Automotive Ethernet Market Share, Size, Trends, Industry Analysis Report, By Component (Hardware, Software and Service); By Bandwidth; By Application; By Vehicle Type; By Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4682

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

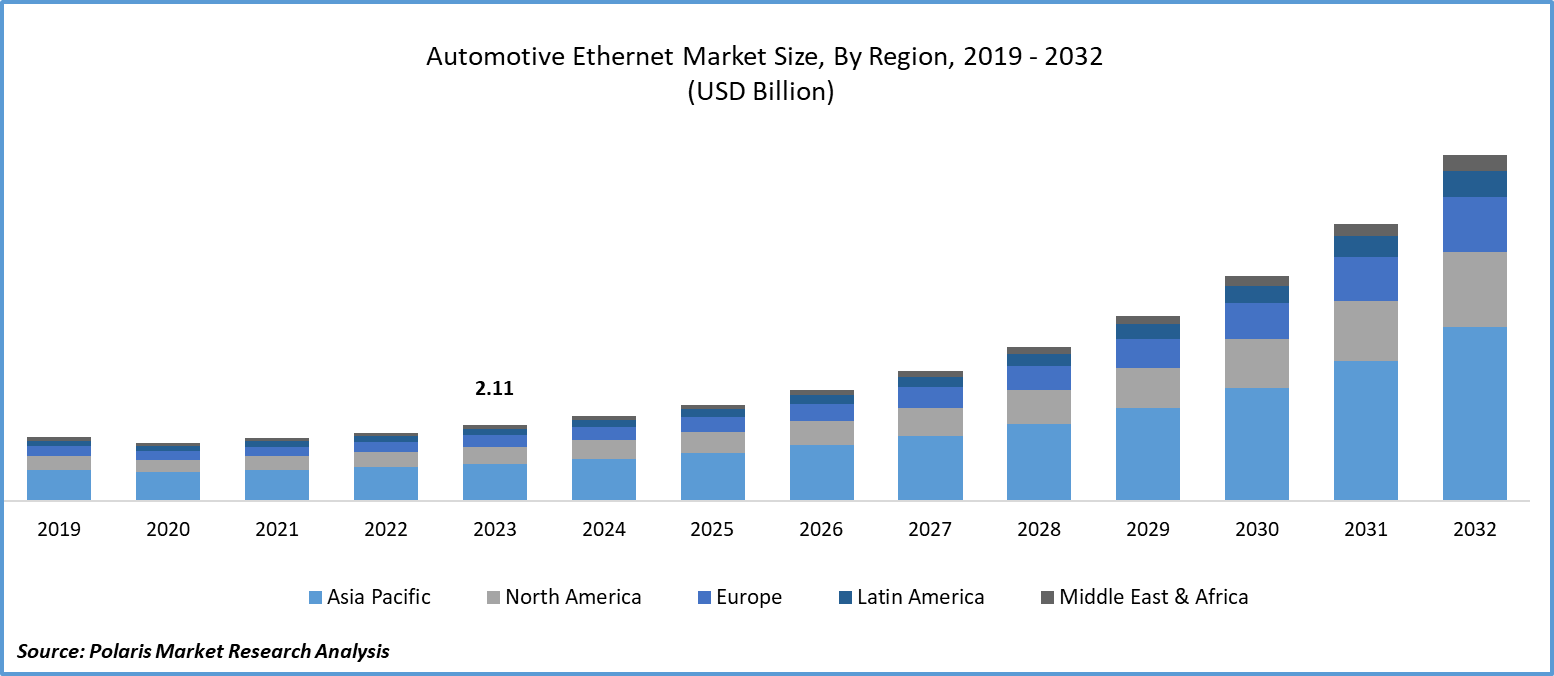

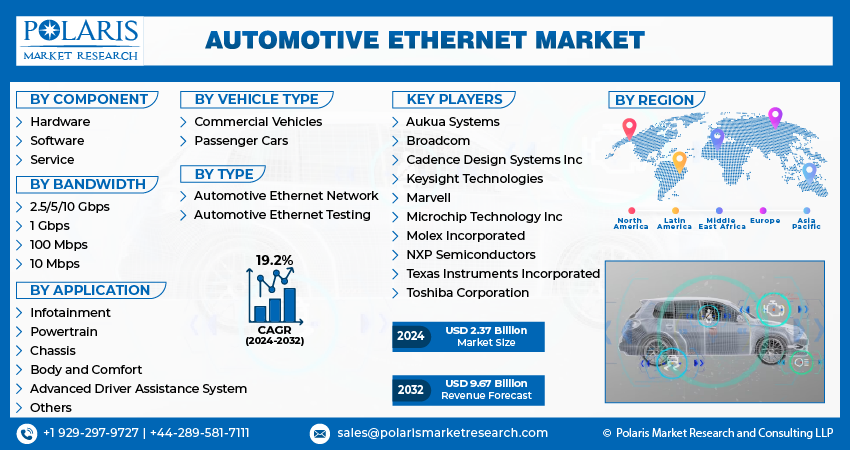

Global automotive ethernet Market size was valued at USD 2.11 billion in 2023. The market is anticipated to grow from USD 2.37 billion in 2024 to USD 9.67 billion by 2032, exhibiting the CAGR of 19.2% during the forecast period.

