Automotive Collision Repair Market Share, Size, Trends, Industry Analysis Report

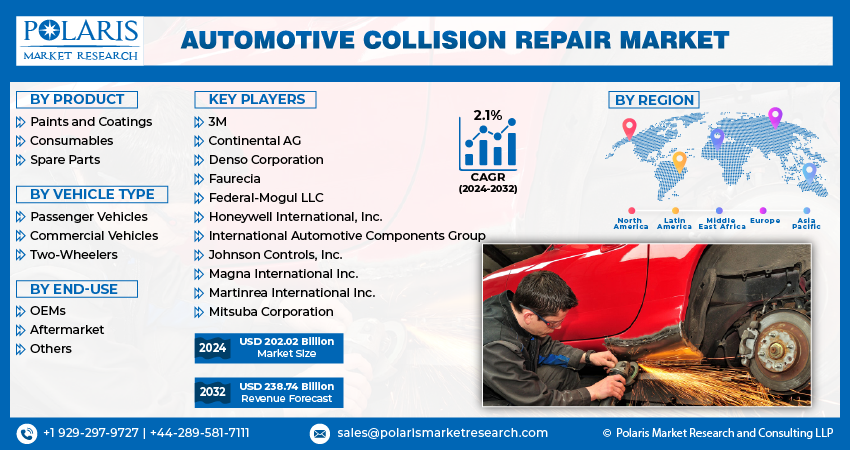

By Product (Paints and Coatings, Consumables, and Spare Parts); By Vehicle Type; By End-Use; By Region; Segment Forecast, 2025- 2034

- Published Date:May-2025

- Pages: 156

- Format: PDF

- Report ID: PM1425

- Base Year: 2024

- Historical Data: 2020-2023

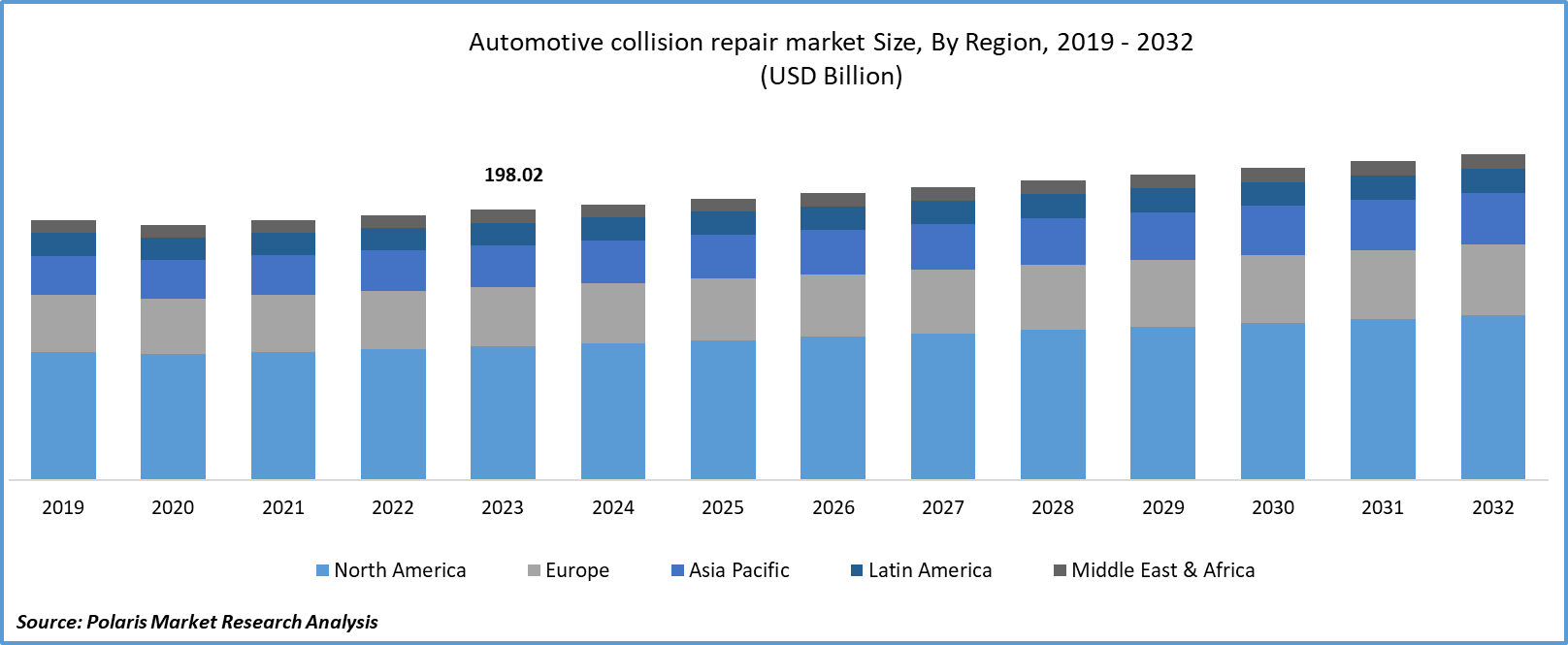

The global automotive collision repair market was valued at USD 201.3 billion in 2024 and is projected to grow at a CAGR of 3.60% from 2025 to 2034. Growth is driven by rising vehicle ownership and increasing incidences of road accidents.

