Automotive Brake Systems Market Size, Share, Trends, Industry Analysis Report: By Type (Disc Brakes and Drum Brakes), Vehicles Type, Technology, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 122

- Format: PDF

- Report ID: PM1443

- Base Year: 2024

- Historical Data: 2020-2023

Automotive Brake Systems Market Overview

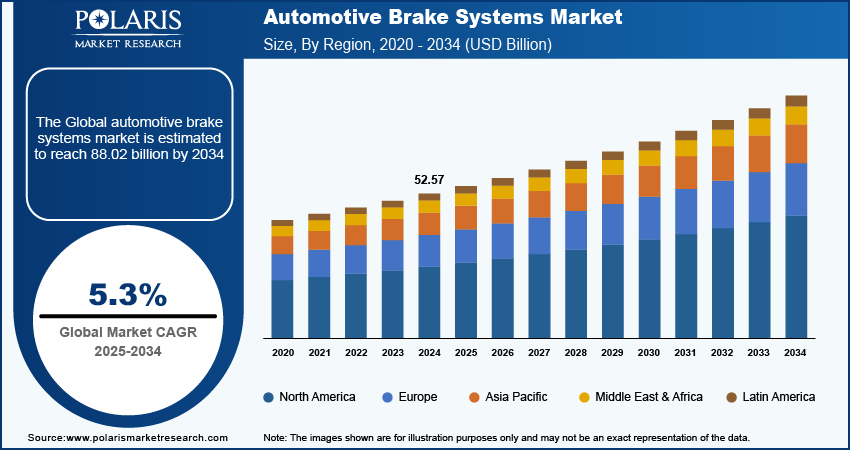

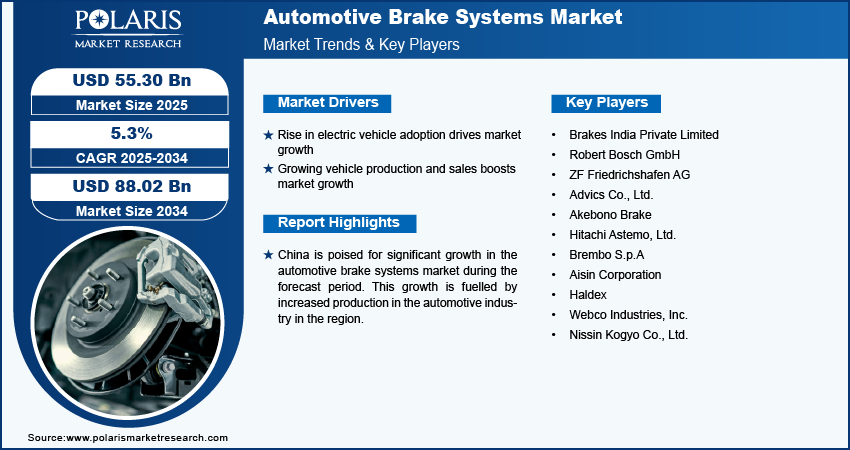

The automotive brake systems market size was valued at USD 52.57 billion in 2024. The market is projected to grow from USD 55.30 billion in 2025 to USD 88.02 billion by 2034, exhibiting a CAGR of 5.3% from 2025 to 2034.

The automotive brake system is a mechanical control mechanism engineered to effectively decelerate or halt a vehicle's motion while prioritizing passenger safety. Comprising various essential components, such as brake pedal, rotor, shoes, pads, drum, calipers, fluid lines, hoses, and master cylinder, the system ensures reliable and efficient braking performance.

Rapid technological advancements, such as electronic braking systems (EBS) and anti-lock braking systems (ABS), propel the market growth. For instance, in June 2023, Tevva, an electric truck manufacturer, merged with ZF Group to introduce regenerative braking technology to the automotive sector. Tevva's regenerative braking system boasts efficiency levels up to four times greater than those of a conventional air brake system. The incorporation of these technologies enhances vehicle performance, safety, and fuel efficiency, rendering them appealing to both consumers and manufacturers.

