Automotive Engineering Services Market Size, Share, Trends, Industry Analysis Report: By Vehicle Type (Passenger Cars and Commercial Cars), Application, Location, Service, Propulsion, Nature Type, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM3272

- Base Year: 2023

- Historical Data: 2019-2022

Automotive Engineering Services Market Overview

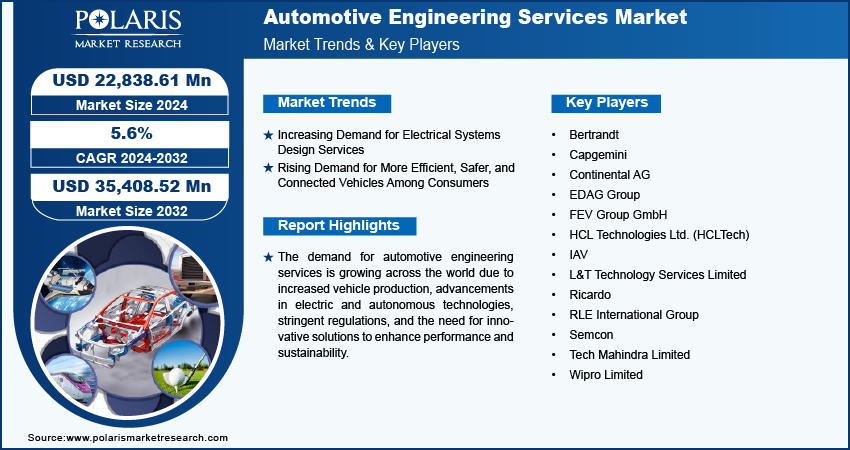

The global automotive engineering services market size was valued at USD 21,650.00 million in 2023. The market is projected to grow from USD 22,838.61 million in 2024 to USD 35,408.52 million by 2032, exhibiting a CAGR of 5.6% during the forecast period.

Automotive Engineering Services (AES) consist of various services involved in the design, development, testing, and manufacturing of vehicles and components such as engines, electronics, and safety systems. These services are provided by engineering firms or internal R&D teams within automakers. The AES market encompasses everything from concept design and prototyping to systems integration and software development for traditional internal combustion engines (ICE) and emerging electric and autonomous vehicles. The demand for automotive engineering services is growing rapidly, driven by technological advancements in electric vehicles (EVs) and autonomous driving. The emergence of EVs, autonomous driving, and connected vehicle technologies has compelled automakers to seek specialized expertise in software development, artificial intelligence (AI), and battery systems. These technologies are crucial for modern vehicles, but many traditional automakers need more in-house capabilities in these areas, leading to an increasing dependence on external engineering services. Further, the push toward sustainable mobility has spurred innovation in lightweight materials, fuel efficiency, and emissions reduction, boosting the growth of the automotive engineering services market.

To Understand More About this Research: Request a Free Sample Report

Government regulations are positively influencing the automotive engineering services market growth. Automakers are facing pressure to innovate and comply with strict standards for reducing carbon emissions, improving fuel efficiency, and enhancing vehicle safety. This has resulted in increased demand for engineering services to assist companies in adapting to changing regulatory requirements and implementing new technologies to meet these goals.

In conclusion, the ongoing technological transformation of the automotive industry, combined with evolving regulatory pressures, is driving the automotive engineering services market growth. Automotive companies are increasingly turning to external expertise to navigate these challenges, ensuring that the vehicles of the future are innovative and also compliant with global standards.

Automotive Engineering Services Market Drivers and Trends

Increasing Demand for Electrical Systems Design Services

The growing complexity and sophistication of modern vehicles fuel the demand for electrical systems design services. In modern vehicles, advanced electrical systems are essential for supporting features such as infotainment, advanced driver assistance systems (ADAS), and electric powertrains. Automotive technology is advancing, requiring specialized design services for wiring harnesses, control units, sensors, and vehicle communication networks.

The shift toward electric vehicles (EVs) and hybrid models increases the need for sophisticated electrical systems. These vehicles rely heavily on precise electrical designs for key functions such as battery management, energy distribution, and motor control. Engineering services that develop these systems are critical for ensuring seamless integration and reliability.

