Financial Inc., Toyota Financial Services, BNP Paribas, Daimler Financial Services, Ford Motor Credit Company, HSBC Holdings plc, Ally Financial, Wells Fargo & Co, Banco Bradesco SA, Capital One, Volkswagen Financial Services, HDFC Bank Limited, Hitachi Capital Asia Pacific Pte. Ltd., and Standard Bank Group Ltd.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Automotive Finance Industry Development

January 2024: AutoFi Inc., a top distributor of finance and sales technology in the automotive sector, extended its platform into showrooms to address challenges that lead to inefficiencies in their sales process, such as decision overload, customer mistrust, and sales desk limitations.

October 2023: The award for Digital Innovation of the Year award was won by Solifi at the 9th Motor Finance Europe Awards in Vienna, Austria, for advancements in automotive finance technology through their Open Finance Platform.