To Understand More About this Research: Request a Free Sample Report

The automotive brake systems market is further driven by increasingly stringent safety regulations and standards. Governments and regulatory bodies are setting increasingly high safety standards, compelling manufacturers to innovate and enhance braking technology to meet these demands. For instance, in June 2023, the US Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) introduced a new Federal Motor Vehicle Safety Standard (FMVSS) that mandates all passenger cars and light trucks to be equipped with automatic emergency braking (AEB), including pedestrian AEB, by September 2029. The rule is intended to reduce rear-end and pedestrian crashes. NHTSA projects that the implementation of its new standard, FMVSS No. 127, will result in a minimum of 360 lives saved annually and the prevention of at least 24,000 injuries per year.

Automotive Brake Systems Market Trends and Drivers Analysis

Rise in Electric Vehicle Adoption

The rise in the popularity of electric vehicles has resulted in an increased need for automotive braking systems. The demand for electric vehicles (EVs) has increased as they emit zero tailpipe emissions, resulting in reducted air pollution and greenhouse gas emissions as compared to traditional internal combustion engine vehicles. For instance, in 2023, according to the International Energy Agency (IEA), 14 million new electric cars were registered globally, a rise of 3.5 million from the previous year.

Growing Vehicle Production and Sales

Rising worldwide need for vehicles, including passenger cars, commercial vehicles, and electric vehicles, is driving market growth. Additionally, the growing population is having a favorable impact on the automotive brake systems market. For instance, in 2022, according to the European Automobile Manufacturers Association, the global production of motor vehicles reached 85.4 million units, marking a 5.7% increase compared to the previous year. The increase in production signals a significant recovery and expansion within the automotive industry, leading to a heightened demand for advanced brake systems. Progressive advancements in braking technology, encompassing enhanced safety features and materials, are concurrently augmenting vehicle performance and safety standards. Therefore, the growing production of passenger and commercial vehicles is propelling the automotive brake systems market.

Automotive Brake Systems Market Segment Analysis

Automotive Brake Systems Market Assessment by Type

The automotive brake systems market segmentation, based on type, includes disc brakes and drum brakes. The disc brake segment held the largest revenue share of the market due to its shorter stopping distance, heat dissipation, and consistent braking performance across diverse driving conditions. Given the emphasis on safety and performance by automotive manufacturers, disc brakes have become the preferred choice over drum brakes. The increasing demand for disc brake systems is being propelled by advancements in automotive technology and consumer inclination towards upgraded braking capabilities. For instance, in November 2022, Continental Automotive introduced the Green Caliper, a lighter brake caliper for disc brakes. The new lightweight Green Caliper delivers exceptional braking performance while also reducing residual braking torque. This design has the potential to save up to two kilograms per brake caliper, as well as up to three additional kilograms per brake disc.

Automotive Brake Systems Market Evaluation by Vehicle Type

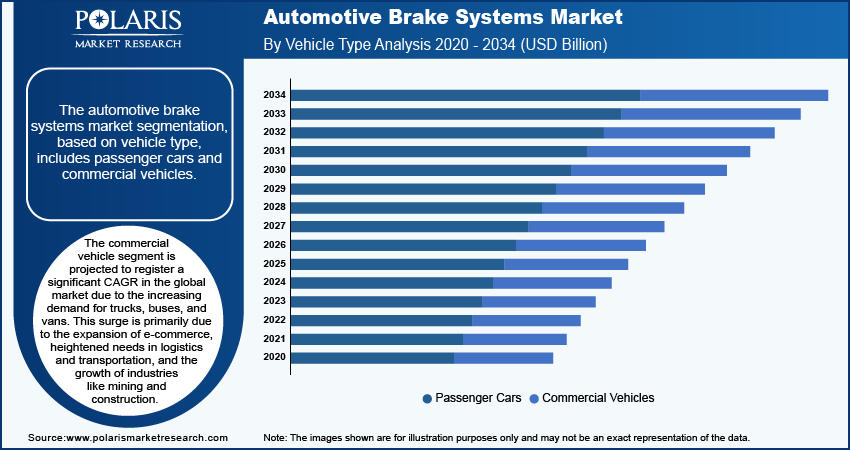

The automotive brake systems market segmentation, based on vehicle type, includes passenger cars and commercial vehicles. The commercial vehicle segment is projected to register a significant CAGR in the global market due to the increasing demand for trucks, buses, and vans. This surge is primarily due to the expansion of e-commerce, heightened needs in logistics and transportation, and the growth of industries like mining and construction. As e-commerce continues to grow, the demand for efficient and reliable transportation solutions intensifies, necessitating a larger fleet of commercial vehicles. The increase in the commercial vehicle fleet corresponds to a rising need for reliable and efficient braking systems. For instance, in 2022, according to the European Automobile Manufacturers Association, the total number of commercial vehicles registered was around 15.9 million globally, which includes vans, trucks, and buses.

