Automotive Digital Cockpit Market Share, Size, Trends, Industry Analysis Report, By Equipment (Digital Instrument Cluster, Driving Monitoring System, Heads-up Display); By Display (LCD, TFT-LCD, OLED); By Vehicle; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 132

- Format: PDF

- Report ID: PM2075

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

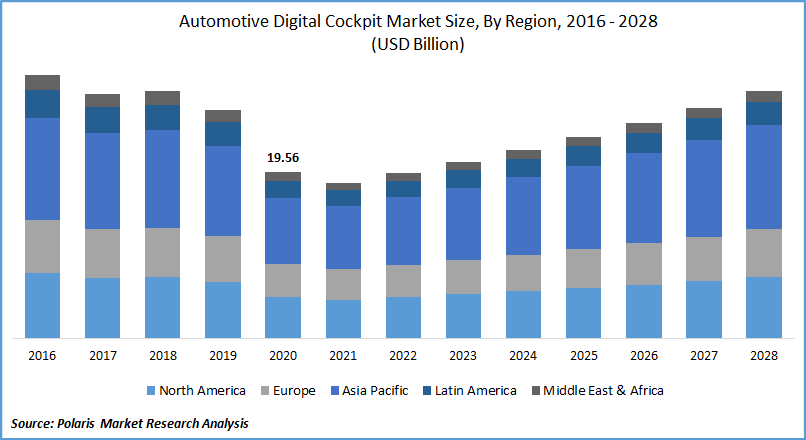

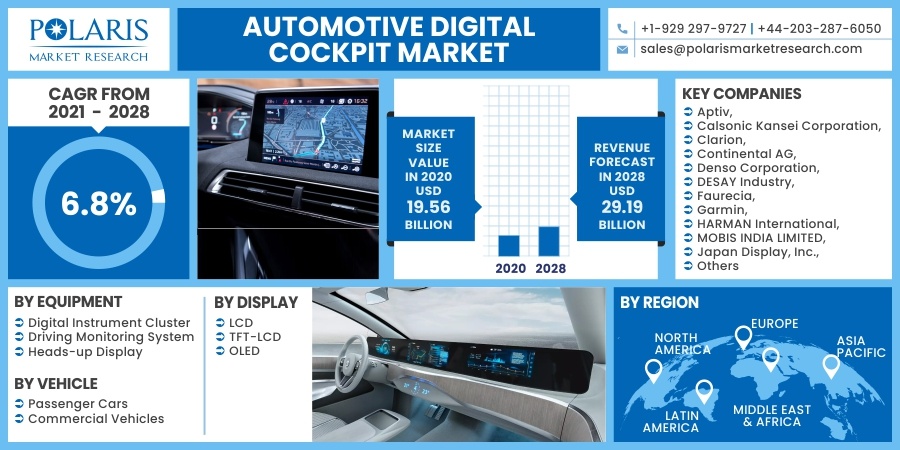

The global automotive digital cockpit market was valued at USD 19.56 billion in 2020 and is expected to grow at a CAGR of 6.8% during the forecast period. The growth of this cockpit market is driven by the surge in innovations in the field of vehicle human-machine interface, coupled with the robust growth in penetration of connected cars and autonomous vehicles that is now required to provide better comfort and convenience to the end-user.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The continual rise in the proliferation of technological advancements in vehicle infotainment, telematics, and navigation is escalating the demand for luxury cars and high-sophisticated vehicle components, which, in turn, is expanding the implementation of the automotive digital cockpit in the global market. Digital cockpit is a term usually used for refining digital experience within a vehicle, including multiple screens, digital assistants, and different means of input. The digital cockpit delivers solutions that encompass a combination of digital instruments and infotainment systems consisting of one or two screens.

The automotive digital cockpit typically comprises the ongoing trend of electrification, hybridization, and the emergence of autonomous or connected vehicles. This creates the prospect of human-machine interface (HMI) software providers to intend and deploy fully-digital instruments cluster with embedded infotainment systems in the automotive digital cockpit market. Thus, the constant advancements in vehicle safety and technological advancements in infotainment systems are considered preferable among end-users.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The proliferation of automotive digital cockpit is rising at a significant pace rate considering the global scenario. With the rapid shift in preference for the mobility market, automotive digital cockpit systems have become viable to provide vehicle occupants with novel and advanced functionalities and secure capabilities, coupled with improved entertainment experience options.

Automobile manufacturers are further supporting the adoption of the ADAS through making substantial R&D developments in digital automobile solutions, which are predominantly used in passenger vehicles on a large scale for premium, safety, comfort, and security benefits in the automotive digital cockpit market. According to the European Automobile Manufacturers Association in 2019, European investments in automotive for R&D have surged by 6.7% to around USD 62.17 billion annually.