Industry Trends

Automotive collision repair involves a series of treatments and replacement procedures aimed at addressing vehicle damage sustained in accidents. These tasks include dent repair, painting, structural and cosmetic component restoration, and part replacement for elements such as bumpers, windows, and doors. Various materials are employed in this process, including paints, hard coatings, spare parts, and consumables like engine oil and resin. The overarching objective of the market is to restore damaged vehicles to their pre-accident condition, ensuring safety, functionality, and aesthetic appeal. The rising global vehicle population, which leads to more accidents, increases the automotive collision repair market share.

Ongoing potential for innovation, particularly in areas like electric vehicle repair and the integration of advanced technologies, presents opportunities for growth. The rising demand for quality repair services results in significant anticipated growth in automotive collision repair industry share during the forecast period.

To Understand More About this Research:Request a Free Sample Report

The growth of the automotive collision repair industry relies heavily on a diverse partnership landscape that spans various sectors. Automakers and original equipment manufacturers (OEMs) collaborate closely with collision repair facilities to ensure access to genuine parts, technical support, and standardized repair guidelines. Insurance companies also play a pivotal role by partnering with repair facilities to streamline claims processes, promote safety standards, and incentivize the use of certified repair facilities. Additionally, collaborations with technology providers and suppliers enable access to advanced tools, equipment, and materials necessary for modern vehicle repairs, driving efficiency and accuracy. Moreover, partnerships with academic institutions and research organizations facilitate ongoing research and development efforts, leading to the adoption of new repair techniques and the training of future technicians.

For instance, in July 2023, BMW North America became a participant in the Sustaining Partner Program offered by I-CAR. This initiative provides funding assistance to support collision repair education and reduce training redundancies. Additionally, the program allows partners like BMW to showcase their advocacy and provide financial backing for broader industry initiatives facilitated by I-CAR.

The rise of hybrid and electric vehicles opens new avenues for specialized repair services boost the market industry. Factors such as technological advancements in vehicles and growing consumer safety awareness also propel market growth.

Key Takeaways

- North America dominated the automotive collision repair market and contributed to more than 40% of the share in 2024.

- The European market is expected to witness the fastest-growing CAGR during the forecast period.

- By product category, the spare parts segment accounted for the largest market share in 2024.

- By vehicle type category, the passenger vehicles segment is projected to grow at the fastest CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Automotive Collision Repair Market?

Vehicle Ownership and Maintenance Culture have Been Projected to Spur Product Demand

Growing vehicle ownership rates, especially in emerging economies, significantly impact the demand for collision repair services. As economies develop and disposable incomes rise, more people can afford to purchase vehicles, leading to a surge in the number of cars on the road. With more vehicles on the road, the likelihood of accidents increases proportionally. This increase in the frequency of accidents directly contributes to the heightened demand for collision repair services.

Moreover, as vehicle ownership becomes more widespread, there is a growing emphasis on vehicle maintenance and the preservation of asset value. Vehicle owners understand that regular maintenance and timely repairs are essential to prolonging their vehicles' lifespans and maintaining their resale value. In emerging economies where vehicle ownership may represent a significant investment for individuals and families, the desire to protect this investment is particularly strong.

After accidents, vehicle owners are increasingly inclined to invest in professional repair services to restore their vehicles to their pre-accident condition. They recognize the importance of using skilled technicians and quality repair materials to ensure their vehicles' safety, functionality, and aesthetic appeal. Opting for professional repair services not only restores the vehicle's appearance but also addresses any structural damage that may compromise its safety on the road.

Which Factor is Restraining the Demand for Automotive Collision Repair?

The Increasing Complexity of Modern Vehicles is Expected to Hinder Market Growth

The increasing complexity of modern vehicles presents a significant challenge to the demand for automotive collision repair services. As vehicles evolve to incorporate advanced technologies, materials, and safety systems, repairing collision damage becomes progressively more intricate and demanding. Modern vehicles often feature complex electronic systems, sensors, and computer-controlled components. Repairing these sophisticated systems requires technicians with specialized training and expertise. They need to understand not only traditional mechanical components but also how to diagnose and repair electronic and computerized systems accurately.