Automotive Ethernet Market Overview

Automotive ethernet is a type of physical network that is mostly utilized for wiring automobile components together. Several vital features are provided by automotive ethernet, including in-car communication, Diagnostic Over Internet Protocol (DoIP-based) diagnostic, and electric vehicle and charging station connections. Additionally, automotive ethernet dramatically lowers the weight and cost of vehicles as compared to the traditional wiring harness. All automobiles, including passenger cars and commercial vehicles, are being equipped with Ethernet technology by top automakers like General Motors, Hyundai, and Volkswagen.

For instance, in November 2023, Broadcom finalized its purchase of VMware, Inc. (US) for approximately USD 61.0 billion. This acquisition is expected to accelerate innovation and offer greater choices and versatility in developing, operating, overseeing, connecting, and safeguarding applications on a larger scale.

To Understand More About this Research: Request a Free Sample Report

The increasing use of Advanced Driver Assistance Systems (ADAS) in vehicles is projected to drive the growth of the automotive Ethernet market. ADAS comprises intelligent technologies that help drivers operate vehicles more safely and comfortably. Automotive Ethernet is essential for managing large volumes of data from ADAS sensors, operating at speeds of up to 1 Gigabit per second (Gbps) and beyond. This high speed is critical for real-time decision-making, where even small delays can be significant. For instance, according to the National Association of Insurance Commissioners, the number of autonomous vehicles on American roads is expected to reach 3.5 million by 2025 and 4.5 million by 2030. Therefore, the increasing adoption of ADAS is fueling the growth of the automotive ethernet market demand.

The COVID-19 pandemic significantly affected the automotive ethernet systems market, with lockdowns halting manufacturing and production. This led to vulnerability among Ethernet makers. Automakers halted production due to a lack of workers, impacting vehicle production. Despite these challenges, the automotive industry began to recover in late 2020, with increased vehicle sales in regions like North America, Asia-Pacific, and Europe. Government initiatives supporting connected vehicles and safety features are crucial for reducing costs for both manufacturers and consumers.

Automotive Ethernet Market Dynamics

Market Drivers

Rising Adoption of Connected Cars

The automotive ethernet market is growing rapidly, driven by the increasing popularity of connected and autonomous vehicles. These vehicles require fast, reliable data transmission for critical tasks such as advanced driver assistance systems (ADAS), real-time sensor communication, and in-car entertainment. Traditional protocols like CAN and FlexRay are not fast enough for these needs, making automotive Ethernet crucial for connected cars. Automotive Ethernet's high bandwidth and low latency are essential for vehicle-to-vehicle (V2V) communication, improving safety and traffic management. Telematics systems equipped with automotive Ethernet can send vehicle performance and diagnostics data efficiently for remote monitoring and predictive maintenance.

Automotive Ethernet also facilitates secure and rapid remote services, software updates, and real-time troubleshooting. Its fast speeds ensure smooth multimedia services and dynamic interfaces in infotainment systems. Ethernet connectivity facilitates effective communication between vehicles and infrastructure, laying the groundwork for a more connected, efficient, and secure automotive environment.

Initiatives for Universal Standardization

In an effort to ensure compatibility and interoperability between different automakers, the auto industry has standardized Ethernet-based communication protocols. This standardization facilitates the widespread use of automotive ethernet.

Market Restraints

Cost Associated With the Installation of Automotive Ethernet Is Likely to Impede the Market Growth

The high initial costs associated with automotive ethernet, including hardware, software development, testing, security, and retrofits for older vehicles, are a major challenge for the market's growth. Ethernet components like transceivers, switches, and cables are more expensive than traditional solutions, increasing overall implementation costs. Developing software for automotive ethernet requires specialized skills and resources, further adding to the financial burden. Extensive testing for reliability in harsh environments and implementing security measures against cyberattacks also contribute to higher costs. Integrating ethernet into existing vehicle architectures can require significant modifications, posing a financial challenge for manufacturers. Despite these hurdles, initiatives like OPEN Alliance TC8 aim to reduce hardware costs, and research is ongoing to develop more cost-effective solutions. Overcoming the high initial costs is crucial for the wider adoption of automotive ethernet.

Report Segmentation

The market is primarily segmented based on component, bandwidth, application, vehicle type, type, and region.

|

By Component |

By Bandwidth |

By Application |

By Vehicle Type |

By Type |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Automotive Ethernet Market Segmental Analysis

By Component Analysis

The service segment is expected to grow at the fastest CAGR during the forecast period due to its wide range of solutions, such as design, testing, maintenance, consultation, and integration, specifically for complicated systems based on Ethernet. The need for specialized services is growing as cars become more autonomous, data-centric, and connected. These services are necessary to guarantee reliable integration and strict adherence to automotive standards. Robust testing and integration services are necessary due to the growing intricacy of automotive networks.