Vehicle connectivity and autonomous driving technologies are also key contributors to the rising demand for electrical systems. The need for robust electrical architectures to support high-speed data transmission and real-time processing is met by engineering services. These services play a crucial role in optimizing electrical systems for performance, safety, and compliance with regulatory standards. Therefore, the rising demand for electrical systems design services boosts the automotive engineering services market growth.

Rising Demand for More Efficient, Safer, and Connected Vehicles Among Consumers

Consumers prefer vehicles that deliver superior fuel efficiency, advanced safety features, and seamless connectivity. This demand has prompted automotive manufacturers to innovate and upgrade their product offerings continuously.

Automotive engineering services play a pivotal role in meeting these expectations by developing and integrating advanced technologies. These services focus on optimizing powertrains, including the design of hybrid and electric propulsion systems, which help improve fuel economy and reduce emissions to enhance efficiency. Further, engineering services contribute to improve vehicle safety by implementing advanced driver assistance systems (ADAS), such as automatic emergency braking and lane-keeping assist.

Connectivity is increasingly important, with consumers favoring infotainment systems, over-the-air updates, and Vehicle-to-Everything (V2X) communication. Automotive engineering services operate on integrating these technologies to provide real-time data and a seamless user experience. This growing demand compels manufacturers to invest in advanced engineering solutions, driving market growth and innovation.

Automotive Engineering Services Market Segment Insights

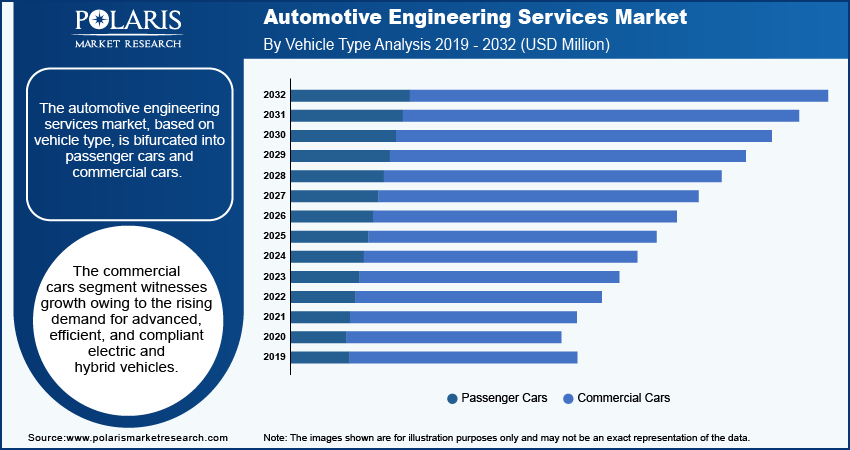

Automotive Engineering Services Market Breakdown by Vehicle Type Insights

The automotive engineering services market, based on vehicle type, is bifurcated into passenger cars and commercial cars. In 2023, the commercial cars segment dominated the market, accounting for around 79% of the market revenue share (i.e., USD 17,101.3 million). The dominance of this segment is attributed to the increasing demand for advanced vehicles and fleet management solutions. The demand for engineering services has increased due to businesses prioritizing efficiency and sustainability, leading to a significant need for innovative solutions such as electric and hybrid commercial vehicles.

Stringent regulations regarding emissions and safety standards compel manufacturers to invest in specialized engineering services to ensure compliance. Consequently, automotive engineering service providers are focusing on developing advanced technologies and systems tailored for commercial vehicles, enhancing their competitiveness. This synergy between demand and innovation positions the commercial vehicles segment as a critical growth driver in the automotive engineering service market.

Automotive Engineering Services Market Breakdown by Location Insights

The automotive engineering services market segmentation, based on location, includes in-house and outsourcing. The in-house segment is expected to register a CAGR of 6.6% during the forecast period. The market for the in-house segment is experiencing rapid growth driven by the increasing need for proprietary knowledge and control over innovation. Companies are investing in internal capabilities to manage core engineering functions such as powertrain development, software integration, and safety testing. This approach ensures better alignment with strategic objectives and allows faster adaptation to technological advancements and regulatory changes. Moreover, the shift toward electric and autonomous vehicles has boosted the demand for specialized in-house teams to handle complex design and development. As a result, the in-house segment is expected to grow significantly during the forecast period, which would offer companies greater control and foster continuous innovation.

