Automotive Electronics Market Share, Size, Trends, & Industry Analysis Report

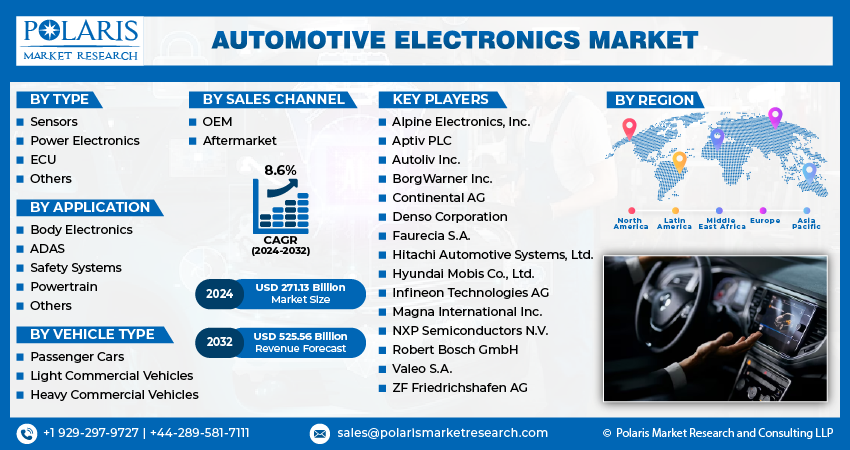

By Type (Sensors, Power Electronics, ECU, Others); By Application; By Vehicle Type; By Sales Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 119

- Format: PDF

- Report ID: PM1436

- Base Year: 2024

- Historical Data: 2020-2023

The global automotive electronics market was valued at USD 318.5 billion in 2024 and is projected to grow at a CAGR of 8.70% from 2025 to 2034. Growth is fueled by the rising adoption of electric vehicles and demand for advanced infotainment and safety systems.

Market Introduction

The surge in demand for Advanced Driver Assistance Systems (ADAS) is a key driver propelling the automotive electronics market. ADAS, encompassing features like collision avoidance and adaptive cruise control, relies on advanced electronic systems. Sensors, cameras, and processing units enhance safety and driving comfort. With increased consumer awareness and regulatory emphasis on safety standards, ADAS has become integral, driving continuous innovation in electronic components.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

Electronics created specifically for use in cars are known as automotive electronics. Compared to commercial (i.e., typical) electronics, automotive electronics are rated at more extreme temperature ranges since they are susceptible to more extreme conditions. Several electronic systems are used in cars to improve driving performance, fuel economy, and rider and driver comfort, among other functions. Many pieces of equipment have switched from being mechanical to being electronic.

Additionally, the term "automotive electronics" describes the use of electronic systems and parts in cars for a range of functions, such as connectivity, safety, entertainment, and communication. Also, the automotive electronics market is boosted as consumer awareness grows and regulations place a greater focus on safety criteria.

To Understand More About this Research: Request a Free Sample Report

For instance, in July 2023, Littelfuse, Inc. unveiled its latest Current Sensing Resistor (CSR) family, introducing a more economical option for current measurement in circuits. These newly introduced CSRs present a cost-effective means for monitoring voltage, controlling power, and managing functions like battery charging and motor speed. Additionally, they serve a dual purpose by offering overcurrent protection within the system.

The automotive electronics market is also witnessing substantial growth driven by the increasing consumer fascination with connected vehicles. As demand rises for enhanced connectivity, safety, and convenience, advanced electronics play a pivotal role. Connected vehicles, incorporating sophisticated electronics, offer real-time data exchange, navigation, and smart features. Consumers are particularly drawn to seamless connectivity, in-car infotainment, and smart functionalities. This growing interest propels innovations in automotive electronics, spanning telematics, advanced driver-assistance systems, and in-vehicle entertainment.

Industry Growth Drivers

Electrification of Vehicles is Projected to Spur the Product Demand

The surge in electric vehicle adoption is propelling significant growth in the automotive electronics market. As the automotive industry increasingly embraces EVs and hybrid models, the demand for advanced electronic components and systems has surged. Crucial elements such as electric powertrains, battery management systems, charging infrastructure, and advanced driver-assistance systems are essential for the operation of these vehicles. This transition sparks innovation in automotive electronics, fostering energy-efficient technologies, connectivity features, and autonomous driving capabilities. Governments worldwide promoting sustainable transportation further drive the adoption of EVs, making automotive electronics a key driver of innovation and growth in the automotive industry.