Additionally, maintaining smooth communication between components is essential for optimal performance and safety as vehicles become more networked. To guarantee industry standards compliance, extensive testing and validation services are required due to the strict regulatory requirements. The expansion of this industry is in line with the trend in the automotive sector toward more technologically sophisticated and networked cars, which is driving up demand for specialized services that are essential to ensuring stable, dependable, and secure communication networks within cars.

By Bandwidth Analysis

The 1 Gbps segment accounted for the largest market share in 2023 and is likely to retain its position throughout the automotive ethernet market forecast period. The 1 Gbps automotive ethernet standard, 1000Base-T1, defined by IEEE 802.3bp, uses PAM3 encoding, a point-to-point setup such as 100Base-T1 and full-duplex transmission. It's a significant advancement, enabling high-speed communication crucial for demanding in-car applications such as active ADAS. For instance, it's ideal for systems like lane departure warning or automatic emergency braking, which need fast, reliable data transfer. The Broadcom Inc. BCM89586M automotive ethernet switch, released in May 2022, supports this 1 Gbps bandwidth and includes integrated security features. This expansion of 1 Gbps bandwidth in automotive ethernet meets the demands of modern automotive technology, providing robust, high-performance in-car networks.

By Application Analysis

Based on application analysis, the market has been segmented on the basis of infotainment, powertrain, chassis, and body & comfort. The infotainment segment dominated the automotive ethernet market growth. Infotainment systems in vehicles combine information and entertainment features to enhance the in-car experience. They offer multimedia entertainment, navigation, connectivity, and communication services. These systems allow passengers to enjoy music, videos, and streaming services. They also provide GPS navigation for directions and traffic updates, along with smartphone integration for hands-free calls, messages, and app access.

Ethernet, infotainment systems can offer high-resolution displays, faster app loading, and seamless multimedia streaming. Ethernet's ability to handle multiple data streams allows for simultaneous navigation updates, live traffic information, and entertainment options without slowing down. Ethernet's scalability also supports future infotainment advancements, such as augmented reality displays and improved connectivity with external networks or cloud services.

Automotive Ethernet Market Regional Insights

The Asia Pacific Region Dominated the Global Market With the Largest Market Share in 2023

The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. The automobile sector in the Asia-Pacific region has undergone a notable shift as a result of technological developments, stable socio-political conditions, and notable economic growth. In terms of worldwide vehicle production and sales, the Asia-Pacific region accounts for the majority. Growing disposable income and a sizable consumer base in developing countries like China, Malaysia, and India have propelled the automobile industry. As a result, there are several opportunities for automotive OEMs and ethernet firms operating in the sector, such as Mitsubishi, NEXCOM International Co., Ltd., and DASAN Networks Inc., to increase revenue.

The Europe region is expected to be the fastest-growing region, with a healthy CAGR during the projected period. The automotive ethernet market is rapidly growing across Europe, with countries like France, Germany, the United Kingdom, Spain, and others playing key roles. Strict safety standards and a focus on technological innovation in the automobile sector are driving this growth. A shared commitment to safety requirements and a growing market for connected vehicles are also fueling the development of automotive ethernet across Europe. These factors are making automotive ethernet a crucial technology in Europe's push for safer, more connected, and technologically advanced vehicles. Leading companies in the automotive Ethernet industry, such as Spirent Communications plc, NXP Semiconductors, and Rohde & Schwarz, are actively improving their product portfolios to meet the increasing demands from automakers.

Competitive Landscape

The automotive ethernet market demand is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Aukua Systems

- Broadcom

- Cadence Design Systems Inc

- Keysight Technologies

- Marvell

- Microchip Technology Inc

- Molex Incorporated

- NXP Semiconductors

- Texas Instruments Incorporated

- Toshiba Corporation

Recent Developments

- In October 2023, Microchip Technology Inc. has revealed its plans to enlarge its Detroit Automotive Technology Center in Novi, Michigan. The new facility, spanning 24,000 square feet, will include extra high-voltage and E-mobility laboratories, as well as technical training areas for automotive customers to develop and enhance solutions.

Report Coverage

The automotive ethernet market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, bandwidth, application, vehicle type, type and their futuristic growth opportunities.

Automotive Ethernet Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.37 billion |

|

Revenue forecast in 2032 |

USD 9.67 billion |

|

CAGR |

19.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Bandwidth, By Application, By Vehicle Type, By Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Automotive Ethernet Market report covering key segments are component, bandwidth, application, vehicle type, type and region.

Automotive Ethernet Market Size Worth $9.67 Billion By 2032

Automotive ethernet Market exhibiting the CAGR of 19.2% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Automotive Ethernet Market are Rising adoption of connected cars