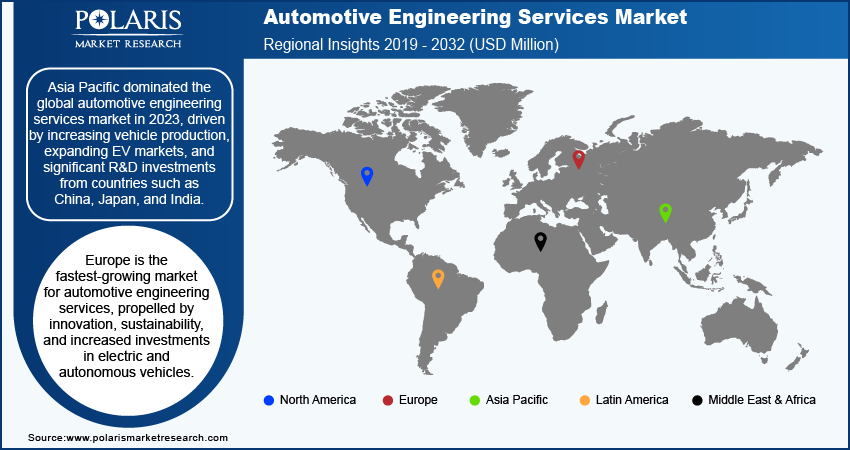

Automotive Engineering Services Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific dominated the global automotive engineering services market in 2023. The demand for automotive engineering services is rapidly increasing in the region due to the region's growing automotive industry, rising vehicle production, and the expanding electric vehicle (EV) market. Countries such as China, Japan, and India are key markets as they are investing heavily in R&D to support advancements in electric and autonomous vehicles. Additionally, favorable government policies promoting sustainable transportation and stringent emission regulations push automakers to adopt innovative engineering solutions. All these factors boost the growth of the automotive engineering service market across the region.

Europe is poised to emerge as the fastest-growing market for automotive engineering services, driven by a robust focus on innovation and sustainability. Automakers in the region are prioritizing advanced engineering solutions to improve vehicle performance and comply with strict regulatory standards as they are increasing investments in EVs and autonomous technologies. Additionally, the region's commitment to reducing carbon emissions has spurred the development of cleaner, more efficient vehicles, further boosting demand for specialized engineering services. The market in Europe is expected to maintain a robust growth trajectory during the forecast period, solidifying its leadership in automotive innovation as industry players collaborate with engineering firms to accelerate technology integration.

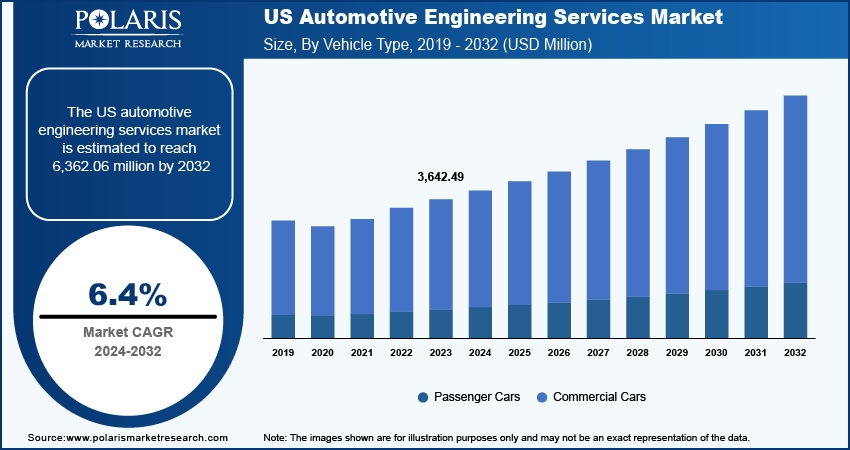

The North America automotive engineering services market is experiencing significant growth, driven by the rapid advancement of electric and autonomous vehicles. Major automakers are increasing investments in R&D to enhance vehicle technologies, improve safety features, and comply with evolving regulatory standards. Furthermore, the presence of established engineering firms and a skilled workforce fosters innovation and collaboration within the industry. The ongoing shift toward connectivity and smart technologies in vehicles is also propelling demand for specialized engineering services, positioning North America as a key player in the automotive engineering services market.