Emergence of Autonomous Vehicles is Expected to Drive Automotive Electronics Market Growth

The automotive electronics market is undergoing a revolution fueled by the rise of autonomous vehicles. The integration of cutting-edge electronics is pivotal for the realization of self-driving cars, relying on sophisticated systems for sensing, decision-making, and actuation. Advanced driver-assistance systems, LiDAR technology, radar sensors, and computer vision are crucial components driving innovation in automotive electronics. As the automotive industry embraces autonomy, there's a heightened demand for robust processors, communication modules, and software frameworks.

The research report offers a quantitative and qualitative analysis of the automotive electronics market size and share to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Industry Challenges

Cybersecurity Concerns are Likely to Impede Market Growth

The surge in connected vehicles and sophisticated electronics integration increases vulnerability to cyber threats, posing risks to safety and privacy. Unauthorized access, software manipulation, and data breaches are substantial risks, prompting significant investments in cybersecurity measures by manufacturers and suppliers. This not only impacts costs but also extends development timelines. To instill consumer trust in embracing advanced automotive electronics, addressing these cybersecurity challenges is imperative. Industry resilience against evolving cyber threats necessitates robust frameworks and collaborative efforts to ensure the secure and sustainable growth of the automotive electronics market.

Report Segmentation

The automotive electronics market analysis is primarily segmented based on type, application, vehicle type, sales channel, and region.

|

By Type |

By Application |

By Vehicle Type |

By Sales Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Sensors Segment is Expected to Experience Significant Growth During the Forecast Period

The sensors segment is expected to experience significant growth during the forecast period. Sensors power advanced safety features like collision avoidance, emergency braking, and adaptive cruise control, heightening on-road safety. Precision monitoring of engine parameters optimizes fuel efficiency, while emission control systems contribute to environmental sustainability. Sensors also fine-tune vehicle performance for a smoother drive, and their role extends to adaptive lighting, parking assistance, and tire pressure monitoring. In navigation, GPS and inertial sensors provide real-time maps and accurate location services. Whether ensuring airbag deployment precision or monitoring battery health, automotive sensors redefine the driving landscape, fostering safety, efficiency, and technological sophistication.

By Application Analysis

Adas Segment is Expected to Experience Significant Growth During the Forecast Period

The ADAS segment is expected to experience significant growth during the forecast period. Automotive Electronics for Advanced Driver Assistance Systems play a pivotal role in enhancing vehicle safety and driving experience. These sophisticated electronic systems incorporate various sensors, cameras, radar, and LiDAR technologies to enable features like adaptive cruise control, lane departure warning, automatic emergency braking, and parking assistance. The integration of ADAS technologies relies on advanced processing units, control algorithms, and communication systems. As the automotive industry progresses towards autonomous driving, the significance of ADAS in enhancing vehicle safety, reducing accidents, and providing a more efficient driving environment continues to drive innovation in automotive electronics.

By Vehicle Type Analysis

Passenger Cars Segment Held Significant Market Revenue Share in 2024

The passenger cars segment held significant market revenue share in 2023. Automotive electronics crafted for passenger cars create a sophisticated environment, prioritizing safety and comfort. Advanced infotainment systems offer seamless connectivity and integrated navigation, while the ADAS suite employs sensors for features like lane departure warnings. Connectivity features integrate smartphones, and electronic climate control ensures optimal comfort. Electronic power steering enhances precision, and keyless entry adds convenience. Digital instrument clusters provide customizable displays, and electronic stability control prevents skidding. These technologies converge to redefine the passenger car experience, blending innovation, safety, and connectivity seamlessly.

By Sales Channel Analysis

OEM Segment Held a Significant Market Revenue Share in 2024

The OEM segment held a significant revenue share in 2023. The OEM sales channel in automotive electronics involves a direct, collaborative relationship where manufacturers supply customized electronic components directly to vehicle OEMs. This streamlined process includes long-term contracts, bulk orders, and technical support for seamless integration. OEMs adhere to stringent quality standards, engage in innovation, and manage global distribution networks. With a focus on cost negotiation, regulatory compliance, and lifecycle management, the OEM sales channel ensures reliable and tailored electronic solutions for vehicle manufacturers, contributing to the efficiency and innovation of the automotive