Automotive Brake Systems Market Breakdown by Regional Insights

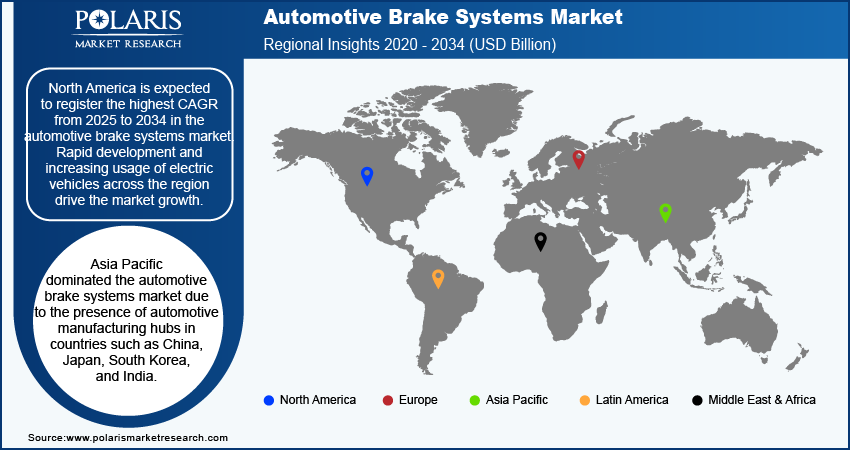

By region, the study provides the automotive brake systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest revenue share due to the presence of automotive manufacturing hubs in countries such as China, Japan, South Korea, and India. Other factors contributing to this growth include the increasing middle-class population, rapid urbanization, and higher rates of vehicle ownership. For instance, according to the Society of Indian Automobile Manufacturers (SIAM), the automotive industry produced around 25.93 million vehicles between April 2022 and March 2023, which includes two-wheelers, three-wheelers, passenger vehicles, and commercial vehicles. Therefore, the increase in the production of vehicles is fuelling the automotive brake systems market in Asia Pacific.

North America is projected to register a substantial CAGR from 2025 to 2034. The rapid development and increasing usage of electric vehicles are driving automotive brake systems market growth in the region. Additionally, government funding for research and development activities is playing a significant role in driving the market for automotive brake systemd in this region. For instance, according to the United States Department of Energy, in 2023, light-duty vehicle registration accounted for 12.26 million, which includes electric vehicles (EV), plug-in hybrid electric (PHEV), and hybrid electric (HEV).

The automotive brake systems market in China is expected to have significant growth due to the increased production in the automotive industry in the region. For instance, according to the International Organization of Motor Vehicle Manufacturers, in 2023, the overall production of vehicles reached the mark of 30.16 million in the region, which includes passenger and commercial vehicles. The significant production volume emphasizes China's crucial position in the worldwide automotive industry and emphasizes the growing need for advanced braking systems. As vehicle manufacturers increase production to cater to consumer and commercial requirements, there will be a parallel increase in the requirement for automotive brake systems.

Automotive Brake Systems Market – Key Players & Competitive Analysis Report

The automotive brake systems market is a dynamic and rapidly evolving environment with several players striving to innovate and differentiate from each other. Major global companies are dominating the market by leveraging extensive research and development capabilities, advanced manufacturing technologies, and broad distribution networks to maintain a competitive edge. The players are engaged in strategic activities such as mergers and acquisitions, partnerships, and collaborations to enhance their product portfolios and expand their market presence.