Automotive Engineering Services Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which would boost the automotive engineering services market growth during the forecast period. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the automotive engineering services market players must offer cost-effective products.

Manufacturing locally to minimize operational costs is one of the key business strategies used by manufacturers in the global automotive engineering services market to benefit clients.. A few major players in the market are Capgemini, IAV, Bertrandt, L&T Technology Services Limited, FEV Group GmbH, Ricardo, Continental AG, EDAG Group, Semcon, Tech Mahindra Limited, Wipro Limited, HCL Technologies Ltd. (HCLTech), and RLE International Group.

Capgemini is a global consulting and technology services provider. The company offers solutions in digital transformation, data strategy, AI, cloud infrastructure, and business process outsourcing across multiple industries and regions. In July 2024, it acquired Lösch & Partner to enhance its systems engineering and application lifecycle management capabilities, strengthening its position in the German automotive industry.

L&T Technology Services Limited (LTTS), an engineering R&D provider, offers solutions across transportation, industrial products, communication, plant engineering, and medical devices, supporting diverse sectors globally. In May 2024, L&T Technology Services and FORVIA formed a USD48.84 million partnership, transferring 300 engineers to LTTS for ultra-low emissions engineering, skill development, and ongoing support.

List of Key Companies in Automotive Engineering Services Market

- Bertrandt

- Capgemini

- Continental AG

- EDAG Group

- FEV Group GmbH

- HCL Technologies Ltd. (HCLTech)

- IAV

- L&T Technology Services Limited

- Ricardo

- RLE International Group

- Semcon

- Tech Mahindra Limited

- Wipro Limited

Automotive Engineering Services Industry Developments

June 2024: Wipro collaborated with Siemens to enhance automotive software development. The partnership will integrate Siemens' PAVE360 software and digital twin technologies with Wipro's expertise in automotive engineering and digital transformation. The partnership aims to accelerate innovation and streamline the development process for automotive manufacturers.

April 2024: Ricardo and Caepro partnered to deliver high-end, cost-effective engineering services in India, combining expertise in powertrains, electrification, and simulation for automotive and commercial vehicles.

January 2024: Continental Engineering Services and Sibros partnered to revolutionize connected mobility with advanced vehicle-to-cloud connectivity and enhanced data management solutions.

Automotive Engineering Services Market Segmentation

By Vehicle Type Outlook

- Passenger Cars

- Commercial Cars

By Application Outlook

- ADAS and Safety

- Electrical, Electronics, and Body Controls

- Chassis

- Connectivity Services

- Interior, Exterior, and Body Engineering

- Powertrain and Exhaust

- Simulation

- Battery Development and Management

- Charger Testing

- Motor Controls

- Others

By Location Outlook

- In-house

- Outsourcing

By Service Outlook

- Concept/Research

- Designing

- Prototyping

- System Integration

- Testing

By Propulsion Outlook

- ICE

- Electric

By Nature Type Outlook

- Body Leasing

- Turnkey

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- Italy

- UK

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Indonesia

- South Korea

- Malaysia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Engineering Services Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 21,650.00 Million |

|

Market Size Value in 2024 |

USD 22,838.61 Million |

|

Revenue Forecast by 2032 |

USD 35,408.52 Million |

|

CAGR |

5.6% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global automotive engineering services market size was valued at USD 21,650 million in 2023 and is projected to grow to USD 35,408.52 million by 2032.

The global market is expected to register a CAGR of 5.6% during the forecast period.

Asia Pacific held the largest share of the global market in 2023.

A few key players in the market are Capgemini, IAV, Bertrandt, L&T Technology Services Limited, FEV Group GmbH, Ricardo, Continental AG, EDAG Group, Semcon, Tech Mahindra Limited, Wipro Limited, HCL Technologies Ltd. (HCLTech), and RLE International Group.

The commercial cars segment dominated the market in 2023.

The outsourcing segment accounted for the largest share of the global market in 2023.