Report Segmentation

The automotive collision repair market is primarily segmented based on product, vehicle type, end-use, and region.

|

By Product |

By Vehicle Type |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Product Insights

Based on a product analysis, the market is segmented into paints and coatings, consumables, and spare parts. The spare parts segment held the largest automotive collision repair market share in 2023. Spare parts are crucial for repairing vehicles damaged in collisions. These parts include a wide range of components such as bumpers, fenders, doors, hoods, headlights, and taillights, among others. As collisions often result in damage to these parts, there is a consistent demand for replacement components in the collision repair process. The spare parts segment encompasses a vast array of products catering to various vehicle makes, models, and years. This diversity in product offering ensures that collision repair facilities can find suitable replacement parts for virtually any vehicle brought in for repairs, contributing to the segment's dominance.

The spare parts segment includes both original equipment manufacturer (OEM) parts and aftermarket parts. OEM parts are manufactured by the same companies that produced the original components installed in the vehicle, ensuring compatibility and quality. Aftermarket parts, on the other hand, are produced by third-party manufacturers and often offer more affordable alternatives.

By Vehicle Type Insights

Based on vehicle type analysis, the automotive collision repair market has been segmented on the basis of passenger vehicles, commercial vehicles, and two-wheelers. The passenger vehicles segment is expected to witness the fastest-growing CAGR during the forecast period. Globally, there is a steady increase in passenger vehicle ownership due to factors such as improving economic conditions, urbanization, and changing lifestyles. With more passenger vehicles on the road, the likelihood of accidents involving these vehicles also rises, leading to increased demand for collision repair services. Modern passenger vehicles are equipped with advanced safety features and technologies aimed at reducing the risk of collisions. However, in the event of an accident, these advanced technologies may require specialized repair techniques and equipment, driving demand for collision repair services tailored to passenger vehicles.

Regional Insights

North America

North America automotive collision repair market accounted for the largest share in 2024. North America has one of the highest rates of vehicle ownership globally. The region's large population, coupled with a strong automotive culture, results in a high concentration of vehicles on the road. With more vehicles on the road, the frequency of collisions and the demand for collision repair services increase accordingly. North America has stringent safety regulations governing vehicle design, manufacturing, and repair. The automotive industry in North America is characterized by the widespread adoption of advanced technologies in vehicles. These technologies, including advanced driver assistance systems (ADAS), collision avoidance systems, and high-strength materials, require specialized knowledge and equipment for repair. The prevalence of such technologies contributes to the demand for professional collision repair services.

Europe

Europe automotive collision repair market is expected to witness the fastest CAGR during the forecast period. Europe is at the forefront of technological advancements in the automotive industry. The region is witnessing rapid adoption of advanced safety systems, such as autonomous emergency braking, lane-keeping assistance, and adaptive cruise control. As vehicles become more technologically sophisticated, the complexity of collision repairs increases, driving the demand for professional repair services. As a result, collision repair facilities in Europe must adhere to strict guidelines and employ highly skilled technicians to ensure compliance, which fuels the demand for professional repair services.

Competitive Landscape

The competitive landscape of the automotive collision repair market is characterized by a diverse array of players ranging from global corporations to local independent shops. These global players offer comprehensive collision repair services, leveraging their scale and resources to cater to the needs of vehicle owners and insurance companies alike. Independent repair shops play a significant role, particularly at the local level, offering personalized service and competitive pricing to their communities. Moreover, technology suppliers contribute to the competitive landscape by providing innovative solutions to improve efficiency and quality in collision repair operations.

Some of the major players operating in the global automotive collision repair market include:

- 3M

- Continental AG

- Denso Corporation

- Faurecia

- Federal-Mogul LLC

- Honeywell International, Inc.

- International Automotive Components Group

- Johnson Controls, Inc.

- Magna International Inc.

- Martinrea International Inc.

- Mitsuba Corporation

Recent Developments

- In May, 2025, PPG launched two new clearcoat lines in the U.S., the SC300 Series and DELTRON NXT DC7020 which offers fast-drying, high-performance solutions that improved bodyshop efficiency, reduced energy use, and met national and California VOC standards

- In July 2023, Classic Collision announced the acquisition of Dayton Collision Centre located in Dayton, Tennessee, marking a significant expansion for the company within the state. This strategic move aligns with Classic Collision's successful track record of operational expansion, which has seen the company extend its footprint into various states.

Report Coverage

The automotive collision repair market report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, vehicle type, end-use, and their futuristic growth opportunities.

Automotive Collision Repair Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 208.55 billion |

|

Revenue forecast in 2034 |

USD 286.40 billion |

|

CAGR |

3.60% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Vehicle Type, By End-Use, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Automotive Collision Repair Market report covering key segments are product, vehicle type, end-use, and region

The global automotive collision repair market size is expected to reach USD 286.40 billion by 2034

The automotive collision repair market exhibiting a CAGR of 3.60% during the forecast period

North America is leading the global market

key driving factors in Automotive Collision Repair Market are Increasing Number of Road Accidents