Startups are also contributing to the market by introducing novel technologies in automotive brake systems production. Major players in the automotive brake systems market include Brakes India Private Limited; Robert Bosch GmbH; ZF Friedrichshafen AG; Advics Co., Ltd.; Akebono Brake; Hitachi Astemo, Ltd.; Brembo S.p.A; Aisin Corporation; Haldex; Webco Industries, Inc.; and Nissin Kogyo Co., Ltd.

Akebono Brake Corporation, established in 1929 and based in Tokyo, Japan, is a global supplier of automotive brake systems. With a workforce of around 22,000, the company has a strong international presence, operating manufacturing facilities in North America, Europe, and Asia. Akebono's wide-ranging product line encompasses high-performance disc brakes, reliable drum brakes, advanced brake pads, precision-engineered calipers, and durable brake linings, catering to various vehicle types such as passenger cars, commercial trucks, and motorcycles. The company has sales offices in key countries, including the United States, Mexico, Germany, France, China, and Thailand. In June 2024, Akebono introduced Akebono ProACT Ultra-Premium Brake Pads to provide exceptional performance and durability. These brake pads utilize advanced friction materials to deliver improved stopping power and reduced noise, meeting the increasing need for quieter and more dependable braking solutions.

Hitachi Astemo Ltd., headquartered in Tokyo, Japan, is a supplier in the automotive components industry. With a global workforce of approximately 90,000 employees, the company specializes in advanced brake systems, suspension systems, steering technologies, as well as components for advanced driver assistance systems (ADAS) and powertrains. The manufacturing plants and research centers are located in regions like North America, Europe, and Asia. In December 2023, Hitachi Astemo, Ltd. announced an absorption-type merger between Hitachi Astemo and its wholly-owned subsidiary, Hitachi Astemo Electric Motor Systems, Ltd. With the merger, Hitachi Astemo will emerge as the surviving company, while Hitachi Astemo Electric Motor Systems will cease to exist.

List of Key Companies in the Automotive Brake Systems Market

- Brakes India Private Limited

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Advics Co., Ltd.

- Akebono Brake

- Hitachi Astemo, Ltd.

- Brembo S.p.A

- Aisin Corporation

- Haldex

- Webco Industries, Inc.

- Nissin Kogyo Co., Ltd.

Automotive Brake Systems Market Developments

August 2024: ZF Aftermarket launched Electric Axle Drive Repair Kits in the US and Canada. These kits allow independent workshops to conduct repairs without the need to remove electric axle drives, streamlining and expediting the servicing process for electric vehicles.

June 2024: Brakes India and ADVICS announced a strategic collaboration to co-develop advanced braking systems tailored for the Indian light vehicle market. The partnership builds upon their extensive history of working together and is focused on elevating the braking technology landscape in India.

August 2022: Robert Bosch announced a substantial investment of USD 283.2 million to expand its manufacturing facility in Aguascalientes, Mexico. This strategic move aims to enhance the plant's production capacity for advanced electronic parking brakes (EPB).

Automotive Brake Systems Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Disc Brakes

- Drum Brakes

By Vehicle Type Outlook (Revenue – USD Billion, 2020–2034)

- Passenger Cars

- Commercial Vehicles

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Anti-Lock Brake System (ABS)

- Traction Control System (TCS)

- Electronic Stability Control (ESC)

- Electronic Brake-Force Distribution (EBD)

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive Brake Systems Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 52.57 billion |

|

Market Size Value in 2025 |

USD 55.30 billion |

|

Revenue Forecast in 2034 |

USD 88.02 billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The automotive brake systems market size was valued at USD 52.57 billion in 2024 and is projected to grow to USD 88.02 billion by 2034.

The market is projected to register a CAGR of 5.3% from 2025 to 2034.

Asia Pacific had the largest share of the market in 2024.

The key players in the market are Brakes India Private Limited; Robert Bosch GmbH; ZF Friedrichshafen AG; Advics Co., Ltd.; Akebono Brake; Hitachi Astemo, Ltd.; Brembo S.p.A; Aisin Corporation; Haldex; Webco Industries, Inc.; and Nissin Kogyo Co., Ltd.

The disc brake segment accounted for the largest revenue share due to its shorter stopping distance, heat dissipation, and consistent braking performance across diverse driving conditions

The commercial vehicle segment is anticipated to account for a significant CAGR of the market