With the rising investments in automotive R&D, the production of commercial vehicles and passenger cars has shown positive market growth. Hence, the demand for automotive digital cockpits is continually growing in the global market. For instance, in June 2021, Volkswagen will introduce the new Polo in selected inclusive automotive cockpit markets with a digital cockpit as a major standard. The system will incorporate entrainment, information, and communication together to promote the user an intuitive experience.

Report Segmentation

The market is primarily segmented on the basis of equipment, display, vehicle, and region.

|

By Equipment |

By Display |

By Vehicle |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Equipment

Among the equipment segment, the driving monitoring system segment held the largest stake in the global automotive digital cockpit market in 2020. Driving monitoring systems are part of infotainment systems that deliver several interactive features, including navigation, entertainment, cabin climate controls, and various safety and security features (e.g., advanced driver assistance systems, etc.

The head-up segment is likely to propagate effectively during the forthcoming years, owing to the rising integration of key technologies such as AI and augmented reality, thereby enabling the user’s experience. Moreover, there has been witnessed a significant development in demand for autonomous vehicles, which would complement the growth of the market.

Insight by Display

The TFT-LCD display segment is expected to see significant revenue in the global automotive cockpit system as this display has frequently integrated into automotive digital cockpits intending to meet the durability and temperature standards of all conspicuous automotive cockpit displays.

Besides, these benefits often make it multiple options among OEM to use the TFT-LCD displays depending upon the range temperatures sensitivity in vehicles, which is climbing its demand by automakers of luxury and high-end vehicles segment. On the flip side, OLED display is expected to pave a high automotive cockpit market share by 2028. The proliferation of OLED displays is diverse; therefore, it is extensively used in various upcoming models of vehicles over other display technologies.

Geographic Overview

Geographically, Asia Pacific dominated the global automotive cockpit market and accounted for the largest share in terms of revenue due to the robust growth in the production and sales of passenger vehicles and the constant surge in demand for luxury vehicles in the region. Additionally, the premium car manufacturers, such as Mercedes-Benz, Audi, Volvo, BMW, and Lexus, have always sustained positive growth in the Chinese luxury car market. For instance, the penetration of luxury cars in the country accounted for over 9% of the total passenger cars sales, in 2019. There are various sensors and digital display cockpit systems were deployed.

As a result, in 2017 - 18, as per the India Brand Equity Foundation (IBEF), it is estimated that passenger vehicle (cars, utility vehicles, and vans) sales are 3.28 million units, growing at a rate of 7.98%. Also, it is observed that India's share in the global passenger vehicle market will touch 8% by 2020 from 2.40% in 2015, as per the IBEF, which is expected to bolster the market growth. In Europe, the global market has apprehended a significant share. The region is considering a manufacturing hub for the most prominent automotive OEMs and premium vehicle manufacturers.

Manufacturing activities concerned with automobiles have been continually driven by the huge investments by OEMs, including BMW, Volkswagen, Jaguar Land Rover, Daimler, Nissan, Honda, and others. The mainstream of premium car manufacturers deploys innovative automotive cockpit display features in vehicles, which, in turn, is estimated to drive the market. Moreover, North America is expected to witness nominal growth in the market. This is due to the widespread of novel COVID-19 disease affecting the demand and supply for a luxury vehicle to a great extent in the regional scenario, as a result of which many suppliers have contracted supply of automotive digital cockpit.

Competitive Landscape

Some of the Major Players operating the global market include Aptiv, Calsonic Kansei Corporation, Clarion, Continental AG, Denso Corporation, DESAY Industry, Faurecia, Garmin, HARMAN International, MOBIS INDIA LIMITED, Japan Display, Inc., Luxoft, Magna International, Marelli Holdings Co., Ltd., Panasonic Automotive Systems Europe GmbH, Pioneer Corporation, PREH GMBH, Robert Bosch GmbH, Valeo, Visteon Corporation, Wayray, Yazaki, and ZF Friedrichshafen AG.

Automotive Digital Cockpit Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 19.56 billion |

|

Revenue forecast in 2028 |

USD 29.19 billion |

|

CAGR |

6.8% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Equipment, By Display, By Vehicle, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Aptiv, Calsonic Kansei Corporation, Clarion, Continental AG, Denso Corporation, DESAY Industry, Faurecia, Garmin, HARMAN International, MOBIS INDIA LIMITED, Japan Display, Inc., Luxoft, Magna International, Marelli Holdings Co., Ltd., Panasonic Automotive Systems Europe GmbH, Pioneer Corporation, PREH GMBH, Robert Bosch GmbH, Valeo, Visteon Corporation, Wayray, Yazaki, and ZF Friedrichshafen AG. |