Regional Insights

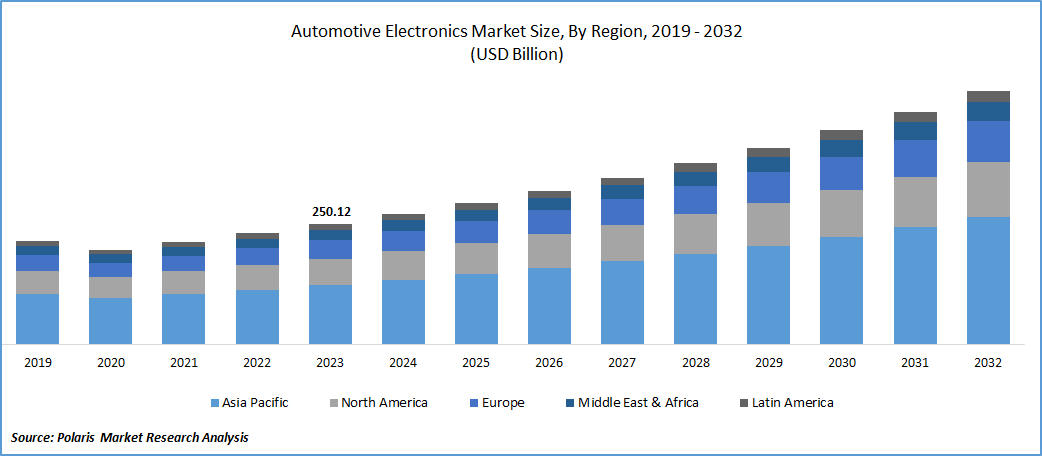

Asia-Pacific Region Dominated the Global Market in 2024

In 2023, the Asia-Pacific region dominated the global market. Asia-Pacific's automotive electronics market drives global industry trends, serving as a manufacturing powerhouse, especially in China. The region's robust capabilities meet the rising demand for sophisticated automotive electronics, fueled by growing vehicle sales and a shift toward electric mobility. Technological prowess, strategic collaborations, stringent regulations, and consumer preferences position Asia-Pacific as a leader in innovation. With a diverse competitive landscape, ongoing smart city initiatives, and supply chain challenges like semiconductor shortages, the region navigates the evolving automotive electronics landscape with adaptability.

Europe is expected to experience significant growth during the forecast period. Europe has a highly sophisticated automotive sector with industry giants like Volkswagen, BMW, and Mercedes-Benz. This dominance contributes significantly to the demand for cutting-edge automotive electronics, emphasizing innovation. European nations lead in prioritizing vehicle safety and enforcing stringent emission standards. This commitment drives the integration of advanced safety features and emission control systems, intensifying the need for sophisticated automotive electronics.

Key Market Players & Competitive Insights

The automotive electronics market involves a diverse array of contributors, and the expected surge of numerous newcomers is poised to intensify competition. Esteemed leaders in the market consistently enhance their technologies to maintain a competitive advantage, placing considerable emphasis on efficiency, reliability, and safety. These entities give precedence to strategic endeavors, including forging alliances, refining products, and participating in collaborative ventures, all with the goal of outperforming others in the industry. Their ultimate aim is to secure a significant automotive electronics market share.

Some of the major players operating in the global automotive electronics market include:

- Alpine Electronics, Inc.

- Aptiv PLC

- Autoliv Inc.

- BorgWarner Inc.

- Continental AG

- Denso Corporation

- Faurecia S.A.

- Hitachi Automotive Systems, Ltd.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Magna International Inc.

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Valeo S.A.

- ZF Friedrichshafen AG

Recent Developments

- In December, 2024, HARMAN Automotive launched Ready CQuence Loop and Ready Link Marketplace to accelerate software-defined vehicle development and enhance in-vehicle experiences, enabling automakers and developers to streamline workflows and unlock new digital revenue opportunities.

- In November 2023, Renesas Electronics Corporation unveiled its strategy for the upcoming generation of system-on-chips (SoCs) and microcontrollers (MCUs), catering to diverse applications within the automotive digital domain. Renesas shared preliminary details about its fifth-generation R-Car SoC designed for high-performance applications, featuring advanced chipset integration technology within the package.

- In January 2023, HARMAN unveiled its latest offerings, the Sound and Vibration Sensor, and External Microphone products, designed to elevate the audio experience both within and outside the vehicle. These innovative additions open the door to a range of applications aimed at boosting safety and user engagement.

Report Coverage

The automotive electronics market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, applications, vehicle types, sales channels, and their futuristic growth opportunities.

Automotive Electronics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 346.21 billion |

|

Revenue forecast in 2034 |

USD 735.4 billion |

|

CAGR |

8.70% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Gain profound insights into the 2024 Automotive Electronics Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2032. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

FAQ's

The global Automotive Electronics market size is expected to reach USD 735.4 billion by 2034

Alpine Electronics, Inc., Aptiv PLC, Autoliv Inc., BorgWarner Inc., Continental AG, Denso Corporation are the top market players in the market.

Asia-Pacific region contribute notably towards the global Automotive Electronics Market

Automotive Electronics market is expected CAGR: 8.70% forecast period (2025-2034)

The Automotive Electronics Market report covering key segments are type, application, vehicle type, sales channel, and region.